“The real problem is not whether machines think but whether men do.” — B. F. Skinner

While robots have long held sway in the domain of science fiction, their role in the automation of jobs formerly performed by humans has cast a specter over the world’s developed economics and will remain a salient political and economic question for a long time to come.

[Read More: This 5G Wireless Company is Poised to Become a Global Household Name]

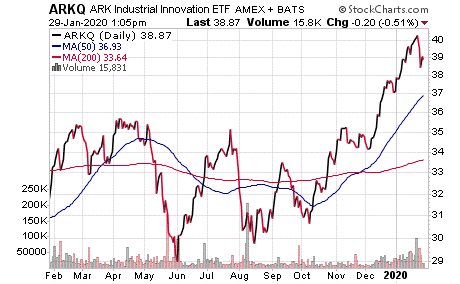

On the other hand, the disruptive innovation driven by the “Fourth Industrial Revolution” also has given new opportunities for investors. For instance, the ARK Autonomous Robotics ETF (BATS: ARKQ) provides investors with exposure to companies around the world that will benefit from new scientific advancements in the areas of energy, materials, transportation, automation and manufacturing.

One of the most crucial differences between ARKQ and its most direct competitor Robo Global Robotics and Automation Index ETF (NYSE: ROBO) is that while ROBO generally focuses on companies that develop or benefit from automation, most of the companies in ARKQ’s portfolio are involved with the fields of autonomous transportation, robotics and automation, 3D printing, energy storage and space exploration.

The ARK Invest fund’s top holdings include Elon Musk-led Tesla Inc. (NASDAQ: TSLA), Stratasys Ltd. (NASDAQ: SSYS), Proto Labs, Inc. (NYSE: PRLB), Materialise NV-ADR (NASDAQ:MTLS), Xilinx, Inc. (NASDAQ:XLNX), NVIDIA Corporation (NASDAQ: NVDA) and AeroVironment, Inc. (NASDAQ: AVAV).

[See Here: The Company Poised to Make This Decade's Most Brilliant Tech Power Play]

This fund’s performance has been solid in both the short run and the long run. As of Jan. 27, ARKQ is up 2.38% for the past month and 14.19% over the past three months. It currently is up 3.58% year to date.

The fund has $183.81 million in assets under management and an expense ratio of 0.75%, meaning that it is more expensive to hold in comparison to other exchange-traded funds (ETFs).

In short, while ARKQ does provide an investor with a chance to profit from the world of autonomous robotics, the sector may not be appropriate for all portfolios. Thus, interested investors always should conduct their own due diligence and decide whether the fund is suitable for their investing goals.

[Read More: This 5G Wireless Company is Poised to Become a Global Household Name]