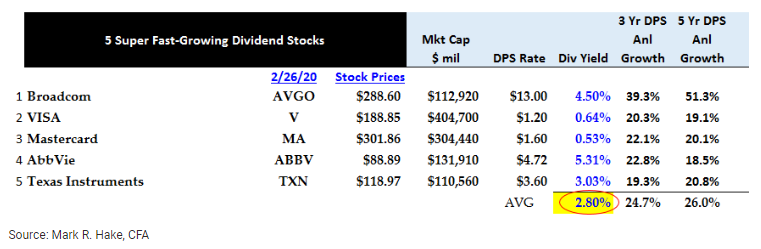

When the market dips, you want to pick up fast-growing dividend stocks at a bargain. That is what happened this past week. As a result, these five super-fast-growing dividend stocks have become cheap.

In putting this article together, I wanted to focus only on stocks whose dividends have grown 20% or faster in the past three to five years. That’s because when the market returns to normal, these kinds of stocks tend to jump back up quickly.

Moreover, the underlying reason their dividends are growing so fast is that the companies’ earnings and/or free cash flow are rising at a fast pace. In other words, the payout ratios tend to stay flat, and the dividends are rising because the underlying earnings or cash flow are growing fast.

These stocks also tend to be fairly liquid, feature large market caps and have earnings which cover the dividends.

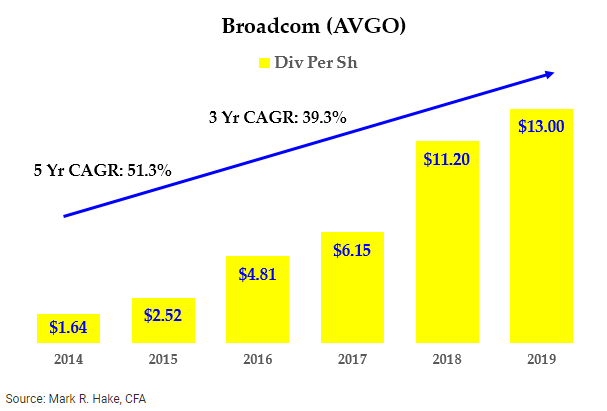

Fast-Growing Dividend Stocks: Broadcom (AVGO)

Dividend Yield: 4.6%

3-Year Dividend Growth Rate: 39.3%

5-Year Dividend Growth Rate: 51.3%

Broadcom (NASDAQ:AVGO) is a semiconductor device and software solutions company. It is the world’s second-largest fabless semiconductor company.

AVGO stock has a $112 billion market capitalization and is also very cheap. It sells for about a 12x price-earnings ratio.

Moreover, its dividend yield is very high at 4.6%. Broadcom’s $13 dividend is well covered by its forward expected earnings of $23.27, according to Seeking Alpha.

As the chart above shows, dividends have grown on average 39.3% over the past three years and 51.3% over five years. .

The company has been growing through acquisitions. Broadcom tried to buy Qualcomm (NASDAQ:QCOM) three years ago. It was prevented by the President Donald Trump Administration, since Chinese interests had majority control of Broadcom.

[Read More: This 5G Wireless Company is Poised to Become a Global Household Name]

Broadcom also acquired CA Technologies for $18.9 billion in 2018. It also recently closed on the $10.7 billion purchase of the enterprise security business from Symantec.

Analysts are generally positive on AVGO and expect higher revenue and earnings for the year ending October. This should continue to lead to high dividend growth over the next several years.

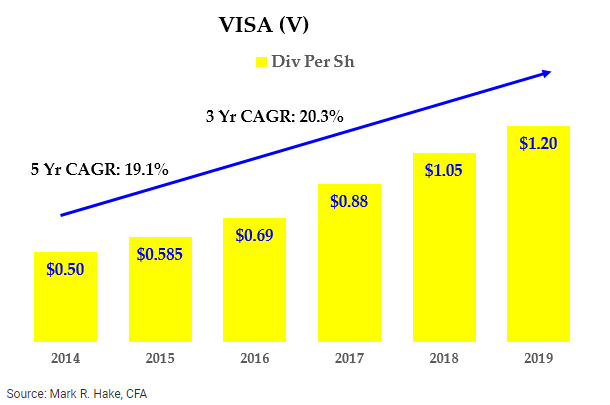

VISA (V)

Dividend Yield: 0.6%

3-Year Dividend Growth Rate: 20.3%

5-Year Dividend Growth Rate: 19.1%

VISA (NYSE:V) is a $404 billion market cap payments company. Everybody knows about Visa. But most do not know that it is not a bank. It makes its money from transaction fees and licensing fees.

Visa stock is not necessarily cheap at 30 times earnings, but its earnings and dividends have been growing very fast. Moreover, its expected earnings per share of $6.14 this year cover the dividend per share of $1.20.

Visa had very strong results for 2019. In its most recent earnings report, transaction volumes were up 11% year-over-year, revenues rose 10% and EPS was up 12%.

Moreover, analysts expect 2020 earnings per share for the year ending September will be 15.4% higher at $6.14 per share. For 2021 they expect an additional 17% spike in EPS growth to $7.18 per share.

So the $1.20 annual dividend per share, which represents just 20% of the expected fiscal year 2020 earnings, has plenty of room to grow.

Watch for good things to happen to the stock as the dividend is hiked. Visa usually raises the dividend once a year in July, so keep an eye out around then.

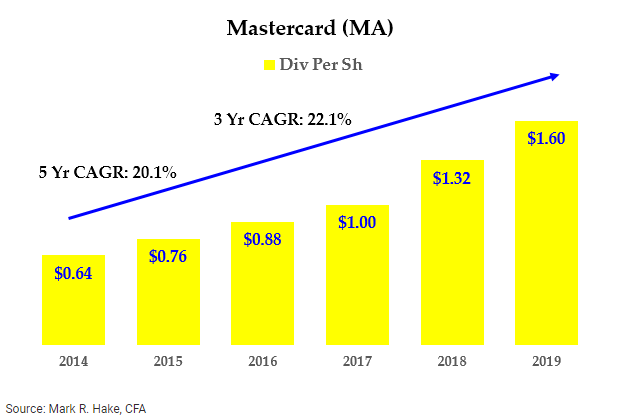

Mastercard (MA)

Dividend Yield: 0.5%

3-Year Dividend Growth Rate: 22.1%

5-Year Dividend Growth Rate: 20.1%

Mastercard (NYSE:MA) is a $295 billion market cap payments company. Just like Visa, it has superb earnings and dividends growth, as it is essentially in the same business.

Also like Visa, Mastercard is not particularly cheap, but its dividends are growing quickly. MA stock trades for 33 times forward earnings. But the earnings are highly priced for their growth.

For example, MA’s earnings per share will grow over 12.5% this year, according to analysts polled by Seeking Alpha. This is after earning rose 42% in the year ending December 2019.

[See Here: The Company Poised to Make This Decade's Most Brilliant Tech Power Play]

Moreover, 2021 expected earnings growth is 20%. Therefore, the $1.60 dividend is well covered by this year’s expected $7.94 EPS.

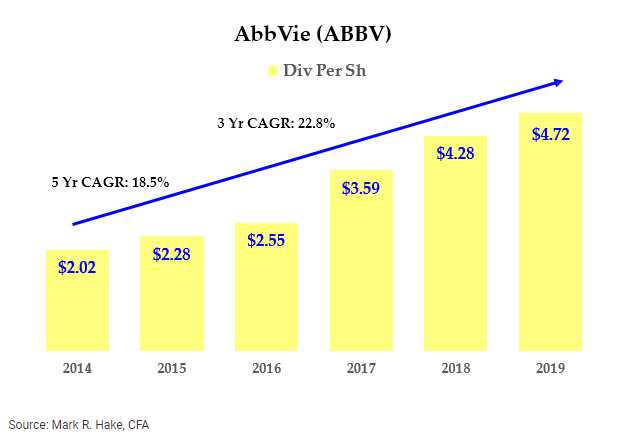

AbbVie (ABBV)

Dividend Yield: 5.3%

3-Year Dividend Growth Rate: 22.8%

5-Year Dividend Growth Rate: 18.5%

AbbVie (NYSE:ABBV) is a roughly $130 billion market cap drug stock which is very cheap. It has a 5.2% dividend yield and a forward price-earnings ratio of just 9 times.

Moreover, its $4.72 annual dividend per share is well covered by the prospective earnings of $9.88 according to Seeking Alpha. This is important since the dividends have been growing very fast over the past three to five years. As the table shows above, dividends have grown on average 22.8% over the past three years and 18.5% over five years.

AbbVie’s purchase of Allergan, expected to close shortly, will boost earnings and dividends and push ABBV stock higher. Allergan is well known for its Botox and other beauty products. Analysts suggest that it will only take a few more months.

AbbVie is losing its patent protection on Humira, a rheumatoid arthritis treatment that accounts for close to half of AbbVie’s revenue.

But the company has indicated that there will be $2 billion in synergies with Allergan. Moreover, the combined earnings will be 10% higher during the first year.

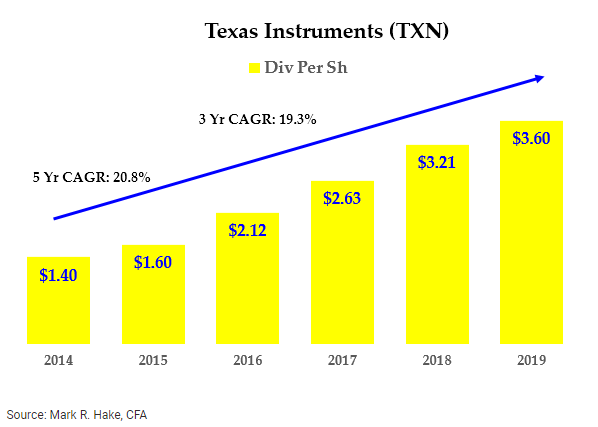

Texas Instruments (TXN)

Dividend Yield: 3.04%

3-Year Dividend Growth Rate: 19.3%

5-Year Dividend Growth Rate: 20.8%

Texas Instruments (NASDAQ:TXN) is a $110 billion market-cap company in the fabless semiconductor manufacturing industry, like Broadcom. Earnings have been turning around this year as demand for chips has picked up, particularly in the automotive and industrial sectors.

TXN stock is cheap at 22.9 times this year’s expected earnings, according to Seeking Alpha.

Analysts expect earnings this year to be $5.19 per share. This more than covers the dividend per share payment of $3.60.

Moreover, Texas Instruments has had a long history of paying dividends. Its dividends have risen for 16 years in a row, which is quite a feat. Expect this to continue with the company’s recent turnaround in earnings expectations.

[Read More: This 5G Wireless Company is Poised to Become a Global Household Name]

In fact, TXN has already paid out two quarters of dividends at the $3.60 annual rate. You can expect another dividend hike announcement in mid-July. This is likely to boost TXN stock further.

Summary – Super Fast-Growing Dividend Stocks

These five stocks have grown their dividend on an accelerated basis, compared to most other companies.

For example, the table above shows these dividend stocks have an average dividend growth rate for the past three years of 25%. And over the past five years, the dividends have risen 26% on average.

Moreover, the average dividend yield is a healthy 2.8%, which is close to the market average. In effect, you get super-fast dividend growth without having to sacrifice dividend yield by buying this group of dividend stocks.

That seems like a pretty good bargain, which is not likely to last long.

[See Here: The Company Poised to Make This Decade's Most Brilliant Tech Power Play]

As of this writing, Mark Hake, CFA does not hold a position in any of the aforementioned securities. Mark Hake runs the Total Yield Value Guide which you can review here. The Guide focuses on high total yield value stocks. Subscribers a two-week free trial.

Leave a Comment