One little-known sector of the market has been inundated with billions of dollars in new investment… just in the month of January 2021.

It’s an obscure tech sector called “TaaS” – which stands for “Transportation as a Service.”

While “transportation” may not sound terribly exciting, there’s a reason legendary hedge-funder Whitney Tilson is staking his reputation on TaaS being the biggest investment trend of the next few years.

In fact, Tilson has been publicly quoted as saying he believes TaaS “will be the next big tech trend that will make investors rich.” And he’s not the only one.

According to Ark Invest, a global asset manager that specializes in disruptive tech… TaaS is a $10 trillion opportunity.

That’s roughly equal to the market cap of Amazon, Apple, Tesla, Facebook, Google, Microsoft, Intel, IBM, General Motors, and Toyota… COMBINED.

In this article we’ll examine what TaaS means at a basic level… what is really represents as a disruptive technology capable of changing the world… why big-money investors are so excited… and which companies and stocks you should be watching.

What Is TaaS Technology?

TaaS is defined as the convergence of two breakthrough technologies: driverless vehicles and electric vehicles.

To understand the incredible excitement – and the amount of money – pouring into TaaS, you need to first examine both underlying technologies.

First, electric vehicles, which, of course, require little or no gasoline to run. Instead, they’re charged and hold a charge in the battery than can propel the vehicle several hundred miles between charges. Battery technology has finally caught up and made electric cars competitive and desirable.

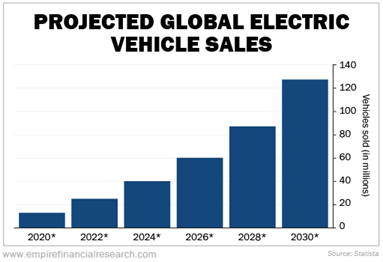

Source: Statista

For proof of that, just look at Tesla Inc. (Nasdaq:TSLA) stock explosion. It gained 719% over the course of 2020. Or Nikola Corp. (Nasdaq:NKLA), which shot up 100% in one trading day.

And lest you think the interest in electric and hybrid cars is environmentally motivated…

Sure, governments are working to phase out gas- and diesel-powered cars over the next couple decades.

But for consumers, “going green” is not the real motivation. Take a look at this table…

| AVERAGE SPECS | GAS VEHICLE | ELECTRIC VEHICLE |

| Price | $35,000 | $50,000 (before tax credit) |

| Range | 250-300 miles | 150-200 miles |

| Drivetrain Warranty | Up to 5 years

Up to 50,000 miles |

Up to 8 years

Up to 100,000 miles |

| Fuel Price | $2.38 per gallon | $1.24 per comparable “eGallon” |

| Time to Refuel | 5 minutes | 90 minutes |

| Moving Parts in Engine | 2,000 | 20 |

| Lifetime Maintenance | $6,000 | $2,000 |

There’s essentially zero maintenance. That’s because EVs have far fewer parts that can go awry or need replacing – 20 in the engine versus more than 2,000! – and don’t require oil or transmission fluid that needs changing out. Plus, there’s the nifty process of regenerative braking. When you brake in a regular car, the extra kinetic energy goes to the brake pads and liners, resulting in wear and tear. In EV, the extra kinetic energy is recovered and returned to the battery.

Clearly, the surge in EVs is a simple economic decision that consumers are already making in droves.

Second, there’s self-driving vehicles. The tech on this has improved by leaps and bounds.

These cars use an incredible range of sensors (radar, sonar, GPS, etc.) and interpret the data pouring in to pick which way to go, identify traffic signs and signals, and avoid obstacles.

What’s the Big Deal about TaaS?

In the space where these tech advancements meet, there is almost endless opportunity to improve the lives of citizens.

Picture a fleet of self-driving vehicles available to pick you up at a moment’s notice… or to deliver a much-needed prescription from the local pharmacy… or a hot meal from your favorite Italian carryout… then deposits itself in an off-the-path area to recharge overnight and be ready to go again tomorrow… and it’s one of thousands of similar “drone cars” driving with perfect safety on your roads.

Whitney Tilson calls it “America’s Next Big Gamechanger.”

And when Tilson talks, people listen.

Who Is Whitney Tilson and Why Is He Involved in Taas?

Whitney Tilson is a Connecticut-born investor, author, and philanthropist, widely considered one of the brightest minds working in financial markets today.

Consider…

- He called the exact day Bitcoin would peak in value (Dec. 16, 2017)… and the exact hour marijuana stocks would start their big collapse (Sept. 19, 2018).

- More recently, just after the stock market bottomed during the coronavirus crisis (March 25, 2020), Tilson said: “This is the absolute best time to be an investor in more than a decade.” He was exactly right – stocks had the best quarter in more than 20 years.

Tilson has also accurately predicted the decline of 88 different stocks, including three bankruptcies. He even helped oust the CEO at America’s most famous rental-car company, which filed for bankruptcy earlier last year.

And along the way, Tilson also purchased, for his clients, many of the most valuable stocks in recent history, well ahead of the mainstream media:

- Netflix when it was $7.78 a share ( today it’s worth 6,400% more)

- Apple at $1.42 (it’s up more than 27,000% since then)

- Amazon at $48 (it’s up more than 6,600% since then)

This is why CNBC once nicknamed Whitney Tilson “The Prophet,” and why it’s critical for you to take a few minutes to hear his view on TaaS.

Let’s evaluate the claims Tilson himself has made about the biggest impacts of TaaS.

1) “TaaS will put an estimated $5,600 back into the hands of 93% of U.S. families every year.”

This claim seems oddly specific, but between insurance, car payments, gas, and parking, the numbers do bear out! Tilson’s point here is that people won’t need to own cars anymore (unless they want to). And what a fantastic change – a huge reduction in the number of cars driving around at any particular moment (up to 80% fewer cars on the road). Consider the fact that the average car owner only uses it 4% of the time – an incredible waste. As for the $5,600 amount, that comes from a study called “Rethinking Transportation 2020-2030” by RethinkX. It concluded that, for the average U.S. household, using TaaS would cost $3,400 a year, versus $9,000 for using a new gas-powered car.

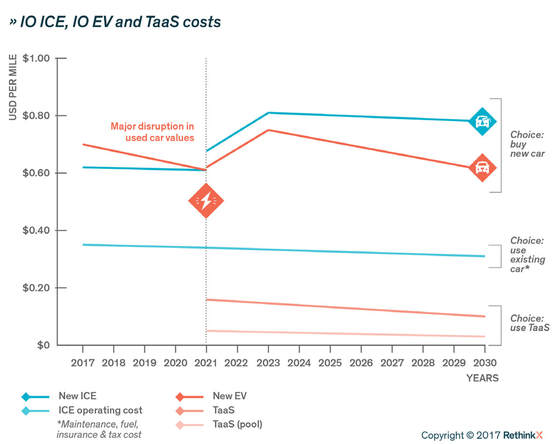

Source: RethinkX

2) “TaaS will dramatically change the value of your car… and real estate.”

No doubt about this claim! Cars will lose their intrinsic value quickly – especially when you consider that TaaS could drive down the cost of traveling one mile from 80 cents to just 10 cents. Plus, the part of real estate value that’s transportation-related, like private parking, proximity to public transport, or a fancy garage, will no longer be considered a “premium” feature, but a waste of space.

3) “TaaS will radically change the tax structure of almost every city and small town in America.”

This is an interesting projection, but one that we don’t think will have such a big impact long-term. Tilson’s conjecture is that local governments that rely on car-related taxes and fees to balance their budget will go broke. (For example, New York collects half a billion in parking ticket revenue each year.) But we feel the change will be gradual enough that new streams of city revenue will prop up what’s missing.

4) “TaaS will be equivalent to the biggest medical breakthrough in history.”

Tilson is talking about the fact that over a million people die in car crashes around the world every year (and at least 50 million more suffer injuries). And because human error is behind 95% of car accidents, the potential for life-saving is massive and extremely exciting. (And think about the way this will shake up the insurance industry!)

What Is the Timeline for TaaS Implementation?

According to Stephen McBride of Forbes, TaaS is ready for Prime Time in 2021, and it’s thanks to a surprising event – COVID-19.

“The only thing holding this massive disruption back is regulation… the need for [self-driving cars] is greater than ever. A lot of people don’t want to get in a car with a stranger who may have been exposed to COVID. They’d rather get in with a robot that can disinfect itself.”

When it comes to the “tipping point” for TaaS, it all comes down to economics… and we’re nearly there.

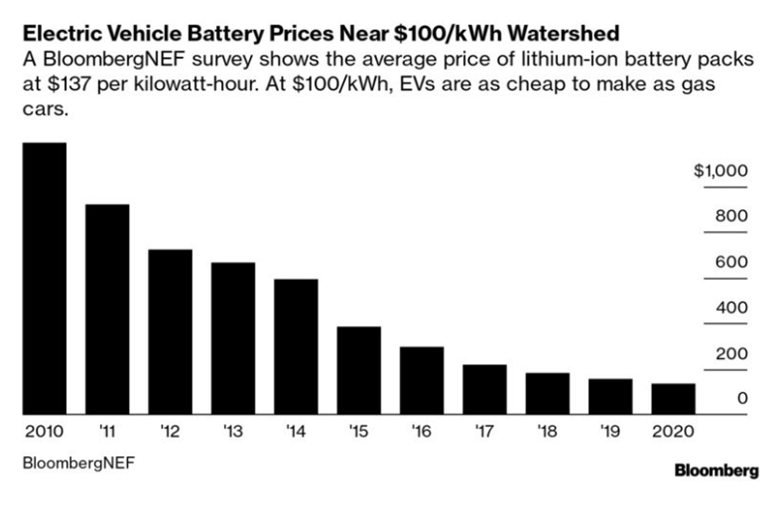

We look to Bloomberg’s “crossover point” model. That’s the point at which it become cheaper to buy an electric car than a gas one.

That’s been creeping closer and closer, and it’s now predicted to hit NEXT YEAR. In 2022.

Source: BloombergNEF

Tilson predicts that by 2025, EV will account for more than half of all new cars sold in the U.S.

And as for the driverless EV tech, it’s already happening. Google’s Waymo has a fleet of driverless cars zooming around Phoenix, Arizona.

But it’s clearly hit the stock market, so if you’re an investor, there’s no time to waste.

In fact, over the past six months, a collection of 20 public companies in the TaaS space reported average gains of 570%!

If that’s not enough of a leading indicator for you, consider this.

On practically a daily basis, reports are breaking about new deals and legislative efforts in response to the massive opportunity TaaS presents.

Whether or not you’re aware of it, TaaS is picking up speed all around you.

Indeed, if you’ve ever seen a Lyft vehicle with a pink fuzzy mustache tacked to the front bumper… or a much more discreet sticker in the window with a large letter “U” for Uber…

Or if you’ve ever downloaded the Uber or Lyft app and hitched a ride in someone else’s car…

You have experienced TaaS firsthand.

But the TaaS opportunity is much bigger than a car ride…

How Big Is the Opportunity for TaaS Stock Investors?

As stated above, Ark Invest has reported TaaS as a $10 trillion market.

Meanwhile, Intel Corp. (Nasdaq:INTC) forecasts that the market for self-driving vehicles will ring in at $7 trillion per year.

Money is pouring into this space on a near-daily basis, making it potentially the most exciting – and investable – forward-looking investment you can make in 2021.

Take a look at these recent headlines:

- Self-Driving Startup Cruise Receives $2B Investment from Microsoft ~ Intelligent Living

- China’s Huawei Develops Smart Roads That Talk to Driverless Cars ~ Bloomberg

- SoftBank’s Son Expects Mass Production of Driverless Cars in Two Years ~ Reuters

- Baidu Is the Sixth Company Approved to Test Fully Driverless Cars in California ~ The Verge

- K. Introduces Lane-Keeping Tech for Driverless Cars ~ Interesting Engineering

- Tesla Inks Deal with Samsung to Develop New Nano Chip for Autonomous Cars ~ The Driven

- Singapore Launches New Self-Driving Bus Trial ~ Tech Xplore

- GM Teams Up With Microsoft on Driverless Cars ~ Seattle Times

What Companies and Stocks are Involved in TaaS?

For whoever can figure out TaaS and dominate it, this is one insanely profitable niche. In fact, an auto exec “describe[d it] gleefully as ‘a license to print money,’” according to a recent article in Cleantechnica.

In other words, everyone wants a piece.

So let’s begin by identifying the areas of the market with the biggest potential, as well as analyzing the biggest players:

TaaS Specialty #1:

Self-Driving Carmakers

The most exciting one right now is Zoox (acquired by Amazon.com Inc. (Nasdaq:AMZN) last year for $1.2 billion). It makes custom autonomous vehicles for the robo-taxi market and is testing them around San Francisco and Las Vegas. Zoox’s lofty end goal is to create a fleet of independently operating EVs to serve the on-demand transportation needs of citizens in cities.

Of course, Tesla Inc. (Nasdaq:TSLA) is on the list. They’re probably a top bet for the best end-to-end customer experience.

But don’t count out Apple Inc. (Nasdaq:AAPL). While they’re late to the game, Apple has announced plans to manufacture driverless cars, and with its giant brand junkie fan base, whatever they come up with could be a consumer favorite.

TaaS Specialty #2:

Autonomous Driving Hardware

The biggest self-driving hardware company is Waymo, owned by Alphabet Inc. (Nasdaq:GOOG). It’s been in the game since around 2009 and licenses its products out to carmakers like Toyota and Audi, as well as an exclusive partnership with Volvo. Waymo is on the bleeding edge when it comes to cheaper, better self-driving hardware. It’s also expanding its reach past robo-taxis, currently developing tech for use in delivery vans and tractor trailers.

A close second is Cruise, a startup owned by General Motors Co. (NYSE:GM) and partnered with both Honda Motor Co. (NYSE:HMC) and Microsoft Corp. (Nasdaq:MSFT) (see software section below). It combines driverless EV tech with ride-hailing tech to provide on-demand transportation. Cruise is currently testing fully driverless (no human present) drives in California.

On a more granular level, LiDAR (Light Detection and Ranging) is a crucial tech you should know about. These tiny sensors are fixed to the vehicle and fire lasers (up to 900,000 times per second!), and measure how long it takes for the light to bounce back. In this way, paired with GPS and navigation systems, LiDAR can identify and avoid objects in real time, from a pedestrian to a bird. The most prominent LIDAR maker is called Aeva (privately held).

TaaS Specialty #3:

AI Navigation Software for Vehicles

Microsoft Corp. (Nasdaq:MSFT) is the clear leader in this sector. It created a program for connected vehicles based on its Azure cloud computing product. Aside from countless startups, Azure has been implemented in Renault Nissan, Volkswagen, and, as of January 2021, has become the preferred cloud provider for General Motors.

Another is Commander, a self-driving AI specifically engineered for robo-taxis in retirement communities. It focuses on extreme safety up to 25 mph. It’s owned by Voyage (private).

TaaS Specialty #4:

Customer-Facing Apps

When it comes to customer interaction, several companies have quite the headstart.

Uber Technologies Inc. (NYSE:UBER), Lyft Inc. (Nasdaq:LYFT), and even Zipcar already have their apps on millions of phones.

However, competitors are nipping at their heels. Amazon’s Zoox recently released an app for ride-hailing in its (still small) fleet in San Francisco. So has Waymo, and Tesla isn’t far behind. (Elon Musk has claimed that Tesla owners could make $30,000 per year by adding their vehicles to a robo-taxi network – basically renting out your vehicle for ride-sharing without lifting a finger.)

TaaS Specialty #5:

B2B Software

The prize peach here is fleet management technology to monitor all the cars on the road, enhancing efficiencies, mapping routes, and easing traffic. Leaders on this front include Bestmile, which sells real-time route optimization algorithm, and Citymapper, a real-time public transit app that helps users choose the best mode of transport. Keep an eye on Waze as well (also owned by Google).

Editor's Note: More information on Whitney Tilson’s #1 TaaS stock can be found here: https://breakthroughinvestors.com/euu5

Top Sources and Further Reading:

- Quiet Bull Market Erupting in Tiny TaaS Sector ~ Empire Financial Research

- The #1 Way to Profit on the Electric Vehicle Boom ~ Whitney Tilson (Sponsored)

- Investing in the Clean Transportation Revolution – Transport-as-a-Service (TaaS) ~ Green Angel Syndicate

- Why 2021 Will Be the Year Self-Driving Cars Go Mainstream ~ Forbes

- How Self-Driving Cars Will Save America ~ Banyan Hill Publishing

- LiDARs for Self-Driving Vehicles: A Technological Arms Race ~ Automotive World

- The Best Electric Vehicle Stocks to Energize Your Portfolio ~ StockInvestor.com