Stock market crash insurance is as precious as gold and silver for investors who seek to protect a portion of their assets from the vagaries of volatile equities.

Anyone who regards stock market crash insurance as unnecessary when equities historically outperform other investments should consider that March 31 marked the end of the worst first-quarter performance in history and the biggest quarterly cratering, a 23.2% drop, for the Dow Jones Industrial Average since 1987. The key question for investors interested in owning precious metals, which tend to rise when equities fall, is what form their purchases should take and whether their key goal is to turn a profit or to protect themselves against societal calamity.

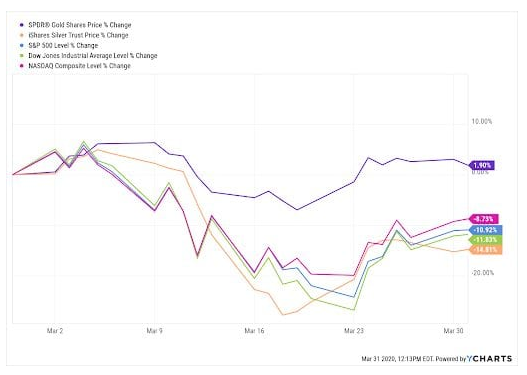

This one-month chart shows gold gaining 1.9%, while silver and major U.S. stock indexes fell.

The difference between paper gold and physical gold is “fairly simple,” said Rich Checkan, president and chief operating officer of Asset Strategies International, a full-service tangible asset dealer in Rockville, Maryland.

“Physical gold is 100% backed gold,” Checkan said. “If you buy an ounce, an ounce is either delivered to you or a storage account in your name. If you buy 100 ounces, 100 ounces are delivered to you or to a storage account in your name.”

[Revealed: Man who Predicted 2008 Collapse Makes SHOCKING new Prediction for 2020]

In contrast, paper gold is basically either an exchange-traded fund (ETF) or futures contracts, Checkan continued.

“The problem with gold ETFs and futures contracts is there are typically more ETF shares or futures contracts sold than there is gold to back it up,” Checkan said. “For instance, many ETFs are leveraged one to three times. In other words, they have one ounce of gold for every one, two or three ounces actually backing it up.”

Futures Contracts Offer Stock Market Crash Insurance with ‘Paper Gold’

Futures contracts allow investors to buy gold today that has not been produced yet. Since “very few clients” ever take delivery of these contracts, more are sold than will ever be delivered, or even produced, Checkan told me.

“The problem is when everyone gets nervous at the same time and wants to take delivery,” Checkan said. “This situation would be akin to a run on cash at a fractional reserve bank.”

No such problem exists for investors who buy physical gold, Checkan said. Ounce for ounce, physical gold is set aside for investors to either take possession of it themselves or have it held in their account for safekeeping elsewhere, such as with a Perth Mint Certificate. In the latter instance, buyers can purchase a certificate to receive a “warehouse receipt” for gold that is stored at the Perth Mint in Perth, Western Australia.

Perth Mint Provides Physical Gold as Stock Market Crash Insurance

Two ways that Checkan likes to invest easily in physical gold are with Perth Mint Certificates (PMC) or the Perth Mint Depository Distributor Online (PMDDO) program. Checkan has devoted space on his company’s website to educate potential gold buyers about those choices and to offer guidance on how to get started in either program.

“In the end, the big advantage to physical gold is the 100% backing,” Checkan said. “Both PMC and PMDDO are 100% backed with a unique government guarantee. That combination ensures peace of mind, which is why I favor these products, especially in this current market environment.”

[Learn More: Former Government Insider Reveals Where He's Investing $1 Million]

Every precious metals investor needs to answer the question at the onset whether the goal is to make money or to preserve assets, said Hilary Kramer, host of a national radio program called “Millionaire Maker” and head of the GameChangers advisory service.

Stock Market Crash Insurance Is Available without Owning Physical Gold

“If you want to capture an increase in demand for bullion, you’re really only speculating,” said Kramer, who also leads the Value Authority advisory service. “You don’t need to get involved with the physical metal or worry about delivery, storage or anything else. Paper gold is all you need because your goal is to buy in, ride the wave and then cash out into dollars again. SPDR Gold Trust (GLD) is fine.”

Chart courtesy of www.StockCharts.com

However, gold buyers who are looking to mitigate risk instead of capturing the highest returns may prefer owning the physical precious metal, Kramer said. The cost of owning physical gold is heightened, compared to paper gold investments, due to the need to pay for delivery and storage, as well as for a premium beyond the world’s current spot market price for the shiny metal, she added.

In comparing the investment proposition of buying gold, a purchase of the physical metal will cost more, much the way someone would pay an insurance premium to protect against a huge loss, Kramer continued.

“Gold is your insurance policy that you’ll be shielded from bigger losses in the market,” Kramer said. “When you’re worried about everything else dropping 10-20%, locking in a 5% loss and paying fees along the way can look good.”

[Discover: The $7 Dollar Firm Using One of the Greatest Investment Secrets in History]

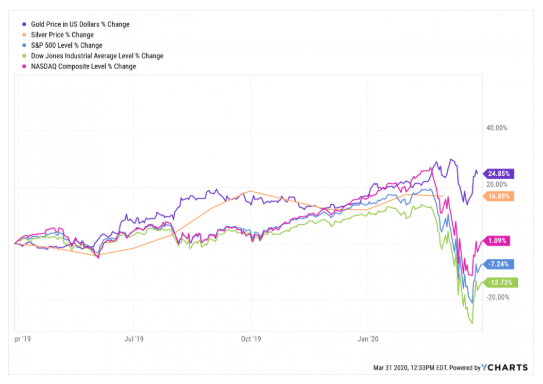

During the past year, gold and silver have sparkled as investments. Gold zoomed 24.8%, silver skyrocketed 16.9% and the NASDAQ Composite climbed 1.1%, while the S&P 500 plunged 7.2% and the Dow Jones Industrial Average dove 13.7%.

Gold and silver soared double-digit percentages in the past year as stocks struggled.

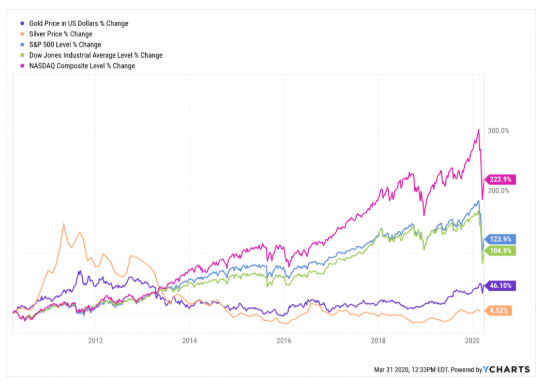

Historically, major U.S. stock market indexes outperform precious metals during long periods of time. For the past 10 years, the top returns have come from the NASDAQ Composite jumping 223.9%, trailed by the S&P 500 leaping 123.9%, the Dow Jones Industrial Average climbing 104.9%, gold gaining 46.1% and silver up 4.5%.

This 10-year chart shows how U.S. stock indexes have outperformed gold and silver.

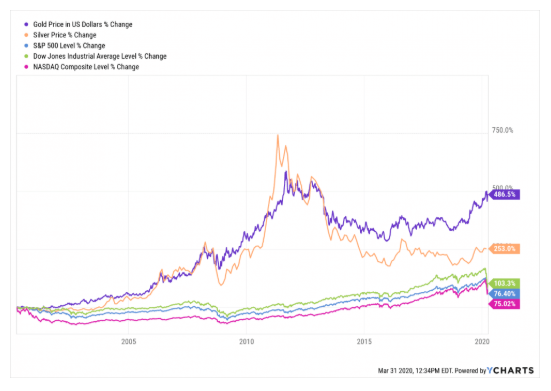

Exceptions exist, however, since precious metals topped the major U.S. stock indexes for the past 20 years. Gold outshined the other investments by soaring 486.5%, silver surged 253.0%, the Dow Jones Industrial Average ascended 103.3%, the S&P 500 improved 76.4% and the NASDAQ Composite climbed 75.0%.

Gold and silver beat the major U.S. stock market indexes during the past 20 years.

Fed Policies Pump up Gold’s Appeal as Stock Market Crash Insurance

“The federal government pumping trillions of dollars into the economy at zero interest means that the odds of real inflation are higher than they’ve been in over a decade,” Kramer told me. “That’s another of the classic reasons to own gold. I’m not convinced that inflation will get out of control this year, but if you are, paper gold is the way to go. Physical gold is most compelling when society itself breaks down. That’s not what happens if the Fed’s interventions pay off.”

Gold traditionally does well in challenging times, except when there’s a “liquidity crisis,” said Bob Carlson, who is chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets.

[Deeper Analysis: Could This Crisis Last 18 Months?]

A variety of Federal Reserve Bank actions in recent weeks have helped to alleviate the liquidity crisis and will continue to do so, said Carlson, who also leads the Retirement Watch advisory service. Demand for gold should be steady and will increase even as the economy recovers down the road, he added.

“An investor who wants to own gold because we’re in a crisis shouldn’t try to time the purchase,” Carlson counseled. “Gold should do well if stocks decline. Gold also should do well if the stimulus measures work and the economy accelerates.”

Federal Monetary and Fiscal Stimulus Should Fuel Gold and Silver Prices

However, the stimulus enacted so far isn’t enough, Carlson said, especially if the forced shutdowns due to the coronavirus continue through April, as President Trump indicated during his March 30 White House briefing. Leaders in Congress stated they are working on a fourth legislative package, after already passing three of them to help businesses and workers who have been hurt financially by the coronavirus crisis.

Whether the $2.2 trillion CARES Act that Congress passed and President Trump signed into law on March 27 helps as much as it should depends on a couple of unknowns, Carlson told me. Unlike in past stimulus and bailout initiatives by the federal government, a major goal of this measure is to provide money to small businesses so they can continue to pay, even if the operations aren’t open or are subsisting at reduced levels, he added.

Congress tried to target aid to the people who need it most through a refundable payroll tax credit, Carlson said. The businesses can receive a tax refund equal to wages they paid employees when the business was affected by the pandemic, he added.

“Another way CARES tries to get money to small businesses is by encouraging businesses to take out Small Business Administration-guaranteed loans,” Carlson said. “When the [SBA] loan proceeds are used to pay employees wages and benefits, the loans will be converted into grants. The businesses won’t have to repay them.

“It is important to the success of the legislation that small businesses realize these benefits are available to them and take advantage of them. It’s also important that the loans be applied for and approved expeditiously. SBA loans are notorious for having long application and approval processes.”

It also is important to have fast feedback about whether these programs are working, Carlson told me. If they are not effective, the government must find ways to make them work or create new programs that will put cash in the hands of small business owners to let them keep paying their employees, even when they aren’t working, he added.

What is the Price of Buying Gold and Silver as Stock Market Crash Insurance?

Each precious metals product is priced differently and is affected by unique supply and demand factors that “change constantly,” Checkan told me. There is not a set premium charged beyond the price of a gold or silver coin, bar, round or certificate on the “spot market,” he added.

[Learn More: Man who Predicted 2008 Collapse Makes SHOCKING new Prediction for 2020]

For example, the two most popular products available to gold and silver investors are Gold Eagles and Silver Eagles, Checkan said.

In “normal” times, when any clients buy Gold Eagles, they pay 5-6% over the spot market price, Checkan said. When they sell, they receive an amount near the spot price, which is the average net present value of the estimated future price of gold.

In distressed times like now, gold buyers pay 8-10% above the spot price, Checkan said. When they sell, they only collect about 1% more than the spot price, he added.

Premiums on Silver Have Soared to Procure Stock Market Crash Insurance

In “normal” times, people who buy Silver Eagles pay 15% beyond the spot price, but only receive around 8% above that price when they sell, Checkan continued.

In times of crisis like the present, when they buy, they pay 38-40% over the spot price but obtain 19% over the same price when they sell, he added.

“Keep in mind, these retail numbers can change based on product availability, changes in demand and availability of secondary market product,” Checkan said. “Further, the numbers quoted above include profit margins for retailers, wholesalers and mints on the client buy side, and they contain margins for retailers and wholesalers on the client sell side.”

Nonetheless, physical precious metals always should be a person’s first step for wealth insurance, Checkan told me. Even though local currency is what people generally use for purchases, the greatest liquidity comes from owning gold and silver directly, he added.

Physical Gold and Silver Could Be the Best Stock Market Crash Insurance

“But anything over and above what you anticipate needing for an emergency, or anything more than you feel comfortable storing and safeguarding yourself, should be placed in the hands of the professionals,” Checkan said. “This is where the Perth Mint Certificate Program shines.”

The Perth Mint’s 100%-backed physical metal is immediately available with premiums that haven’t varied in more than 20 years — 2.25% above the spot price to buy and 1.25% below the spot price to sell — in all types of markets, both calm and unsettling.

“ETF premiums tend to remain constant as well, but you typically cannot take delivery of gold and silver when needed,” Checkan said.

In addition, ETF holdings usually are leveraged, so not all the gold and silver are available to back the fund’s position, Checkan continued.

Physical Precious Metals’ Pricing Soars for Stock Market Crash Insurance

There is a two-tier market right now with the price of physical precious metals jumping, compared with paper gold and silver investments, said Van Simmons, who leads David Hall Rare Coins in Santa Ana, California. People wanting paper precious metals products such as GLD or other ETFs still can buy them at small premiums, whereas physical gold and silver are not available, except at higher prices and premiums, he added.

“The definition of paper commodities is computer trades,” Simmons said.

In contrast, Simmons said he buys and sells physical gold and silver products and arranges for physical delivery of bullion that purchasers can hold in their hands. He cautioned for prospective buyers to beware of any delayed deliveries of precious metals.

“They either have it for sale, or they don’t,” Simmons said. “I had a client tell me he could buy gold, but delivery was two months out. That doesn’t make sense to me.”

As the stock market fell, gold prices gained and demand for the physical metal rose.

Coronavirus Fallout Drives Interest in Stock Market Crash Insurance

However, the coronavirus crisis has forced people in countries around the world to stay at home to reduce the risk of becoming infected as the number of cases and deaths worldwide more than doubled in the past week to hit 857,487 and 42,114, respectively, on March 31. In America, the number of cases in the past week has jumped 244.0% to 188,530, with deaths rocketing 401.8% to 3,889.

On March 12, as paper trading in gold and silver were driving down prices, U.S. retail demand for bullion-priced physical gold and silver coins and products took off, said Patrick A. Heller, communications officer at Liberty Coin Service in Lansing, Michigan. Dealer inventories were pretty much quickly exhausted, then wholesaler inventories were largely depleted, he added.

“Projected delivery times are stretching out to the future as the wholesalers wait for the mints and ingot fabricators to create new product to fill orders,” Heller said. “Out of production items such as U.S. 90% silver coins have seen their premiums soar. All other products in current production are also up in premium.”

“The public has stopped liquidating gold and silver bullion products; they are only buying,” Heller said.

People also aren’t waiting any longer to do research or wait for the “right time to buy,” Heller continued.

“They are just coming in and buying,” Heller said before Michigan Gov. Gretchen Whitmer ordered the shutdown of non-essential businesses in the state. “A few people have been put off by the extended delivery times, but that is about the only objection.”

[Discover: Former Government Insider Reveals Where He's Investing $1 Million]

For investors who seek stock market crash insurance, gold and silver offer a valid opportunity for those who can find what they want and buy it. However, performance charts show that gold and silver generally are contrarian investments that are good to own when the share prices of equities fall but usually doomed to drop when stocks soar.