Extremes are investors’ early alarm system.

When euphoria is everywhere, it’s time to run for the hills.

And when everyone is screaming that the world is on the precipice of demise, it’s time to load up the truck.

Billionaire Warren Buffett has been shelling out this piece of advice for decades: “Be fearful when others are greedy, and be greedy when others are fearful.”

Of course, that’s easier said than done.

But today I’m going to share with you the exact moment to start buying hand over fist… because it’ll happen again.

Viva la Bull!

The Great Bear Market was gored to death on March 23.

[Breakthrough: How the Son of a Police Officer Shocked the World With This Tiny $3 Stock]

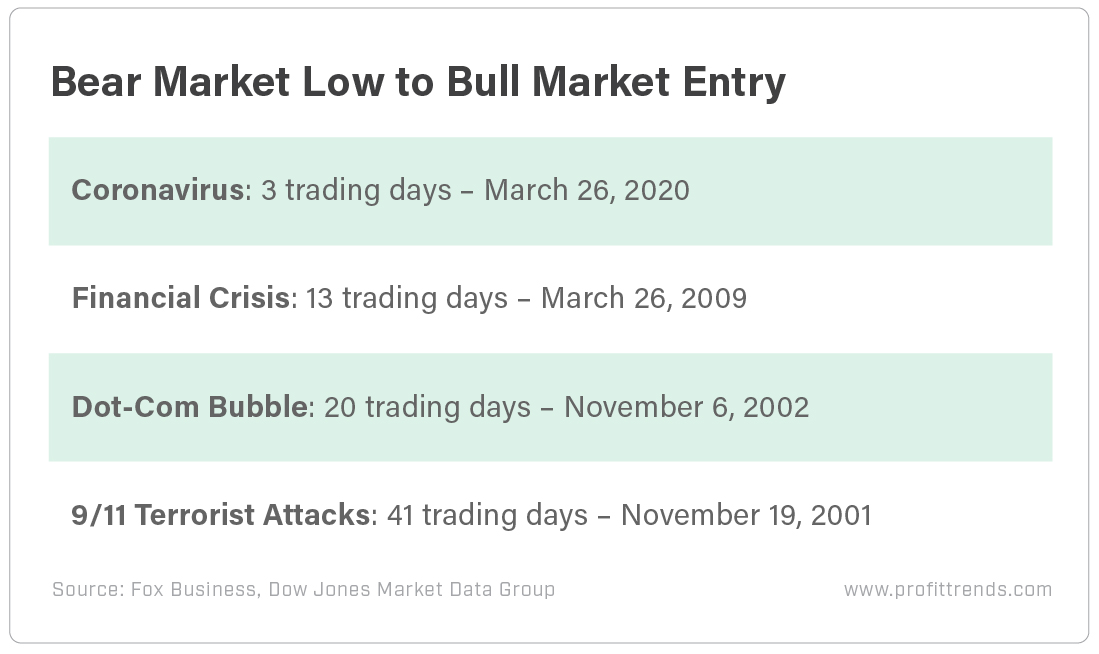

The fastest 30% drop in market history culminated in one of the shortest bear markets on record for the Dow Jones Industrial Average, as well as the quickest move ever from bear market low to bull market entry…

By market standards, that was a blink of an eye.

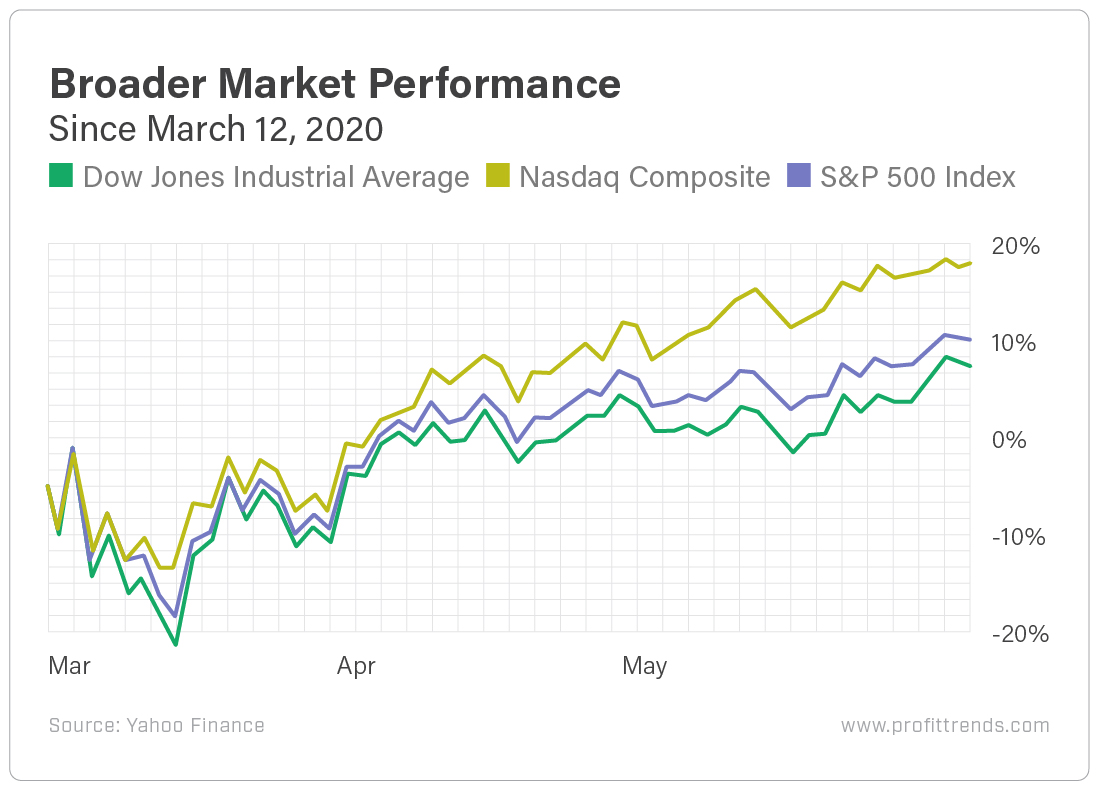

The Dow Jones has rebounded 31.5% from its lows on March 23. The S&P 500 is up slightly more than that, and the Nasdaq has rocketed 36% higher and is positive for the year.

Previously, I pointed out that event-driven bear markets tend to be the shortest-lived and easiest to tame of all bear market breeds.

Though, let’s be honest… No one expected the most recent bear market to essentially be dead on arrival.

But maybe we should have. There was a telltale sign that the bottom was in.

Now, the current recovery has been so quick – and so classicly V-shaped – that its legitimacy is constantly in doubt.

The airwaves are littered with experts saying stocks are overpriced. (Many of these people have been saying the same thing ever since the second quarter of 2009.)

And it often seems that, for permabears, any stock price is overpriced.

That negativity isn’t just coming from the experts. It’s also echoed by the average investor.

But before you think that’s a signal to race to the sidelines, take a breath.

Because you might miss…

The Easiest Moneymaking Signal There Is

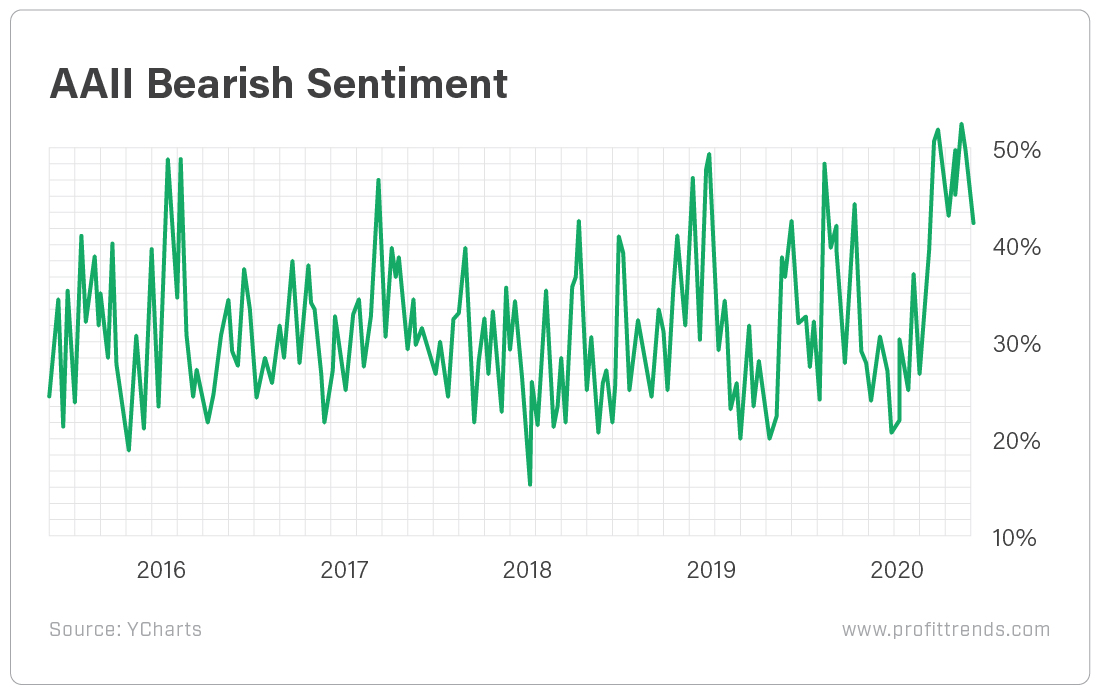

Last week, the American Association of Individual Investors (AAII) Sentiment Survey showed 42.1% of investors were bearish.

[Inspirational: He Started With $7,500 and Now Signs Billion Dollar Deals With Titans of Tech]

That means just under half of investors believe the market will be lower six months from now. That’s significantly above the long-term average of 30.5%.

But here’s where things get interesting…

The week of March 12, bearish sentiment on the AAII survey crossed over 50%. And it’s largely hung around that level since then…

A lot of investors have been fearful.

[Revealed: This Three Dollar Stock is Now a Hidden Gem Trading Under a Secret Name]

But I’m sure you already understand what’s happened since…

After finding the bottom on March 23, the Dow, Nasdaq and S&P have rocketed higher.

Now, consider this…

[Breakthrough: How the Son of a Police Officer Shocked the World With This Tiny $3 Stock]

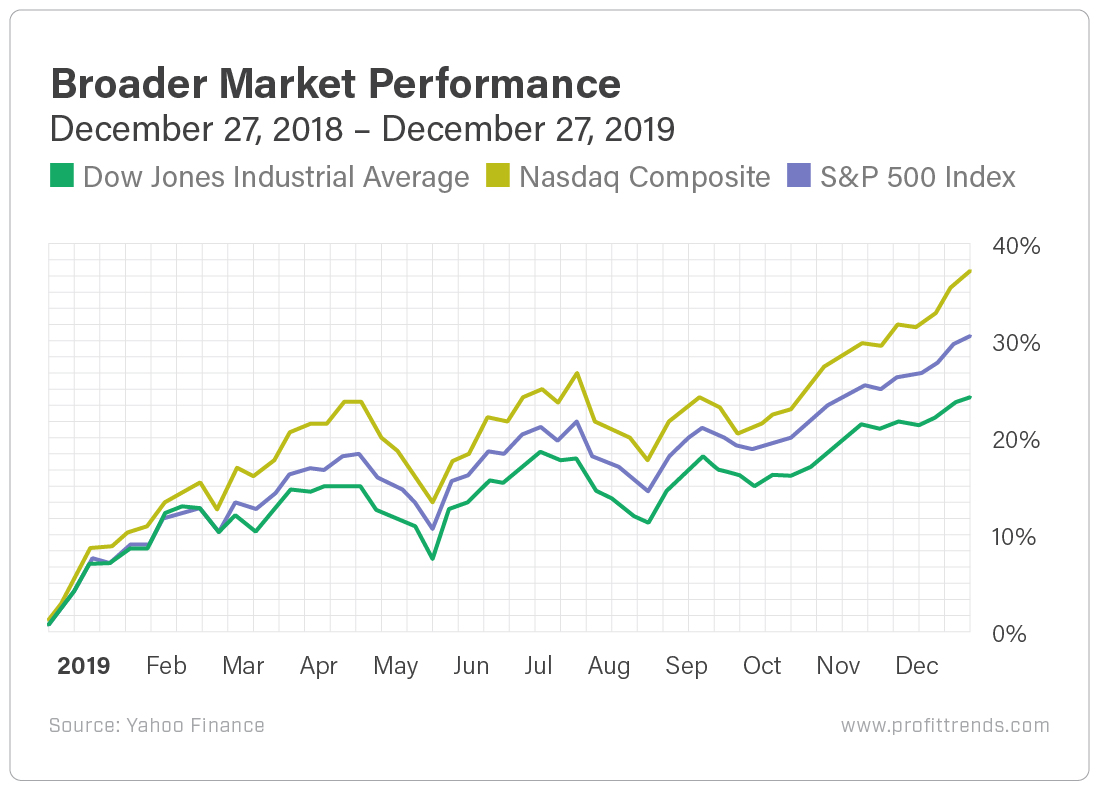

The last time bearish sentiment on the AAII survey topped 50% was on December 27, 2018.

And look what the the indexes did over that next year…

And as Billy Mays would say, “But wait, there’s more!”

[Inspirational: He Started With $7,500 and Now Signs Billion Dollar Deals With Titans of Tech]

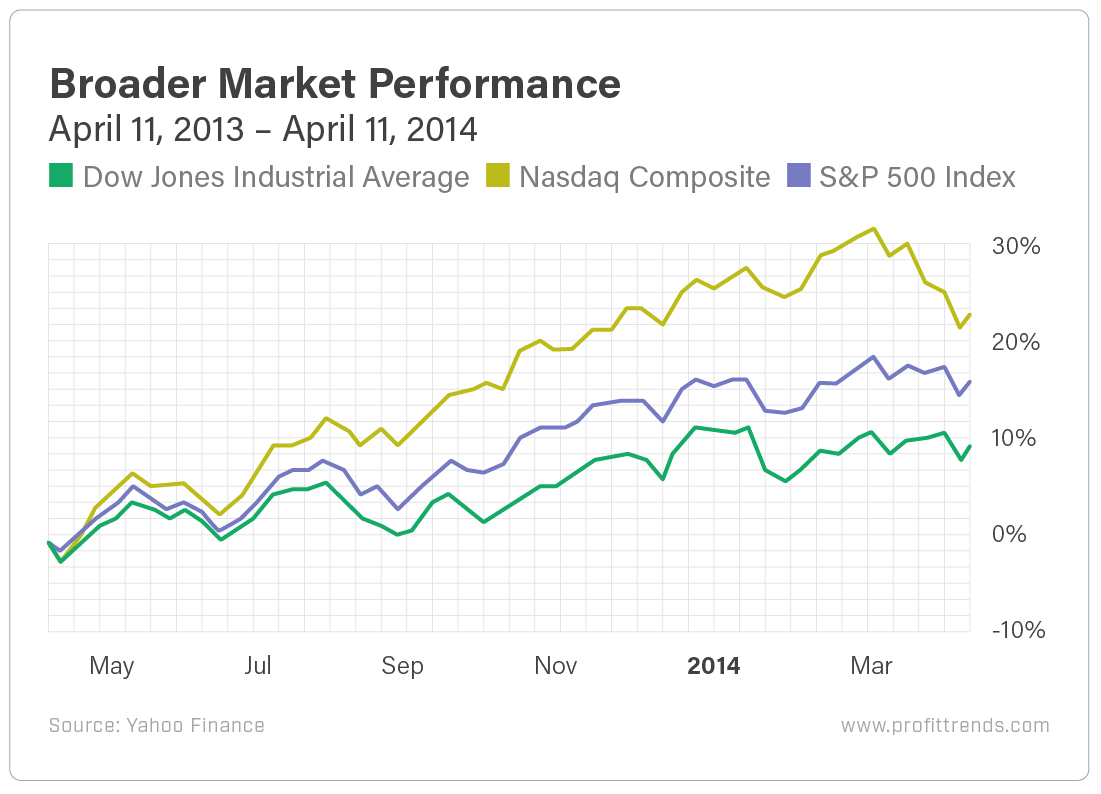

On April 11, 2013, bearish sentiment topped 50%. And over the next year, the markets rallied…

Of course, if we look back to February and March of 2009, bearish sentiment was higher than 50% for weeks. It even hit an all-time high of 70.27% on March 5 – the day before the markets bottomed during the financial crisis.

We all know what happened next: the longest bull market run in history.

So what’s the takeaway from all of this?

When bearish sentiment on the AAII Sentiment Survey hits 50%, buy!

It’s a contrarian indicator, particularly at an extreme.

It’s the easiest moneymaking signal in the market.

And historically, when optimism is low, the median gain of the S&P over the next 26 weeks is 7.1%. And over the next year, the index posts a median gain of 17.9%.

That means all of those naysayers are positives for broader market returns.

[Revealed: This Three Dollar Stock is Now a Hidden Gem Trading Under a Secret Name]

This isn’t the time for investors to hide their heads in the sand. Nor is it the time to make the mistake of continually or habitually sitting on the sidelines.

This is a time to embrace that we’re in a new bull market, with new opportunities and new profits. And as long as fear is elevated, the bull should keep running.

Here’s to high returns,

Matthew