Summary

-Apple is starting the 2020 fiscal year in a position of strength, as Q1 saw the company shattering its previous all-time revenue record.

-Services and the Wearables, Home and Accessories business segments are growing at impressive rates and will help the company create a runway to $400 a share.

-Apple is truly a shareholder-first company, as 2020 started out with $3.5 billion in dividends and equivalents paid and $20 billion in shares repurchased.

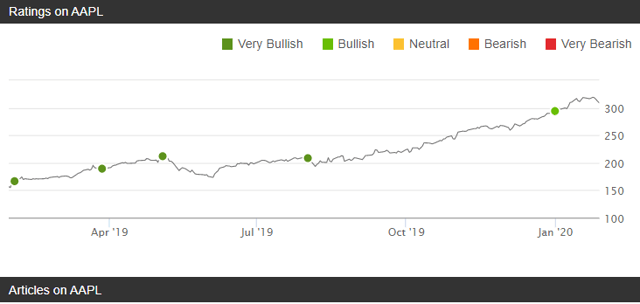

Is it really a surprise that Apple (AAPL) had a very strong Q1 2020, beating EPS by $0.45 and revenue by $3.41 billion? On 8/1/2019, I stated that AAPL had a great chance to break $300 per share by May 2020, and in my article on 12/30/2019, I increased that target to $325 and said $400 by May 2021 is a real possibility. The company is doing everything right and is firing on all cylinders. I believe at all-time highs, AAPL is still a Buy and I am going to raise my price target to $425 for May 2021. On 1/28/20, the stock closed at $317.69, so if I am correct, investors could make $107.31 per share, or 33.78%, on their investment by next May. Keep in mind that the 33.78% increase is prior to factoring in the quarterly dividends.

APPLE does it again and blows out Q1 with its largest quarterly revenue ever

The company reported a 9% increase in revenue and a 19% increase in earnings per diluted share over Q1 2019, shattering another record in its story. During Q1 2020, AAPL’s active installed base of devices grew in each of its geographic segments with a global footprint of over 1.5 billion devices. Its total revenue for Q1 2020 was $91.8 billion, with products growing by $5.7 billion, or 7.72%, and services growing by $1.84 billion, or 16.92%.

[Learn More: The Company About to Blow Nearly Every Other Tech Firm Out of the Water]

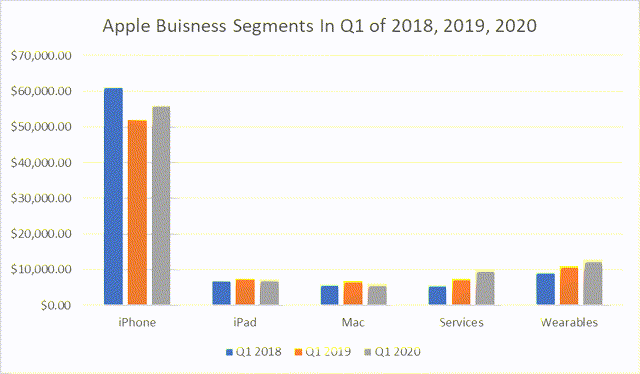

AAPL is obviously generating a ton of cash, as its revenue came in at $91.8 billion in Q1 2020, but how the company generated it is more impressive to me. In Q1 2018, iPhone sales broke the $60 billion level, but in 2019 and 2020, sales couldn’t break through the previous highs. Without continuous record levels year over year in iPhone sales and somewhat stagnant iPad and Mac levels, the company diversified, and its newest business segments are a beacon of light. In Q1 2019, Services grew by 33.33% and Wearables, Home and Accessories increased by 19.13% year over year from Q1 2018. In Q1 2020, these trends continued, as Services grew 36.97% and Wearables, Home and Accessories increased by 16.92% year over year from Q1 2019.

The combination of Services and the Wearables, Home and Accessories have tremendous potential for the future of AAPL. The combination of iPad and Mac sales in Q1 2018 was $12.58 billion, while the combination of Services and the Wearables, Home and Accessories was $14.61 billion. Two years later, the combination of iPad and Mac sales in Q1 2020 was $13.14 billion and the combination of Services and the Wearables, Home and Accessories was $22.73 billion. AAPL’s two newest business segments are growing at a rapid pace and generating continuous sequential revenue year over year. We are already seeing Services and the Wearables, Home and Accessories business units picking up the slack from the company’s other segments when cycles aren’t as hot, but what about the future? I think these are in its infancy and have a runway of growth ahead. I think it is possible that over the next decade AAPL could see as much as 50% of its revenue generated from Services and the Wearables, Home and Accessories business segments if these trends continue.

AAPL’s financials are something special

A company’s financials illustrate a story that can’t be fabricated, because numbers don’t lie. A one is a one, and there is zero room for misinterpretation. AAPL’s market cap is quickly approaching $1.5 trillion, and if you look into its Q1 financials for 2020, the growth may surprise some people for a company of this size. While AAPL’s total assets only grew by 0.62% in Q1 2020, they became more efficient throughout its operations, which positively impacted the bottom line. When comparing Q1 2019 and Q1 2020, the company had double-digit growth in net income, cash generated by operating activities and its Services business segment. AAPL’s net income for Q1 year over year increased by just over $2.27 billion, or 11.37%, while the cash generated by operating activities jumped by roughly $3.83 billion, or 14.33%. The Services segment of total net sales also grew by $1.84 billion, or 16.92%. In addition to these three double-digit increases, AAPL grew net sales by $7.51 billion, or 8.91%, the products segment of net sales increased by $5.67 billion, or 7.72%, and AAPL’s gross margins increased by $3.19 billion, or 9.95%.

[Don't Miss! The #1 Tech Stock of 2020 is Showing Signs That It's Price is Ready to Explode]

The company may not be growing its asset base by much, but it is monetizing its assets much more efficiently. The fact that AAPL is operating more efficiently and squeezing additional growth out of its current assets is a positive sign to me. Its increase of over $3.8 billion in cash generated by operating activities year over year in Q1 is larger than that of many mid-cap market caps. These numbers are promising because they are setting the stage for continuous growth throughout 2020. AAPL is starting the year off in a position of strength, and if the momentum continues, then we may just see the company break its previous records of overall net sales and net income for the year.

The company continues to generate value through buybacks and dividends for shareholders

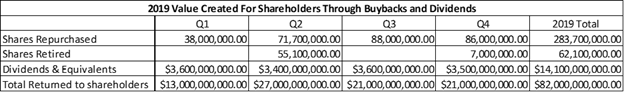

If AAPL is buying its own stock on the way up, why wouldn’t you? It gives me a great deal of confidence when companies are buying shares at or near all-time highs, because it signals great confidence in the future. In 2019, AAPL returned $82 billion to shareholders, and in Q1 2019, the company paid $3.6 billion in dividends and equivalents, and repurchased 38 million shares, for a total of $13 billion returned. AAPL swung for the fences in Q1 2020 and has a head start on its 2019 year in generating value for shareholders. In Q1 2020, the company repurchased $20 billion in shares and paid out $3.5 billion in dividends and equivalents. AAPL continues to be a shareholders' stock by generating tremendous value outside of the share price.

AAPL has multiple catalysts

I believe that 2020 and 2021 will be great years for AAPL, as there are multiple catalysts on the horizon. The most promising catalyst is 5G, in my opinion. Many people, including myself, have been waiting for the 5G iPhone to debut to upgrade. I still have a 7 Plus, and the only reason I didn’t upgrade to the 11 was 5G. While 5G should create a super-cycle for iPhone upgrades, it should also spill over into iPads. Not everyone purchases a Wi-Fi-only iPad, and once the LTE version is upgraded to 5G, I think we will see a mini super-cycle for iPad upgrades.

Outside of 5G, the Services and Wearables, Home and Accessories business segments should continue to be growing catalysts. I believe that Services will continue to grow, and components such as Apple TV, Arcade and Apple Card will fuel a healthy portion of its growth. On the Wearables, Home and Accessories side, don’t be surprised if you see AAPL create an Apple Home segment to compete with Google (GOOGL) Home or Alexa home products from Amazon (AMZN). I have seen Apple HomeKit products where large companies are creating products that work with Apple Home App, but I think it would be beneficial for AAPL to enter the space. The company has such a loyal customer base that if it branded a package of products to work from the Apple Watch, iPhone or iPad, I think it would be a huge hit.

[Alert! The Company With Over 200 Patents / 500 More Pending in Tech Called “the new oil.”]

Conclusion

AAPL is a company investors should own, hold and let the dividends compound. I can’t think of a more shareholder-friendly company when reviewing the value it has generated for shareholders through buybacks and dividends. I believe there is a lot of growth in AAPL’s story and there is no reason why history can’t repeat itself. The next decade has the potential to be just as good as the previous one for the company. I think AAPL is still a Buy, and shares will trade over $400 per share by May 2021.

by Steven Fiorillo

Deep Value, long only, Growth, dividend investing

Disclosure: I am/we are long AAPL, AMZN, GOOGL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Additional disclosure: Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. Investors should conduct their own research before investing to see if the companies discussed in this article fits into their portfolio parameters.