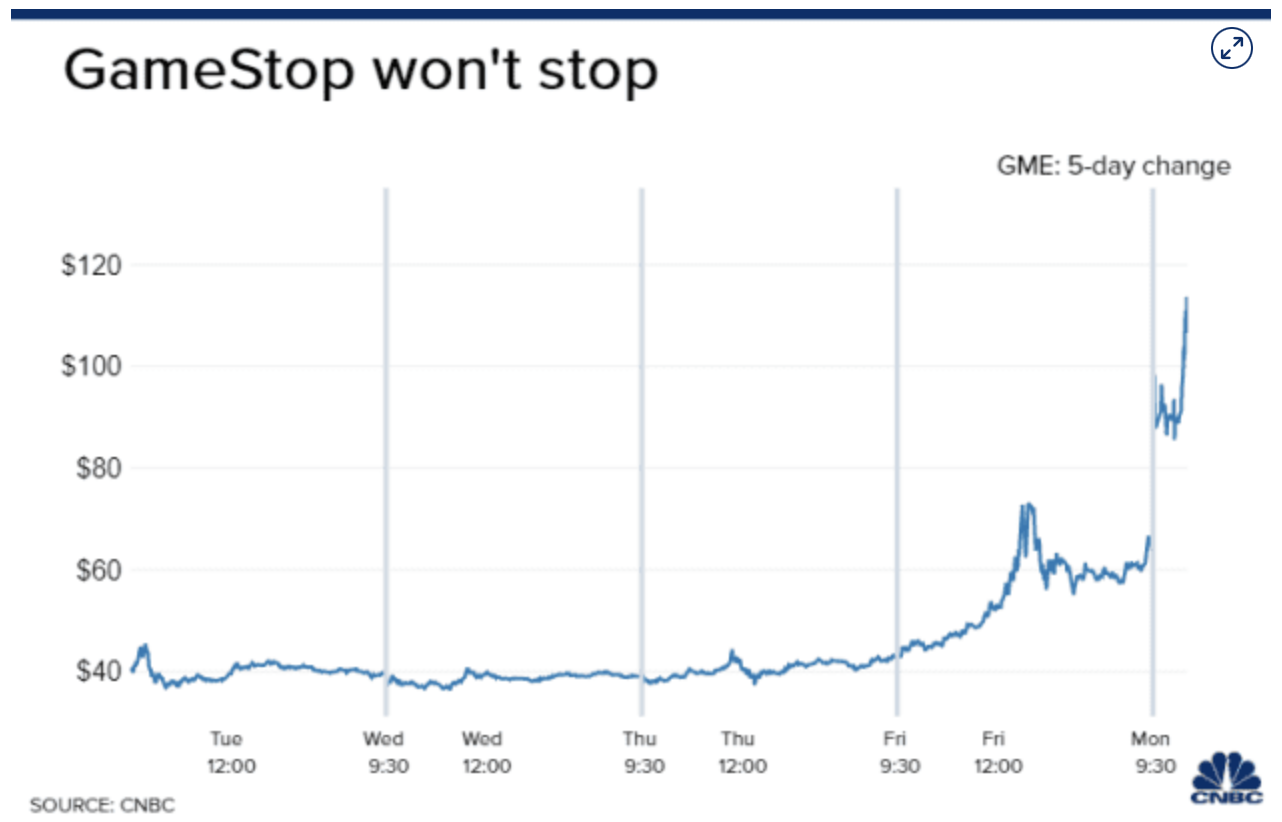

The explosive rally in GameStop (GME) is showing no signs of slowing down as retail investors talking in chat rooms and hedge funds rushing to cover their short bets against the stock pushed it above $120 a share at one point Monday.

Shares of the brick-and-mortar video-game retailer soared more than 140% to $159.18 at its high of the session in morning trading. The stock was briefly halted for volatility. Within an hour of the opening bell, more than 70 million shares has already changed hands, doubling its 30-day average trading volumes of 29.8 million shares.

GameStop shares have soared more than 600% in January alone and are up over 800% in three months. The stock was worth just $6 apiece four months ago.

Monday’s jump came despite a double-downgrade from Telsey Advisory Group. The Wall Street firm slashed its rating on GameStop to underperform from outperform, saying there’s a disconnect between fundamentals and valuation.

“The sudden, sharp surge in GameStop’s share price and valuation likely has been fueled by a short squeeze, given the high short interest, and, to a lesser degree, speculation by retail investors on forecasts for the new gaming cycle and the involvement of activist RC Ventures,” Telsey analyst Joseph Feldman said in the note on Monday.

[Alert: Look at this RARE 5100% Chart!]

“We believe the current share price and valuation levels are not sustainable, and we expect the shares to return to a more normal/fair valuation driven by the fundamentals,” the firm added.

GameStop has been a popular short target on Wall Street. In fact, more than 138% of its float shares had been borrowed and sold short, the single most shorted name in the U.S. stock market, according to FactSet citing the latest filings.

On Jan. 11, news broke that activist investor and Chewy (CHWY) co-founder and former CEO Ryan Cohen is joining GameStop’s board. The stock jumped on the announcement on hopes Cohen would drive a change in strategy. The gain triggered a rush of short covering from hedge funds and traders who bet against the stock. When a shorted stock trades sharply higher, short sellers would have to buy back shares to cut their losses, which fuels the rally.

[Breakthrough: Warren Buffett made $12 billion with the idea behind this simple technique]

GameStop has also been a hot topic in online chat rooms, Twitter and Reddit as some retail investors and day traders aim to push shares higher and squeeze out short sellers.

One post on the popular “wallstreetbets” Reddit Monday morning said “IM NOT SELLING THIS UNTIL AT LEAST $1000+ GME.” The post quickly drew more than 2,000 comments.

“It’s just another reflection of the ebullient mood,” Peter Boockvar, chief investment officer at Bleakley Advisory Group, said Monday of GameStop, “Again, it will matter when it does, whenever it does.”

Citron Research, a vocal GameStop short seller, said Friday it would not be commenting on the company any longer because of attacks from the “angry mob” that owns the stock. Citron said there were too many people hacking Citron’s twitter account on Friday, and it canceled a livestream where it was going a detail five reasons why the stock will go back to $20.

Telsey’s 12-month price target is $33. According to FactSet, the average price target of analysts is just $12.39, far below where it was trading Monday.

“This stock has completely disconnected from the fundamentals.” Anthony Chukumba, analyst at Loop Capital, said on CNBC’s “Squawk on the Street” on Monday. “This is very much being driven by retail investors, individual investors, many of them trading on Robinhood, many of them trading on options. And GameStop has an incredibly high short interest and the shorts are getting squeezed.”

“The fundamentals, in a word, are terrible,” Chukumba added. “Gamers are increasingly doing full-game downloads. They’re just downloading these game, they’re not buying the physical games. GameStop just doesn’t really participate in that.”

[Learn More: these stocks can quickly multiply in price 5x, 10x, 100x, or much higher…]