I’m going to start this article with some good news: The world might finally be past the peak of COVID-19.

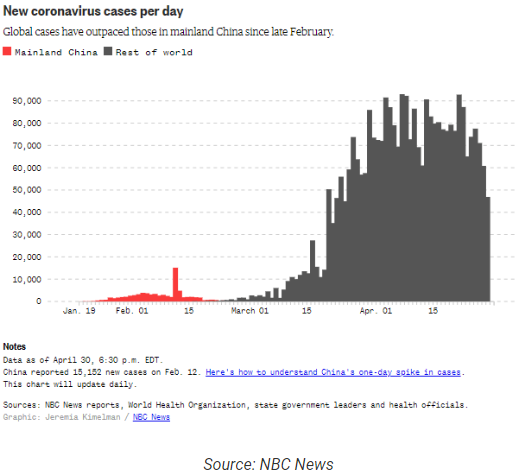

Graphs of new cases per day, like the one below, are starting to show a steady and fairly rapid decline after an extreme surge in mid-April.

President Trump recently announced that the federal government will not be extending its emergency social distancing guidelines. And here in Maryland, the economic reopening process is expected to start in the next couple of weeks.

But now that I’ve given you the good news, it’s time for the bad news:

Life is unlikely to return to 100% normalcy after the current COVID-19 pandemic is contained.

After all, we’re still more than a year away from a vaccine. And National Institute of Allergy and Infectious Diseases (NIAID) Director Anthony Fauci expects the virus to make a resurgence next fall or winter — likely before that vaccine is ready.

[Alert: New Technology Could Put Millions Out of Work while also Creating Many Millionaires]

In other words, some of the drastic containment measures we’ve seen — such as widespread telework, a shift toward food delivery, and the abandonment of cash in favor of contactless payments — are likely to persist long-term. This “new normal” will take some getting used to, but it could be lucrative for investors in certain companies that benefit from these measures.

Today, we’re looking at three stocks that are likely to enjoy strong tailwinds in the coming months as we adjust to the new normal after COVID-19.

GrubHub (NYSE: GRUB)

ARK Invest expects the global food delivery market to reach $3 trillion over the next decade.

And here’s the truly mind-blowing thing: It made that prediction before COVID-19. Now that the world is battling a pandemic, the delivery industry’s future looks even brighter.

After all, COVID-19 has shaken up the restaurant industry. Dine-in service is effectively illegal throughout much of the United States and the rest of the world.

Sadly, many restaurants won’t survive the shock, especially those that are stuck paying for a lot of now-empty dining floor space. The ones that are best positioned to ride out the lockdown are those that specialize in takeout and delivery.

What’s more, even before COVID-19, a new, completely delivery-focused business model was proliferating throughout the food service industry.

Ghost kitchens are disembodied restaurant kitchens with no dining rooms, pickup counters, or storefronts of any kind; they serve customers exclusively through food delivery apps. This model is far less costly in terms of overhead than a traditional restaurant, since a ghost kitchen can be located anywhere and does not require expensive commercial real estate.

In 2019, more than half a dozen ghost kitchen companies closed financing rounds of at least $40 million each.

[Breakthrough: New Tech Outside the Mainstream of Ai, 5G, and Robotics is Seeing Massive Gains]

Between the rise of ghost kitchens and the COVID-19-related decline of traditional dine-in restaurants, we can predict with near certainty that ubiquitous food delivery services will be a part of the new normal after the pandemic.

That’s great news for Grubhub (NYSE: GRUB), the largest publicly traded delivery company. It partners with more than 350,000 restaurants around the world. (For comparison, rival Uber Eats only has 220,000 restaurant partners).

Grubhub’s fundamentals make an even better case for the stock than COVID-19. The stock has always posted revenue growth in excess of 18% per year and has a comfortably low debt-to-equity ratio of 33%.

Visa (NYSE: V)

Dine-in restaurants aren’t the only institution that might never recover from COVID-19. Cash is another.

In this time of paranoia about touching and sharing items, Americans have come to realize that coins, bills, and payment keypads are pretty filthy from all the people that handle them.

As IPO Authority editor Monica Savaglia wrote in a recent Wealth Daily article:

“According to the Federal Reserve, the lifespan of various bills ranges from four to 15 years — meaning your bills have had a lot of time to accumulate germs… but so has the device you’re paying on.

Imagine all the people who have touched the same screen as you and signed their names to complete the transaction. Imagine if that screen didn’t get cleaned every day. That’s equally disgusting. That’s why contactless payment methods are the way to go and will soon become second nature for you.

Tap-and-go payment just needed a little bit of a push, and that’s exactly what it’s getting right now. People are remembering they don’t have to touch that dirty screen; instead, they can hold a phone or card near a reader and in seconds the entire transaction is over.

Today, most transactions are moving towards tap and go by card or smartphone. About 64% of food merchants offer tap and go at checkout. 92% of drug stores and pharmacies also offer tap and go as a way to pay. It’s quick and easy and provides little to no contact between worker and customer.”

It’s a foregone conclusion that contactless payment systems will only become more common after COVID-19, and there’s a small handful of companies that stand to benefit from that trend.

Visa (NYSE: V) is one of those companies.

[Learn More: Discover the Real Reason the Rich Get Richer and Ensure You Don’t Get Left Behind]

As the larger of the two major card payment processors (Mastercard being the smaller one), Visa is indispensable in any credit or debit card transaction, including contactless transactions. In fact, it plans to issue more than 100 million contactless cards in the U.S. by the end of this year.

The company’s fundamentals aren’t too shabby, either. It has grown earnings by at least 8% — and sometimes as much as 500% — in each of the last 11 quarters year over year. It also has a low debt burden, representing just 47% of equity.

Microsoft (NASDAQ: MSFT)

When I finish writing this article, I’m going to upload it into Wealth Daily’s content management system and then let our editors know it’s ready for review.

How am I going to do that? Back in the old days, I might have just walked across the office and told them in person. But now that the office is closed for COVID-19, I’ll just ping them on our work instant messaging platform instead.

Workplace instant messaging platforms have received a lot of media attention in recent weeks due to an inevitable consequence of the COVID-19 pandemic — widespread remote work.

Everyone who can work from home is doing so right now, often, and has been doing so for a better part of two months. Nonessential workers are barred from their offices, after all, and many firms — including publishing companies like Wealth Daily, for that matter — are perfectly capable of operating without a centralized workplace.

[Alert: New Technology Could Put Millions Out of Work while also Creating Many Millionaires]

Remote work and the instant messaging platforms that power it are likely to become a part of the new normal after COVID-19. Some of those firms could have a hard time convincing their workers to return to the office.

Working from home is extremely popular, after all. Buffer’s annual State of Remote Work reports consistently show that more than 90% of workers desire the ability to work remotely at least occasionally.

And there’s some evidence to suggest that it can be good for companies as well. A 2014 Stanford University study of workers at a Chinese travel agency found that remote workers were actually 13% more efficient than their office-based counterparts.

For many people, Slack (NYSE: WORK) is the company that comes to mind when you bring up instant messaging platforms for remote work. After all, it’s a specialized workplace instant messaging platform that went public in a flashy direct public offering last summer.

Slack may be the “pure play” in the workplace instant messaging industry, but that doesn’t necessarily mean it’s the best investment in that industry. In terms of users, Slack is substantially smaller than Teams, a similar instant messaging platform from Microsoft (NASDAQ: MSFT).

In fact, in the second week of March, Microsoft added as many Teams users as there are total Slack users —12 million of them, to be exact.

What’s more, Slack is a relatively young company that's not yet profitable and sports a questionably high valuation. Microsoft, on the other hand, is a reliable bluechip with steady earnings growth and a more down-to-earth valuation on an earnings and revenue basis.

[Breakthrough: New Tech Outside the Mainstream of Ai, 5G, and Robotics is Seeing Massive Gains]

The COVID-19 pandemic, and the global economic shutdown it has provoked, is, simply put, a pivotal moment in human history whose effects will be felt long after this wave of infections is contained.

Delivery services like Grubhub, contactless payment processors like Visa, and workplace technology companies like Microsoft will find themselves in such demand again in the event of a future pandemic. And, as we’ve discussed, they were already on the up and up.

Until next time,

Samuel Taube

Leave a Comment