If you’ve been following the crypto market closely, you know it suffered a severe drawdown on March 12. Nearly all cryptos fell by 50%.

Now, many – especially those in the news media – think this drawdown means bitcoin has lost its safe-haven status. Or worse, that bitcoin and crypto won’t survive.

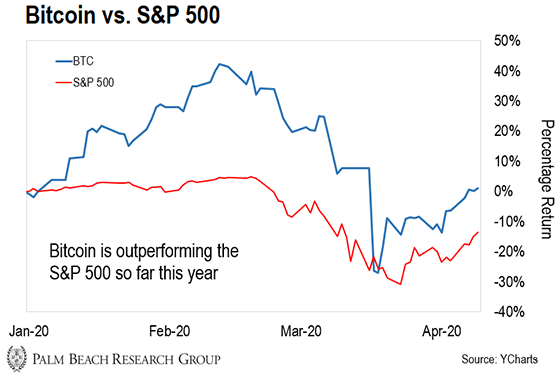

You might be surprised to learn bitcoin is actually outperforming the S&P 500 so far this year. While bitcoin is essentially flat, the S&P 500 is down 12.7%. Yet, no one is suggesting the stock market is doomed…

[Inside: This Upcoming Crypto Event Could Create the Next Round of Bitcoin Millionaires]

So today, I’ll share with you why I’m not worried about bitcoin and crypto’s longevity… Plus, I’ll tell you about a niche market in crypto that’s taking off during the coronavirus pandemic…

Crypto Is Here to Stay

Why did bitcoin and other cryptos sell off during the broad market crash?

First, during liquidity events like the sell-off we saw in March, institutions and investors off-load financial assets across the board to raise funds. And bitcoin and altcoins (all other cryptocurrencies), which are highly liquid and available to trade 24 hours a day, were no exception.

And second, exchanges like BitMEX had over $4 billion in highly leveraged crypto derivatives. The swift move lower caused a cascading effect of liquidations. And roughly 60% of open interest closed in a single day.

The silver lining here is, in general, bitcoin and crypto survived the downswing. They didn’t need circuit breakers to prevent further damage like we saw in the stock markets. And they didn’t need emergency central bank operations to keep functioning.

In 24 hours, the crypto market was effectively cleansed, and things were back on track.

[Limited: Don’t Buy Bitcoin Before Learning About the Best Five Dollar Way to Play This Event]

If anything, the emergency governing mechanisms we saw over the last month might get folks to wake up to the fact that we have more to worry about with traditional, centralized markets than we do with the crypto markets.

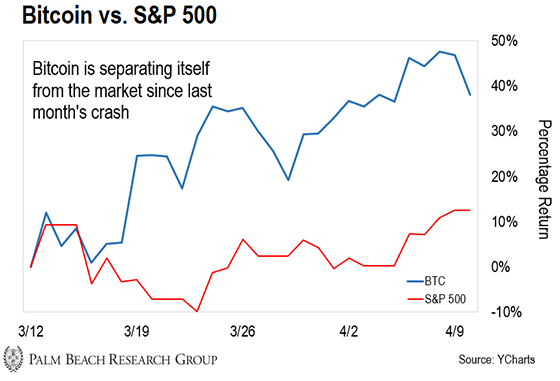

Further, as you can see from the chart below, bitcoin has clearly outperformed the stock market since 2020’s “Black Thursday” – as some are calling it.

Bitcoin’s decoupling from the stock market is a good sign. Unlike correlated assets, which move with the market, and inversely correlated assets, which move in the opposite direction… bitcoin is a noncorrelated asset.

[Urgent: You Have to Act Before May 12, 2020 to Take Advantage of this Lucrative Opportunity]

And it’s not just bitcoin. There’s another niche sector of the crypto market that will benefit from this…

Tech Royalties

I’m talking about stablecoins.

A stablecoin is a cryptocurrency with a fixed price. It’s designed to maintain a stable value. Most are pegged to the U.S. dollar (USD) and trade at or near $1.

Stablecoins solve one of crypto’s major problems: Volatility. And as I’ll show you, they’re growing in usage.

They’re part of a crypto subclass we call “Tech Royalties.” That’s because you can use them to provide income streams similar to royalty companies.

And the current pandemic is showing just how important and resilient these royalties are. It’s one of the few asset classes growing during this crisis.

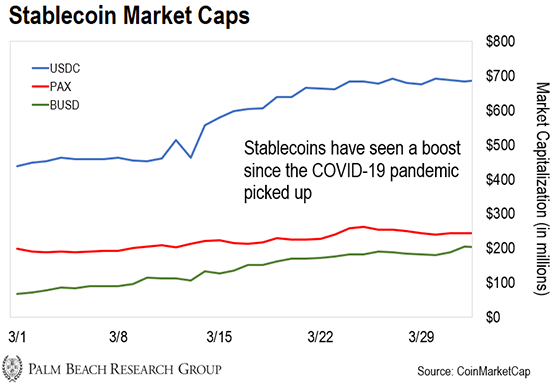

Take a look at the chart below, which shows the market caps of popular USD-backed stablecoins USD Coin (USDC), Paxos (PAX), and Binance USD (BUSD).

Over the last month, they rose 61%, 24%, and 178%, respectively.

[Inside: This Upcoming Crypto Event Could Create the Next Round of Bitcoin Millionaires]

What this shows is stablecoins use is exploding during the pandemic. And there are a few reasons why…

The first is investors are “de-risking” their portfolios. In other words, they’re selling their cryptocurrencies and moving the funds into stablecoins.

But there’s something else going on here, and it’s bullish for stablecoins and cryptos…

[Limited: Don’t Buy Bitcoin Before Learning About the Best Five Dollar Way to Play This Event]

Investors are keeping their crypto funds in Tech Royalties rather than converting them back into U.S. dollars.

You see, stablecoins offer opportunities to earn as much as 8% yields. So investors are starting to recognize the superior benefits of crypto finance over traditional finance.

Plus, when these investors feel it’s safe to invest in crypto again, they’ll be ready with funds that are already in the crypto ecosystem.

Crypto Is Going Mainstream

Bitcoin decoupling and increased stablecoin usage are two very positive signs for the crypto markets.

But I’m seeing other signs that prove the coronavirus pandemic is not a doom-and-gloom scenario for cryptos:

- Forty-eight hours after Black Thursday, crypto trading platform Coinbase saw a 5x increase in cash and crypto deposits, a 2x increase in new-user sign-ups, and a 6x increase in trading volume.

- By the end of March, the number of unique wallets holding at least 1 bitcoin reached an all-time high, demonstrating crypto investors’ willingness to hold crypto through uncertainty.

- Decentralized exchanges saw record volume of $668 million in March, according to Dune Analytics.

Clearly, the talking heads are mistaken. Crypto is not dead.

Once we get past the coronavirus, a bright future lies ahead for early adopters.

[Urgent: You Have to Act Before May 12, 2020 to Take Advantage of this Lucrative Opportunity]

Remember, bitcoin was born during the Great Recession of 2008. And I think today’s crisis will propel cryptocurrencies into the mainstream.

If you want to test the stablecoin waters, consider taking a small stake in USD Coin (USDC). It’s one of the most popular stablecoins in the world. And you can use platforms like Celsius and Compound to earn a high yield.

Regards,

Greg Wilson