The coronavirus pandemic is the worst crisis we’ve faced since the 2008 financial crisis.

Millions of Americans are unemployed… Once-thriving businesses are now forced into bankruptcy… Bread lines are forming across the country…

Yet, stock prices are going up… The S&P 500 is up over 30% since the March 23 crash.

The world doesn’t seem to make sense right now… But at PBRG, we can still chart a course through these uncertain times. While fear paralyzes others, we look for ways our readers can profit from the turmoil.

You see, the recent uncertainty has created what we call a “golden income window.” And while it’s open, you can reap income from the market like it’s your very own ATM.

[Alert: New Technology Could Put Millions Out of Work while also Creating Many Millionaires]

Today, I’ll tell you what this window is… and more importantly, why now’s the time to strike…

The Golden Income Window

To take advantage of the golden income window, we use a strategy we call Instant Cash Payouts. It’s when we offer shareholders a form of “insurance” with “low-ball offers.”

In technical terms, it’s called selling put options.

That simply means, using a unique aspect of the options market, we agree to buy investors’ shares for a certain price and a certain length of time, in exchange for an upfront cash payout.

The cash is ours to keep – no matter what happens with the underlying stock. And we only have to buy shares if they drop to our agreed-upon price.

The bottom line: We get paid to buy companies we love – at a discount. That’s what makes this strategy so powerful.

Now, we only make low-ball offers on the best companies in the market. These are companies that dominate vital industries. They gush free cash flow and profits, and they look after shareholders.

More importantly, they’ll make it through a market crash with relatively minor damage. Sure, their share prices might fall a bit, but it won’t be a mortal blow. They’ll eventually recover.

[Breakthrough: New Tech Outside the Mainstream of Ai, 5G, and Robotics Seeing Massive Gains]

But here’s the thing…

The golden income window means we get paid more during times of volatility like we’re seeing now…

Ideal Conditions

To measure fear in the market, we keep a close eye on the market’s fear gauge, the CBOE Volatility Index (VIX). And as you can see, this year, it has been at its highest levels since last August.

We use a reading of 20 as our dividing line. A reading above 20 means investors are fearful and nervous. A reading below 20 means investors are calm and complacent. And with current levels above 20, this tells us investors are worried.

Here’s why this is important…

[Discover: Learn the Real Reason the Rich Get Richer and Ensure You Don’t Get Left Behind]

When investors are scared, they pay higher options premiums. This allows options sellers to generate thick income streams from the market.

And that’s what Daily editor Teeka Tiwari and I have been doing in our elite hedge fund-like service, Alpha Edge.

So far this year, Big T and I have closed 16 trades for average annualized gains of 33.4%. And we did this during one of the worst market crashes in history.

Now, we know there’s a disconnect between Wall Street and Main Street. While stocks are rising again, average citizens are struggling to make ends meet.

It’s not right or fair… But the good news is: Anyone can generate money from the golden income window we’re seeing today.

The Goldilocks Zone

Even though the country is slowly starting to reopen, COVID-19 will be with us until we develop a vaccine, treatment, or herd immunity against the disease.

And that means we’ll continue to see extreme volatility in the markets.

[Alert: New Technology Could Put Millions Out of Work while also Creating Many Millionaires]

Meanwhile, Federal Reserve chair Jerome Powell has vowed his central bank will do everything it can to backstop the market with an unlimited flow of credit.

“When it comes to this lending, we’re not going to run out of ammunition. That doesn’t happen,” he said back in March.

That was all we needed to hear. It means the most powerful central bank in the world will be firing a bazooka of cash at the market… and repeatedly reloading as needed.

This will support stock prices – no matter the long-term consequences.

And with volatility running rampant (causing options premiums to increase)… and the Fed firing bazookas of cash at the stock market (causing stocks to rise higher)… we have ideal “Goldilocks” conditions on the horizon to power our income potential higher.

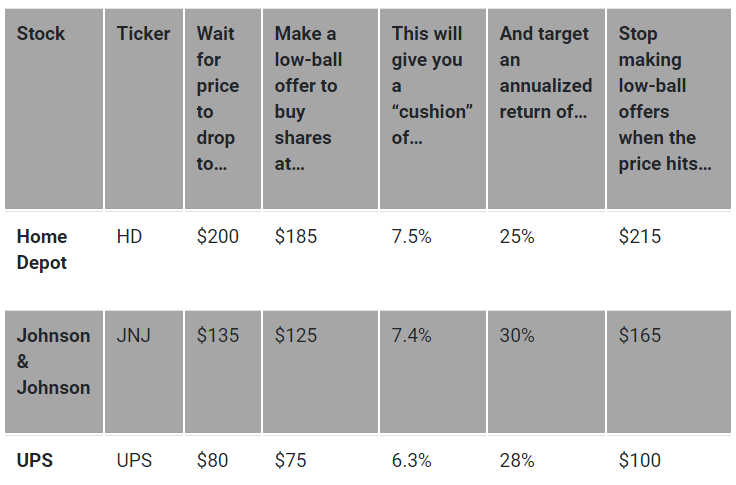

To help you profit from the current volatility, I’ve listed three trades I’m watching closely. Once the levels I’ve marked are hit, we plan to strike…

If you don’t know how to make a low-ball offer (sell a put option), then consider buying shares when they drop to the level I’ve indicated in the fourth column.

However you play it, know that as investors, we are in a target-rich environment. COVID-19 created many unintended consequences. And one of those is the incredible income you can generate by simply agreeing to buy shares in the world’s best companies – if they fall in price.

It’s a strategy Big T and I are using for reliable income and large profits. And it’s one you can use as well.

[Discover: Learn the Real Reason the Rich Get Richer and Ensure You Don’t Get Left Behind]

Invest wisely,

William Mikula

Analyst, Palm Beach Daily