We have been stuck in a low inflation environment for so long, it’s hard to remember when inflation was ever a problem. The last time inflation was even 3% was in 2011.

The last time prices rose 5% in a year, it was 1990. Since 1914, the average historical inflation rate has been 3.24%.

In July, consumer prices rose a paltry 1% annualized, so inflation isn’t on many people’s radar.

But it should be…

The federal government printed more money in June than it did in the first 203 years of this country’s existence. It has already approved more than $10 trillion in stimulus funds, and more are likely coming.

You know the saying… A trillion here, a trillion there… Soon, it adds up to real money.

(That joke used to be told with billions, not trillions.)

[Revealed: This Unique Gold Strategy is Hard-Money Expert’s Favorite Play For 2020]

My Bold Prediction

All of that money sloshing around is inflationary. We’re already seeing it in the markets – stocks and real estate are on fire.

I expect we’ll see it in everyday prices as well. Money will join other limited goods and services – particularly as hundreds of thousands of businesses around the U.S. close for good.

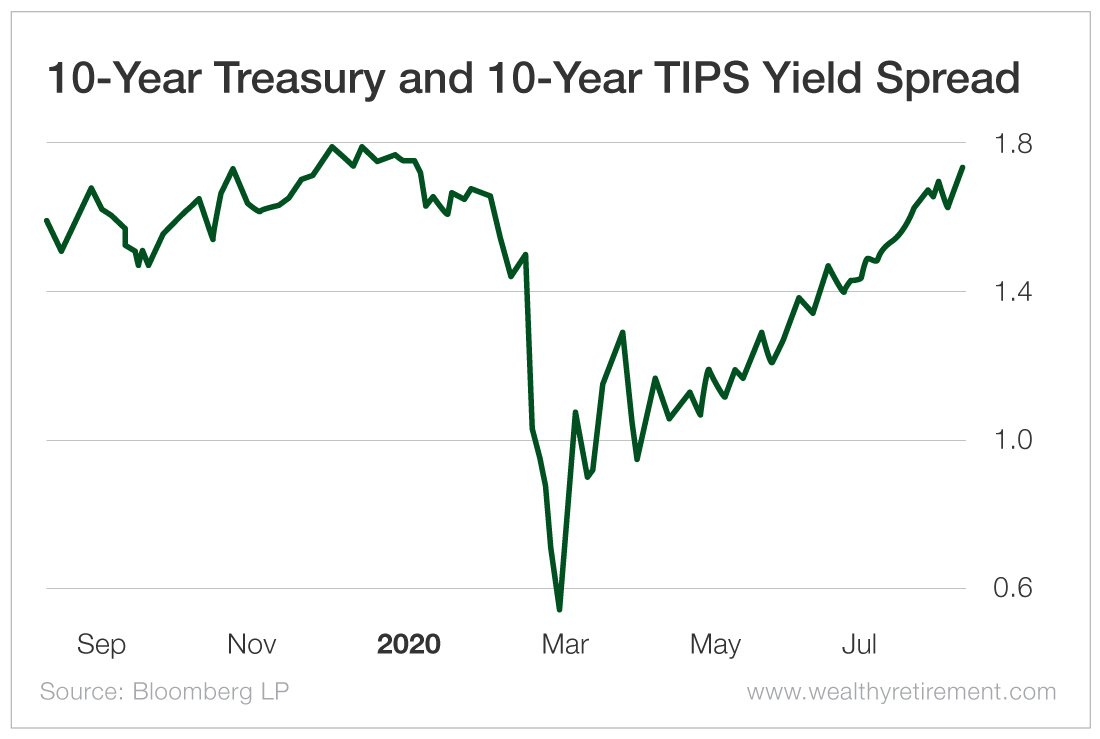

The market seems to expect higher inflation judging by the spread on Treasury Inflation-Protected Securities (TIPS).

This spread is the difference between the 10-year Treasury bond yield and the 10-year TIPS yield. (TIPS are Treasurys that keep up with inflation. Regular Treasurys do not.)

When the spread between the two rises, as it has done since March, that indicates the market expects inflation to climb.

The current TIPS spread is 1.73. That is hardly hyperinflation, but it has been steadily rising and is above the average for the year. I expect this trend to continue.

Perhaps the most important reason inflation will rise is Fed Chair Jerome Powell saying on Thursday that he’s going to let it.

Previously, the Fed’s inflation goal was 2%. That meant the Fed would raise rates if inflation peaked above 2%.

On Thursday, Powell said that even if inflation rises above 2%, he will keep rates near zero.

[Learn More: $7 Gold Investment Could Hand Investors a Small Fortune as Gold Soars]

When was the last time the Fed got its timing right? It typically overshoots its goals, adjusting interest rates too quickly or too slowly.

I have little doubt that inflation will roar higher before the Fed is forced to play catch-up. And it will happen sooner than most people think.

Safeguard Your Portfolio Now

So how do you protect yourself from higher inflation before it eats away at your buying power?

Here are a few ideas…

TIPS. As I mentioned, TIPS are Treasurys that keep up with inflation. However, it’s important to understand that TIPS pay a small amount of interest twice a year. Then the adjustments for inflation are added to the principal.

So when the bond matures, you receive your principal plus all of the inflation-related adjustments.

Gold. The shiny yellow metal has been used as a hedge against inflation for years. While it has strong moves higher and lower, over the long term, it does a decent job of keeping up with rising prices.

Perpetual Dividend Raisers. These companies raise their dividends every year.

If you invest in a stock whose dividends are rising 8% or more per year, chances are that even after taxes, you will be way ahead of inflation and will actually increase your buying power.

A company like AbbVie (NYSE: ABBV) is a great example. It has raised its dividend every year since it was spun off from Abbott Laboratories (NYSE: ABT) in 2013. It has hiked its dividend by a compound annual growth rate of more than 16% per year.

Not a lot of people are warning about inflation yet. But they will when it’s too late.

Take steps to protect your buying power today so that when prices rise, your portfolio is well-equipped to handle it.

Good investing,

Marc

[Discover: The $7 Dollar Firm Using One of the Greatest Investment Secrets in History]