Forget coronavirus, Wall Street ended the first month of third-quarter 2020 with a lot of vigor after completing a fabulous second quarter, marking the fourth consecutive month of rally. In fact, a new bull market that was developed last quarter exiting the coronavirus-induced short bear market, is raging forward in the third quarter too.

Meanwhile, several stocks have skyrocketed in July. A handful of those are large-cap (market capital > $10 billion) Zacks top-Ranked stocks with strong growth potential and robust earnings estimates revisions within the last 30 days. Investment in these stocks should lead to solid returns.

Market Rally Continues Despite Various Concerns

Market participants faced several hurdles in July. The resurgence of coronavirus in as many as 24 states which forced them to close some parts of the economy that were reopened just a month ago, raised questions on the V-shaped recovery of the U.S. economy.

Moreover, second-quarter 2020 earnings results are pathetic so far and GDP plunged 32.9% year over year, marking the largest-ever decline in a quarter. Initial jobless claims increased in the last two weeks of July. Both Conference Board's consumer confidence index and University of Michigan's consumer sentiment index revealed falling trends last month.

[Exclusive: Man Who Made EIGHTEEN 1,000% Recommendations Unveils #1 Stock]

Additionally, it is still unknown to everyone whether a vaccine for the treatment of COVID-19 will be available anytime soon. Negotiations between Republicans and Democrats related to the second round of fiscal stimulus are still going on. Notably, the unemployment benefit of $600 per week ended in July. Finally, the economic and geo-political conflict between the United States and China heightened last month.

Yet, defying this long lineup of negatives, the three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — surged 2.3%, 5.5% and 6.8%, respectively, in July. Aside from these three large-cap-specific indexes, the small-cap-centric Russell 2000 also gained 2.7%.

Negatives Are Already Priced in Market Valuation

The Dow, the S&P 500 and the Nasdaq Composite jumped 45.1%, 49.3% and 62%, respectively, from their recent lowest levels recorded on Mar 23. The astonishing performances are primarily due to the fact that negative estimates are already factored in market price while the stock markets always look for future expectations.

Disappointing corporate earnings were expected since lockdowns were imposed for nearly two months in the last quarter to curb the spread of the deadly virus. Although second-quarter GDP plunged 32.9%, it is still narrower-than the consensus estimate of a decline of 34.7%.

All 50 states reopened in the last week of May though half of them were forced to close some parts of their economies in face of the second wave of coronavirus. Despite this, a series of economic data in May and June clearly indicated that the fundamentals of the U.S. economy stayed stable.

Unprecedented fiscal and monetary stimulus generated huge pent-up demand, which should be bolstered after the second round of fiscal stimulus expected early this month.

[Extra: They Laughed, Yet FIVE of the Stocks He Named Went on to Soar Over 1,000%]

Finally, although corporate earnings estimates are still negative for the rest of this year, the earnings growth picture is steadily improving since the start of July for third-quarter, fourth-quarter and full-year 2020. In fact, there has been a notable improvement since the outbreak.

Our Top Picks

We have narrowed down our search to five large-cap stocks with solid growth potential and robust earnings estimate revisions that popped more than 15% in the past month. Each of the picks carries a Zacks Rank #1 (Strong Buy).

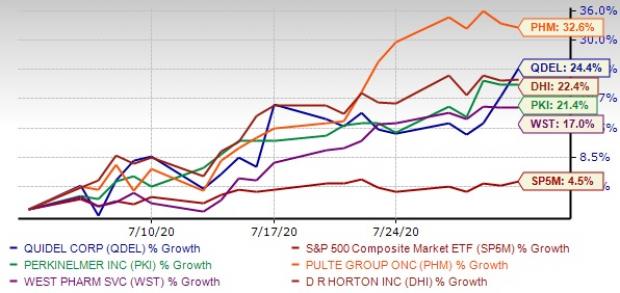

The chart below shows the price performance of our five picks in the past month.

(source: zacks.com)

(source: zacks.com)

PulteGroup Inc. (PHM) is engaged in homebuilding and financial services businesses, primarily in the United States. The company has expected earnings growth of 22.1% for the current year. The Zacks Consensus Estimate for current-year earnings has improved by 44.9% over the last 30 days. The stock price has soared 32.6% in the past month.

[Read On: Legendary Stock-Picker May Have Cracked the Code to 1,000% Gains!]

Quidel Corp. (QDEL) develops, manufactures and markets diagnostic testing solutions for applications primarily in infectious diseases, cardiology and gastrointestinal diseases worldwide. The company has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings has improved by 6.5% over the last 30 days. The stock price has climbed 24.4% in the past month.

D.R. Horton Inc. (DHI) operates as a homebuilding company in East, Midwest, Southeast, South Central, Southwest, and West United States. The company has expected earnings growth of 19.6% for the current year (ending September 2020). The Zacks Consensus Estimate for current-year earnings has improved by 5.8% over the last 7 days. The stock price has appreciated 22.4% in the past month.

PerkinElmer Inc. (PKI) provides products, services and solutions to the diagnostics, life sciences, and applied services markets worldwide. It operates in two segments, Discovery & Analytical Solutions and Diagnostics.

The company has an expected earnings growth rate of 17.8% for the current year. The Zacks Consensus Estimate for current-year earnings has improved by 20.4% over the last 30 days. The stock price has surged 21.4% in the past month.

West Pharmaceutical Services Inc. (WST) manufactures and sells containment and delivery systems for injectable drugs and healthcare products in the United States, Europe and internationally. It operates through two segments, Proprietary Products and Contract-Manufactured Products.

The company has an expected earnings growth rate of 31.8% for the current year. The Zacks Consensus Estimate for current-year earnings has improved by 18.3% over the last 30 days. The stock price has advanced 17% in the past month.

[Exclusive: Man Who Made EIGHTEEN 1,000% Recommendations Unveils #1 Stock]