Investors are debating “U,” “V” or “W.”

What type of economic recovery will it be?

Well, there’s already plenty to celebrate this year.

Equities have rebounded sharply from their 2020 lows.

The Dow Jones Industrial Average and S&P 500 are nearing breakeven for the year. The high-flying tech stocks on the Nasdaq are setting new all-time highs and are inching closer to a 20% gain for the year.

But there’s one asset that’s outperforming them all: gold.

And there’s no sign of its bull market losing steam.

Gold’s Decade Highs

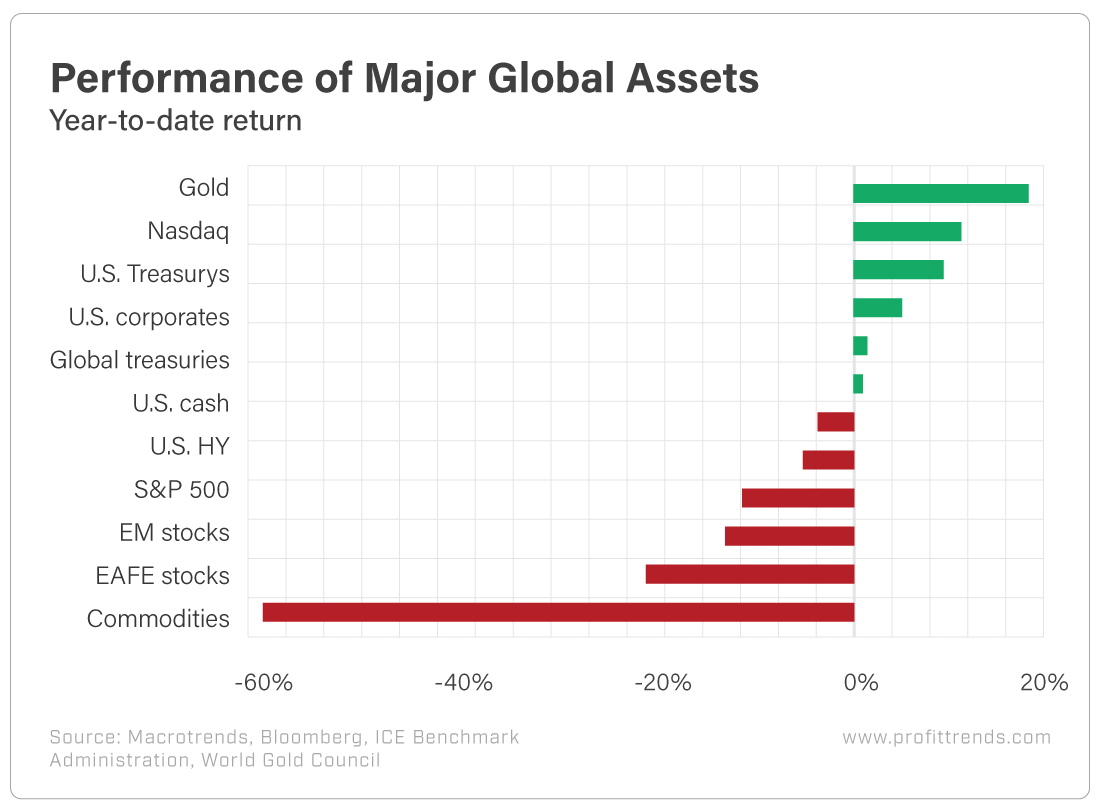

In the first half of 2020, gold outperformed every single major asset class…

It rose 16.8% during that span and continues to rocket higher in July.

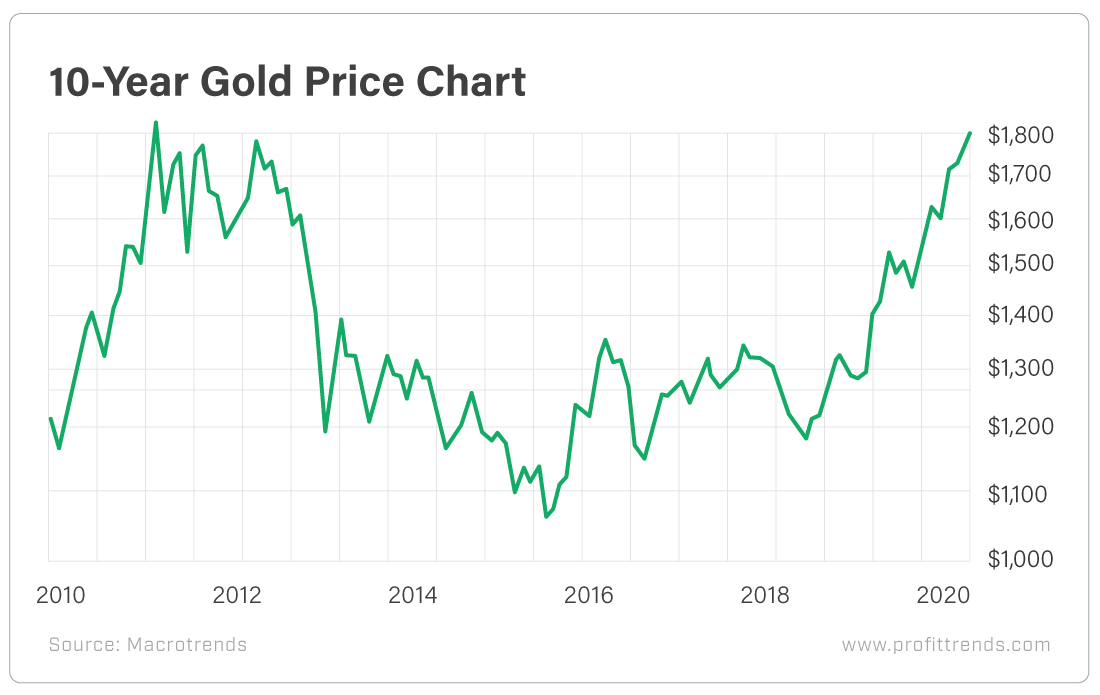

Gold is now worth more than $1,800 an ounce.

[Revealed: This Unique Gold Strategy is Hard-Money Expert’s Favorite Play For 2020]

Those are levels we haven’t seen in almost a decade, since before the final leg of the precious metal’s massive rout that sent prices back to near $1,000…

Buoyed by volatility in stocks and economic uncertainty triggered by the coronavirus pandemic, gold’s price is rapidly approaching record highs. And in some currencies it is already there.

In the first quarter, global gold demand ticked 1% higher.

Admittedly, that’s not a huge increase.

But investors have to understand the multifaceted nature of the gold market. There are dueling forces at work.

For instance, demand from the jewelry and technology segments was hit hard in the first quarter, even falling to record lows as tracked by the World Gold Council.

But demand for coins surged 36% to 79.6 metric tons as gold-backed exchange-traded funds gobbled up 298 metric tons during the quarter.

[Learn More: $7 Gold Investment Could Hand Investors a Small Fortune as Gold Soars]

And of course, we can’t forget the major disruptions in gold’s global supply chain due to COVID-19.

All of this is creating a perfect opportunity for a bull run in gold. And when the precious metal takes flight, it tends to stay aloft for a very long time.

A New Golden Bull

I forecast gold would have a solid year in 2020. And that was before COVID-19 hit the U.S.

Now, with major indexes soaring – and admittedly some stocks wildly overpriced – I think this bull market in gold isn’t going to last just for months… but for years.

If history is any guide, we could be in store for a meteoric rise in precious metal prices.

In August 1971, President Richard Nixon ended the dollar’s convertibility to gold. It marked the beginning of the end of the Bretton Woods international monetary system.

In turn, we saw a bull market in gold run from 1971 to 1980.

The next bull market in gold was triggered in 2001 and lasted until 2011.

That’s two bull markets in gold. We saw new highs during both. And both lasted roughly a decade.

The precious metal is beating every other major asset class year to date.

And I don’t think we’ll see gold hit the brakes anytime soon.

In fact, I expect we’ll see new all-time highs and the first-ever move above $2,000. Gold is already trading at its highest level since the end of its last bull market. And for good reason.

The world is facing the worst financial crisis since the Great Depression of the 1930s.

The International Monetary Fund is forecasting the global economy will contract 4.9% this year. The pandemic is having far worse impacts than initially thought. And in the U.S., the number of cases is rising once again.

Now the Federal Reserve and central banks around the globe are doing everything in their power to keep economies propped up. The amount of stimulus and relief checks being sent is unprecedented, measured not in billions but in trillions. And all that aid has a dilutive effect on currencies, which is another bullish tailwind for gold.

So it doesn’t matter whether we have a U-, V- or W-shaped recovery in store. Gold will continue to shine.

Here’s to high returns,

Matthew

[Discover: The $7 Dollar Firm Using One of the Greatest Investment Secrets in History]