Barclays is preparing clients for a range of outcomes ahead of the Federal Reserve’s meeting later this month, saying stocks could pull back sharply or rally depending on the decision.

The firm’s chief U.S. equity strategist, Maneesh Deshpande, wrote that if the Fed cuts rates by 25 basis points, the market will likely have little reaction. That cut is priced in. But the analyst warned clients they should be prepared for how to invest around a surprising deeper cut to rates or no cut at all.

“Based on current Fed fund futures prices, our model indicates that equity returns would be ~0% and ~1.2% for a one rate cut (our base case) and two rate cuts, respectively,” Deshpande wrote in a note published Wednesday. “In the (highly unlikely, in our view) event of no rate cuts, our analysis indicates that equities would selloff of by ~ 1%.”

Barclays studied regular and unscheduled FOMC meetings since 1994 in determining just how much markets could move if Fed officials stun investors.

Investors believe there’s an 80% chance that the Fed announces a 25 basis point cut and a 20% chance it announces a 50 basis point cut when it concludes its meeting on July 31. Fed funds futures also indicate that investors believe there’s virtually no chance the central bank holds rates steady, despite advocacy by two regional Fed presidents to leave the overnight lending rate unchanged.

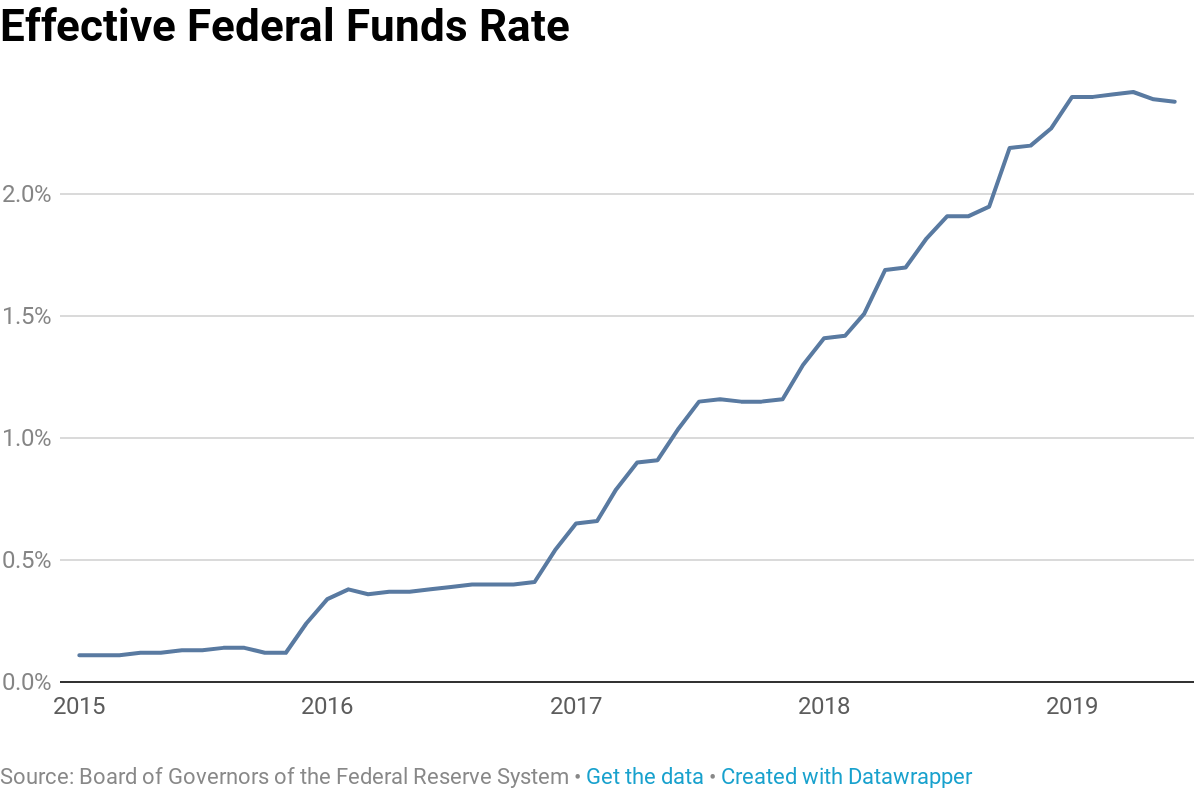

Those in favor of a rate cut highlight potential consequences of recent data in Europe and Asia, where economic growth is decelerating and central banks have been quick to promise easy monetary policy. Others, including Robert Tipp, chief investment strategist at PGIM Fixed Income, think the Fed made a mistake in hiking rates.

“I don’t think the Fed should have ever hiked rates this cycle,” Tipp told CNBC. “We have never had inflation exceed its target … the outcome has been inflation below target and one of the slowest recoveries” on record.

“I don’t think they should have hiked rates in December,” he added. “The world was sending you a pretty strong signal that it wasn’t ready for higher interest rates.” The Fed currently pegs its overnight funds rate in a range between 2.25% and 2.5%

Yet another more hawkish coalition of central bankers point to historically low unemployment rates, above-average GDP growth in the U.S. and decent-but-not-stellar inflation as reason for patience before adjusting borrowing costs.

And while most economists don’t foresee an economic contraction in the U.S. anytime soon, the Fed’s decision next Wednesday could have big implications for the forward-looking stock market if Chair Jerome Powell and his colleagues don’t announce a 25 basis point reduction as expected.

“Equity market reactivity increases when equity markets are rallying over the prior month,” Deshpande added. “Thus, historically, when the SPX has rallied by 5% over the previous month and the Fed does a surprise 25 bp cut (hike), SPX would rally (sell off) by 180 bp. Conversely, when equities are falling, effectiveness of Fed rate changes declines (e.g. during full-blown recessions).”

and even $8,181 per month thanks to the same strategy allowing them to collect these checks.