The month of September has been the house of pain for the Nasdaq and especially the FAANG stocks of Facebook (NASDAQ: FB), Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Netflix (NASDAQ:NFLX) and Google’s parent Alphabet (NASDAQ:GOOG, GOOGL), as well as the MAGA stocks of Microsoft (NASDAQ:MSFT), Apple, Google and Amazon.

Fierce rotation out of the heavily weighted tech darlings into transportation, industrial, materials and a swath of big initial public offerings (IPOs) has the QQQs reeling by 13.5% off the Sept. 2 high of $303.50.

Technical damage within these market leaders is everywhere, and the Qs have sliced down through the 50-day moving averages, which has chartists buzzing about where the next line of support is for the FAANG/MAGA index.

As of Friday’s close of $267, the Qs entered some open water below the 50-day (blue) line and still well above the 100-day (orange) line. From an extreme overbought condition realized in August that was part and parcel to the surge in call option buying juiced by SoftBank, an overshoot to the downside of the 50-day isn’t crucially negative.

[Breakthrough: Learn About the Lesser-Known Firm That’s Set to Win the Race to Deploy 5G]

(source: stockinvestor.com)

(source: stockinvestor.com)

There is good technical support just underneath at the $260 level that should not just hold, but invite strong buying interest, since the fourth quarter is typically and historically the strongest time for sales and earnings growth within the tech sector. Businesses and federal, state and local governments have budgets with “use it or lose it” year-end deadlines.

Assuming the Nasdaq does catch a bid down here by the month’s end on anticipation of a rock n’ roll third-quarter earnings season, the rebound will likely be measured since the market is also entering the final weeks of the election where Democrats will retain control of the House of Representatives while control for the White House and the Senate are up for grabs.

[Revealed: The Most Promising 5G Stock You’ve Never Heard of is Poised to Go Vertical]

Against this backdrop, there are some apolitical secular investment themes within the broader tech sector that, like many great tech stocks, are now on sale thanks to the past three weeks of unrepentant selling pressure. For income investors seeking to initiate or add some tech stocks with attractive dividend yields, your time has come.

The current correction has provided a sweet entry point for buying into the 5G and cloud storage markets, where the best-of-breed stocks in both sub-sectors are trading 10-15% off their 52-week highs. The advent of the remote working economy, artificial intelligence-driven platforms, big data enterprise networks, internet of Things (IoT), digital payments and mobile e-commerce are all huge contributors to cell tower and data center operators.

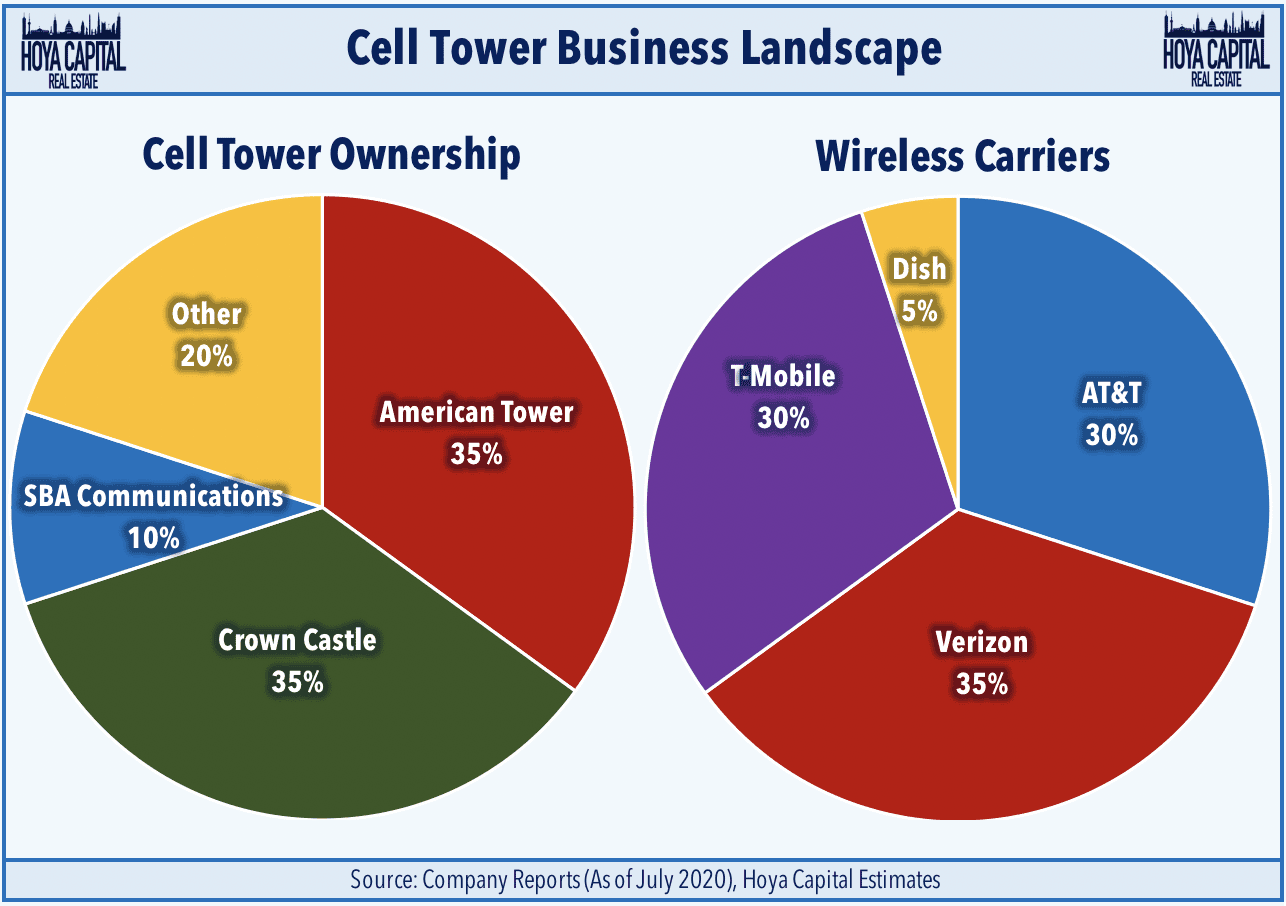

The global telecom tower market accounted for $40 billion in 2017 and is expected to grow at a compound annual growth rate (CAGR) of 18.0% during the forecast period 2018-2025, to reach $145 billion by 2025. (Source: theinsightpartners.com)

(source: stockinvestor.com)

(source: stockinvestor.com)

The two stocks within this space that rule the roost are American Tower REIT (AMT), paying a current dividend yield of 1.76%, and Crown Castle International Corp. (CCI), offering a current dividend yield of 3.01%.

[Learn More: Huge Corporations Have to Pay This Company a Toll to Use the 5G Network]

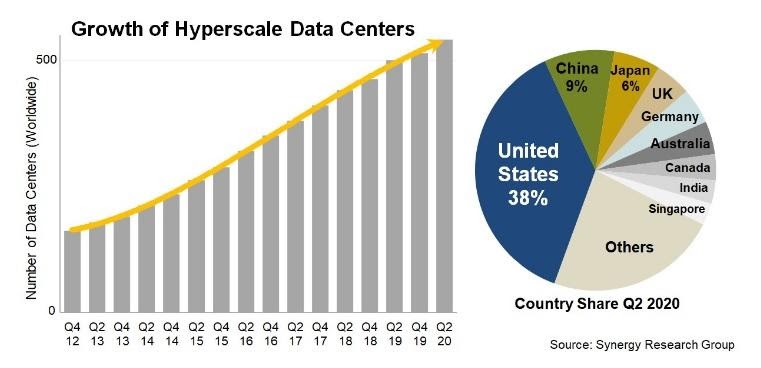

The growth of data centers to handle the volume of data moving to the cloud is also as close to a “bulletproof” trend as investors can find. The demand for multi-cloud strategy and the advent of 5G technology will lead to the expansion of the global data center market at a CAGR of more than 17% during the forecast period 2020-2023.

(source: stockinvestor.com)

(source: stockinvestor.com)

The four primary drivers are the rise in adoption of multi-cloud and network upgrades to support 5G, the rising adoption of loT devices, big data analytics and the rise in adoption of edge computing.

Edge computing is a network architecture wherein the data is stored and processed near its origin. An edge server in this network serves as the connection between separate networks. The advantage of edge computing is that the stored content is close to the client machine, thereby reducing latency and improving server response.

[Breakthrough: Learn About the Lesser-Known Firm That’s Set to Win the Race to Deploy 5G]

Growing demand for efficient and secure data management has spurred edge computing implementation in large-scale enterprise. This development is expected to have a positive impact on overall market growth.

There are five data center stocks with attractive dividends to consider:

CyrusOne Inc. (CONE) — dividend yield 2.81%

QTS Realty Trust Inc. (QTS) — dividend yield 3.02%

Digital Realty Trust Inc. (DLR) — dividend yield 3.09%

CoreSite Realty Corp. (COR) — dividend yield 4.14%

The fastest-growing stock in the data center space is Equinix Inc. (EQIX) with 2021 sales forecast to hit $6.5 billion and profits to soar by 31%. The company sports a market cap of $67 billion, which is exponentially higher than the next competitor, and it operates on five continents. EQIX pays a dividend yield of 1.41%.

Those seeking high-visibility income and growth after a Nasdaq smackdown should look long and hard at the opportunity the market has just afforded investors. It has been a while since I highlighted these special real estate investment trusts (REITs), but anytime there is an opportunity to put some money to work in these sectors at a meaningful discount, it’s worth casting a light where income-oriented investment capital has been well served.

[Revealed: The Most Promising 5G Stock You’ve Never Heard of is Poised to Go Vertical]