If income investors have a common weakness, it’s the siren song of high yields. As the late financial writer Ray DeVoe wrote, “More money has been lost reaching for yield than at the point of a gun.”

If a yield looks too good to be true, there’s a good chance it is — the market prices in a dividend cut, which often becomes a self-fulfilling prophecy. A high dividend represents a high cost of capital, which all but forces struggling companies to slash payouts.

But not all high yields are warning signs of things to come.

Once in a while, the market just gives us a gift like blue-chip pipeline operator Enterprise Products Partners.

Last year was tough for energy stocks. Catastrophic might be a better word. Chronic oversupply created miserable conditions for energy producers.

But here’s the thing: Even if oil and gas prices stay in the gutter for years, we still need energy. And midstream transporters like Enterprise Products make money irrespective of market prices. They move energy; they don’t sell it.

Enterprise Products (NYSE: EPD) historically raised its payout a little each quarter. That stopped in 2020, as the company opted to hold its distribution steady.

[Shocking: Elon Musk’s VERY strange confession about the future of his electric car empire]

At current prices, Enterprise Products yields an eye-popping 9%. And the payout should be safe for the foreseeable future. The company pays out about 68% of its cash flow from operations, plowing the rest into new capital investments.

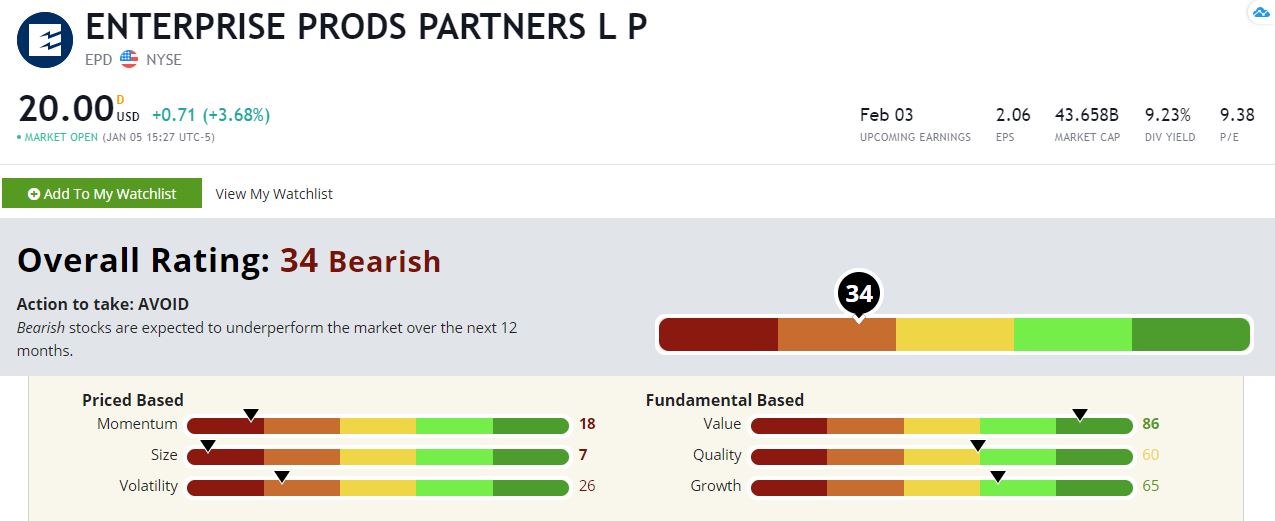

Enterprise Products Stock Rating

Let’s take a look at Enterprise using Adam O’Dell’s Green Zone Ratings system. MLPs tend to rate low on the Green Zone system because their accounting is quirky, and Enterprise isn’t an exception here.

Enterprise Products stock sports an overall rating of 34, which would place it in “bearish” territory as a company we would normally avoid. But it’s worth doing a deep dive here, as the story gets a little more interesting when we look at the individual drivers.

Value — Enterprise rates exceptionally high based on value, coming in at 86. This means that only 14% of stocks in our universe are cheaper based on our criteria — and it gets better. Because of their quirky accounting, MLPs generally have low or even negative GAAP earnings, which depresses metrics like the price-to-earnings ratio, which is a major input into our model. So, while a rating of 86 is already strong, Enterprise’s value is still understated. The stock is even cheaper than it appears here … and it already looks cheap as dirt.

[Buy Alert: This $3 Stock is in a Perfect Position for Total Global Energy Domination…]

Growth — Despite being as cheap as it is, Enterprise’s 65 growth rating is respectable. Remember, this isn’t some trendy tech stock. It’s a boring, conservative natural gas pipeline company with a management team that is stodgy even by the stodgy standards of the sector. That’s impressive.

Quality — Enterprise also rates surprisingly well on quality, coming in at a 60. I say “surprising” because MLP accounting tends to skew the numbers in a negative way. Our quality score is heavily influenced by profitability metrics and debt management. MLPs tend to have low reported profitability (due to their GAAP earnings being skewed by high depreciation charges) and relatively high levels of debt. So, once again, Enterprise is a much higher-quality stock than its already respectable quality rating would suggest.

Volatility — Unfortunately, you can’t expect smooth sailing with Enterprise Products stock. The energy space has been volatile in recent years, and EPD hasn’t been immune. Its volatility score of 26 means that it’s more volatile than 74% of the stocks in our universe. It doesn’t matter that the company’s operations have been steady. The stock itself has been a wild ride up and down.

Momentum — It’s a similar issue with momentum. EPD rates at just an 18 here, as the energy sector spent a good deal of 2020 in virtual freefall. Enterprise Products stock would need to rise by about 50% from current levels just to get back to its pre-COVID-19 prices.

Size — And finally, EPD rates low on size, coming in at a rating of 7. This is a large-cap stock, so we can’t expect it to benefit from the small-cap bump.

Bottom line: With an overall rating of 34, Enterprise Products is not a stock I would normally recommend. But if you’re looking for high yield, it’s worth making an exception. If we get a rotation from growth to value in 2021, EPD should generate some healthy capital gains on top of its 9% yield.

[Read On: The Company About to Bankrupt Every Utility Company in America and Make You Rich]