Many large retailers have spent the last few months adapting to government-issued “stay-at-home” orders to minimize the spread of COVID-19. But some of those companies have found other ways to cater to their customers, including enhanced e-commerce platforms, curbside pickup and home delivery.

Though restructuring has dealt a swift blow to revenues across the board, many upcoming first-quarter reports may offer a light at the end of the tunnel as it appears consumers are readily adapting to new shopping methods. It could be the start of a profitable retailing trend.

One Investment Guru Points to Rally of Retailers Offering Curbside Pickup

Hilary Kramer, an investment guru and author of several advisory services, including Value Authority, said that the goal in this unusual circumstance is for the large retail chains to simply outlast the weaker ones.

“The goal is not world domination at this point,” Kramer said. “It’s simply about outlasting the weakest rivals who were going to go under anyway and now COVID-19 will speed up the process.”

[Opportunity: How You Can Get Paid Every Time a Package Leaves the Amazon Warehouse]

Kramer went on to highlight what the main difference is between the stronger and weaker retail companies.

“Stronger retailers already have a multi-channel footprint and can offer home delivery or curbside service,” Kramer said. “They can shut the retail stores or restrict floor traffic if needed. Weaker ones don’t have the time or the resources to do that.”

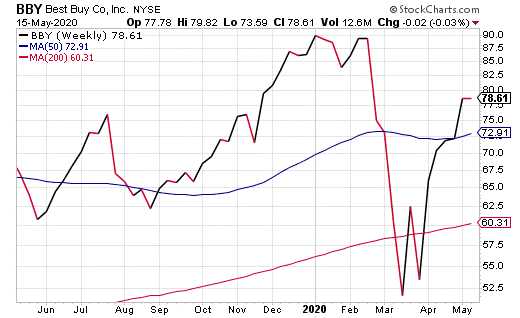

Best Buy Benefits as One of the Rallying Retailers Offering Curbside Pickup

According to data from S&P Global Market Intelligence, shares of Best Buy (NYSE:BBY) rose 34.6% in April. This stoked hope among investors, as the company rebounded from its 30% drop in March. Like many retailers, the current quarantine forced Best Buy to tweak its business model by introducing curbside pickup and delivery services. On April 15, management’s business update showed that through curbside pickup, the company retained 70% of weekly sales during a comparable period last year.

Best Buy’s Chief Executive Officer Corrie Barry credited the retainment of sales to the strength of the company’s multi-channel capabilities, including online sales and curbside pickup, in a statement on April 15.

“This is a testament to the strength of our multi-channel capabilities — as our Domestic online sales are up over 250% and approximately 50% of these sales are from customers choosing to pick up their products at our stores since moving to our curbside service model,” Barry said.

[Learn More: The Nearly $1.5 Billion in Payouts Waiting and How You Can Easily Claim a Slice]

“It is important to look at all of the services Best Buy has suspended to cooperate with Covid-19 guidelines, such as in-home delivery, installation and repairs. Though these popular services have been paused, the company is still making a steady recovery. Best Buy stock prices currently stand 58% higher than the March lows. Though the prices have fallen 13% year to date, the rebound made in April is proof that recovery may be on the horizon.”

The company is expected to report first-quarter earnings on May 21, before the market opens, for the fiscal period which ends in April. According to NASDAQ, the consensus earnings per share (EPS) forecast for the quarter is $0.66, while the reported EPS for the same quarter last year was $1.02. Though the immediate reaction may be to cringe at the reduced EPS prediction, a decrease of $0.36, is not uncorrectable. Best Buy has a current yield of 2.86% and an EPS of $5.81. As of the market’s close Wednesday, May 13, Best Buy’s stock traded at $75.03, which is at the higher end of the company’s 52-week range. Currently, the company has a 36% dividend payout ratio and dividend amount of $0.555, which is up from its previous dividend amount of $0.50.

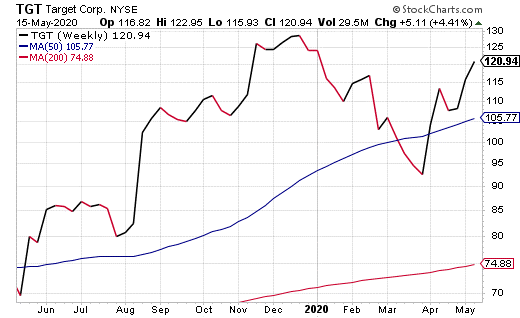

Target Joins Rally of Retailers Offering Curbside Pickup

In its usual creative fashion, Target (TGT:NYSE) is determined to lead the charge through the COVID-19 slump by optimizing its e-commerce platforms, collaborating with designers to launch Target-exclusive products and offering curbside delivery. By implementing these strategies, Target’s share price has recovered to roughly 8% below its pre-COVID-19 high.

[Don’t Miss: Why Amazon is Legally Obligated to Ensure Everyday Americans Get This Money]

In a statement on April 28, Michael Fiddelke, Target’s CFO and executive vice president, said the company expects to have the financial capacity to emerge from the pandemic in a position of strength.

“Having established an even stronger bond with our guests during this unprecedented time, we expect to have a compelling long-term opportunity to grow profitably and gain additional market share in the years ahead,” Fiddelke said.

Target’s current dividend is $0.660, which it has held since its previous dividend amount and has a pay date of June 10. The company’s stock price last closed at $119.14, which is 7% off its 52-week highs.

Looking ahead, the company is scheduled to release its first-quarter results on May 20, and NASDAQ’s current Zacks estimates predict Target’s first-quarter revenue will spike 7% and reach $18.85 billion. If this prediction holds true, it will top last year’s first-quarter 5% revenue expansion. Moreover, the estimate predicts Target’s full-year fiscal 2020 period revenue to reach 4%, which would beat fiscal 2019’s 3.7% growth.

For investors willing to ride out the COVID-19 tidal wave, pay attention to Target, as its ability to continue top-line growth during an economic downturn may result in a valuable payoff.

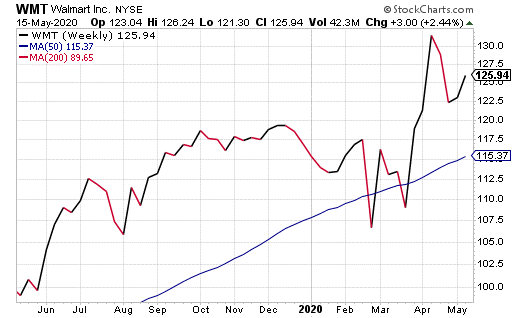

Survival of The Quickest — Walmart Out-Delivers Rivals Offering Curbside Pickup

One company that has gone to the head of the retailing pack in offering curbside pickup is Walmart (NYSE:WMT). Walmart’s share price is up more than 4% in 2020, compared to the 9% downturn in the S&P 500. Chances are its plethora of consumer services may have something to do with it.

[Opportunity: How You Can Get Paid Every Time a Package Leaves the Amazon Warehouse]

Not only does the company offer curbside pickup and online purchasing methods, but it launched free NextDay delivery from its website in fiscal 2020 and created a grocery delivery membership option called Delivery Unlimited. On April 30, the company announced yet another delivery option called Express Delivery.

Walmart announced the service delivers more items from the store “than ever before” to customers’ doors in less than two hours. However, the service is not free and will include an extra $10 fee, plus the delivery charge. But for customers with a Delivery Unlimited membership, it is only a $10 fee for the service.

Walmart Helps Lead Rally of Retailers Offering Curbside Pickup

Walmart’s e-commerce capabilities have placed it higher on the retail chain in terms of financial strength during this pandemic, Kramer said.

“WMT has done better because its e-commerce capabilities were much better advanced, Kramer said. “While there were a lot of inventory and delivery glitches, the site has come a long way in terms of suggesting replacements for products that are sold out or even pushing shoppers to a nearby store for curbside pickup.”

On May 6, Walmart released a statement by its CEO, Doug McMillion, to address the pandemic and its future effects on the retail industry. McMillon said that the company saw quick gravitation to online purchasing and curbside pickup before COVID-19 and, since the crisis began, he has seen customers embrace these options further.

“My feeling is that once this crisis is more under control, people will have seen the benefits of that service and will likely continue to use it,” McMillon said.

[Learn More: The Nearly $1.5 Billion in Payouts Waiting and How You Can Easily Claim a Slice]

Walmart is slated to release its first-quarter results on May 19. The Zacks Consensus Estimate for first-quarter earnings has gone down $0.01 in the last seven days to $1.19 per share. The penny difference suggests an 0.9% increase from last year’s reported figure in the same period. Additionally, the consensus for revenues is $129.2 billion, marking a 4.3% rise from last year’s same-period figure. Looking further out, projections for the company’s second-quarter sales indicate a 3% increase. Both quarterly estimates would mark the company’s strongest growth since the second quarter of fiscal 2019 when revenue leaped 3.8%.

The company has a current dividend amount of $0.540, and the next pay date is Sept. 8. It has a forward dividend of $2.16, or 1.75%, with earnings scheduled to be announced on May 19. As it appears, Walmart’s stock traded heavily prior to the company’s first-quarter report. On May 14, its closing price of $123.71 was $0.21 higher than its open, with trading volume at 7,291,365.

Kramer described Walmart as a strong defensive play, and investors could find it rewarding.

“As the biggest player in staples, it has the best defensive position in the long term to capture share from weaker rivals,” Kramer continued. “We made double-digit returns here in Value Authority a few years ago and might do it again under the right conditions.”

With Walmart’s strong forward outlook, its ability to grow amidst a country-wide shutdown and plan to continue strengthening its e-commerce outlets, it may be a solid option for investors looking for near-term and long-term gains.

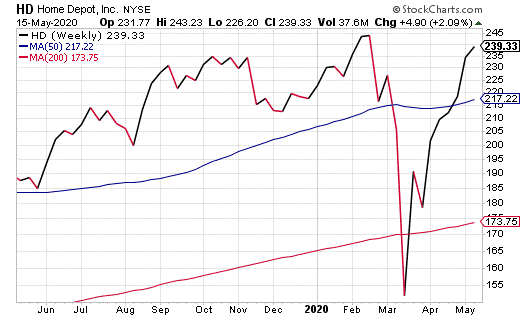

Home Depot Is Among Rallying Retailers Offering Curbside Pickup

Home Depot (NYSE:HD) will release its first-quarter financial report before the market open on May 19 but the well-known hardware supplier has seen some optimism in recent days. Randal Konik, of the Jefferies Financial Group, raised his target price for the stock to $269 which was an all-out leap from his previous price of $228.

According to TheStreet, Home Depot is on the verge of breakout territory as it has seen an outperformance in shares. The article reported that analysts are projecting an EPS of $2.23, which is roughly $0.01 higher than the same period last year. Over the past 12 months, the company has proven its strength, even amid the pandemic. Its strength is evident, as it is currently within 8% of its 52-week high.

[Don’t Miss: Why Amazon is Legally Obligated to Ensure Everyday Americans Get This Money]

Zacks Consensus Estimate has revenue estimates project at $27.23 billion, which indicates an increase of more than 3% since its report at the same time last year.

Home Depot pays an annualized dividend of $6.00 and its most recent pay date was March 26. It also offers a forward dividend of $6.00, or 2.61%. According to Yahoo Finance, it has an optimistic performance outlook for the short term, mid-term and long-term projections.

Kramer Weighs Risk and Reward of Home Depot Among Rival Retailers

Kramer stated that Home Depot is a different type of retailer, and because people are stuck at home, they are finishing projects that were put on hold, giving the company a continued source of revenue.

“HD is a little different because it’s more of a pent-up demand story as people stuck at home push the button on deferred maintenance and renovation projects,” Kramer said. “The stores are full when they’re allowed to open at all. The potential upside here is huge but the risk of a COVID relapse is also higher here.”

For investors watching Home Depot’s solid defense against the pandemic, it may be worth considering a bit longer as market factors point toward a strong first-quarter report.

Stepping Through the Sliding Doors as the Economy Looks at Reopening

With the economy reopening in phases, many retailers are seeing a controlled amount of foot traffic recently but are still holding fast to their new methods of sales. Walmart CEO McMillon opined that even when “normality” resumes, customers will still appreciate the different shopping options that are now being offered.

[Opportunity: How You Can Get Paid Every Time a Package Leaves the Amazon Warehouse]

In the near-term, investors should be reviewing first-quarter reports and weighing prospects. In a more distant future, the market is looking to see how these retailers are going to regain the money that was poured into the current restructuring models. While it is more than plausible that these curbside pickup services may remain permanent, it will be of interest to see if it is fiscally possible to keep them in place.