Table of contents:

Who is Jeff Brown?

Toxic Tech: 5 Tech ‘Darlings' to Dump Right Now

The #1 Biotech Stock of the 2020s

5 Stocks that Will Soar in the ‘Post-COVID’ World…

Top Biotech Buyout (2,200% Secret)

See your special offer: What’s in it for you?

HOST Buy? Sell? Hold?

If you’re in the markets right now, these are strange and stressful times…

While some experts believe we’re in store for a “greater depression” not seen in 100 years…

Others are convinced the worst is behind us.

What’s the truth?

Hi. My name is Chris Hurt.

And, today, we’re fortunate to be sitting with the one man who can probably help guide us better than anyone else…

Jeff Brown, thank you for joining us…

JEFF My pleasure, Chris.

HOST Jeff, in early March 2000, your firm called the exact peak of the first dotcom boom, saying “a catastrophe lay ahead”…

And from there, sure enough, the NASDAQ did go on to drop 77%, and it wiped out millions of investors in the process…

Your firm also predicted the housing bubble…

The top in cryptos…

And—on January 6, 2020—45 days before last year's crash started, you were right again…

Warning Americans a big pullback was coming…

No one else I’ve found comes close to matching your firm’s accuracy in forecasting big movements in the market.

JEFF Well, Chris. I’m an optimist by nature. So, it never feels great to be right on those “down calls.” But I never shy away from telling the truth, as I see it…

HOST Right, an optimist…

Since retiring from professional life — a career where you worked on the first Boeing 777 and led teams at both Qualcomm and NXP Semiconductors…

…Where you turned that company around and helped propel it to a 761% gain…

You’ve been issuing a string of stock recommendations that—quite simply—have been off the charts…

In 2015, you brought people’s attention to Bitcoin… before it shot up nearly 100X…

In 2016, you singled out NVIDIA — it went on to become the #1 stock of the year…

In 2017, you did it again…

You picked AMD. And not only did it go on to top the Nasdaq 100 in 2018… It topped the chart in 2019 as well.

Last year… amid all the chaos and turmoil caused by COVID-19, again, you were right…

You picked the #1 tech stock of the S&P 500.

Jeff, it’s incredible…

How do you do it?

JEFF Well, Chris, it’s been a great run for sure. But this isn’t “work” for me. It’s my passion. And I enjoy every minute of it.

HOST For folks tuning in from home, Jeff is going to discuss his new #1 pick with you today.

And he’ll also be making — live today, here on camera — another major prediction… a “second wave” that, Jeff, I understand will catch many investors by surprise…

JEFF That’s right, Chris.

I believe we’re on the cusp of something we haven’t seen in 20 years…

You see, much like in ‘99-2000…

Many of the popular tech “darlings” of today are going to go by the wayside…

Some, by my estimate, are in line to fall by as much as 92%.

“Two Different Stock Markets”

HOST 92%. Wow, Jeff, that’s… you’re predicting a major crash.

JEFF Well, Chris. Here’s what my research tells me…

We’re on the verge of a “splintering” in the market…

Some tech stocks, which have reached absolutely absurd valuations…

Are going to crash hard.

At the same time, there’s a small segment of the tech world… largely ignored until now… that’s rising up fast. And billionaires (including Jeff Bezos) are quickly shifting their money to this small sector.

I call these “market resistant” stocks. And, over time, these types of shares have turned $5,000 into as much as $1.5 million.

Just one of these stocks can change your life dramatically…

HOST That’s exciting, Jeff. So, it almost sounds to me like there’s “2 different stock markets” emerging…

JEFF That’s right, Chris.

HOST On the one hand, many popular stocks will tank. But, on the other, some will go through the roof. Is that right?

JEFF That’s a good way to put it.

And that’s the whole reason I’m here, Chris… to help people get on “the right side of history…”

You see, I believe we’re at an absolutely pivotal moment in time…

For many investors, what they do in the next few weeks will shape their future.

You see, here’s the thing:

Covid-19 has changed the world. It has absolutely changed the world.

And some businesses have been waiting literally for years for a moment like this to happen…

Then—overnight—a new reality occurred…

You have many seniors who never bought anything online…

All of a sudden, they’re having groceries delivered to their house. They’re buying prescriptions online and seeing how convenient it is… they don’t have to stand in line… it’s often cheaper to do, too.

In short, the coronavirus has led to major changes in the way the world works that usually takes years… sometimes decades… to occur.

Now, for some companies, that means destruction.

But, for others, it’s a real boon.

So, you want to be in the right stocks right now, Chris.

Sadly, many people’s portfolios are built on quicksand. One small shift, and it will all crumble to pieces.

HOST Alright, Jeff, let’s get started. I want to hear about your “Second Wave” prediction. And, also, if you can, I’d like you to hear about your recent trip to California…

I understand there was an urgent development with your #1 pick… and that you flew last minute to a private half-a-billion-dollar research facility… I’m guessing, in Silicon Valley?

JEFF No, Chris. It was actually 7 hours south of Silicon Valley…

And, yes, it’s quite urgent. And exciting.

The company I’ve found is at the heart of a 5,900% technological boom that’s going on right now.

And, recently, they received rare approval from the Federal government that I believe will absolutely light a match under their stock price…

It’s…let’s just say there’s going to be some fireworks.

What is the “Second Wave”?

HOST Amazing. Alright. For the folks at home, I encourage you to get your pens, notepads, whatever you need, ready. Jeff is arguably the top technology expert in the world right now. So, you’re going to learn a ton…

Alright, Jeff, the “Second Wave”…

Tell me about it.

You’re not talking about the coronavirus, right?

JEFF That’s right, Chris.

The “second wave” I’m referring to is, rather, a new crash I expect we’ll soon see in the market — a “second wave” of falling prices…

HOST Like the crash we saw back in 2020?

JEFF Well, for some investors, it won’t be catastrophic. But sadly, for many… perhaps most… especially those who’ve bought in all the recent hype we’re seeing… it could be much worse.

HOST There’s a number that stuck in my head from earlier on… You mentioned 92%… Jeff, could stocks really crash 92%? That’s obviously very severe. That would probably be the worst crash on record.

JEFF Well, Chris, it's a very fragile market.

But there’s an important distinction to make…

I don’t think the “broad” equities market—the S&P 500 most people use as a benchmark—will crash 92%.

Overall, stocks in general might “only” fall 25%.

HOST That’s a relief.

JEFF But, here’s the thing…

And this is very important for your viewers, Chris…

As I said, there’s going to be a kind of “splintering” in the market…

Some stocks — including many investors are blindly chasing right now — need to fall around 85% to 92% to be fairly valued.

But others will soar. In fact, the coronavirus has almost guaranteed these will rise dramatically…

HOST Jeff, I’m confused…

How can some stocks rise while others fall to the ground?

JEFF Chris, you remember the late ‘90s and early 2000s, right?

HOST Some of it. You mean the stock market?

JEFF Yeah.

HOST Well, yes, there was the big run up in tech, followed by the crash—the dot com explosion everyone remembers…

“Pets.com vs. Amazon all over again…”

JEFF Precisely.

That’s the perfect analogy to what’s going on today, Chris. It’s Pets.com vs. Amazon all over again…

HOST Pets.com vs. Amazon?

JEFF Chris…

In the early 2000s, stocks got whacked.

But, did we see winners and losers?

HOST Yeah…

JEFF Of course.

Take Pets.com.

If someone bought into the hype and invested in that stock…

Well, they got demolished.

They lost all their money.

But this was really an easy mistake to avoid…

I mean, Chris, Pets.com was the poster boy for dot-com stupidity…

They spent twice their yearly revenue on a single Super Bowl ad!

A single ad!

HOST That’s nuts… I’m guessing that ad didn’t bring in 2 years’ worth of revenue?

JEFF Of course not. The company shut down within months.

But here’s the thing…

Other investors took a different approach…

They did their homework, and invested in Amazon.

Some were able to pick up shares for 10 cents on the dollar…

Cathie Wood, who started a big tech investment firm, said she got laughed at when she bought Amazon for $10…

HOST Wow.

JEFF But who’s laughing now, Chris.

Look at it today…

It’s a blip on the screen!

HOST Yeah, that’s remarkable, Jeff. I can’t even see the drop back then.

JEFF Even if you didn’t get in at the bottom…

Heck, even if you were off by an entire year!

You were still able to make a life-altering fortune.

Amazon recently topped $3,000. It’s up over 500X. You could have literally turned $5,000 into $2.5 million.

That’s how millionaires are made.

HOST But, Jeff, Amazon — you had to have been lucky to pick Amazon. That was an isolated case. Almost like finding a needle in a haystack…

JEFF Yes, Chris. Amazon was an amazing pick.

But it was far from an isolated case…

Consider…

Instead of buying eToys, which plummeted from $80 down to $0…

You could have bought eBay…

Which went up as much as 12,000%…

Or, instead of buying Webvan… a precursor to food delivery services—20 years too early…

Look at what Bezos did…

He put $250,000 in Google. And his stake morphed into as much as $4.8 billion.

Is it any wonder he’s now the world’s richest man?

Look.

Here’s the frustrating thing, Chris…

Say you got the trend right… you absolutely knew the Internet thing was going to be big. But you picked the wrong companies…

Well…

You would have been better off staying out of the market completely!

A similar thing is playing out today.

There’s a lot of “blind” investing going on. And the trend followers are going to get hurt.

HOST So, Jeff, if I understand correctly, what you’re saying is…

Some companies today are the equivalents of “Amazon” 20 years ago… while others are more like Pets.com? Do I have that straight?

JEFF Correct.

We’re going to see a “Second Wave.” Some tech stocks are going to sink severely.

But others—the modern versions of Amazon, if you will—could end up paying for your entire retirement. In one fell swoop.

That’s why I say this is a defining moment, Chris. And why it’s critical people align their portfolios correctly today.

“I have to offer some pushback…”

HOST Jeff, I get what you’re saying.

But at the same time, I have to offer some pushback…

We’ve seen the numbers…

Stocks have soared…

Some jobs are coming back…

I mean, isn’t there a chance this “second” crash… simply won’t happen?

JEFF Well, Chris, of course, anything can happen. I don’t have a crystal ball.

But ask yourself this…

Don’t you have the feeling something isn’t quite right with the markets right now?

Is it natural stocks soared back within just a couple weeks as if nothing happened at all?

Look, some of the stuff we’re starting to see is very reminiscent of ’99…

Have you heard of Hertz?

Crazy story…

The stock declared bankruptcy…

Then, all of a sudden… over 100,000 retail traders on Robinhood… an app that lets you trade stocks for “free”…

When the stock dropped to $0.50… these traders thought it was a bargain.

So they pumped up the stock 10X… to over 5 bucks!

They didn’t realize this was a bankrupt company…

We are seeing insanity all around the market today, Chris.

People are being greedy in all the wrong places.

HOST But the numbers Jeff…

JEFF Look, I agree, Chris.

Some of the numbers are encouraging.

I’m an optimist.

But, at the same time, we’ve now officially entered a recession…

We still have over 10 million people out of work…

Tech companies have laid-off workers by the thousands — and many of those jobs aren’t coming back.

And this hasn’t been fully priced into the market yet.

HOST So what, in your opinion, will “spark” this second wave?

JEFF Well, a couple things…

First is basic economics…

Companies lost billions in the last shut-down. But, as I mentioned, that’s not being priced in. There’s a huge disconnect right now between corporate profits and stock prices.

Probably the widest gap in history.

HOST OK…

JEFF The second reason is an actual “second wave” in the number of Covid-19-cases we’re seeing…

Another major market panic could spark, just as it did last March.

“What can the average investor do?”

HOST But Jeff… what can we do? I mean, what can the average investor do at home to help his family prepare? Should we sell our stock holdings? Hang on… What’s… What’s the solution?

JEFF Well Chris, it’s not a time to panic sell all your portfolio.

I know many analysts who did that back in March… and they really massacred the savings of the people they were supposed to be helping out.

They guided investors to the slaughterhouse.

HOST That’s right Jeff. You actually recommended something very different back in March… didn’t you?

JEFF That’s right, Chris. I knew this setback was temporary. And I actually told all my readers that this was a historical buy opportunity. I stressed not to panic sell their stocks…

HOST We have a clip here…

I’m guessing your subscribers were pretty happy.

JEFF Absolutely. Nick, one of my analysts, ran the numbers…

And he found that… by using conservative estimates…

Our strategy in last March actually could have saved each subscriber, on average, $25,900.

HOST Wow, that’s incredible, Jeff.

But how can you tell a good company from a bad one right now?

“Is this the worst tech stock in America?”

JEFF Well, there are a lot of factors that go into it. And that’s what my research firm specializes in.

But to give you a quick example…

Are you familiar with Zoom?

HOST That’s the video conferencing service, right?

JEFF Right.

That’s the service it seems like everyone is using these days to host video calls.

Well, look at Zoom’s stock chart…

It’s up almost 5X in a year.

HOST That’s good!

JEFF Well, it was good… if you invested 12 months ago…

But the valuation today is insane, Chris. Absolutely insane.

In fact, the stock price would need to get chopped down by over 90% before I would consider recommending it to my subscribers.

HOST Why, though? I mean, yes, maybe it’s high. But, clearly, the service is in demand… It seems like the right product at the right time.

JEFF Seems like it.

But the numbers don’t lie, Chris…

There’s a simple metric I like to look at…

It basically compares the price of a stock, to the sales that company generates…

We call it the price to sales ratio.

Well, for Amazon, their price to sales is roughly 5.

That means investors believe Amazon is worth 5 years’ of sales…

Totally reasonable.

Microsoft.

The price to sales is 11.

That’s high. The last time it was that high was actually back in the first dotcom era…

But Zoom…

Do you want to guess what their number is?

HOST Well, judging by the way you’ve set this up, I’m guessing it’s high…

20? Maybe 30 or 35?

JEFF 55!

HOST What!?

So, Amazon’s at 5… and Zoom’s at over 50?

JEFF That’s right.

Let me ask you…

Is Zoom 10 times more valuable than Amazon on a valuation basis?

HOST [Hesitates]

JEFF The answer is no, Chris.

Amazon’s a stud.

But Zoom?

There’s a lot of pain ahead…

HOST Zoom — Jeff, that is just one of the popular tech companies you see trouble ahead for, correct?

JEFF Correct. There are 5 tech darlings right now that are absolutely toxic.

HOSTAnd you’ve put all of these names, and stock tickers, in a new report our viewers can claim.

JEFF That’s right.

“Toxic Tech: 5 Tech ‘Darlings” to Dump Right Now”

HOST I have it here…

Toxic Tech: 5 Tech “Darlings” to Dump Right Now.

I’m guessing Zoom is in there. Is that the worst?

JEFF Well, it’s definitely up there.

But in my opinion, there’s one company right now that’s — hands down — the single worst in America. But for some reason, tech investors love it…

In fact, nearly two and a half million separate investors own this dud…

It’s in 100 different funds… Including Vanguard’s popular 500 Index Fund.

Fidelity, Blackrock, State Street, Schwab—they own gobs of it. $16 billion total.

Even former President Trump owns shares!

HOST Wow, I’ll need to check this out in detail…

JEFF Absolutely. Chris, I don’t know if you’ve got money in the market. But if you do, there’s a very good chance you’re exposed to one of these toxic stocks and don’t even know it.

HOST Alright Jeff, so we’ve covered the losers…

Let’s get to the more “optimistic” side of things…

The side I know you love best.

What are some of the winners you see coming?

“Which Companies Will Prosper?”

JEFF Sure.

Look, as I mentioned earlier, Chris…

Covid-19 has changed the world.

And, for some companies, it’s really been a blessing in disguise.

HOST Example?

JEFF Well, many of the companies that will see exponential shifts are lesser-known.

But to give a quick, well-known example.

Think about Netflix…

HOST OK.

JEFF Can you guess how many new users Netflix added since Covid-19?

HOST I dunno. But I’m guessing it’s quite high.

JEFF 26 million!

And that was in the first two quarters alone.

In fact, subscriptions have now reached record highs.

And they added almost 37 million new customers in 2020 alone.

HOST So, Jeff, folks at home should write this name down on their piece of paper? Netflix…

JEFF Well, don’t get me wrong Chris. Netflix is a great company. But it’s way overpriced…

HOST So, what’s your top pick?

I know you were one of the first to put 5G and AI stocks on the map for average investors…

I saw some of your recommendations are up 106% and 204% as of late last month… that’s a triple.

So, I’m guessing maybe a 5G stock or AI stock?

JEFFChris, it’s true…

I absolutely love 5G and AI plays. And my readers have made out like bandits.

But, right now, the company I’m most excited about… the one I flew last minute out to California for… is in the one sector I believe is a powder keg of opportunity today…

Biotech.

HOST Biotech?

JEFF That’s right…

Chris, this will easily be one of — if not the — biggest bull market over the next decade.

Think about it…

What industry is getting more attention now than ever before?

Where is all the money… the VCs… the government funding…

Where’s all that money flowing to?

HOST Biotech…

JEFF Yes. VCs invested $12 billion in the first half of 2020 alone…

A new record high.

And about $23 billion for the year.

HOST I can see that makes sense. I mean, everyone is scrambling to find a cure… Seems like, every day, I’m seeing a new biotech stock jump up…

Moderna… Didn’t they jump up recently like $20 bucks when it was thought they had a cure?

JEFF Yes. Their stock’s gone way up since they introduced their vaccine. They’re up almost 8X in a year.

Sorrento. Their stock shot up 239%—in 3 hours…

HOST Wow…

“The Smart Money is Moving In…”

JEFF Yeah, this market is hot right now Chris.

That’s why billionaires like Jeff Bezos are investing hand-over-fist. In fact, Bezos has already put over $130 million in this sector…

Even Warren Buffett, who’s typically avoided tech… recently invested close to $200 million through Berkshire Hathaway.

HOST So, what you’re saying is the smart money is going “all in”?

JEFF Exactly.

They know it’s the one sector set to explode.

And, look…

What most people don’t realize about biotech stocks is…

They don’t move in the same way as other sectors…

They’re very “market resistant.”

HOST You mean they don’t crash?

JEFF Well, I wouldn’t say that. There’s risk in any stock.

But what I mean is…

Take the crash in March last year…

Do you know what the top stocks were?

HOST Biotech?

JEFF That’s right.

After the first quarter…

When stocks were the most volatile…

My team and I recommended the #1 stock in ALL the S&P 500…

HOST That’s 500 stocks in total, right?

JEFF Right.

HOST And you picked the top one?

JEFF Correct. A biotech stock.

Even during the crash of ‘08…

The top winners of that year — going up 84%… 108%… even 382% — could all be found in biotech…

Chris, look at this chart. It will drive the point home even more…

HOST OK.

I’m seeing Intuitive Surgical. I take that’s another biotech, Jeff?

JEFF It is.

And the reason I wanted to show you and your viewers this chart is to illustrate the explosive power of picking the right biotech stock.

Chris, Intuitive Surgical went public in 2000… was that a good year for stocks?

HOST No, it was probably one of the worst.

JEFF It was horrible.

But Intuitive was (and still is) a great company.

Their surgical robot… the “da Vinci”… was a tech marvel. It still is.

And through 2000, to 2008, and this recent crash…

It’s not only resisted the market’s downward pull…

But the stock is up over 300X!

HOST Wow that’s a huge gain, Jeff.

JEFF It is.

That turns $5,000 into $1.5 million.

For most people, that’s life-changing money.

It pays off your mortgage…

Chris, I don’t know if you’ve got kids…

But if so, you can pay their tuition at the most expensive Ivy League college in the country. Even with today’s sky-high tuition!

That’s why I’m so excited to share my top biotech stock.

“What’s your top play, Jeff?”

HOST I’m excited too. What’s your top play, Jeff?

JEFF Well, my top biotech is playing a critical and major role in the research going on in Covid-19 right now.

It provides the testing equipment researchers need to evaluate their different potential treatments for the coronavirus. This equipment is used by over 10,000 research labs worldwide.

HOST 10,000 labs. That’s quite a bit…

JEFF Yeah, this isn’t your “usual” type of biotech company. It’s not developing a new therapy. But, rather, is the bedrock for all of biotech. Which makes it that much more potentially explosive.

In fact, the FDA recently issued them an Emergency Use Authorization… a kind of “fast track”…

Which means, this company will be the first… the absolute first to use genome sequencing to diagnose Covid-19…

That’s critical, Chris, especially with the Second Wave now upon us…

HOST So, Jeff, I’m going to take a wild guess here…

Obviously, if this company helps treat the coronavirus, they’re going to be worth a ton of money.

JEFF Naturally.

And this company has got a phenomenal business model. One of the best in the world. In fact, in the past, another tech company used it to grow their valuation from $500K to $57 billion…

HOST Wow, that’s… I can’t even calculate the percentage.

JEFF That’s a 10,000-fold increase.

Now, obviously I’m not saying this company is going to go up 10,000X…

But they are in a unique position in terms of their testing capabilities. They’re in a sweet spot.

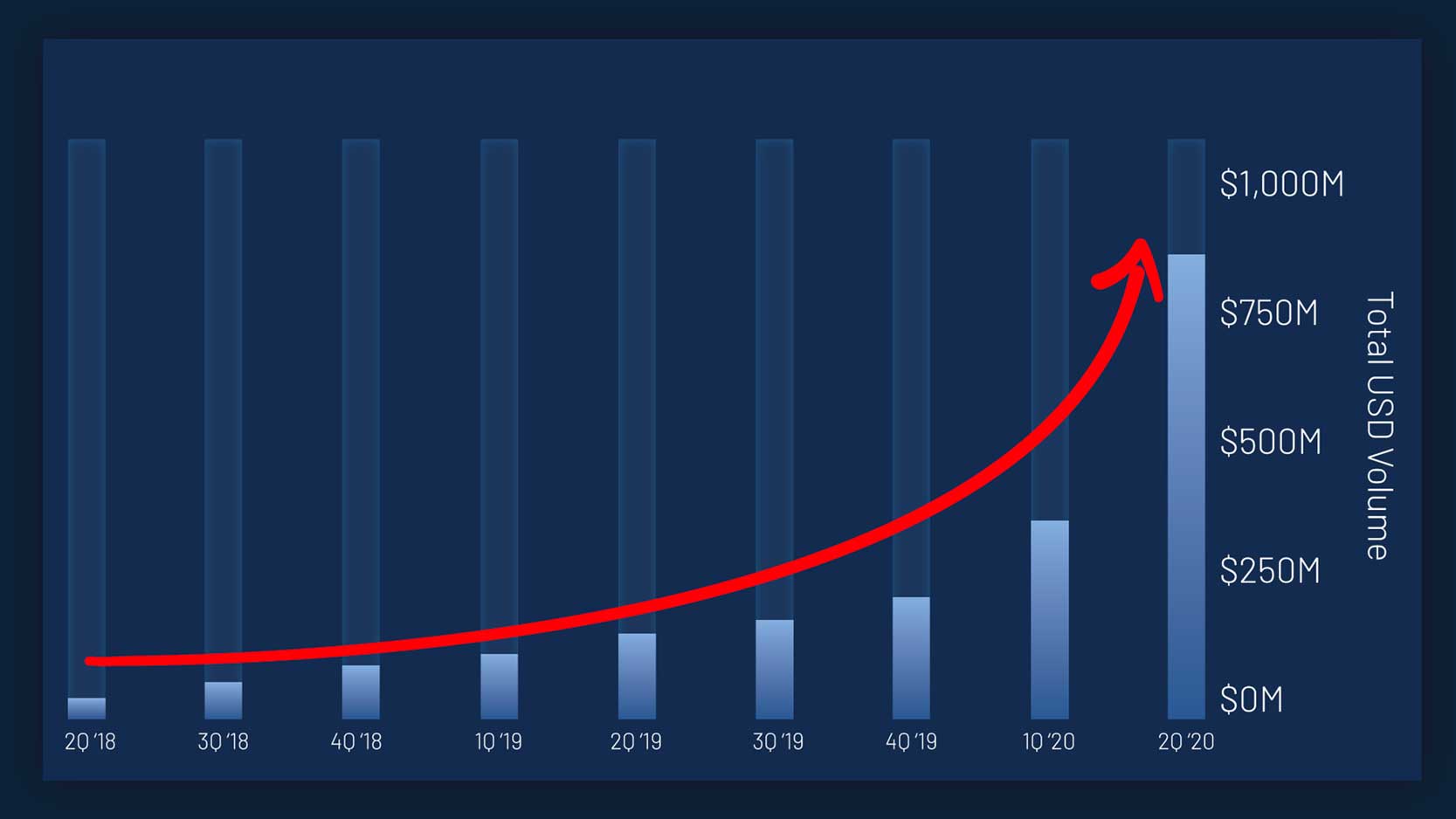

However, regardless of what happens with the coronavirus, they’re going to make a boatload of money. And here’s a chart to prove it…

As you can see—their revenues have been going up exponentially for years now.

HOST Wow, that’s remarkably stable. So, it’s not a flash in the pan?

JEFF That’s right.

HOST Alright.

So, Jeff, let’s get to this recent journey you made to Southern California…

We have a clip here of you here going into a private half-a-billion-dollar research facility…

Tell us what we’re looking at, Jeff. And what you discovered…

“4570 Executive Drive, San Diego”

JEFF Sure.

So, what you’re looking at here is me standing outside 4570 Executive Drive, in San Diego, California.

That’s the location of the Human Longevity headquarters…

HOST Human Longevity?

JEFF Yes. Chris, these are biotech pioneers. The company was co-founded by Peter Diamandis, who started the million-dollar X prize. And Craig Venter, a genius I’ll get back to later.

Anyway, this lab is doing cutting-edge research on life extension. A market set to reach $600 billion by 2025.

HOST So I take it that’s your #1 biotech stock, Jeff. Human Longevity?

JEFF No. Human Longevity is good, but it’s not my top pick.

HOST What?

JEFF They’re still private. So investors can’t buy their shares on the stock market right now.

HOST Ah, OK. So, why did you visit them?

JEFF Because, buried in their lab is advanced special equipment… something called a “gene sequencer.” I traveled to San Diego to get my genome sequenced…

HOST Your genome?

JEFF Chris, you’ve probably heard about companies like Ancestry.com or 23AndMe…

HOST Yeah…

JEFF Well, what these companies do is send out genetic testing kits, which help people glean certain information about their family tree, and gives some basic health info…

But it actually goes much further than that.

HOST So why not just order a test kit and have it done with?

JEFF Well, that would have been easier. And saved me $19,000 for the test, plus travel.

But here’s the thing, Chris…

Each of us has a unique genome…

A specific sequence of DNA that makes us all different.

To use a simple analogy, think of a book…

Imagine every word in a book is a unique pair of DNA…

Well, depending on how these “words” or DNA are put together…

That determines the final “book,” if you will…

Whether it’s going to be a comic book… a romance novel… or an action-packed thriller.

Make sense?

HOST Sure…

JEFF Well, in the same way…

The sequence of your DNA determines who you are as a person… And it affects everything from the color of your hair, to your health, to whether you’re prone to certain genetic diseases or not…

It’s all determined by genetics.

And that’s why genetic sequencing is so important, Chris…

Because it’s a blueprint to your body.

Armed with this blueprint, scientists and doctors are now doing incredible things.

It’s being used to “hack” biology so we can avoid sickness…

And many diseases we once thought were incurable are now being effectively treated… and could be on the verge of being cured outright.

HOST Wow, like what?

JEFF Sickle cell. Blood disorders. Some forms of cancer. Even some forms of blindness.

Chris, there’s a lot of negative things going on in the world right now. But on the tech — and especially on the biotech side — we’re seeing rapid, incredible advances…

And sequencing is at the forefront. It’s like a beachball on a wave that gets pushed first.

For those who take advantage and get in early, it could mean a spectacular shift in your wealth.

HOST So why spend all this money, Jeff? Did you go to San Diego for health reasons?

JEFF Well, obviously, it doesn’t hurt to get arguably the highest-level diagnostic in the world…

But, really, the main reason I went to this lab can be found right here…

The genetic sequencer.

HOST Why is this so important, Jeff?

JEFF To use the book analogy again…

This is the machine that’s able to “read” all the words… all our DNA. The sequencer “pieces” together the whole story.

And that’s where the magic happens.

Right now, researchers are using these devices to single out dangerous genetic mutations…

Eli Lilly, for example, is using it to design custom cancer therapies.

It’s also being used to reduce deadly misdiagnoses.

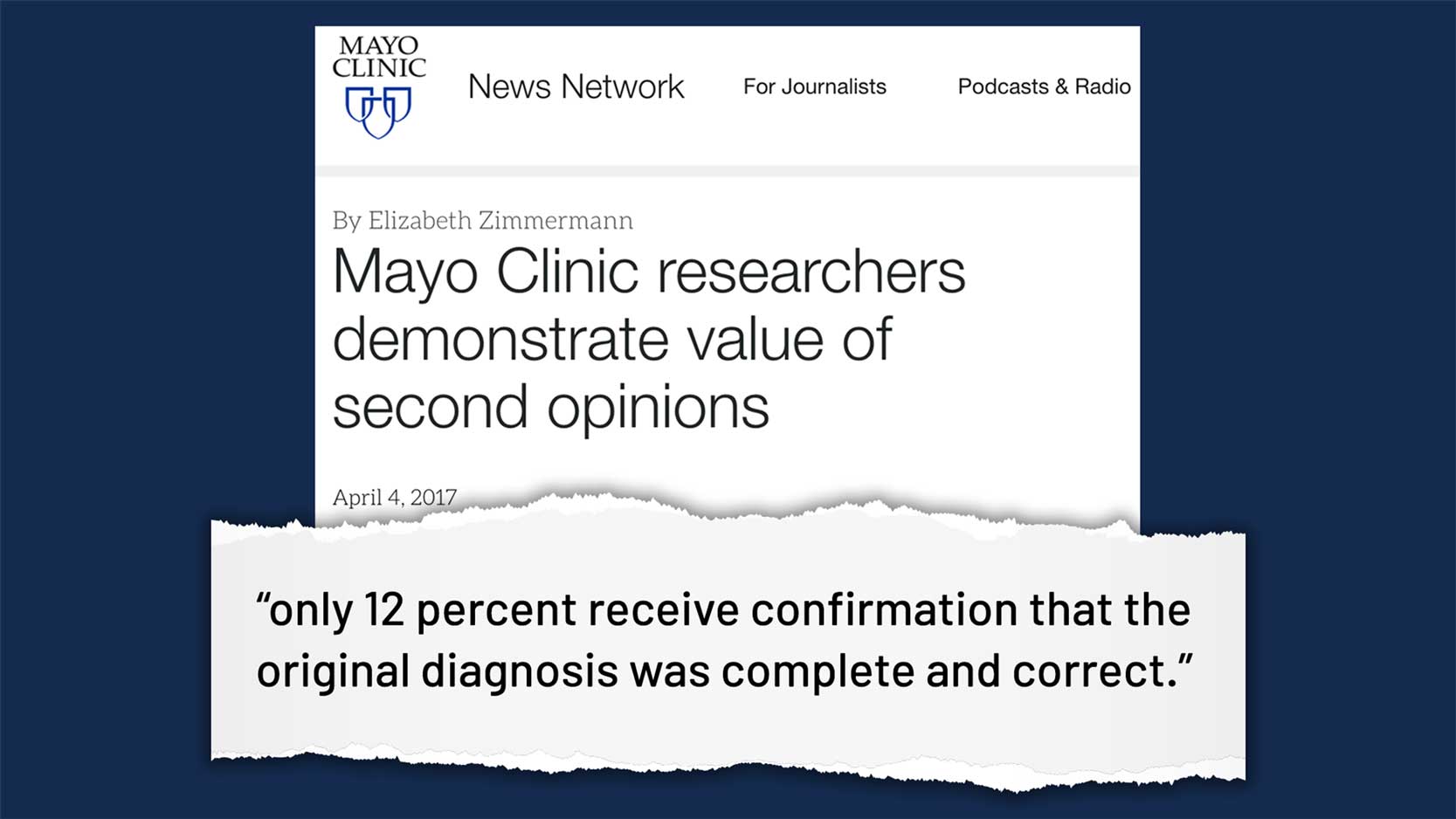

Chris, do you know that — on average — only 12% of patient illnesses are correctly diagnosed by primary care providers?

HOST 12%? That means roughly 9 out of 10 people are given the wrong diagnosis?

JEFF Yes. I know that sounds incredible. And disturbing. But those aren’t my numbers, Chris. That comes straight from the Mayo Clinic.

Johns Hopkins also did a study. And they found medical errors were actually responsible for the death of 251,000 Americans.

Each year!

HOST That’s scary.

JEFF Yeah. Medical errors are the 3rd leading cause of death in America, right behind heart disease and cancer.

One in three misdiagnoses lead to serious injury or death…

And these screw-ups cost the economy billions.

HOST So, what you’re saying is, not only will this new tech help save lives… but there’s also a lot of profits up for grabs?

“A 5,900% Technological Boom…”

JEFF Exactly, Chris.

When the first genome was sequenced, it cost over $1 billion.

Now, some labs can sequence a genome for under $500!

That’s why more and more health insurance companies are mandating people get their genome sequenced.

In fact, back in 2018, only about 1 million Americans had their genome sequenced.

But that number’s expected to explode…

60 million are estimated for 2025.

That’s a 60-fold growth. Or 5,900%.

To put that in perspective…

We’re at a point where…

It’s like buying Amazon at $50. Before its steep climb.

HOST Wow…

JEFF Yeah, I haven’t seen a setup like this since I recommended CRISPR Therapeutics back in 2016.

HOST CRISPR. That’s genetic editing, right?

JEFF Right.

HOST Jeff, weren’t you the only analyst to alert investors about that ground-breaking tech?

JEFF Well, I’m not sure I was the only one… But I was definitely one of the first. I know I alerted my subscribers about it on October 19, 2016… when the company went public.

Had you kept your shares, it shot up 5X afterwards…

HOST That’s pretty good!

JEFF Not bad.

But here’s the thing, Chris…

Without genetic sequencing, there IS no genetic editing.

Johns Hopkins… Harvard… Princeton… the Mayo Clinic… the Cleveland Clinic… the National Institutes of Health…

All the top research and medical labs in the world right now use genetic sequencers. And, specifically, the one created by my #1 pick.

Without this sequencer, all the work being done on Covid-19 and many other life-changing treatments comes to a standstill.

HOST Alright. So, Jeff, I’m not gonna jump the gun this time.

Your top pick… it’s the company who manufactures these sequencers?

JEFF Bingo. That’s right, Chris.

It has everything going for it. It’s the same type of “no brainer” setup I’ve found in all my past winning picks.

Earlier, I mentioned Craig Venter, one of the co-founders of Human Longevity…

Well, Craig is the top pioneer in the genetic sequencing space.

His lab was the first to sequence a whole genome. He did it years before anyone thought it was possible.

Well, Chris, guess who he’s working with now?

HOST Your #1 biotech?

JEFF That’s right.

HOST So, sounds like this is probably the top sequencing company in its field…

JEFF Absolutely.

By a landslide.

But it’s on almost nobody’s radar, Chris. They don’t make the news.

And that’s a shame…

Everyone right now is too busy chasing hype stocks like Zoom Video Communications. Even bankrupt stocks like Hertz!

“I’m guessing there’s some urgency to this play…”

HOST So, Jeff, why did you rush to San Diego? I’m guessing there’s some urgency to this play…

JEFF Absolutely.

As I mentioned earlier, because of the role they’re playing in helping solve Covid-19, this company was fast-tracked by the FDA… and given a rare “Emergency Use Authorization”…

In fact…

Dr. Scott Gottlieb

Dr. Scott Gottlieb

Dr. Scott Gottlieb, the FDA’s former Commissioner, just joined their Board of Directors!

But not only that…

My top biotech also has a brand-new model… a new sequencer that just came out!

HOST Why is that important?

“Like when Apple releases a new iPhone…”

JEFF Well, Chris, it’s like whenever Apple releases a new iPhone. Share prices spike.

Same thing here…

Every time this company has introduced new models in the past…

It has led to a massive influx in revenue and share price.

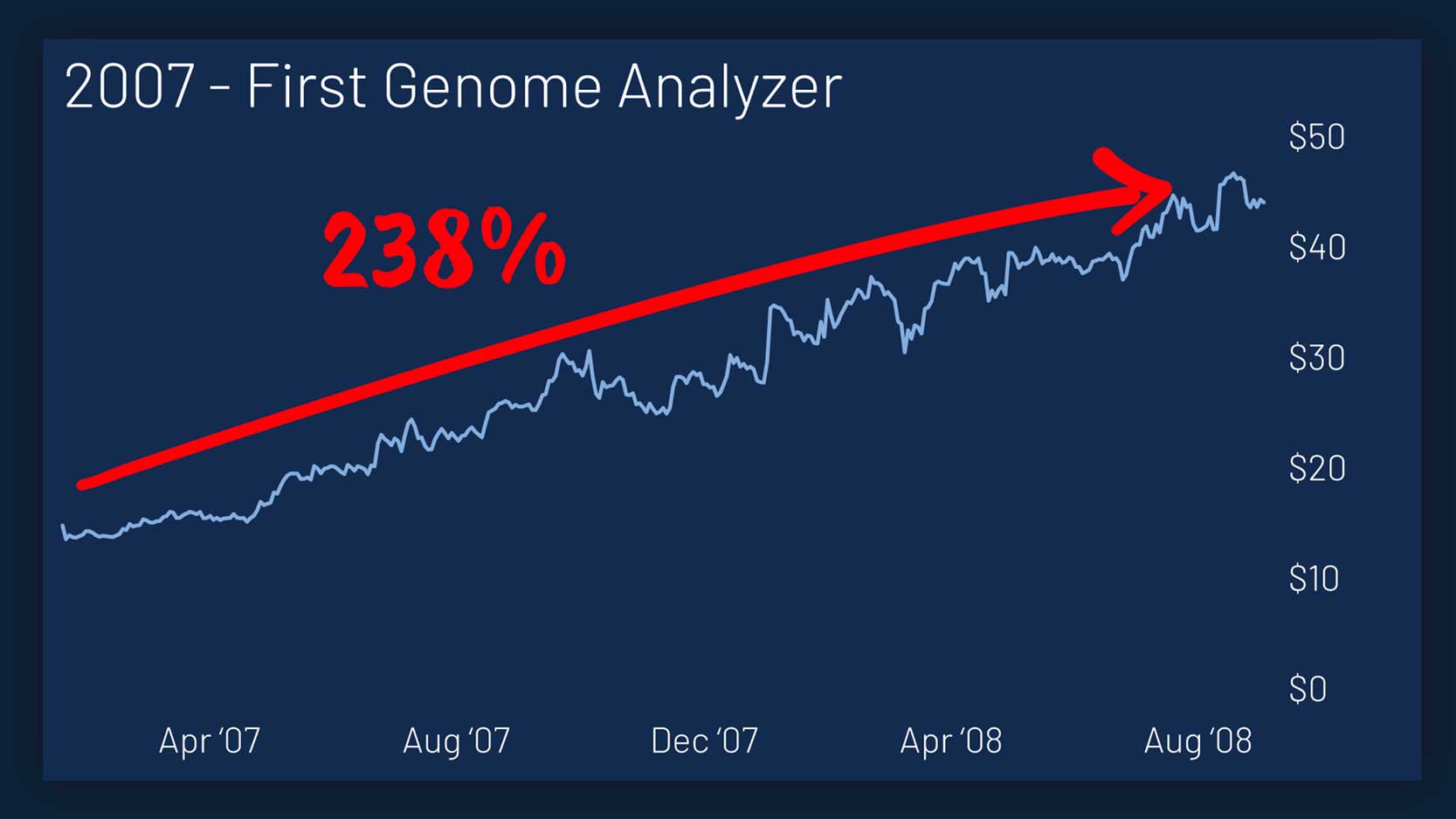

For example, back in 2007, when the company introduced its first genome analyzer, shares rose 238%…

In 2009, it happened again. Shares tripled…

In 2012, same story again. Shares surged 365%…

And in 2017, shares rose another 189%.

That’s all on the back of new models.

HOST So, basically, what you’re saying is this stock could go up again anywhere from 189% to 365%?

JEFF That’s what my analysis is telling me, Chris…

Remember, all those happened before Covid-19.

So, it’s critical people take a position now…

Before the new model comes out.

HOST Alright.

So, Jeff, I know you have a huge following.

Over 1 million folks read your daily technology newsletter, The Bleeding Edge…

100,000-plus pay to receive your monthly tech stock recommendations…

So, how can people get a hold of your #1 biotech pick?

JEFF Well, my team and I just put together a special report that outlines everything.

“The #1 Biotech Stock of the 2020s”

HOST It’s this one right here…

The #1 Biotech Stock of the 2020s: Why the FDA Just Fast-Tracked the “King of Genetic Sequencing”

JEFF That’s right.

HOST What can you tell us about the report?

JEFF Well, obviously, we cover the stock in full detail… and give out its name and ticker symbol…

As you’ll see, it’s an American company. So anyone with a standard brokerage account can easily buy it.

We also layout the case for the company’s growth potential — which we believe is staggering.

HOST I see a chart here. I’m guessing that’s the one?

JEFF Yes.

HOST Now, Jeff, what’s the timeline here…

Can we wait a couple weeks… or, is this really a stock we need to buy today?

JEFF Well, obviously, I can’t give individual advice.

But, yes…

My personal recommendation would be to take a position today.

Or, the next day the stock market is open.

9:30 AM sharp.

I mentioned the catalysts…

Their great business model…

But not only that. This company mints money. Especially since their leadership team is basically run by the “Warren Buffett of biotech”.

HOST What?

JEFF Chris, the leadership team here is incredibly smart with their money.

One investment bagged them an 850% profit… another recently handed them $278 million in cash.

HOSTWow. So it’s like a “2 for 1”…

JEFF Yeah. That’s part of the reason why Baillie Gifford… the famous tech hedge fund that bought Tesla before it shot up 30X…

Owns 17 million shares…

It’s why Morgan Stanley, Blackrock, Vanguard…

They’ve all written monster checks to the company…

It’s also why Rockefeller’s venture capital arm was one of the first to fund the company.

Mark my words, Chris. This is going to be a giant. A name everyone will recognize five years from now.

HOST And, Jeff, you’re also making this report free of charge for anyone who wants a copy, right?

JEFF Correct.

Anyone who tries out The Near Future Report — my flagship technology investing letter — today, will get a free copy of my #1 Biotech Stock report…

HOST And your report on the 5 “Toxic Tech” stocks…

JEFF Right.

In fact, Chris, because of the strange times we’re facing today, my team and I actually decided to put together a couple extra reports to help guide people.

HOST Tell me about the others…

“5 Stocks that Will Soar in the ‘Post-COVID’ World…”

JEFF Sure.

We put together another report called…

The New Economy: 5 Stocks That Will Soar in the “Post-COVID” World…

HOST Interesting… What’s that one about?

JEFF Well, Chris, I told you earlier about how the world has changed…

But, the fact is…

Many of the companies that will profit most are names 95% of investors are unfamiliar with. They’re not the big names getting all the press. But that means their upside is that much higher…

HOST Example?

JEFF Sure.

One is quickly becoming a MAJOR player in the payment processing world… In fact, one of its “touchless” products recently processed 3 times more payments after Covid… They did $1.6 million — in one quarter alone!

With companies choosing to avoid cash, this is a massive trend that will continue…

HOST Can you give me another example?

JEFF Another is proving to be absolutely essential in the nationwide rollout of 5G…

As a matter of fact, they were recently awarded $204 million from the U.S. government. But it is an absolute steal right now… trading 75% below it’s all-time highs.

My other plays are leaders in AI and the cloud computing space.

HOST So, readers are getting the full gamut of investment recommendations here, Jeff.

Biotech… 5G… AI… the “cloud”.

JEFF That’s right, Chris.

Listen, from a technological point of view, this is absolutely the most exciting time to be alive…

I mean, technology itself is progressing at an exponential rate…

But when you add in that…

Overnight, because of Covid…

The way people do things changed…

We’ve now entered into a “new economy.”

Like I said, you’ve now got 60, 65-year olds buying their groceries and prescriptions online…

People are working from home. We’re never going back to “normal.” Which may be hard for some folks to accept. But the sooner you understand why — the more money you can make.

So you can become a beneficiary of the situation, instead of a victim.

The 5 companies I’ve picked out here are the ones that will reap the lion’s share of the profits in the days and months to come.

“Top Biotech Buyout (2,200% Secret)”

HOST Awesome. I love it Jeff.

Alright, I see one more here…

The Top Biotech Buyout Candidate: The 2,200% Secret…

2,200%. I like that! What can you tell me about this one?

JEFF Well, obviously Chris.

As they say…

Past performance is no guarantee of future results…

But buyouts — especially biotech buyouts — often prove to be the most lucrative investments of all…

Take Celator Pharmaceuticals. They shot up 2,200% when Jazz Pharmaceuticals acquired them.

HOST Wow…

JEFF Forty Seven, Inc… they shot up 15X earlier last year when Gilead bought them out.

And, in last 2019, I recommended a small biotech firm called Synthorx. Readers of mine could have bagged a 432% profit in under 6 weeks.

HOST Wow, that’s incredible Jeff. And you think your #1 buyout stock could do the same?

JEFF Well, again, I obviously can’t guarantee how high it will go. And, for that matter, I can’t say for sure if the stock will get bought out or not.

But it has all the hallmarks of a potential buyout…

All the information I’m seeing right now leads me to believe it’s the ideal acquisition target.

However, even if there’s no buyout, to me this is an easy double Chris.

So, I recommend you take a position. Even a small one.

HOSTThat’s great. Are there any other reports you want to cover?

JEFF Well, there’s actually another investment report we put together that’s especially critical today, given how much new stimulus the government is pumping into the economy.

Last time I saw a setup like this, it led to a 679% profit in a month.

But I’ll let people see the details on that when they get their other reports.

There’s just one last thing…

HOST Shoot…

“One-Page Blueprint”

JEFF One thing my team and I did… which we’ve never done before… is put together a “One-Page” Blueprint…

Basically, we wrote down on one single page all of our “Second Wave” recommendations…

So—at a glance—you’ll see…

- The name and ticker symbol for my #1 top biotech picks…

- For the 5 Toxic Tech stocks…

- The 5 “New Economy” stocks…

- My top buyout…

- As well as my 679% “stimulus” play.

HOST That’s great. I can see how that makes it very easy for anyone to take action.

JEFF And that’s the most important thing, Chris.

Taking action.

As I mentioned, I believe we’re on the cusp of a great “division”…

Take a position in the right stocks, and you’ll walk away rich. I mean, you could walk away with an absolute fortune.

But other investments will crack your nest egg completely…

So, we wanted to make this as simple as possible for people to take action. So, they have no excuse to position themselves on the right side of history.

HOST Great.

Alright, Jeff, so how can people get access to your research?

I understand you’ve put together a special offer for our viewers…

JEFF Right.

Chris, if any of your viewers sign up today, my team will send them — immediately and by email — all 5 reports in my Second Wave “protection plan”… as well as my one-page blueprint… absolutely free.

All we ask in return is they try out our flagship investment letter… The Near Future Report…

And, of course, they can try that out on a completely risk-free basis.

HOST Jeff, I’ve seen the numbers…

Your track record is second to none…

You singled out Bitcoin in 2015, before it shot up almost 100X…

You picked the #1 tech investments in 2016, 2018, 2019, and 2020. And that’s on top of a recently closed 258% winner…

So, I’m guessing The Near Future Report probably comes at a steep price…

Maybe $1,000… $2,000?

JEFF Well, Chris, judging by the responses we’ve received, I certainly believe it’s easily worth that much.

But no…

My goal is to bring lucrative tech investments to the average guy.

I’ve made my money. But this is my passion.

It’s why I’m always up at 5 in the morning talking to contacts and listening to key director calls…

I can’t tell you how happy it makes me feel to read the letter of thanks I get. And the lives that we’re changing.

Now, obviously, all investments carry risk and past performance does not indicate future success.

But it’s humbling to see our impact.

So, the regular price of a one-year subscription… if you can believe it, Chris… is only $199.

But we actually put together an even better deal for your viewers, Chris.

“I repeat. Do NOT go to our main website. There, you’ll have to pay full price.”

So, for anyone at home, please do NOT go to our main website. I repeat. Do NOT go to our main website. There, you’ll have to pay full price.

We’ve set up a special page where your viewers can try out The Near Future Report for $49.

HOST $49. Is that… Jeff… for a full year? Or maybe for a 2-, 3-month subscription?

JEFF No, that’s for a full year.

Try it out. If, within 60 days, someone decides it’s not for them, no biggie. Let us know. Our support staff will send you back 100% of your money.

HOST So, zero risk…

JEFF Yes.

HOST Alright, Jeff. This has been illuminating. I’ve learned a ton, as I’m sure my viewers have as well.

I know your schedule is tight. But, before you go… do you have any final words for our audience?

“Jeff’s Final Thoughts”

JEFF Yes.

Chris, I’ll turn here and look at the camera… to speak directly to your viewers…

As I’ve said, we’re at a critical juncture in history…

The firm I’m a part of has a long track record of making accurate calls.

But does that mean we get it right 100% of the time?

No.

But let me ask you this:

Do you think it’s likely this market will just keep going up and up forever?

I think you and I both know—deep down—that things have gotten a little bit “out of hand”.

In the long run, I’m an optimist…

And putting your hard-earned dollars in the right tech investments today WILL pay off handsomely.

But, please, do me a favor…

At least take a good, hard look at your holdings.

We’ve entered a new economy…

Are your investments safe? Are you invested in companies about to be left behind?

On the other side…

Are you set to profit from the stocks that are likely to skyrocket in the year—and decade—ahead?

My team and I have gone to great lengths to put together a comprehensive Second Wave “protection plan.”

We’ve labored hundreds of hours…

Assembled everything you need to navigate these confusing times.

To help you avoid the pitfalls — and spot the winners — in the days ahead.

Including my #1 play in…

Not only biotech… but also in 5G, cloud computing, and AI.

These are all areas, as you know, that will absolutely go skyward thanks to this increasingly digital, post-Covid world.

Look…

This is an urgent situation. And I sincerely believe the decision you make today—right now—will either make or break your investing future.

Here’s what I recommend:

Invest $50 bucks.

And get a copy of the materials I’ve put together.

Is that too much to discover the top company at the head of a 5,900% technological surge…

Like Amazon was when it was $50?

I think $49 is ridiculously cheap for what you’re getting.

But that’s just me.

See for yourself.

If you don’t agree with my analysis and recommendations, no problem. You certainly won’t offend me.

All you’ve risked is two minutes of your time.

But if you agree with me… and you take action…

Those could end up being the two most productive (and profitable) minutes of your life.

Years from now, you and your family may look back to the decision you made today with profound gratitude.

The one day that made all the difference in the world.

HOST Well said, Jeff.

That’s right… I guess… going back to the start… you want to invest in the “next Amazons” today, not the Pets.com…

JEFF Yeah. Well put, Chris.

HOST Alright. For the folks at home, we’ll be putting a link to the special offer Jeff put together for you… his generous $150 discount to The Near Future Report… below this video.

Just go ahead and click on that button. Once you do, you’ll be taken to a special page where you can review everything before you decide to sign up.

Jeff Brown, it’s been a pleasure…

JEFF Thanks, Chris.

“Closing Statement from Chris Hurt”

That wraps up today’s edition of the Tech Minute.

I think you can see now why I invited Jeff Brown to be on the show.

He’s one of the brightest minds in tech. And his track record is second to none.

He’s picked more #1 tech winners than anyone else I’ve come across.

And, recently, he closed out on yet another triple-digit winner…

258%, to be exact.

Now, we’ve seen where Jeff has set his sights…

Biotech.

The coronavirus changed the world.

And—I think it’s obvious, but as Jeff states—some specific stocks will absolutely rise as a result.

Perhaps spectacularly.

That’s why Jeff and his team put together a comprehensive Second Wave “protection plan”…

Which features, of course, his #1 biotech pick…

His top buyout candidate, that could shoot up as much as 2,200%…

As well as his 5 toxic tech “darlings” to avoid, among others.

And he’s offered us a special offer, too…

If you try out his #1 newsletter, The Near Future Report…

You get a full year for just $49.

That’s $150 off the retail price you can put directly in your pocket.

There’s no time left to lose.

A “second wave” is upon us…

And just like in the dotcom era, there will be monster winners like Amazon… and big-time bankruptcies like Pets.com.

I don’t know about you… but when everything is said and done… I’d rather come out on the winning side.

To see what Jeff’s put together for us…

Click on this button:

You’ll also see one last surprise addition Jeff decided to throw in…

I’m Chris Hurt. And this has been Tech Minute.

Thank you for tuning in.

AUGUST 2020