Certain areas of the market matter more than others…

Well, “matter more” might be a stretch. But certain areas give us a greater understanding of where we are, and more important, where we're headed.

You can think of these as “leading sectors.” When they're booming, it's a good sign for the overall market. Today, one of those leading sectors is hitting new highs… And investors are taking notice.

Sentiment in the sector has hit multiyear highs as a result. But don't take that as a bad sign. History says we can still see further gains. And that's a good sign for this group of stocks and the overall market.

Let me explain…

Transportation stocks are up 94% since bottoming back in March.

That alone is a rally for the history books. And it has driven the sector to its highest level on record.

[Revealed: Legendary Investor’s #1 Pick in Tech Trend that No One’s Talking About]

Investors are taking note. And those who have been on the sidelines are starting to pile into this rally.

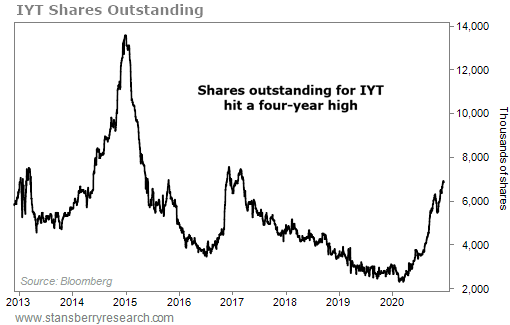

One way to see it is that shares outstanding for the iShares Transportation Average Fund (IYT) are now at their highest level since 2016…

You see, exchange-traded funds (“ETFs”) like IYT can create and liquidate shares based on investor demand. If investors are eager to buy transportation stocks, IYT can increase shares to meet the new demand. And if nobody wants to own this sector, the fund simply cuts shares.

This can give us a good gauge of how investors feel about a given market. When shares outstanding are high, it means investors are falling in love with a sector.

We are starting to see this kind of excitement today. Shares outstanding for IYT are at their highest level in about four years. Take a look…

[Opportunity: This Could Put an Extra $5,600 in Your Pocket Each Year]

Investors are piling back into this sector in a big way. And you can see the multiyear high in shares outstanding in the chart above.

But that doesn't mean the rally is over… While excitement is definitely returning to the transportation sector, we are nowhere near peak levels.

Shares outstanding for IYT peaked at the end of 2014. Back then, IYT's shares outstanding were more than double where they are today.

That means there are still folks standing on the sidelines who could get back in. If those investors start putting money to work, we'll continue to see big gains in transports.

In short, yes, this excitement is something to keep an eye on in the coming months. But it's no reason to sell just yet. Investor sentiment in transportation stocks could jump much higher before the rally eventually peaks.

And since transportation is a leading sector, seeing excitement build and prices rise is a good thing. It tells us the overall market is in a good place… and that gains can continue to rack up from here.

Good investing,

Chris Igou

[Breakthrough: This Will Create More New Millionaires than Anything Else on the Planet]