Banks have a dirty track record.

Historically, they have dumped trillions of dollars into the fossil fuel industry… a slap in the face for climate change champions.

But in the age of the Paris climate agreement, the world is watching. And this trend appears to be reversing.

So far in 2021, banks around the world have committed $203 billion in loans and bonds to climate-friendly renewable energy projects. That’s at least $10 billion more than what’s been put toward hydrocarbon-based businesses.

We have finally reached the financial tipping point where banks are financing more clean energy projects than dirty ones. And today, I’ll reveal which companies are leading the charge.

Go Green to Get Green

Banks want to invest only in industries and businesses that provide decent returns. And that’s increasingly difficult to do in the fossil fuel sector.

Some of the biggest banks are setting the right example. JPMorgan Chase (NYSE: JPM) and Citigroup (NYSE: C) have historically been the biggest lenders to fossil fuel companies. But their green loans and bond sales in 2021 are (so far) outpacing those for fossil fuels.

This is the first year that has happened since the Paris climate agreement was signed in 2015.

So why is this happening now? There are several reasons.

Let’s look at JPMorgan as an example. Its shareholders (not to mention climate change activists) think it should withdraw from fossil fuel financing altogether. Feeling the pressure, JPMorgan plans to reduce its exposure to the oil and gas industry.

[Wall Street Insider: Why July 4th Could Spark The Greatest “MegaTrend” of The Decade]

But these giant banks aren’t changing their tune just to be good, green corporate citizens. Their fossil fuel profits are dwindling.

And as more renewable projects ramp up, they want to get in on the action. They realize future profits will come from lending to renewable projects.

Still, not all banks are on board.

Wells Fargo (NYSE: WFC) is in a similar boat. Only recently – and after immense pressure – did it reveal plans to loan $500 billion for sustainable projects by 2030.

Truth be told, some of the greenest banks aren’t even here in the U.S. They’re in France.

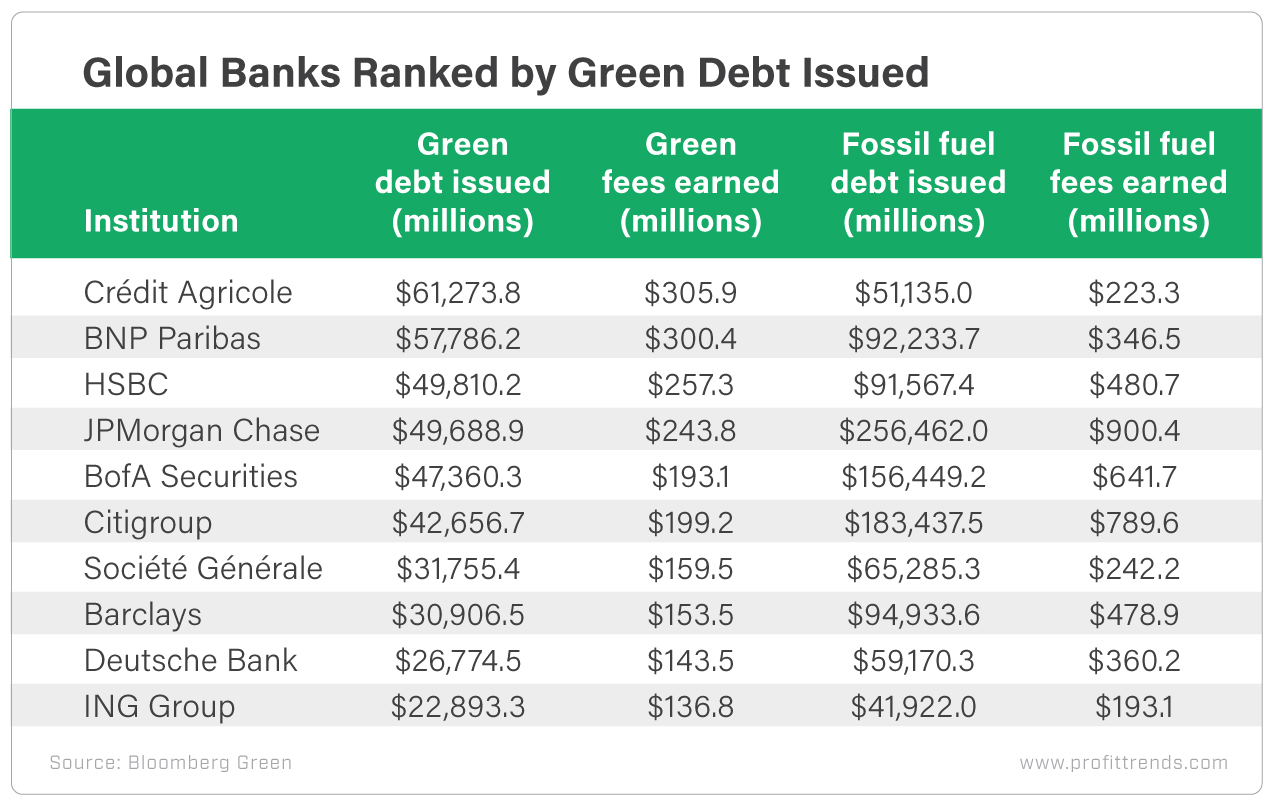

The leading underwriter of bonds for green projects is Crédit Agricole (OTC: CRARY). Two other Paris-based banks, Société Générale (OTC: SCGLY) and BNP Paribas (OTC: BNPQY), are also leading lenders for sustainable projects.

Here’s how the top global banking institutions rank based on the amount of debt issued to clean energy projects…

[Trend Alert: Three of the World’s Richest Billionaires Are Quietly Piling Into THIS]

Tipping the Scale

Today, the renewable energy lending market is rapidly growing. Though it’s still tiny compared with the fossil fuel sector’s lending market.

Consider that over the last five years, renewable energy projects have raised about $160 billion in debt, compared with the $3.6 trillion fossil fuel companies have raised.

Investment banks have been slow to shed their fossil fuel customers. Sadly, U.S. investment banks still dominate dirty lending.

But the tipping point is here… and it’s leaning in favor of clean energy.

If you’re looking for profits in the banking sector, make sure to carefully review prospective investments. You’ll want to be part of the companies that are fighting for tomorrow… not the ones that are clinging to yesterday.

Good investing,

Dave

[See Also: The Best Electric Vehicle Stocks to Energize Your Portfolio]