One industry is disrupting health care stocks today … and you can profit.

In capitalism, it’s quite true that “change is the only constant.”

New businesses form every day. And unsuccessful ones die off. Even entire sectors and the industry groups within them don’t remain stagnant.

When new technologies or business practices come about and prove superior, the “old” ways of doing business get left behind, as the market collectively adopts the “new” way.

We call this disruption.

Netflix Is to Blockbuster What This Industry Is to Pharma Stocks

Think about what streaming (Netflix, for one) did to Blockbuster video…

As soon as it was possible to deliver several hours of high-quality video content through a standard internet connection, there was no longer a need to drive yourself to a physical Blockbuster location to rent a DVD.

[#1 Biotech Stock: This Could be the Closest Thing to Buying Amazon When it was $50]

The streaming video technology and business model permanently disrupted the DVD rental business.

There’s nothing new about disruption in the business world.

New technologies have replaced old technologies … and superior business models have supplanted inferior ones … for all of time.

Though, some would argue we’re now on the cusp of a massive tidal wave of new, disruptive technologies and business models that will reshape every industry for decades to come.

And that’s what this Industry Disruption feature is all about … highlighting a disruptive sector, industry group or business model that deserves your attention.

Let’s jump straight into our first installment with an industry that’s near and dear to my heart…

Genomics: The Health Care Stocks Disruptor

I was a medical-school dropout before I found my way to the investment world. So I’m still passionate about the broader health care sector.

Last October, I presented at an investment conference when I made a pitch for, as I said it, “DNA being the future of everything.”

You see, DNA is the foundational “building block” of all living things — humans, cockroaches, even viruses and bacteria.

Thus, the key to understanding all living things is in understanding DNA … and, more poignantly, the specific sequences of DNA that make up the genomes of each living organism.

[Buy Alert: Buffett Recently Dumped $800 Million of Apple Stock to Invest in This!]

Once we’re able to read the full sequence of DNA — the “code,” so to speak — we can then understand what that code does in healthy individuals, and in unhealthy ones, who are overtaken by a disease or other ailment.

And that’s why I’m confident the genomic medicine industry will massively disrupt health care stocks — namely the traditional pharmaceutical industry.

Simply put, when you have the ability to fix the root cause of a disease (DNA) … you no longer need to treat the “downstream” problems it causes in the human body, which is largely what pharmaceuticals do.

We’re already seeing signs of investor interest shifting away from pharma stocks and into genomics stocks.

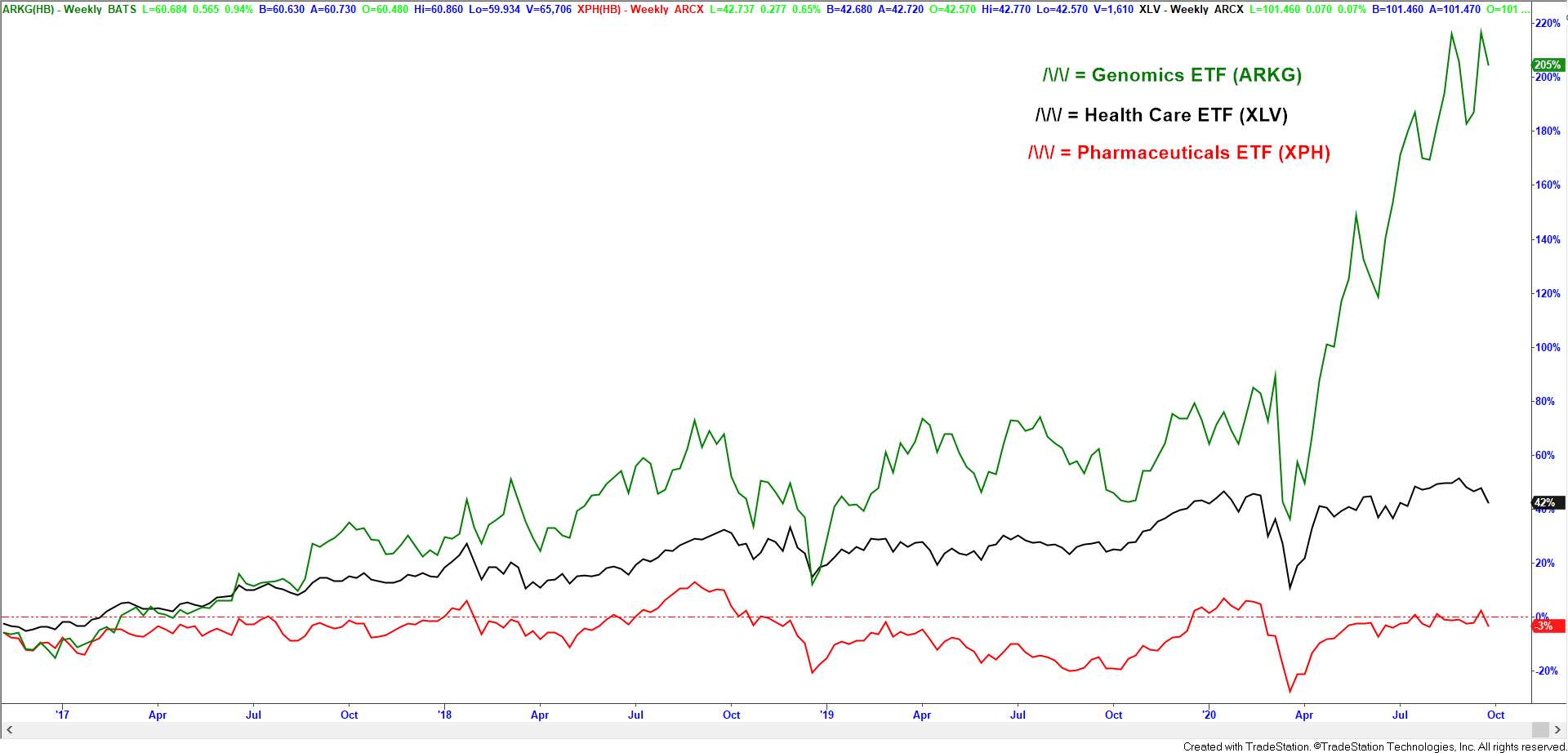

I like to look at sector exchange-traded funds (ETFs) — which hold a basket of stocks in the same industry — for a broad view of sector performance.

Take a look at the four-year chart of the performance of three ETFs:

- A pharmaceuticals ETF (XPH).

- A broader health care stocks ETF (XLV).

- And the Ark Genomic Revolution ETF (NYSE: ARKG), which I recommended in my investment conference presentation last October:

Past 4 Years: Investors Shift From Pharma to Genomics Stocks

As you can see, the broader health care sector ETF (in black) is up around 42% over the last four years, while the narrower pharmaceuticals ETF (in red) is down 3%.

Meanwhile, shares of the Genomic Revolution ETF (ARKG) — in blue — have tripled over the same time!

[Learn More: See Why Billionaires are Flocking to this Tiny Niche of the Tech Sector]

COVID Adds Fuel to Genomics Stocks

Of course, the 2020 coronavirus pandemic has added fuel to investors’ interest in genomics stocks. You can see that clearly in the chart above.

Yet you can also see that genomics stocks were outpacing the pharmaceuticals industry and the broader health care sector for several years before the pandemic hit.

The genomics revolution won’t go away once we’re past the current coronavirus pandemic. If anything, the pandemic has been both a “test” of this disruptive industry and an accelerator of its importance and acceptance as the future of health care.

Buying shares of the ARK Genomic Revolution ETF (NYSE: ARKG) is a smart way to gain diversified exposure to this cutting-edge disruptive industry.

To good profits,

Adam O’Dell, CMT

[#1 Biotech Stock: This Could be the Closest Thing to Buying Amazon When it was $50]