What would you spend your money on if you were rich?

For a lot of people, the answer is extravagance. Millionaires and billionaires love to show off their wealth by buying the most expensive yachts or the fanciest bottles of wine.

Years ago, I dreamed of having wealth like that. I’d get jealous hearing stories of the elite splurging on the rarest paintings at auctions, because I thought I’d never be in that position.

But as I spent more and more time studying the markets, I realized the secret to becoming rich is to spend your money like the rich do – at least, when it comes to stocks.

I’m not talking about buying millions of dollars’ worth of shares. Instead, you need to be as selective about which stocks you buy as the wealthy are about their paintings.

I call these “luxury” stocks outliers. These are companies that crush the competition every year. They can deliver 10x or 100x your money in just a few months. And they’re how a lot of the wealthy made their fortunes.

But how do you find these outliers?

[Learn More: The Company About to Blow Nearly Every Other Tech Firm Out of the Water]

It’s not that hard. After years of searching for these stocks myself, I developed a system to do the work for me.

And today, I’ll tell you where it’s telling us to look for these outliers…

Green Means Buying

I’m a snob when it comes to stocks. I only want the best of the best. That means companies that make big money, have huge sales and earnings growth, low debt, and awesome businesses.

So I built my “unbeatable” stock-picking system to discover which ones fit the bill.

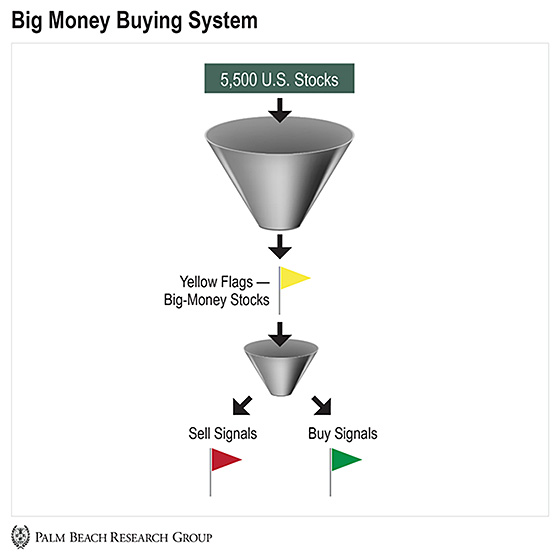

It scans nearly 5,500 stocks every day, using algorithms to rank each one for strength. It also looks for the movements of big-money investors.

When it sees them piling into or getting out of a stock, it raises a yellow flag. Then, it puts these yellow flags through another filter.

If the flag turns red, it means the big money is selling. If it turns green, it means the big money is buying…

source: palmbeachgroup.com

It’s that simple: When I see red, the big money is selling. And when I see green, it’s buying. It takes all the emotions out of investing.

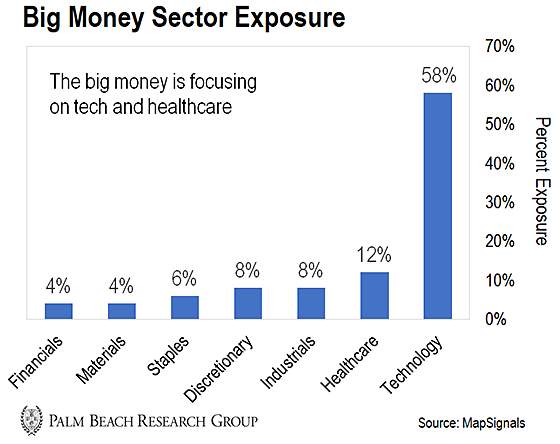

And right now, big money is flocking to the technology and healthcare sectors.

[Alert! The Company With Over 200 Patents / 500 More Pending in Tech Called “the new oil.”]

The Outliers Are in Tech

As you can see in the chart below, money continues to pour into tech and healthcare.

These sectors have been the true engines of market growth over at least the last year.

The big money is especially focusing on tech. And that’s logical because tech continues to make our lives easier and more convenient. That’s good in the name of progress and profits.

Now, my BMI indicator still says we’re overbought, so you don’t want to go all-in at these heights. But here’s the caveat: There’s no bad time to buy outlier stocks, just better times to find deals.

[Don't Miss: The #1 Tech Stock of 2020 is Showing Signs That It's Price is Ready to Explode]

Outliers will continue to outperform over the long run, so by constantly deploying money into them, you never really need to worry about timing the market.

One way to get broad exposure to tech and healthcare is the Invesco QQQ (QQQ) exchange-traded fund… It holds 53 top infotech and health care stocks.

It’s up 25% since we first recommended it on April 20. But with my system showing big money still plowing into these sectors, we think there’s plenty more upside here. Just remember not to bet the farm on any single trade.

So act like the rich and be a stock snob. Don’t settle for anything but the best of the best for your portfolio. And watch as your wealth snowballs over time.

Patience and process!

Jason Bodner

Editor, Palm Beach Insider