September is set to become the first month since March to record a sharp decline in stock markets. With just one day of trading left for this month, the three major indexes — the Dow, the S&P 500 and the Nasdaq Composite — are down 3.4%, 4.7% and 5.9%, respectively.

However, surprising many financial experts, Americans have expressed their highest level of confidence in the economy in September since March. In other words, U.S. consumer confidence reached the highest level in September since the coronavirus outbreak.

Consumer Confidence Jumps in September

On Sep 29, the conference board reported that its consumer confidence index for the month of September came in at 101.8, the highest in six months. The metric exceeded the consensus estimate of 89.6. Notably, consumer confidence increased in September after back-to-back monthly declines.

Meanwhile, the August index was also revised upward to 86.3 from 84.8 reported earlier. The index in September marked the biggest one-month jump in 17 years. However, consumer confidence index remained below its pre-pandemic level of 130.7 recorded in February.

[Breakthrough: The World’s Most Successful Tech Giants are Buying into this Emerging Field]

The Present Situation Index, which gauges consumers’ views on current market conditions, climbed from 85.8 in August to 98.5 in September. Moreover, the Expectations Index, which is a measure of consumers’ short-term (for the next six months) outlook for income, business and labor market conditions, surged to 100 from 86.6 in August.

Americans who said jobs were plentiful rose to 22.9% from 21.4% in the previous month. The percentage that said jobs were hard to find fell to 20% from 23.6% in August. Americans claiming business conditions are “good” increased from 16% to 18.3%, while those claiming business conditions are “bad” decreased from 43.3% to 37.4%.

Notably, a similar-type of study known as consumer sentiment conducted by the University of Michigan stated that the preliminary index for September came in at 78.9 compared with 74.1 in August. The consensus estimate was 74.9.

Importance of September's Index Reading

Strong consumer confidence confirms U.S. economic stability, which will enable them to spend higher in the near future. Notably, consumer spending is the largest driver of U.S. GDP growth. The pace of the U.S. economic recovery during April to July slowed in August as a result of the termination of the CARES (Coronavirus Aid, Relief, and Economic Security) Act in July.

The Trump administration provided more than $2 trillion of fiscal stimulus of which a major part was $600 per week per person unemployment benefit and Payroll Protection Program (PPP) for small businesses. These two stimuli have kept both consumer and business confidences higher and ushered in U.S. economic recovery during peak pandemic period.

[Big Money: Google and Microsoft Just Put Over $4 Billion into this New Technology]

However, lack of a fresh round of stimulus resulted in slowing growth of job creation, retail sales and durable goods orders in August. At this juncture, a jump in consumer confidence this month amid severe volatility in stock markets is a bright sign for the U.S. economy.

Our Picks

At this stage, it will be better to invest in consumer-centric stocks that have strong growth potential and have skyrocketed in the past six months. We have narrowed down our search to five such stocks each carrying a Zacks Rank #1 (Strong Buy).

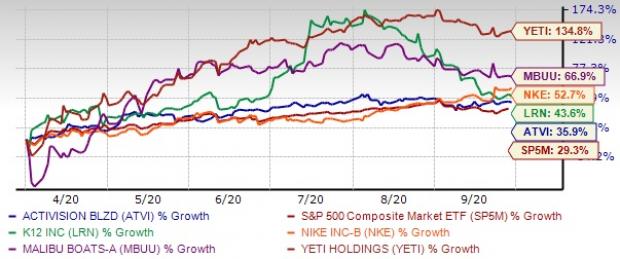

The chart below shows the price performance of our five picks in the past six months.

YETI Holdings Inc. (YETI) designs, markets, retails and distributes products for the outdoor and recreation market under the YETI brand in the United States, Canada, Australia and Japan. The company has an expected earnings growth rate of 19.2% for the current year. The Zacks Consensus Estimate for the current year has improved 2.9% over the past seven days. The stock price has soared 134.8% in the past six months.

[Read On: Discover What Bill Gates is Calling the “Holy Grail” of Modern Tech]

Malibu Boats Inc. (MBUU) operates as a designer, manufacturer and marketer of sport boats primarily in the United States. The company has an expected earnings growth rate of 33.1% for the current year (ending June 2021). The Zacks Consensus Estimate for the current year has improved 23% over the past 60 days. The stock price has jumped 66.9% in the past six months.

NIKE Inc. (NKE) is engaged in the business of designing, developing and marketing of athletic footwear, apparel, equipment and accessories, and services for men, women and children worldwide.

The company has an expected earnings growth rate of 73.8% for the current year (ending May 2021). The Zacks Consensus Estimate for the current year has improved 17.3% over the past seven days. The stock price has rallied 52.7% in the past six months.

K12 Inc. (LRN) is a technology-based education company that provides proprietary and third-party online curriculum, software systems, and educational services to facilitate individualized learning for students primarily in kindergarten through 12th grade in the United States and internationally.

The company has an expected earnings growth rate of 90% for the current year (ending June 2021). The Zacks Consensus Estimate for the current year has improved 9.6% over the past 30 days. The stock price has climbed 43.6% in the past six months.

Activision Blizzard Inc. (ATVI) develops and distributes content and services on video game consoles, personal computers and mobile devices. It operates through three segments: Activision Publishing Inc., Blizzard Entertainment Inc., and King Digital Entertainment.

The company has an expected earnings growth rate of 43.6% for the current year. The Zacks Consensus Estimate for the current year has improved by 0.3% over the past 30 days. The stock price has surged 35.9% in the past six months.

[Big Money: Google and Microsoft Just Put Over $4 Billion into this New Technology]