Seven inflation-shelter investments to buy are gaining appeal as potential safe havens amid fears a famine may spread beyond 140 million undernourished people in needy nations as the world’s food supply is squeezed by Russia’s attack and blockade of Ukraine.

The seven inflation-shelter investments to buy feature a currency, a mineral company, gold, an energy stock and other prospective hedges to shield against the worst effects of rising prices. Despite President Biden blaming the worst inflation in 41 years on Russia’s unrelenting attacks on Ukraine, its military and civilians, other key factors include disrupted supply chains, prolonged government stimulus policies, soaring federal deficits and regulatory curbs on fossil fuels.

Russia’s President Vladimir Putin, who caused sanctions to be placed on his country by sending troops into Ukraine in violation of international law, now is insisting that other nations cease their restrictions on his country’s goods before he allows grain exports to resume. Russia’s invasion of Ukraine, described by Putin as a “special military operation,” has shelled hospitals, schools, residential areas, churches, nuclear power plants, oil refineries and a theater used as a shelter, amid reports his soldiers raped, tortured, kidnapped and executed Ukrainian civilians.

Seven Inflation-Shelter Investments to Buy Feature U.S. Dollar Fund

The U.S. dollar offers one relatively safe-haven among the seven inflation-shelter investments to buy. Investors seeking to go long in the greenback can do so easily via the Invesco DB U.S. Dollar Index Bullish Fund (NYSEARCA: UUP), according to the latest issue of Fast Money Alert. That advisory service, co-led by Mark Skousen, PhD, and Jim Woods, informed its subscribers this week that the fund can serve as an inflation hedge.

Source: stockinvestor.com

The investment seeks to establish long positions in ICE U.S. Dollar Index futures contracts with the intent of tracking the changes, either positive or negative, in the Deutsche Bank Long USD Currency Portfolio Index. The fund invests in futures contracts to try to mirror the results of the index.

That index is calculated to reflect the changes in market value over time, whether positive or negative, of long positions in dollar contracts. As the U.S. Dollar Index moves against a basket of foreign currencies that include the euro, the yen and the Canadian dollar, so does UUP, Skousen and Woods wrote.

UUP Is one of Seven Inflation-Shelter Investments to Buy

Due to the dollar-bullish trends of rising interest rates, pressured foreign currencies and a general flight to safety in a bear market that officially began this week, it makes sense to add UUP to one’s portfolio, the co-leaders of the service wrote.

Chart courtesy of www.stockcharts.com

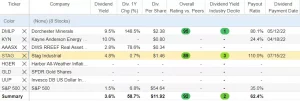

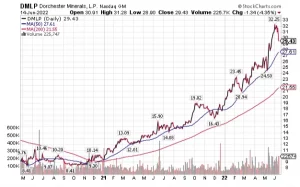

Skousen, who also leads the Forecasts & Strategies investment newsletter and the Five Star Trader, Home Run Trader, TNT Trader services, further favors a mineral stock as an inflation hedge: Dorchester Minerals, L.P. (NASDAQ: DMLP), of Dallas. The oil and gas royalty company, a recent recommendation of Five Star Trader, began operations on January 31, 2003, after the combination of Dorchester Hugoton, Ltd., Republic Royalty Company, L.P. and Spinnaker Royalty Company, L.P.

[Urgent: Top Ranked Economist – “Food Shortages are Coming…” Six Steps to Prepare]

The limited partnership (LP) has been expanding its resources, acquiring 3,600 new mineral and net royalty acres in 13 counties across Colorado, Louisiana, Ohio, Oklahoma, Pennsylvania, West Virginia and Wyoming. Skousen wrote that it has $33 million in hand to support further growth, with just $1.8 million in debt.

“Business is booming,” Skousen opined. “Revenues and earnings more than doubled in the past year.”

Chart courtesy of www.stockcharts.com

One of Seven Inflation-Shelter Investments to Buy Has Soared

In fact, the company’s revenues rose 127% to $112 million, and its earnings grew 159% to $86 million. Plus, its profit margins exceed 76% and its return on equity (ROE) reached 70.9%.

Dividend lovers will appreciate that Dorchester has returned payouts to its shareholders. In the past year, Dorchester’s quarterly dividend has gone from 48 cents to 75.4 cents per unit. Expect another increase in July, with Dorchester selling for just 11.8 times earnings, Skousen continued.

Woods Lists GLD Among Seven Inflation-Shelter Investments to Buy

SPDR Gold Shares (NYSE: GLD) is an exchange-traded fund that is pegged directly to the price of gold bullion. Woods described gold the greatest store of value in the market today.

With geopolitical angst rampant, gold and precious metals mining stocks are starting to shine, Woods opined. Traders have begun moving into the safety of an investment that seeks to reflect the performance of the price of gold bullion, after subtracting the expenses of the fund’s operations.

The fund’s shares are designed to provide a cost-effective and convenient way to invest in the precious yellow metal. Advantages of investing in the shares include ease and flexibility of buying and selling the shares, as well as reduced costs from purchasing the bullion and storing it.

Chart courtesy of www.stockcharts.com

SPDR Gold Shares is a recommendation in the market trend-following Successful Investing newsletter that Woods heads. Gold has come under pressure due to the market’s latest risk-off trade. But he advised holding gold through GLD in expectation of future moves higher once the market calms, even though that timing remains unknown.

Energy Mutual Fund Joins Seven Inflation-Shelter Investments to Buy

Kayne Anderson Energy Infrastructure Company (NYSE: KYN), a Houston-based closed ended equity mutual fund launched and managed by KA Fund Advisors, LLC., provides the largest payout of the seven inflation-shelter investments to buy. KYN offers a current dividend yield of 8.6% and is a recommendation of Bryan Perry, a high-income aficionado who is a veteran of Wall Street firms and the editor of the Cash Machine investment newsletter.

[Former Goldman Sachs Exec: “America’s problems explained in ONE chart”]

Crude oil prices have risen in recent months, but they dipped Tuesday, June 14, amid reports that President Joe Biden and Saudi Arabia’s crown prince would meet and possibly agree upon Organization of the Petroleum Exporting Countries (OPEC) boosting production to offset global supply constraints. Oil hit 14-week highs earlier on June 14, with U.S. crude climbing to almost $124 a barrel as OPEC kept its forecast that 2022 global oil demand would top pre-pandemic levels.

Perry chose to use KYN to increase the weighting of his monthly newsletter’s model portfolio to tap into a secular transition to natural gas from coal at America’s largest electric utilities. The mutual fund provides exposure to the rising demand for exporting natural gas to Europe and Asia through liquified natural gas (LNG).

Chart courtesy of www.stockcharts.com

Pension Fund Chairman Recommends Broad Dividend-paying Energy Fund

Bob Carlson, a pension fund chairman who also leads the Retirement Watch investment newsletter, currently is recommending DWS RREEF Real Assets (AAASX). The investment is a basket of four different inflation hedges and has six share classes.

Carlson advised that investors check with their brokers or the fund for guidance on the best share class for each person. The mutual fund is allocated among inflation-sensitive assets, including infrastructure stocks, commodities, gold, real estate stocks and Treasury Inflation-Protected Securities (TIPS). It owns both stocks and futures contracts.

The fund’s managers change the allocations to the different sectors based on economic outlook and inflation. They have shown a knack for profitably adjusting the portfolio, Carlson commented.

In addition, analysts specializing in each of the sectors select the individual securities to be purchased after the top managers decide on allocations. This investment offers diversification and a chance to benefit from a full basket of inflation hedges, he added.

Connell Chooses Two of Seven Inflation-Shelter Investments to Buy

“Real assets typically provide purchasing power protection during periods of inflation,” said Michelle Connell, a former portfolio manager who heads Dallas-based Portia Capital Management.

Real assets include real estate investment trusts (REITs), real estate, energy and commodity futures. Most classifications of REITs benefit investors in the form of dividends and purchasing power protection.

However, REITs that have distribution centers and warehouses as their underlying properties also will benefit from supply-side inflation that is caused by a lack of goods demanded by consumers, Connell said.

Connell told me one of her favorite REITs involved in distribution centers and warehouses is Boston-based Stag Industrial Inc. (STAG). A key reason is that distribution centers became more “imperative” during the pandemic due to a shift from brick-and-mortar retailers to online shopping.

[Urgent: Top Ranked Economist – “Food Shortages are Coming…” Six Steps to Prepare]

Amazon (NASDAQ: AMZN) is STAG’s largest tenant and 40% of the REIT’s portfolio provides distribution for e-commerce businesses, Connell said. Its stock has pulled back with the market in the past month, but Connell views that reduced price as a buying opportunity.

Chart courtesy of www.stockcharts.com

“The demand for distribution centers is expected to continue to grow,” Connell said. “While e-commerce sales have grown 167% in the past five years, they are expected to grow another 50% in the next five years.”

Seven Inflation-Shelter Investments to Buy Include Fledgling Fund

Another way to protect against inflation is through real assets that feature commodity futures, Connell said. Commodity futures not only protect purchasing power, but they typically have less downside risk during volatile or bear markets, she added.

The Harbor All-Weather Inflation Focus ETF (HGER), designed as a commodities futures exchange-traded fund (ETF) to hedge against inflation, is followed by Connell. The fund is sub-advised by Quantix Commodities LP, a commodities solution boutique firm of former senior Goldman Sachs traders.

HGER, intended to guard against the detrimental effects of inflation, weighs multiple factors such as money supply, wage growth, supply chain constraints, surging demand for goods and chronic underinvestment in commodities. The ETF allows investors a way to shield themselves in an Inflationary environment by using commodity futures that have a proven record of providing diversification and offer a refuge during rising prices.

In contrast, broad-based commodity indices are not designed with Inflation protection as a targeted objective, according to HGER’s managers. To that end, Harbor All-Weather Inflation Focus ETF developed an inflationary hedging index with Quantix Commodities LP to help both institutional and retail investors seek to profit from rising consumer prices.

The ETF is worth considering at a time when the Consumer Price Index (CPI) has risen during the past year to 8.6%, a level not seen in 41 years. Connell has been researching and monitoring the fledging fund that launched earlier this year as an inflation-protection strategy.\

Chart courtesy of www.stockcharts.com

The seven inflation-shelter investments to buy offer a chance to profit despite the world’s growing hunger problem. Amid the highest inflation in 41 years, the Fed reportedly plans to announce interest rate hikes of at least 50 basis points today to limit price hikes that also have been exacerbated by rising federal deficits and Russia’s unrelenting deadly attacks on Ukraine. These seven inflation-shelter investments to buy offer potential relief from the market’s recent plunges.

[Exclusive: Nomi Prins – The #1 Stock for America’s Great Distortion]

Read more from Paul Dykewicz at StockInvestor.com