“Buy when there’s blood in the streets, even if the blood is your own.”

History generally attributes this legendary saying to Baron Nathaniel Mayer Rothschild.

The story, as it’s often told, goes as follows…

After the Battle of Waterloo, Rothschild used advance information about the British coalition’s victory in Belgium to profit greatly off United Kingdom gilts. U.K. gilts are the equivalent of U.S. Treasury bonds, and Rothschild, privy to the information before most, positioned himself long on these gilts.

As word finally began to spread about Napoleon’s defeat, British stocks and bonds soared, and Rothschild made a killing.

Now, the reason Rothschild is accredited with saying “Buy when there’s blood in the streets” is because prior to the public (and many financial and government magistrates) learning the outcome of Waterloo, news of several British defeats at Napoleon’s hands had pervaded the public narrative.

So there was a palpable fear that the British would lose a very costly war, which sparked a frenzy of selling, driving asset prices into the basement. However, thanks to his intricate network of private couriers, Rothschild knew the information about Commander Wellington’s victory at Waterloo was true.

In order to capitalize on this confusion, he bought up all the depressed assets he could. He then sold them at exponentially higher prices after the truth came to light, and British assets soared in value… or so the legend goes.

My point is that the best time to buy and trade financial assets is when folks are panic selling.

That’s precisely what the investment herd is doing right now.

Source: energyandcapital.com

The recent end of April’s sell-off left a lot of blood on Wall Street, but we can apply the Rothschild lesson to thrive off the volatility.

[Exclusive: Daymond John, “The People's Shark,” reveals where he's investing]

Investors Hate Volatility, but Traders Thrive off It

Take a look at this stock heat map from this week. It doesn’t take a rocket scientist to know investors are getting hammered right now.

Traders on the other hand, especially the unique group of Wall Street players known as Naked Traders, are raking in cash, even as stocks are free falling.

Why?

In short, traders thrive off of volatility.

How so?

When it comes to trading stocks and options, change is good. When stock market volatility is high, it means a lot of changes.

To make money in the financial markets, we need changes. Specifically, we need the price of “X” to go higher. The speed of these changes, or the rate of change, is how we measure whether markets are volatile or not.

The higher the rate of change, the higher the volatility, and vice versa. As volatility, or the rate of change, increases, the overall number of potential profit opportunities also increases.

This is how individual investors like us can thrive during these volatile bear markets.

And no one does this better than my colleague and cubicle cellmate, Sean McCloskey.

Usually it takes an impressive string of winners to stand out to me, especially considering the incredible run the energy sector has had throughout the pandemic.

However, this morning I happened to peek across my desk and immediately recognized the smile on Sean’s face. You see, he had his latest trading activity for his Naked Trades community up on his screen.

[“The People's Shark” is Helping Everyday Americans Discover the Next Huge Startup]

Let me give you a sneak peak of what made him so happy during a market crash:

- 51% on Walmart

- 205% on Petrobras

- 124% on the VIX

- 84% on Baker Hughes

- 157% on Denison Mines

- 133% again on Petrobras

- 119% on Pfizer

- 130% on Uranium Energy Corp.

Keep in mind that these are just the trades they’ve made this year!

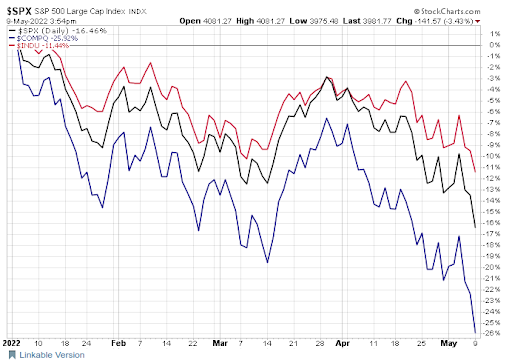

And all while the Nasdaq is down a whopping 27%, the S&P 500 is down 17%, and the Dow is down 12%!

Source: energyandcapital.com

This may sound incredible, even downright dishonest, but I assure you these are real gains made by real people with a system that’s as easy to use as playing a game of checkers!

So I have to ask: Do you want to roll over like the rest of Wall Street or do you want to take control of your financial future?

Until next time,

Keith Kohl

[Daymond John: America’s Comeback Summit – “I’m Investing 100K in This”]