I’m not a fan of going to the grocery store.

In fact, unless my wife drags me, I only go grocery shopping when I absolutely need something.

I work off a list and am in and out in short order.

But now I have another option to avoid the big crowds and the long lines … shopping online.

By shopping online, I can choose to pick up my groceries in the parking lot, or have them delivered to my doorstep.

This segment of grocery shopping has really taken off because of the coronavirus pandemic.

And I’m convinced it’s only going to get bigger.

I used Money & Markets Chief Investment Strategist Adam O’Dell’s Green Zone Ratings system and found a big international grocery store that’s already in the online shopping segment.

It’s one grocery stock that has massive growth potential and value — along with low volatility.

The company’s impressive footprint will allow it to capitalize on the uptrend in grocery spending.

We Spend More at the Store … Online

In 2019, Americans spent more than $700 billion across nearly 38,000 grocery stores countrywide.

That was up from $632 billion the year before.

[Inside: One of the World’s Leading Angel Investors Unveils Next Tech Breakthrough]

For context, Americans spent a median of more than $65,000 per day in 2018 and more than $70,000 in 2019.

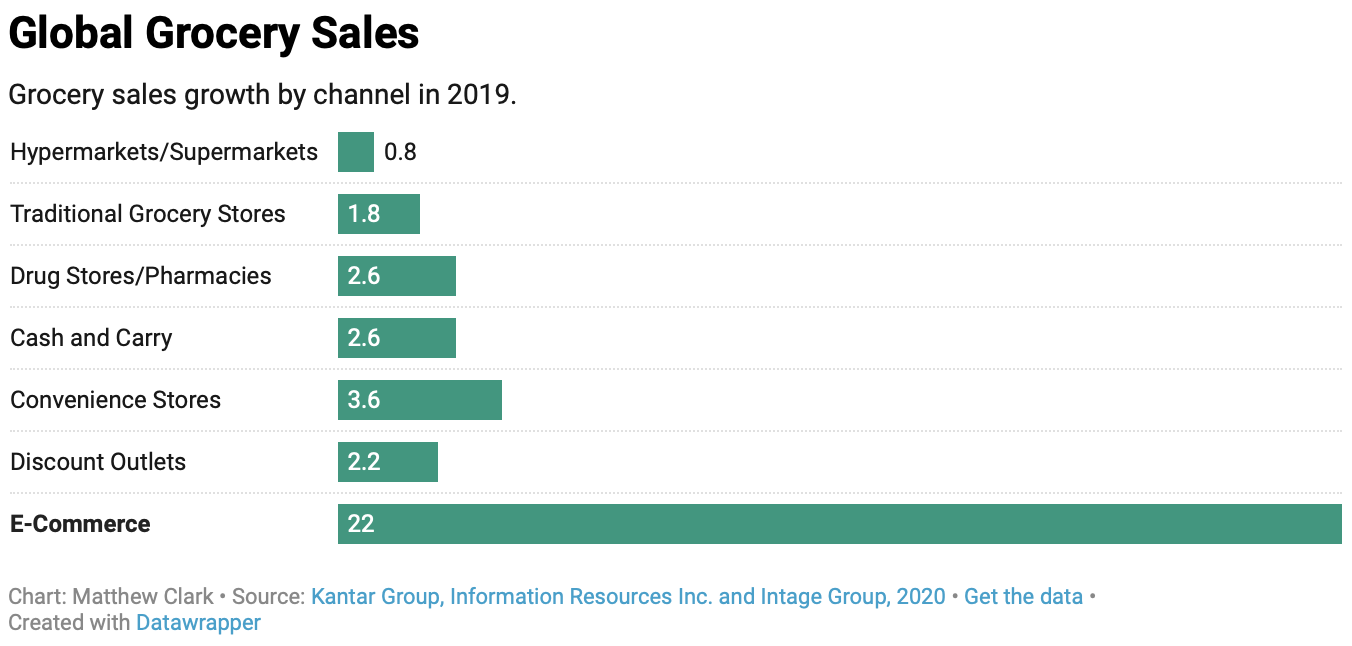

What’s more is that online grocery sales internationally should grow nearly 8% in 2020 — exceeding all other grocery sales growth.

Online Grocery Store Sales Soar in 2019

(source:moneyandmarkets.com)

(source:moneyandmarkets.com)

This chart shows that grocery sales grew the most online … and that was before COVID-19.

Considering that more people are staying at home … or, at least, not going to the grocery store as much in person, because of COVID-19, that number will grow.

[First Look: Amazing New Technology Will Be in 266 Million American Homes By End of 2020]

Keep in mind that the economy is in a downtrend and millions around the world are unemployed.

But they still need to go to the grocery store for basic food and supplies.

That makes grocery stocks more recession-proof.

The expansion into online grocery sales means those stocks are ripe with growth potential.

And, we’ve found one that we believe will outperform the market 3X over the next 12 months!

This Grocery Chain Is One of the Largest in the World

Using Adam’s Green Zone Rating system, we uncovered one of the largest grocery store chains in the world — with stores in the U.S., the Netherlands, Belgium, Luxembourg, the Czech Republic, Greece and Serbia.

Koninklijke Ahold Delhaize NV (Over-the-Counter: ADRNY) is a global grocery store with subsidiaries including Food Lion and Hannaford in the U.S. along with Albert Hejin — the largest chain in the Netherlands.

ADRNY’s Growth Outpaces the Food and Beverage Industry

(source: moneyandmarkets.com)

(source: moneyandmarkets.com)

In its latest quarterly report, Koninklijke showed some massive growth:

A 1% quarterly increase in net sales.

A 6% quarterly increase in comparison sales in the U.S.

Net consumer online sales growth of 6%.

An increase in operating income of 78%.

An outlook of earnings per share growth of more than 20% for the rest of 2020.

Those are all impressive numbers.

Additionally, the stock price has jumped more than 55% since hitting a low in March 2020.

[Learn More: Renowned Investor Reveals What He Thinks Will Be the #1 Tech Stock for 2020]

Now, let’s take a deeper dive into how Adam’s Green Zone Rating system ranks:

Overall — It ranks a 96, meaning only 4% of all other stocks rated were higher. It also means we are strong bullish on the stock.

Volatility — The company ranks a 100 on volatility. It is one of the least volatile stocks on the market. We know that low-volatility stocks tend to outperform high-volatility ones.

ADRNY stock rating volatility

Value — ADRNY ranks a 97 on value with price-to-cash-flow, price-to-sales and price-to-earnings all below the food and beverage industry averages.

ADRNY value

Growth — Koninklijke ranks a 91 on growth with nearly $79 billion in sales and a one-year annual earnings-per-share growth rate of 36%.

What to Do With Koninklijke Stock

This grocery stock has an overall rating of 96, which means we see the stock outperforming the overall market by three times over the next 12 months.

Remember: No matter what the economy or the stock market looks like, you still have to shop for groceries.

Everyone needs food and basic supplies.

It’s what makes Koninklijke a recession-proof stock.

Add to that its online presence, specifically in Europe, and the company has positioned itself for even more growth in the future.

The bottom line: We need to shop for basic essentials, whether it’s in-person or online. Koninklijke is one of the largest grocery chains in the world — and one with tremendous growth potential.

You want to jump into this company now and watch your profits soar three times greater than the market.

By the way, if you’re not quite sure what we mean when we say a stock trades “over-the-counter (OTC)” like ADRNY, check out my colleague Chad Stone’s recent article where we answered one of your questions about OTC stocks.

[Inside: One of the World’s Leading Angel Investors Unveils Next Tech Breakthrough]

Until next time …

Safe trading,

Matt Clark

Research Analyst, Money & Markets