This virus has upended everyone’s lives … in just about every way.

And as I’ve written frequently in Bauman Daily, no matter how quickly the economy reopens, some changes are here to stay for the foreseeable future … and that means opportunities for us as investors.

For example, Global X Cloud Computing ETF (Nasdaq: CLOU), an exchange-traded fund (ETF) I recommended in April, is up 26% in less than a month. That’s just one sector that’s seeing huge benefits from this crisis.

Today, I’ve identified another great opportunity … one that’s driven by the sudden transition away from the office.

[Learn More: The Company About to Blow Nearly Every Other Tech Firm Out of the Water]

Before the pandemic, less than 4% of U.S. employees worked from home full time. But a recent report from the Brookings Institution found that as many as 50% now telecommute.

And whether you prefer the home office or not, this trend is here to stay.

A recent survey found that 74% of Chief Financial Officers said that they expect to make remote work permanent for at least some of their workforce. They recognize the many benefits of this arrangement.

But it’s also exposing them to nightmarish new risks … and creating a tailwind for this $167 billion industry.

INCREASED SPENDING ON THIS INDUSTRY TOPS THE LIST

Even before COVID-19 arrived, implementing an effective cybersecurity strategy was paramount for company executives.

After all, data breaches resulted in 165 million records being exposed in 2019 alone. Those attacks not only hit companies’ pocketbooks but their reputations as well.

And the remote work movement has presented hackers with yet more opportunities to infiltrate corporate networks and compromise sensitive data.

[Alert! The Company With Over 200 Patents / 500 More Pending in Tech Called “the new oil.”]

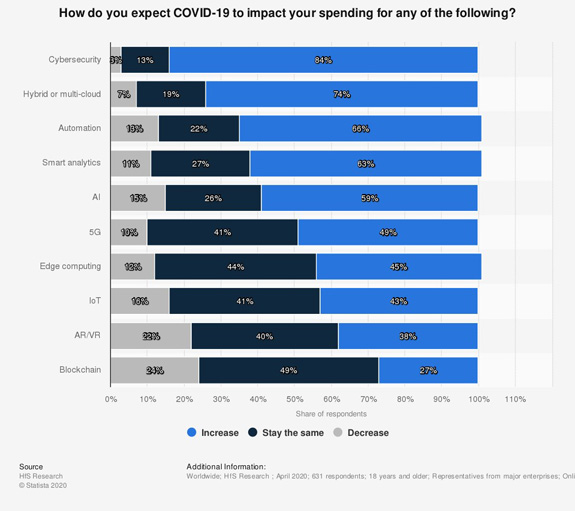

As a result, nearly 84% of respondents to a recent survey expect to increase cybersecurity spending as a result of COVID-19 … higher than any other survey category as shown below:

A quick scan of cybersecurity companies proves that this massive shift isn’t just imminent … it’s happening:

- Check Point Software Technologies Ltd. (Nasdaq: CHKP) has seen a surge in demand for its remote-access virtual private network (VPN) licenses. One client went from 8,000 to 80,000 daily users!

- Okta Inc. (Nasdaq: OKTA) showed in its most recent app usage report that network security apps were among the fastest-growing, trailing only video conferencing tools.

- An insurance company shifted from a 20% virtual workforce to 100% using one secure identity platform.

You can profit from the increasing demand for cybersecurity solutions with the First Trust NASDAQ Cybersecurity ETF (Nasdaq: CIBR). It invests in companies that provide security for both private and public networks, as well as the devices that operate on them.

[Don't Miss: The #1 Tech Stock of 2020 is Showing Signs That It's Price is Ready to Explode]

As we permanently embrace changes in how we work, cybersecurity is yet another industry seeing explosive growth driven by the pandemic. The time to get in is now.

Best regards,

Clint Lee

Research Analyst, The Bauman Letter