One of the most important lessons of biotech investing has nothing to do with drugs…

Nearly half of modern medicine disregards the business of dispensing pills from a bottle. Yet there are still barriers of entry for rivals, like running clinical trials. There's even “breakthrough” status.

Even experienced biotech investors don't understand this yet. And that means you can use it as your big advantage…

I'm talking about breakthrough devices.

Like a new drug or a new target, breakthrough devices are guarded by patents. The difference is that with devices, it's not simply two or three patents that matter.

There's hardware and software, plus new functions. Each of these can be improved. So once a new device is approved, its owner builds a mountain of patents.

You might know the biggest medical-device companies, like Medtronic (MDT), Johnson & Johnson (JNJ), or Abbott Laboratories (ABT). These massive companies use patents to extend sales of their devices. For example, take Medtronic's pacemakers…

[Breakthrough: This Could be the Closest Thing to Buying Amazon When it was $50]

By the time the first pacemaker patent runs out, Medtronic will have moved on to sell pacemakers that restart your heart. It also sells pacemakers that can survive in an MRI. Neither innovation is covered in the core patents.

My search of the U.S. patent database shows that Medtronic has 3,933 issued patents on pacemakers. Good luck competing with Medtronic in this market. It has generations of engineers behind its devices.

Unlike making drugs, making medical devices isn't a business of fits and starts…

A successful medical-device maker should experience a slow march of progress, with steady profits along the way. In other words, device makers don't face a patent cliff like Big Pharma does, where big-name companies can suddenly lose their dominance to generics. Device makers are steady ships.

Smaller device makers also offer stable profits, with the bonus that they are also acquisition candidates. This is the sort of device maker that we like to focus our research on in Stansberry Venture Technology.

These sorts of companies help balance out our higher-risk drugmakers in the model portfolio… while still offering significant upside.

The most serious risk to a device maker's profits is a new class of technical competitor…

This is the risk detailed in Harvard professor and investor Clayton Christensen's classic book, The Innovator's Dilemma. He gives the example of when steam shovels met hydraulics.

The major excavator manufacturers were aware of hydraulics… But their biggest and most important customers had no use for them. They weren't powerful enough. So the excavator makers had to make small changes to their existing lineup of products to satisfy their customers.

[Buy Alert: Buffett Recently Dumped $800 Million of Apple Stock to Invest in This!]

For example, Bucyrus-Erie, the leading cable shovel maker at the time, tried a “hybrid” approach – marrying the new hydraulic technology with its cable lift mechanism. As Christensen writes…

“The cable lift mechanism was the only viable way at that time, based on the state of hydraulics technology, to give the Hydrohoe the bucket capacity and reach that Bucyrus marketers thought they needed to appeal to their existing customers' needs.”

But only four of the 30 or so established cable-based excavator manufacturers in the 1950s survived the transition to the dominance of hydraulic excavators by the 1970s.

So the type of breakthrough medical devices that we're looking for are not an incremental change in patents. We're looking for a breakthrough that can move markets, too.

And when we find one in Stansberry Venture Technology, we have three ways to win…

First, following the breakthrough device's initial success, you can hold small device makers for years – and annual improvements will hold margins steady.

And as I mentioned earlier, these are smaller companies and acquisition targets by bigger device makers. So if there is a buyout later, we can expect a one-time boost of about 50% to its share price.

But the final – and best-case – scenario is where no one buys the small device maker… and it becomes gigantic.

Look at Intuitive Surgical (ISRG)… which makes surgical robots that are hand-operated by surgeons.

I first visited the company in early 2004. I even tried tying sutures in knots with its new robot. I'm no surgeon. Instead, I was there researching the company as an analyst for Stansberry Research. (I was the company's fourth employee.)

[Learn More: See Why Billionaires are Flocking to this Tiny Niche of the Tech Sector]

At the time, no one knew the lasting value of a single breakthrough device. And since my visit, Intuitive Surgical has kept growing… and growing.

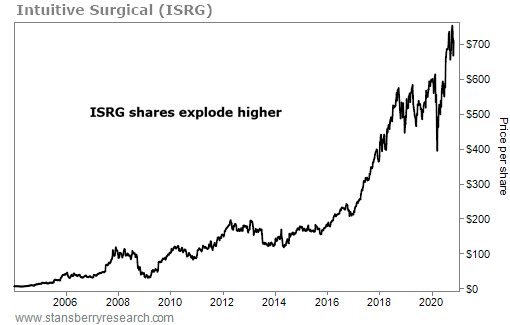

Take a look at its chart since then…

As you can see, shares have rallied thousands of percent since I first visited the firm.

These surgical robots weren't an incremental change… They were a whole new way of doing surgery. For cancer, robotic surgery has meant less risk of infection and less trauma. People aren't “opened up.” Instead, there are tiny incisions for where the tools enter, and your skin is simply stretched, with no large cuts.

As a result, healing is faster since your immune system isn't chasing down a billion new invaders. Plus, there aren't new blood vessels to feed scar tissue – a blood supply that cancer can use to re-form.

And the long-term value of Intuitive's robots is in their precision. They make microscopic surgery routine.

[Breakthrough: This Could be the Closest Thing to Buying Amazon When it was $50]

If you track medicine and investing, Intuitive's story should tell you one thing…

Medical-device companies belong in any serious biotech investor's portfolio.

Good investing,

Dave Lashmet

Leave a Comment