Sometimes, stocks become so undervalued or overlooked that investors can find embarrassingly good deals by simply taking a long-term view. Those are the stocks I'll highlight today, and they come from a wide range of places in the market.

Simon Property Group (NYSE:SPG) is cheap because investors think malls are risky right now, Las Vegas Sands (NYSE:LVS) is undervalued because we don't know when entertainment will come roaring back, and wireless giant AT&T (NYSE:T) is unloved because it's in a stagnant business.

Malls aren't as bad as they seem

As one of the biggest mall owners in the world, Simon Property Group was likely to be one of the hardest hit by shutdowns and a reduction in economic activity due to the COVID-19 pandemic. There's no doubt that malls have suffered, but they haven't been as hard hit as you might think, and their recovery could be relatively quick.

In the third quarter of 2020, management said that mall and premium-outlet occupancy was at 91.4%, only slightly below the 95.1% rate at the end of 2019, and the company collected 85% of net billed rent, up from 72% in the second quarter. Business isn't back to normal, but people are going to malls and shopping at a regular clip this holiday season, and that's even before any sort of recovery from the pandemic.

[Alert: Look at this RARE 5100% Chart!]

On the dividend side, Simon Property Group paid $1.30 per share in the third quarter of 2020, down from $2.10 quarterly earlier this year. If we assume that by 2022, the company will return to a quarterly dividend of about $2.10 per share, it would yield a whopping 9.4% at today's stock price. I think that's plausible if there's an economic recovery in 2021 given evidence we've already seen of a rapid recovery in net bill payments and a relatively high occupancy rate in Simon Property's malls. The stock looks like it's very cheap if you're bullish on malls roaring back, and that's exactly what I see happening over the next two years.

Gambling on a recovery

Few industries have been hit as hard as gambling in 2020, especially in Asia, where COVID-19 restrictions have been stricter than in the U.S. That's hurt a company like Las Vegas Sands (with operations in Macao and Singapore) more than most. But it's still one of the best gambling companies in the world given those highly sought-after licenses.

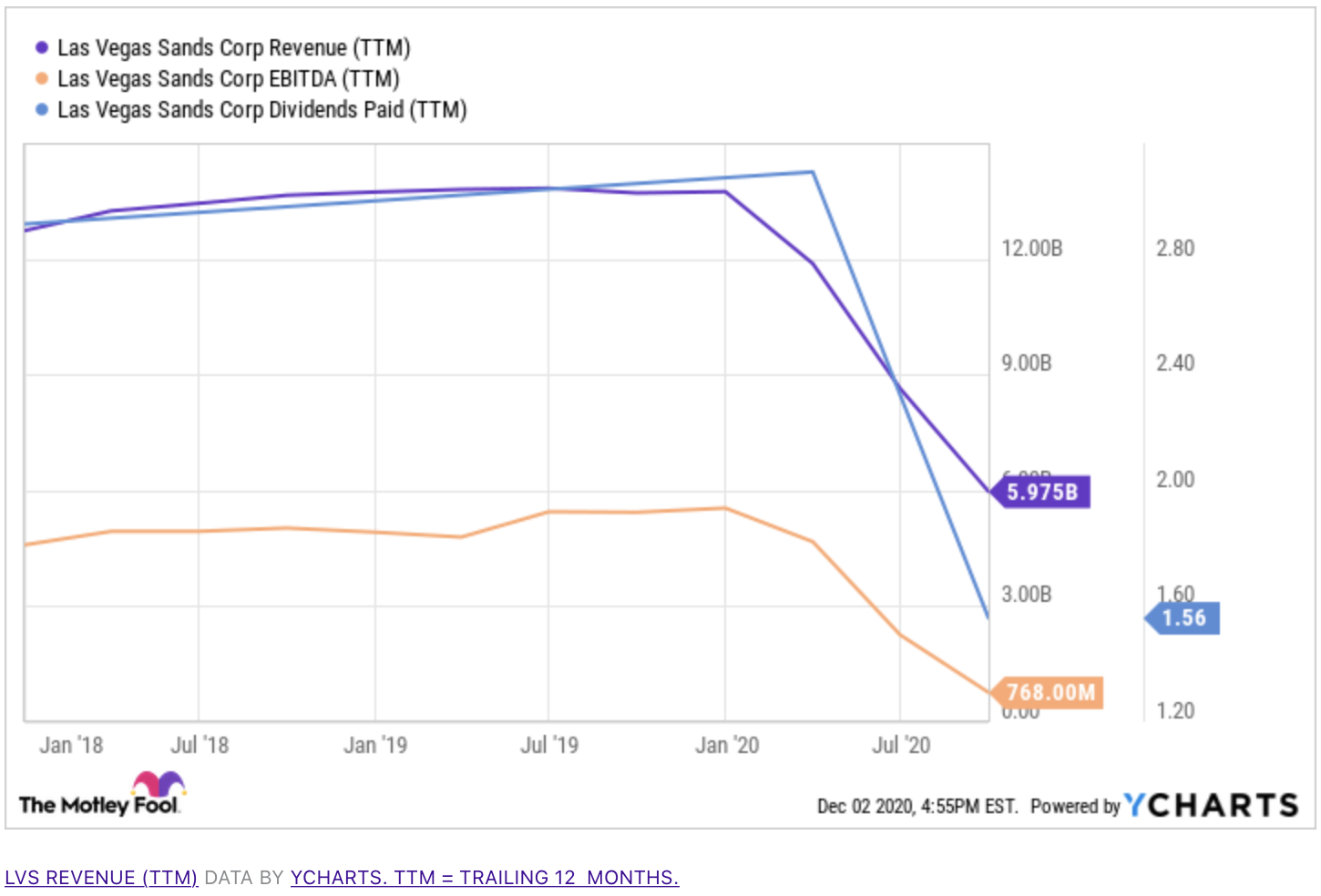

Below, you can see the impact of the pandemic on Las Vegas Sands' operations. Revenue has fallen more than 80%, and in Macao and Singapore, the business has been devastated.

The upside for investors is when a recovery comes in the gambling industry. I think there's going to be a huge surge in demand around the world, and Las Vegas Sands should be one of the beneficiaries. In the U.S., we've seen a rapid recovery when casinos reopen and that's even before the threat of COVID-19 is gone. In October, Las Vegas Strip gambling revenue was down just 30.2% versus a year ago, and UNLV's Center for Gaming Research reports U.S. gambling revenue was down just 13.7% in September versus a year ago. Macau and Singapore's restrictions are stronger today, but when travel reopens there's no reason to think gambling revenue won't recover in late 2021 and into 2022, returning cash flow to normal.

[Breakthrough: Warren Buffett made $12 billion with the idea behind this simple technique]

The dividend is currently suspended but was being paid at an annualized rate of $3.16 earlier this year. If that comes back — as I think it will given Las Vegas Sands' excess cash flow and history of growing its dividend — it would equate to a 5.5% dividend yield at today's stock price, a steal for a company operating in highly profitable, highly regulated gambling markets in the U.S. and Asia.

No love for wireless

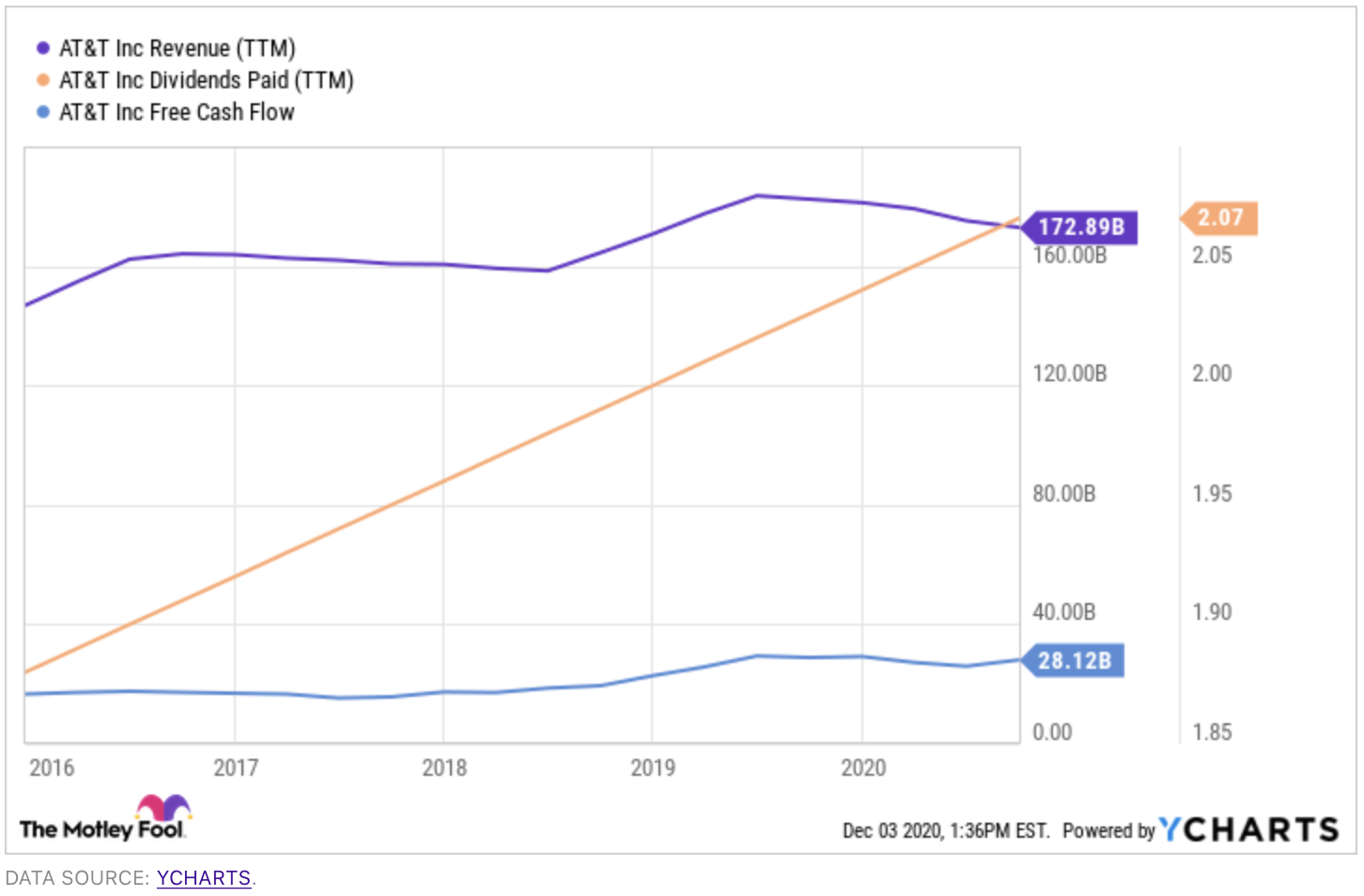

The market hasn't loved the wireless telecommunications business for a while now, and AT&T has fallen out of favor like others in the industry. It hasn't helped that huge acquisitions like DirecTV and Time Warner haven't performed particularly well. But despite those problems, AT&T continues to churn out cash and pay a lofty 7.2% dividend yield.

What AT&T has going for it right now is the consistent cash flow of its standard wireless business and potential upside from the rollout of 5G technology across the country. 5G should enable new technologies like autonomous vehicles, mobile VR, more connected devices, and other innovations. If those take hold, they could help the company grow revenue and profitability, making the high dividend yield today a steal for long-term investors.

[Learn More: these stocks can quickly multiply in price 5x, 10x, 100x, or much higher…]

High dividend yields to buy today

Each of these stocks is cheap for a reason. But if we look out a year or two, they should all be fully recovered from the pandemic and producing cash in big numbers once again. That's why these stocks are cheap — embarrassingly cheap — today.