Gold and the US Dollar

Investors flock to gold in uncertain times. And it is fair to say current market conditions are unpredictable. The trade war with China, Brexit, recession fears, the yield curve inversion, and speculation regarding the Federal Reserve are just a few of the concerns weighing on investors' minds. The price of gold has reflected this uncertainty. Since the end of Q1 2019, gold is up 20.5%. In comparison, the S&P 500 is up only 3.6%. That's an alpha that would make any hedge fund manager blush.

The Long Term Break Out

Since 2013, gold has drifted in a range from $1,050 to $1,375. That changed in June of this year. Price shot out of that range and has continued going higher as you can see on the monthly price chart below. We've seen excellent follow-through in July and August. Another positive sign is June, July, and August have been the heaviest volume months of the year, indicating a bullish appetite.

These are great bullish signs, but let's go a step deeper. Let's see if these gold prices are getting juiced somehow.

Dollar Denominated Asset

Gold is a US Dollar(USD) denominated asset, meaning it's traded in USD in markets around the world. Investors in countries other than the US must first exchange their local currency for USD. For example, if an investor in Germany wants to buy gold, he must exchange his Euros(EUR) for USD, then buy gold using the USD. When the dollar gets stronger, gold gets more expensive for foreign investors. When the dollar weakens, gold gets cheaper for foreign investors. Therefore, a weak US Dollar artificially reduces the price for foreign investors and thereby increases demand. Vice versa, a strong US Dollar artificially raises the cost for foreign investors and thus decreases demand.

So, what's been going on with the US Dollar?

Let's take a look at the US Dollar Index (DXY). It is an index that tracks the movement of the US Dollar against a basket of world currencies. It gives a more global view of the strength of the US Dollar than just looking at individual currency pairs. For example, events specific to England (Brexit, for example) may distort our view of the global strength or weakness of the USD. The US Dollar Index includes the British Pound, Euro, Japanese Yen, Indian Rupee, Chinese Yuan, and many other currencies in its basket.

Since the breakout occurred in June 2019, the US Dollar Index(DXY) STRENGTHENED nearly 1.6% from 97.2 on June 3 to 98.8 on August 30. The price of gold increased more in foreign countries than it did in the US, suggesting the global appetite for gold is very strong. Below is a daily chart of the DXY from June 3 to August 30.

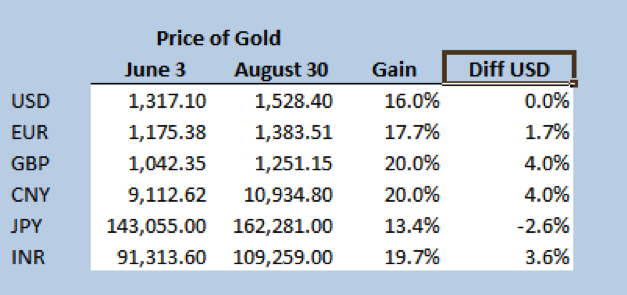

Let's take a look at a few specific foreign countries/currencies: Euro (EUR), Great British Pound (GBP), Chinese Yuan (CNY), Japanese Yen (JPY), and Indian Rupee (INR). As you can see in the chart below, the price of gold increased significantly more than the US Dollar in 4 of these five currencies. The only outlier is the Japanese Yen, which is a “safe haven” currency in times of economic uncertainty (much like gold itself).

The two most significant differences from the US Dollar are the Great Brittan Pound and the Chinese Yuan. It makes sense due to the economic uncertainty hovering over these countries.

England has been dealing with the terms of Brexit and how that will affect its economic outlook. China is engaged in a trade war with the US… And that negotiation can change with one tweet. These events affect England and China far more than other countries which causes a weaker currency which causes gold to be relatively more expensive.

Will the US Dollar Stay Strong?

Let's first look at a long term picture of the DXY. Below is a monthly chart going back 15 years. We are not at all-time highs, but it is fair to say we are indeed at an elevated level with plenty of room for a downside move. If I were looking to make a value investing trade, I certainly wouldn't be looking to buy the US Dollar at this level.

Many factors cause currencies to fluctuate. Let's take a look at a few of the significant factors.

Interest Rates – A high-interest rate relative to the rest of the world causes investors to flood into that currency so they can buy debt denominated in the currency.

For example, the Federal Reserve recently lowered interest rates for the first time since 2008.

And the Trump Administration has been very vocal in encouraging the Federal Reserve to continue to lower interest rates.

If interest rates continue to fall, this will put pressure on the US Dollar to fall.

Economic Conditions – A strong economy leads to demand for a currency which increases the price. The US GDP growth has not been stellar, but it has been better than most other countries.

However, it's unclear how much longer this will last. Recession fears have increasingly been in the news, and the inversion of the yield curve has spooked some investors.

If the US does go into recession, this will also put depreciation pressure on the USD.

Political Uncertainty – The US is one of the most politically stable countries in the world. We don't worry about coupes or serious government upheaval. But we do have an election coming up. I don't think this will be a significant factor, but any change causes uncertainty by definition. “Uncertainty” is deflationary.

Based on the above, there are good reasons to believe the US Dollar is more likely to weaken than strengthen. A weakened US Dollar makes gold relatively cheaper for foreign investors, increases the global demand, and is very bullish for gold.

Conclusion

Let's take a breath and do a quick recap of what we covered.

- Gold has crushed the S&P 500 since Q1 2019

- Gold broke out of a long term trading range in June 2019 on high volume, and significant follow-through in July and August.

- The US Dollar has strengthened during this period making the price move all that much more impressive.

- The US Dollar could weaken in the future, giving more strength to this upside move in gold.

Conclusion: The global demand for gold is robust even though it has been fighting a strong US Dollar. If the US Dollar starts to weaken, this headwind could turn into a tailwind and push the price of gold much higher.