Like Glenn Close’s chilling character in the 1987 film classic Fatal Attraction, gold is telling the financial world, “I’m not going to be ignored.”

As the price of the mystical metal draws ever closer to its all-time high, it is verily screaming, “Don’t ignore me!”

And yet, most investors seem oblivious to gold’s resurgence. After all, why bother with an asset that has gained 24% year-to-date, when stocks like Tesla (NASDAQ:TSLA), Nio (NYSE:NIO) and Moderna (NASDAQ:MRNA) can chalk up a number like that in a couple good trading days?

I mean, why bother with any investment other than Tesla?

One plausible answer would be that tomorrow might not resemble today.

Economic conditions might deteriorate further, geopolitical tensions might ratchet higher or the U.S. dollar’s recent slump might become a tumble.

Any one of these factors could halt the rallying stock market in its tracks, while simultaneously lighting a fire under the gold market.

[Revealed: This Unique Gold Strategy is Hard-Money Expert’s Favorite Play For 2020]

I am not suggesting that the stock market is on the verge of imminent collapse. I am simply suggesting that gold deserves to be not ignored. It warrants a modicum of respect from us investors, as well as a portion of our investment capital.

And the chart below is one big reason why…

An ‘Investment in Monetary Disorder’

(Source: Charts by InvestorPlace)

(Source: Charts by InvestorPlace)

The U.S. Dollar Index just hit a two-year low. And dollar weakness usually promotes gold strength.

James Grant, editor of Grant’s Interest Rate Observer, refers to gold as an “investment in monetary disorder.” Certainly, that’s been true throughout history.

And that statement is just as true today. In fact, monetary disorder could be the main fuel for the next phase of the gold bull market.

The dollar’s recent decline to a new two-year low seems fairly orderly so far. But a swooning currency never inspires confidence, which is why it usually inspires gold buying.

For now, the U.S. dollar remains the “prettiest horse at the glue factory,” as my friend Doug Casey likes to say. But the greenback is still a “horse”… and a heavily indebted one at that.

[Learn More: $7 Gold Investment Could Hand Investors a Small Fortune as Gold Soars]

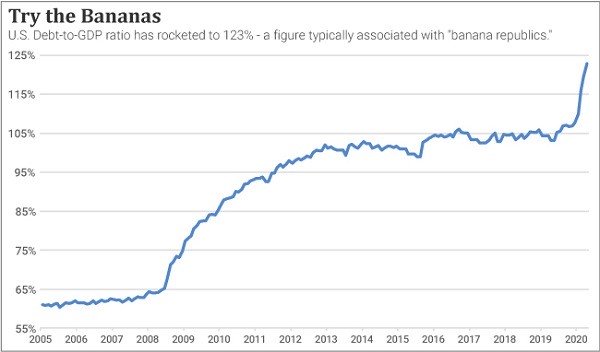

The U.S. government’s debt recently topped $26 trillion — a stunningly large sum equal to 123% of GDP. This frightening data point might not be so frightening if our debts were decreasing.

(Source: Charts by InvestorPlace)

(Source: Charts by InvestorPlace)

But they aren’t. Instead, our coronavirus-infected fiscal and monetary policies are making a mess of our national balance sheet. During the last 12 months, the U.S. federal deficit topped $3 trillion!

That’s more than the total debt that the nation had amassed during its first 214 years.

Even more unsettling, these official numbers do not include any of the debt states and municipalities have piled up, nor the tens of trillions of dollars of future liabilities that entitlement programs like Social Security and Medicare will impose on the nation.

[Discover: The $7 Dollar Firm Using One of the Greatest Investment Secrets in History]

These official numbers also exclude the recent machinations of the Federal Reserve, which is busy conjuring trillions of dollars out of thin air and using them to buy fixed-income securities of all stripes.

These Herculean efforts to protect the economy from stubbing its toe might achieve the Fed’s objectives. And it might even achieve these objectives without causing any visible harm to free markets or the U.S. dollar’s value.

But the greenback’s downward-sloping price chart is sending a different message. It is saying that massive deficit spending and equally massive money-printing operations are monkeying with the currency’s strength … and inviting weakness.

The dollar’s recent swoon might be just a blip that reverses itself quickly and fades away.

But that’s the low-probability bet…

Why We’re Sticking With Gold

The history of heavy deficit spending and ambitious monetary stimulus efforts (i.e., money printing) tells us that these episodes usually produce inflationary effects that beget currency weakness … and gold buying.

Admittedly, the precious metals have been soaring for months already, which has been great news for the folks who haven’t been ignoring gold.

In my investment services, for example, I’ve recommended nearly a dozen gold or silver plays since October 2018. Most of those trades have gained at least 100%, if not a multiple of that number.

For the sake of prudence, I have recommended pocketing a portion of those gains. But I continue to urge my subscribers to maintain sizable positions in gold-related investments.

The reasoning is clear: I continue to expect much larger gains ahead for both gold and silver. Maybe not immediately … but certainly within the next year or so.

Of course, whenever an investment reaches multi-year highs, like gold and silver have done, it is tempting to assume the rally has reached the “ninth inning” and head for the exits to “beat the traffic” of imminent selling.

Nothing wrong with that approach. You never go broke taking a profit.

[Revealed: This Unique Gold Strategy is Hard-Money Expert’s Favorite Play For 2020]

But that said, I doubt the gold and silver rally has entered the late innings. Quite the opposite; I suspect we’re still playing the second or third inning.

When this ballgame ends, gold with be trading for at least $3,000 an ounce, and silver will be topping $35 an ounce. And an extra-inning affair would not surprise me — lifting the gold price past $4,000 and the silver price to a new all-time high above $50.

You could call my forecast a hunch. I’d call it a direct extrapolation from historical precedent — the precedent that monetary disorder produces a rising gold price.

In moments like these, gold becomes almost impossible to ignore. It distinguishes itself by delivering strong gains, while most other assets are delivering losses.

So keep your eyes on the dollar … and don’t ignore gold any longer.

Regards,

Eric Fry