My background is in electrical engineering. But I’ve always had an interest in investing. I’ve been doing it for my family for more than 45 years.

And companies in the energy infrastructure and technology sectors have been some of my favorites to profit from.

I’ve been recommending top tech companies to my paid subscribers for more than a decade. And for good reason.

The shares of publicly traded tech companies are major drivers of global economic change. And that reality is going to be with us for a long time.

Many of my tech investment recommendations have paid off handsomely for my subscribers. But I’m starting to get questions from them about tech.

They wonder, “Is the tech sector’s best days behind it?”

“If not, how do you pick good tech companies to invest in?”

“And what about the sector’s higher risk?”

Read on for my answers to these questions.

[Exclusive: See How Startup Millions are Now Accessible to the Average Investor]

Why Invest in Technology?

I mentioned tech’s fundamental role as a driver of economic change.

Many tech companies are successful. Some are so successful that they generate high returns.

And it’s those types of companies that I search for every day. Even an average tech company can outperform top companies in other sectors.

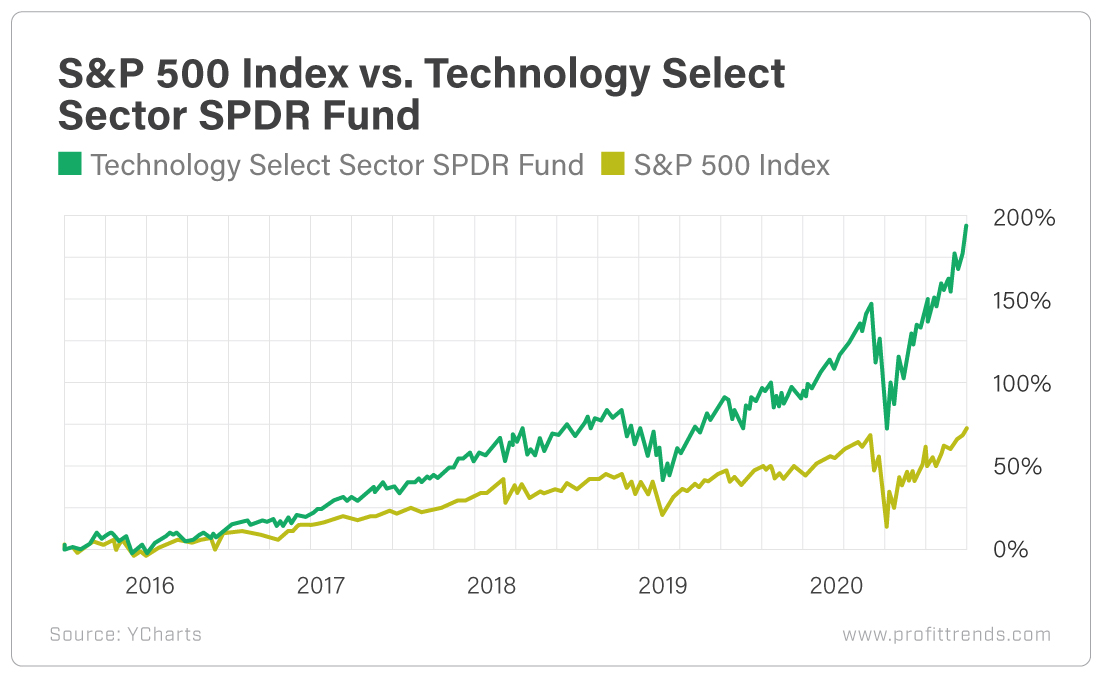

For example, let’s compare the five-year returns of the S&P 500 with those of the Technology Select Sector SPDR Fund (NYSE: XLK).

The technology ETF’s performance was nearly three times greater than that of the S&P 500. Where would you rather invest your money?

Are the Glory Days of Tech Over?

I don’t believe so. Not for one minute.

It’s human nature to innovate. Engineers are constantly designing better mousetraps.

[Breakthrough: This is Your Chance to Get in Early on the Next Amazon, Google, or Starbucks]

Over the past decade, dozens of big technological ideas have come to fruition. New technology has focused on how we communicate and travel. Think electric vehicles, ride-sharing and 4G.

Technology has also changed the way we consume information and transact business, through streaming services as well as online banking, investing and financial transacting.

And technological advancements have impacted how we learn and work, making it possible for both to be done remotely.

These would be exciting developments in normal times. But many have become absolutely critical during the coronavirus pandemic.

In terms of tech, the next 10 years are shaping up to be even more exciting than the last 10. But some of the biggest changes – and investment opportunities – are coming from completely different places.

The Internet of Things (IoT) is introducing the Fourth Industrial Revolution (Industry 4.0).

With the aid of 5G, remote surgery will become commonplace.

Mines will become completely automated through electric vehicles. The energy space’s transformation away from fossil fuels will create millions of jobs around the world.

And all of this will happen regardless of who occupies the White House.

How to Pick Good Tech Companies

First, you have to figure out where the disruptions are happening. Keep one eye open to spot new trends.

[Exclusive: See How Startup Millions are Now Accessible to the Average Investor]

I mentioned several areas for starters above. But there are a few more things to keep in mind.

Over the next 10 years, we’re going to see a shift in technological advancements. In the last decade, the consumer was the beneficiary and focus.

In the next decade, many tech innovations will benefit the enterprise world. My focus is on the six key technology developments below.

Advances in semiconductor technology are used to enable other tech advancements. We’ll see larger chips that run on lower power, with speeds at least 10 times faster than they are today.

IoT devices will continue to automate factory floors everywhere.

Industrial automation software will raise productivity to levels unimaginable today. Industry 4.0 is underway.

Artificial intelligence (AI) software combined with machine learning will create even more amazing tech advances in far shorter periods of time.

Robotics employing AI will disrupt the operating room, doing some simple procedures without the aid of a doctor.

And lastly, fully electric autonomous vehicles will transport us and disrupt the last-mile delivery service sector.

What About Tech’s Higher Risk?

Every investment has associated risk. The key is to get the highest returns with the lowest risk.

[Breakthrough: This is Your Chance to Get in Early on the Next Amazon, Google, or Starbucks]

American entrepreneur Robert Arnott famously said, “In investing, what is comfortable is rarely profitable.”

Every investor has a different comfort level when it comes to risk. I like to hedge my risk with the question “Is this product or service going to disrupt the sector it’s focused on?”

If the answer is yes, I then apply my other rules of investing. (At the top of that list is position sizing.)

Make sure you understand what you’re buying. Don’t invest in anything you can’t explain to the average 8-year-old.

The trend is your friend. The tech sector has seen record gains for the last five years.

And in 2020, the tech sector has continued to perform. Since January 1, 2020, the S&P 500 has posted gains of 8.58%.

But the tech-heavy Nasdaq is off to a record-setting start this year. It’s up 34.3% – four times the S&P 500’s return.

There’s every reason to expect tech’s outperformance will continue. You can bet that’s what I’ll be focused on.

EVs… renewable energy… technology… biotech… online learning… those are the areas my colleague Matthew Carr and I are investing. And you should too.

Good investing,

Dave

[It's Not Too Late: Learn How a $100 Investment Could Turn into an $800,000 Exit!]