“I’ll never buy a security that doesn’t pay a dividend.”

That’s the strong stance Kevin O’Leary takes when investing.

If the name doesn’t ring a bell, you may know O’Leary as “Mr. Wonderful.” He’s the royalty-seeking, lead “shark” from ABC’s Shark Tank.

(The show invites aspiring entrepreneurs to pitch their product ideas to successful entrepreneurs in hopes of receiving funding from the “sharks.”)

O’Leary learned to focus on dividend-paying stocks from his mother. Though the power of this strategy wouldn’t become apparent to him until much later in his life…

You see, when O’Leary was a child, he’d watch his mother take one-third of her weekly paycheck to buy telecom bonds and large-cap dividend stocks.

It wasn’t a great deal of money, as she received only a modest salary from working at a clothing store.

[Major Buy Alert: Man Who Picked Apple, Bitcoin Reveals His “Pick of the Decade”]

But when his mother passed – and O’Leary became executor of her estate and reviewed her brokerage statements – he discovered the power of her strategy.

It was the first time O’Leary saw what dividend-paying stocks could do over 50 years…

“They blew away everything,” according to O’Leary.

This eye-opening experience cast dividend-paying stocks in a new light for O’Leary. From that point forward, his investment strategy was fixated on dividends. And he’s put his mother’s advice to work…

With over $1.3 billion in assets, his investment firm O’Shares ETFs has four funds under management. By mandate, O’Leary’s three original ETFs may only purchase stocks that provide investors yield. In other words, if a stock doesn’t pay a dividend… it’s off-limits.

O’Leary himself dislikes stocks that don’t pay dividends because they only provide a return when a share price goes up.

But a dividend-paying stock can reward him in two ways: regular dividend payments and a rise in share price when the market recognizes the stock’s value.

How to Build a Safe Income Machine

Here at Palm Beach Daily, we frequently talk about asymmetric opportunities like cryptos and pre-IPO companies. These are ideas that can turn tiny grubstakes into life-changing gains… like turning $500 into $50,000 or even $500,000.

But as Daily editor Teeka Tiwari always says, our core strategy is to have multiple streams of safe income.

[Hot New Tech: The World’s Best Investors are Lining Up Behind an Explosive New Technology]

You can then use a portion of that safe income to make asymmetric bets without putting your current lifestyle at risk. And the best thing is, even if your asymmetric bets don’t pan out, your safe income replenishes every year.

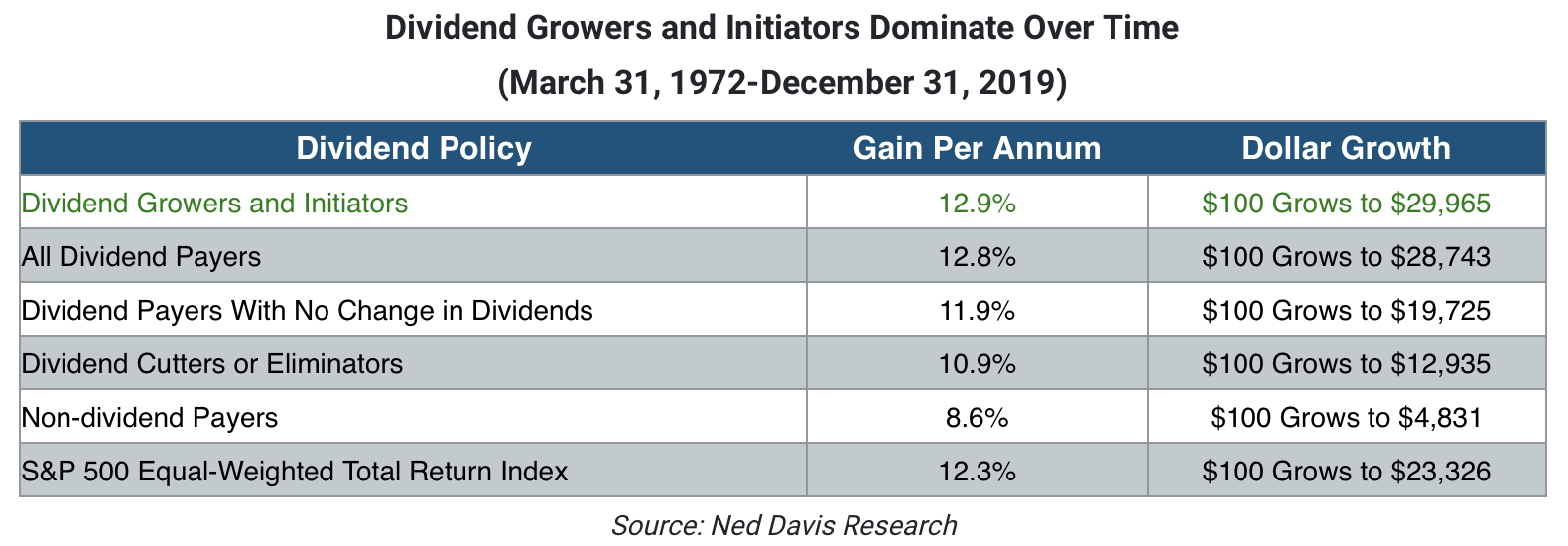

That’s why we share O’Leary’s fondness for dividends… But the good thing is you can “juice” your dividend payments even more by looking for consistent “growth” in those dividend payments. (See the table below.)

As you can see, “Dividend Growers and Initiators” have the highest annualized returns. (Other dividend payers finished at respectable second and third places.)

It’s clear dividend growth matters. Research proves companies that consistently grow dividends make investors far wealthier.

At PBRG, we’ve called them Dividend Elites. So how can you find them?

[Mad Rush: AMZN, GOOG, MSFT, FB… They're all betting on new tech projected to soar 295,762%]

Five Characteristics of Dividend Elites

Dividend Elite stocks are, first and foremost, companies that aggressively grow their dividends year after year. But a few other criteria set them apart…

- No. 1: Dividend Elites are usually small- or mid-cap stocks.

Smaller-sized companies have more potential for growth than larger-sized companies. Think about it this way: Blue-chip stocks are the giant, seasoned oak trees that grow 7% per year. Small-cap stocks are the young oak trees that grow 15% per year.

These stocks also see less interference from big institutional investors. Small- and mid-cap stocks are often too small for the billions that huge funds have to invest, and that makes them cheaper for investors like us.

- No. 2: Aggressive dividend growth.

Just like the blue-chip stocks, Dividend Elite stocks raise their dividends often and by large amounts.

And as you saw in the table above, companies that raise their dividends outperform the market – and other types of stocks – over the long haul.

- No. 3: A safe payout ratio.

If you’re buying a stock for dividend growth, you need to make sure there’s actually room for the dividend to continue growing. One way of doing this is by calculating what’s called the “payout ratio.”

[Major Buy Alert: Man Who Picked Apple, Bitcoin Reveals His “Pick of the Decade”]

To calculate a payout ratio, divide a company’s dividends per share by its earnings per share. The lower the payout ratio, the more room a company has to increase its dividend.

Dividend Elites have small- to average-sized payout ratios – typically less than 70%. This leaves room for dividend growth to continue for many quarters.

- No. 4: Low debt levels.

Raising dividends is fantastic – but not if it comes at the expense of safety. Dividend Elites are companies with no debt or low/manageable debt levels.

Just as in your personal finances, too much debt in a company is dangerous. If the marketplace suffers a downturn, or the business venture that needed the debt funding flops, the company is in a bad spot.

That means investors are unlikely to get a dividend… let alone an increasing dividend… from companies carrying a lot of debt.

- No. 5: Discounted valuations.

With Dividend Elites, price matters, too.

We don’t need these stocks to be trading at “fire sale” prices. But we’re not interested in them if they’re not offering us good value.

Ideally, we’d like to see a Dividend Elite stock trading at a discount to the market, its sector or industry, or its own historical average. All of the above is even better.

[Hot New Tech: The World’s Best Investors are Lining Up Behind an Explosive New Technology]

If we’re able to buy at discounted prices, we should eventually realize upside capital appreciation. An ideal combination of share-price and dividend growth.

A Simple Way to Get Started

Investing in Dividend Elites offers market-beating returns for a fraction of the cost. Plus, you’ll have an additional safe income stream in the form of dividends.

For easy exposure to this area of the market, you could go with the ProShares Russell 2000 Dividend Growers ETF (SMDV). This is a one-of-a-kind ETF that focuses on a rare breed of smaller companies that have raised their dividends for at least 10 straight years.

Or you can invest in select companies by following our criteria above.

Either way, you’ll create a safe stream of replenishing income. You can then take a portion of that safe income and use it to buy asymmetric ideas like cryptos, cannabis stocks, and pre-IPO companies… without harming your current lifestyle.

Regards,

Grant Wasylik

Analyst, Palm Beach Daily

[Mad Rush: AMZN, GOOG, MSFT, FB… They're all betting on new tech projected to soar 295,762%]