It’s no secret that I’m a science fiction fan.

I routinely quote sci-fi books and movies, as well as litter my articles and videos with references to them.

But beyond that, a lot of my investment themes veer toward the future.

I’m not talking about flying cars – not yet. Though they do finally exist.

I’m talking about technology trends upsetting the current world’s apple cart. I’ve long believed that Klaus Schwab’s book The Fourth Industrial Revolution provides a viable road map for investors.

It may not be The Forever War, Gateway or We Are Legion (We Are Bob), but I think it’s an important book for tech investors.

Schwab outlines the trends that are reshaping the world as we know it.

[Inside: One of the World’s Leading Angel Investors Unveils Next Tech Breakthrough]

He writes about 3D printing, artificial intelligence (AI), autonomous vehicles, big data, the cloud, cryptocurrencies, the Internet of Things (IoT), quantum computing, robotics, smart homes and more.

These are projected to have a combined potential impact of as much as $60 trillion over the next decade.

That’s the kind of dough investors would be remiss to ignore. And there’s plenty of potential upside.

That’s why today I’m going to highlight four easy – and inexpensive – ways to play this trend.

Revolutions 1, 2, 3…

The First Industrial Revolution used water and steam power to mechanize production.

The Second Industrial Revolution harnessed electricity to fuel mass production.

And the Third Industrial Revolution used electronics and information technology. This led to the rise of some automation.

Now our current digital age is the beginning of the Fourth Industrial Revolution (4IR).

And each of the trends I outlined above are just one piece of the 4IR mosaic. Investors who recognize their long-term potential have the chance at obtaining life-changing gains.

[First Look: Amazing New Technology Will Be in 266 Million American Homes By End of 2020]

This is why I’ve covered 4IR and its impact on various industries for years. Though I believe it could pick up pace because of COVID-19.

Nonetheless, pandemic or not, there’s no global upheaval more sweeping than 4IR.

But keep in mind, we’re still in the early stages. There’s a long runway ahead of us.

Four 4IR ETFs to Trade

Sometimes, when a trend is so massive – so globally expansive – it’s almost impossible to build a portfolio of individual companies.

Especially when many of those trade on foreign exchanges.

In these instances, exchange-traded funds (ETFs) are the way to go.

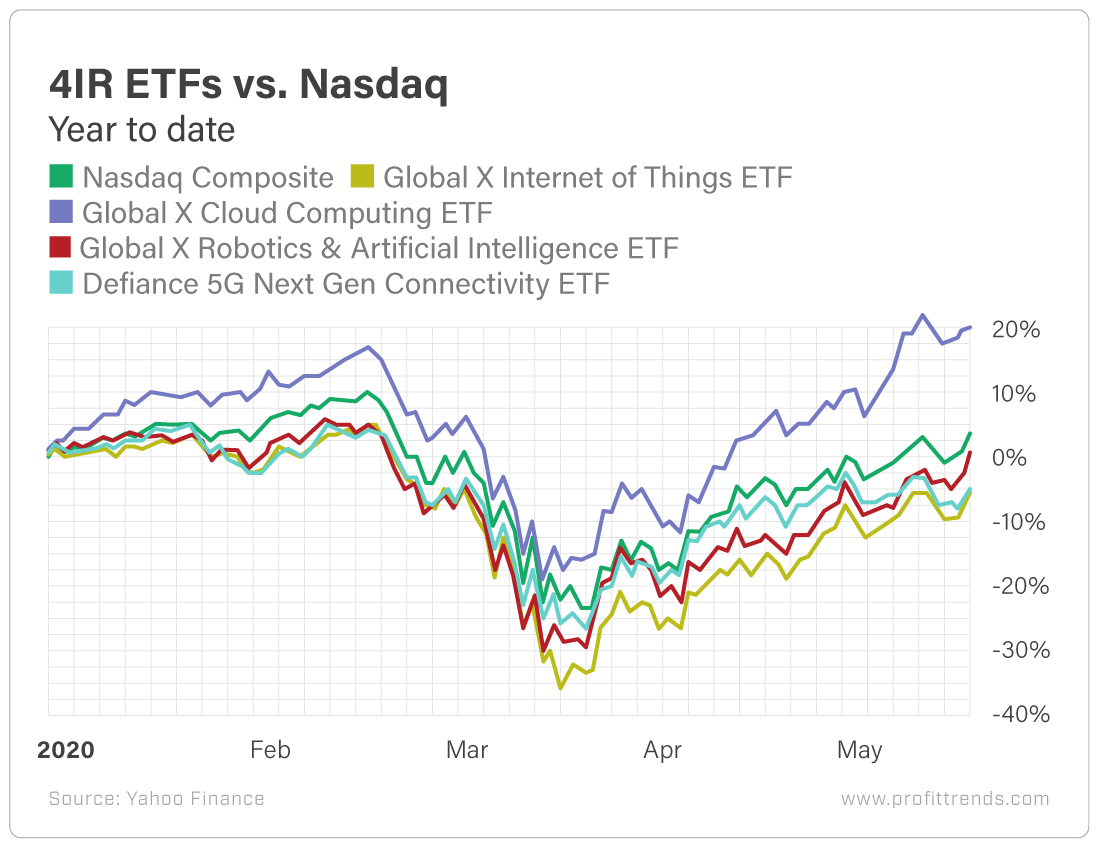

And so far in 2020, these four 4IR ETFs are posting solid performances…

Of course, that’s for good reason.

[Learn More: Renowned Investor Reveals What He Thinks Will Be the #1 Tech Stock for 2020]

For instance, companies the world over dropped a record $107 billion on cloud computing infrastructure services in 2019. And this year, we’re likely to see even more as the global pandemic has shifted everything online.

That’s been the rocket fuel behind Global X Cloud Computing ETF‘s (Nasdaq: CLOU) momentum. The fund is up nearly 20% over the past five months, leaving the broader indexes to choke on its fumes.

Besides the massive upside the segment promises, this is also a great way for investors to gain exposure to stocks like Shopify (NYSE: SHOP) and Netflix (Nasdaq: NFLX) – which have price tags that top $400 apiece – for less than $20.

Plus, the ETF offers exposure to cloud security companies like LogMeIn (Nasdaq: LOGM), Twilio (NYSE: TWLO), Qualys (Nasdaq: QLYS) and Zscaler (Nasdaq: ZS), among others.

The Global X Robotics & Artificial Intelligence ETF (Nasdaq: BOTZ) is in positive territory for 2020, nipping at the heels of the Nasdaq’s performance.

Like the Global X Cloud Computing ETF, this fund enables investors to snag pricey shares of Intuitive Surgical (Nasdaq: ISRG) and Nvidia (Nasdaq: NVDA) for roughly $20. But it also provides exposure to foreign robotics powerhouses Daifuku, Dynatrace, Fanuc, Keyence, Mitsubishi, Omron and SMC.

[Inside: One of the World’s Leading Angel Investors Unveils Next Tech Breakthrough]

The Defiance 5G Next Gen Connectivity ETF (NYSE: FIVG) is currently down 4.6% this year. The ETF is heavily weighted toward handset makers Nokia (NYSE: NOK) and Ericsson (Nasdaq: ERIC).

But we’re in store for this ETF to gain ground as chipmakers and handset makers pick up speed in the months ahead – especially with the continued rollout of 5G. Because there are two key pieces all 4IR technologies require: faster and more efficient integrated chips, and faster connectivity.

The Global X Internet of Things ETF (Nasdaq: SNSR) is the laggard of this group. Though it’s worth pointing out that it’s still outperforming the Dow Jones Industrial Average and the S&P 500 this year. Both indexes are down more than 8.25% year to date.

But the Global X Internet of Things’ largest holding, Dexcom (Nasdaq: DXCM), shows the true potential of the IoT. The insulin pump manufacturer’s shares are up more than 90% this year. Its mobile continuous glucose monitoring systems have been selling like hotcakes as diabetes remains a global issue.

Technology Marches On

The Fourth Industrial Revolution is a $60 trillion tidal wave.

Autonomous vehicles will be commonplace before you know it.

Your already-connected home will become smarter.

[Learn More: Renowned Investor Reveals What He Thinks Will Be the #1 Tech Stock for 2020]

Your smartphone will get more intelligent.

And the digital world will continue to meld with the physical as AI, IoT and robotics gain traction.

There’s no better advice than what my colleague David Fessler so often states: “Technology marches on.”

Investors need to make sure their financial independence isn’t being trampled on by missing out on next-generation gains. Grabbing a piece of these four ETFs is an easy and inexpensive way to ensure that.

Here’s to high returns,

Matthew