I had a somewhat startling realization while hiking with my dog the other day…

It is fall.

The lush green of the day before had been replaced overnight by falling yellow leaves.

You could smell the change in the air. Even my pup could smell it as she caught the scent of turkeys in the crisp “suddenly fall” morning.

But it’s not just the weather that’s changing.

For investors, October marks the beginning of the most important three-month stretch for the U.S. economy – holiday spending.

The unofficial start of the holiday shopping season is merely days away – October 10.

Of course, there’s no beating around the bush. This year won’t be typical for seasonal spending, but nothing in 2020 has been.

[Next-Level: A Silicon Valley man walks into Starbucks… And then THIS happens]

However, don’t go all “Grinch” just yet. Because there’s one surefire investment I believe everyone should consider that is bound to bring holiday cheer.

Two New Shopping Holidays

It’s finally starting.

People are starting to think about the holidays. They’re creating wish lists and jotting down perfect gift ideas for loved ones.

And even though we haven’t gotten past Halloween yet, Americans are expected to start their holiday spending this Saturday.

That’s thanks to two new unique initiatives.

The first is the 10.10 shopping festival.

The second is Amazon‘s (Nasdaq: AMZN) Prime Day, which was pushed to October 13 and 14. This could be the company’s largest Prime Day ever, with projections of more than $10 billion in gross merchandise sales over the two-day span.

Now, the outlook for the holiday season is cautiously optimistic. Many forecasts are for a roughly 1% to 1.5% increase in sales year over year. That would bring total holiday sales to around $1.15 trillion.

But there’s the potential for a major surge. In fact, there are projections of as much as a 2.6% increase if consumer confidence picks up, particularly among more affluent consumers.

That’s still considerably less than the growth we’ve seen in most years. And it would be close to the slowest increase we’ve recently seen, of 2.1% in 2018.

[Revealed: How to buy all the stuff you want – without paying for them the usual way]

But considering all that’s transpired this year, this demonstrates the resilience of the American consumer.

And there’s one way I believe investors can play this upswing… e-commerce.

A One-Stop Shop for Growth

The Amplify Online Retail ETF (Nasdaq: IBUY) is an exchange-traded fund (ETF) made up of companies that get the majority of their sales online.

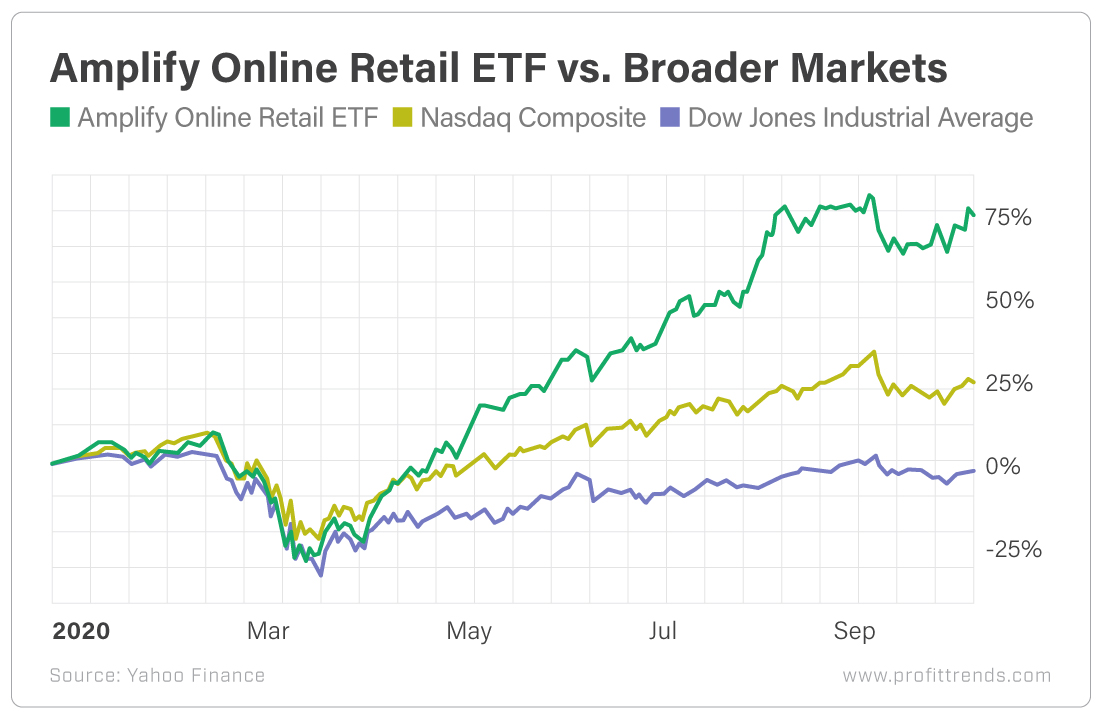

And it’s obliterating the broader markets. It’s left in its wake not only the lagging Dow Jones Industrial Average but also the high-flying Nasdaq.

With consumers relegated to interacting virtually with the world, e-commerce has skyrocketed. I actually believe e-commerce has reached a tipping point, driven by the pandemic.

In the second quarter, the Census Bureau reported that e-commerce accounted for more than 16% of total retail sales in the U.S.

[Learn More: With 10 seconds and this simple financial maneuver you could be generating $$$]

Not only is this a record level, but the $211.5 billion it represents is up more than 30% from the first quarter’s e-commerce sales.

That’s a transformative push by the consumer.

So even though total U.S. retail sales slipped because brick-and-mortar stores were shuttered due to the pandemic, e-commerce continues to thrive. And that’s not expected to slow down anytime soon, as COVID-19 cases have recently spiked and online shopping is becoming more widely accepted.

The Amplify Online Retail ETF’s largest holding is Overstock (Nasdaq: OSTK). The e-commerce platform has been reborn in 2020 as shares rocketed more than 1,000% higher.

The next-largest holdings are Carvana (NYSE: CVNA), Peloton Interactive (Nasdaq: PTON), Revolve Group (NYSE: RVLV), Wayfair (NYSE: W) and PayPal Holdings (Nasdaq: PYPL).

These are e-commerce darlings and provide a microcosm of the growth digital companies are seeing this year.

For instance, revenue for Carvana, Peloton, Overstock and Wayfair is projected to grow more than 40% in each of the next two quarters.

PayPal is expected to see revenue jump more than 20% in each of the next two quarters.

And Revolve Group is experiencing an upswing in sales as well.

The American economy has been under serious pressure due to the pandemic. But we’ve watched consumers remain resilient during these long months. They’ve changed their buying habits by purchasing more online. And this holiday season, I believe we’ll likely have record e-commerce spending take place.

One of the best ways to play that is with the Amplify Online Retail ETF.

[Learn More: With 10 seconds and this simple financial maneuver you could be generating $$$]

Here’s to high returns,

Matthew