It’s quarterly earnings season and there is one company that has clearly stood out from the rest during the coronavirus pandemic, and Amazon’s Q2 earnings should reflect that.

If there’s been a darling of the market during the coronavirus outbreak, it’s been Amazon.com Inc. (Nasdaq: AMZN). It’s set to report earnings Thursday, with some very high expectations.

The company was positioned perfectly for both stay-at-home orders and businesses moving employees to work remotely.

Amazon can be played two ways for investors:

- Strong e-commerce: We were already shopping online before. The COVID-19 lockdown just made that far more prolific — maybe permanently.

- Cloud services: Amazon’s Web Services cloud platform has done well as it caters to streaming video platforms and also helps companies manage data and workflow as more employees conduct business remotely.

Remember, both of these plays were strong even before we all were locked down from going out.

[Opportunity: How You Can Get Paid Every Time a Package Leaves the Amazon Warehouse]

Amazon Before the Pandemic

The company was already trending up before the coronavirus after a banner holiday shopping season, and it reached a new high during the pandemic.

That should tell you that traders see Amazon as a solid investment, not just for now, but for the future.

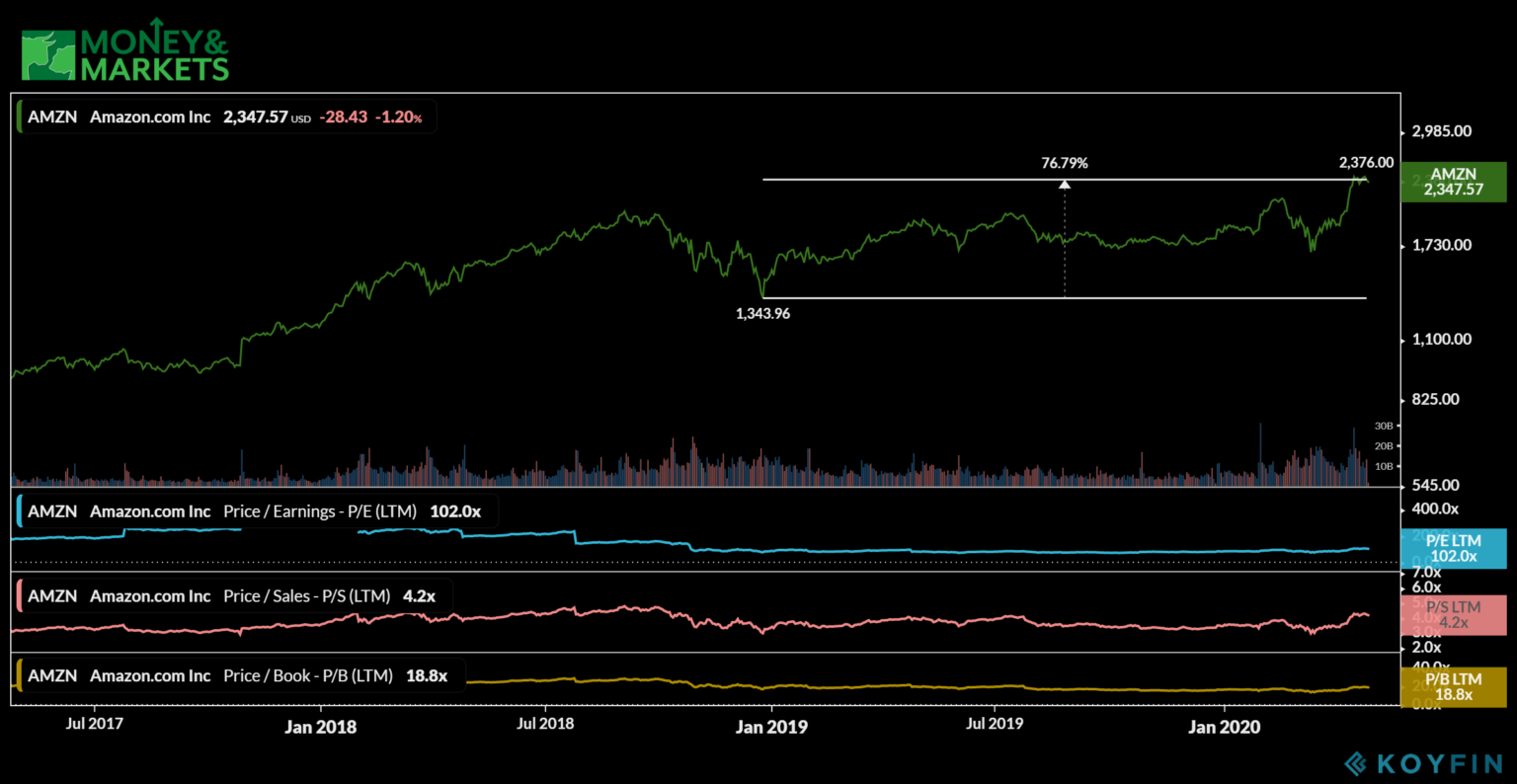

Since December 2018, the stock price has grown by nearly 77%.

Remember, the S&P 500 is down in 2020 thanks to the pandemic and other factors such as oil prices.

Now Amazon trades above $2,300 per share — which obviously is quite expensive and likely the only downside to the stock, other than it doesn’t pay a dividend. It still maintains a solid price to book of 18.4 and price to sales of 4.1.

That share price is buoyed by what will be a big uptick in sales that will likely be reflected in Amazon’s 2Q earnings as the company went on a hiring spree to help deal with order fulfillment.

[Don’t Miss: Why Amazon is Legally Obligated to Ensure Everyday Americans Get This Money]

Adding grocery delivery with its acquisition of Whole Foods just puts more value on Amazon. That value continues to go up as many shoppers buy groceries online because they believe it’s too dangerous to go to the store.

And let’s not forget about its cloud computing platform.

The demand for more data storage and cloud flexibility as millions of Americans work remotely has also increased the value of Amazon as a whole. Just like its stock, AWS was already thriving before the pandemic.

What to Expect in Amazon’s Q2 Earnings

In the fourth quarter of 2019, Amazon reported a huge jump in revenue, net income and earnings per share, again due to a massive holiday shopping haul.

Amazon’s revenue was $87.4 billion with a net income of $3.3 billion and an EPS of $6.47.

For Amazon’s 2Q earnings, you can expect those numbers to be lower. Analysts are projecting revenue of around $73 billion. The company’s guidance for revenue is between $69 billion and $73 billion.

If it matches Wall Street’s projections, Amazon will have year-over-year revenue growth of more than 20%.

I think that is a feasible expectation.

[Opportunity: How You Can Get Paid Every Time a Package Leaves the Amazon Warehouse]

As more and more people use Amazon to shop and to do business, it’s reasonable to expect a jump in revenue.

I see Amazon’s Q2 earnings beating analyst expectations — albeit slightly.

If they don’t, shares of the company could see a slight dip, but that would make Amazon an even stronger buy.