COVID-19 cases are surging… once again.

Hospitalizations in the U.S. are hitting records.

And former U.S. Food and Drug Administration (FDA) Commissioner Dr. Scott Gottlieb warned that it’s about to get worse. He predicted U.S. COVID-19 deaths could reach 4,000 per day by January.

It’s a grim forecast for what’s supposed to be a joyous time of year.

But there is hope…

At the moment, Pfizer (NYSE: PFE) and Moderna (Nasdaq: MRNA) are awaiting FDA approval of their COVID-19 vaccines. The duo are expected to have enough doses to vaccinate 35 million people by this year’s end. Then the supply will ramp up in 2021.

So that’s an enormous first step.

[Breakthrough: This Could be the Closest Thing to Buying Amazon When it was $50]

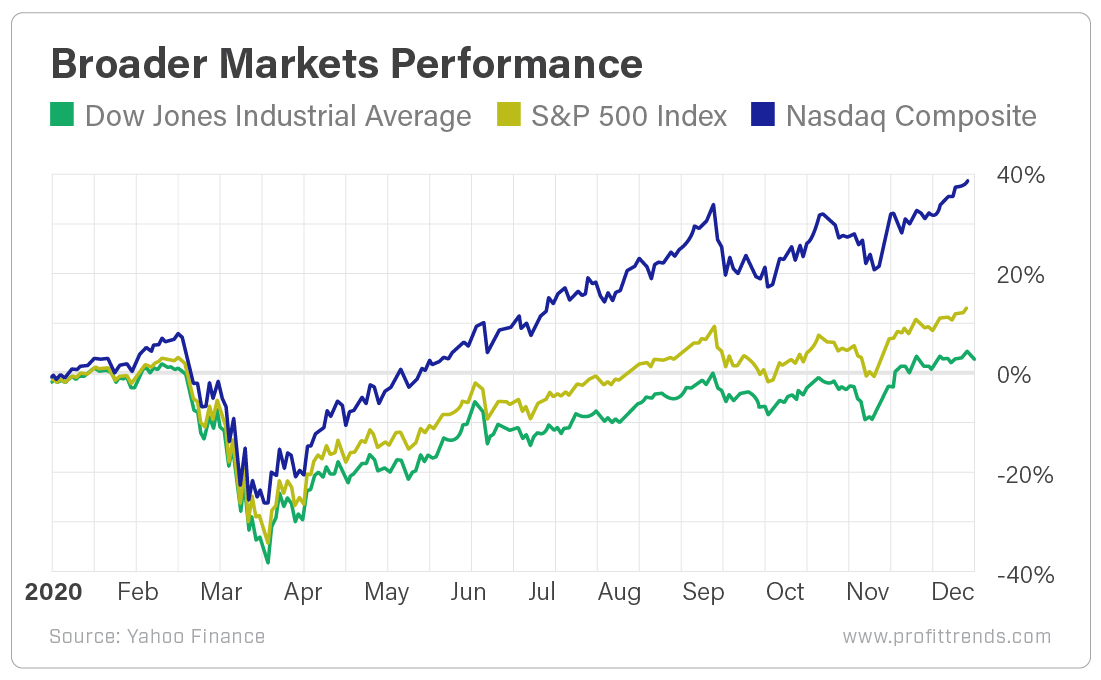

And the Dow Jones Industrial Average, S&P 500 and Nasdaq recently surged to new all-time highs on these vaccine hopes.

But the economy isn’t going to reopen tomorrow.

We have several very difficult weeks ahead of us. And I think there’s an opportunity to position ourselves now for those brighter days to come.

Opportunity in Crisis

Look, there’s no beating around the bush… 2020 has been apocalyptic for large swaths of the U.S. economy.

A dozen national restaurant chains have declared bankruptcy, including California Pizza Kitchen, Chuck E. Cheese, Ruby Tuesday and Sizzler.

Let’s not kid ourselves, many of those have been circling the proverbial drain for years. COVID-19 has merely accelerated their demise, bringing a quick end to a long, slow death.

[Buy Alert: Buffett Recently Dumped $800 Million of Apple Stock to Invest in This!]

But those are chains. That figure doesn’t encompass the more than 110,000 restaurants that have gone under due to the pandemic. To put that in perspective, that’s 1 in every 6 eateries in the U.S. going kaput.

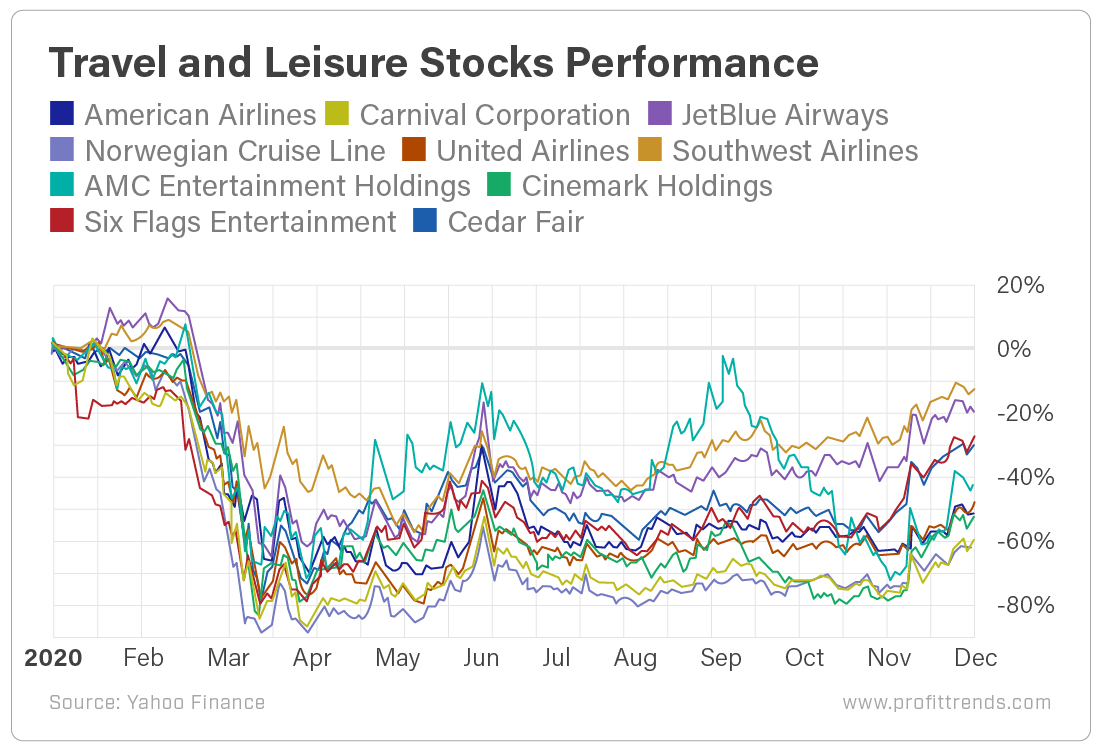

This year has also been devastating for airlines, cruise ship operators, movie theaters and theme parks.

Most of the marquee names are in the red year to date. And many are still 25% below where they began 2020, let alone their 52-week highs.

But in this wreckage, I think there are some interesting and profitable opportunities for the long haul.

Get Your Hands Dirty

Warner Bros. announced that it plans to release all of its 2021 movies simultaneously on HBO Max and in theaters. This is not encouraging to the future of the theater industry.

The first test of this will be Wonder Woman: 1984 on Christmas Day. The studio has 17 major films on the docket for 2021, including Dune, The Matrix 4 and a Sopranos prequel, The Many Saints of Newark.

I don’t think this is the final nail in the coffins of AMC Entertainment Holdings (NYSE: AMC) and Cinemark Holdings (NYSE: CNK). But it’s definitely a nail.

I believe this moment is a chance for movie chains to become more streamlined and less reliant on overpriced concessions. We can’t call time of death yet.

The same goes for theme park operators Cedar Fair (NYSE: FUN) and Six Flags Entertainment (NYSE: SIX). Sure, no one’s looking to hang out in large crowds waiting to ride a roller coaster right now. But once the vaccines become widely available, they most certainly will be.

And when that happens, airlines will be packed again.

This year, we’ve spent most of our time in our homes, viewing the world from afar through screens and mobile devices. In response, major carriers reduced their routes by as much as 90% during the peak of the pandemic.

Some suffered even worse fates, as dozens of airlines collapsed.

Right now, the industry is a wasteland of red that only the bravest of investors are venturing into.

But this is a moment to be greedy when others are fearful. Time and innovation are on our side.

[Learn More: See Why Billionaires are Flocking to this Tiny Niche of the Tech Sector]

With the markets at all-time highs, some days it feels like there are few opportunities trading at discounts. But airlines, cruise lines, movie operators and theme parks still are.

Investors can buy shares at a steep discount, knowing that there are COVID-19-free days on the horizon. Most of these companies will see their revenues surge next year as their customers return.

So don’t be afraid to go dumpster diving in what will be the hottest sectors for 2021.

Here’s to high returns,

Matthew