Millions of Americans already have or will soon get a check for $1,200 from the federal government, and to put it to good use, you might consider a few stocks to buy with your stimulus check.

Thanks to a $2.2 trillion coronavirus stimulus package passed by Congress in March, you will soon get your check — assuming you aren’t above the income thresholds.

While some will save the money, use it to pay bills or buy that sought-after big-screen television (which is what the government would like most), the smart investor will look for ways to bolster their portfolio and their future nest eggs.

For the purpose of this story, we looked at several different factors to find the right companies to invest in:

- Market Capitalization: We looked at large and very large companies as they are more prone to handle any other market volatility we may see down the line.

- Annual Dividend Yield: Companies that pay a dividend provide an extra benefit for investors — a quarterly or yearly payout of earnings.

- Price: To best stretch your $1,200 check, we looked at companies that are reasonably priced — $100 or less.

- Price to Cash Flow: In order to maintain those dividends, the companies we looked at needed to have a low price-to-cash-flow ratio.

- Earnings per Share Growth: Despite being in turbulent market times, companies that have grown their earnings per share show the potential to continue that trend.

- 60-Month Beta: We also wanted to find companies that are less prone to volatility than the overall market.

So, using those criteria, here are four stocks to buy with your stimulus check.

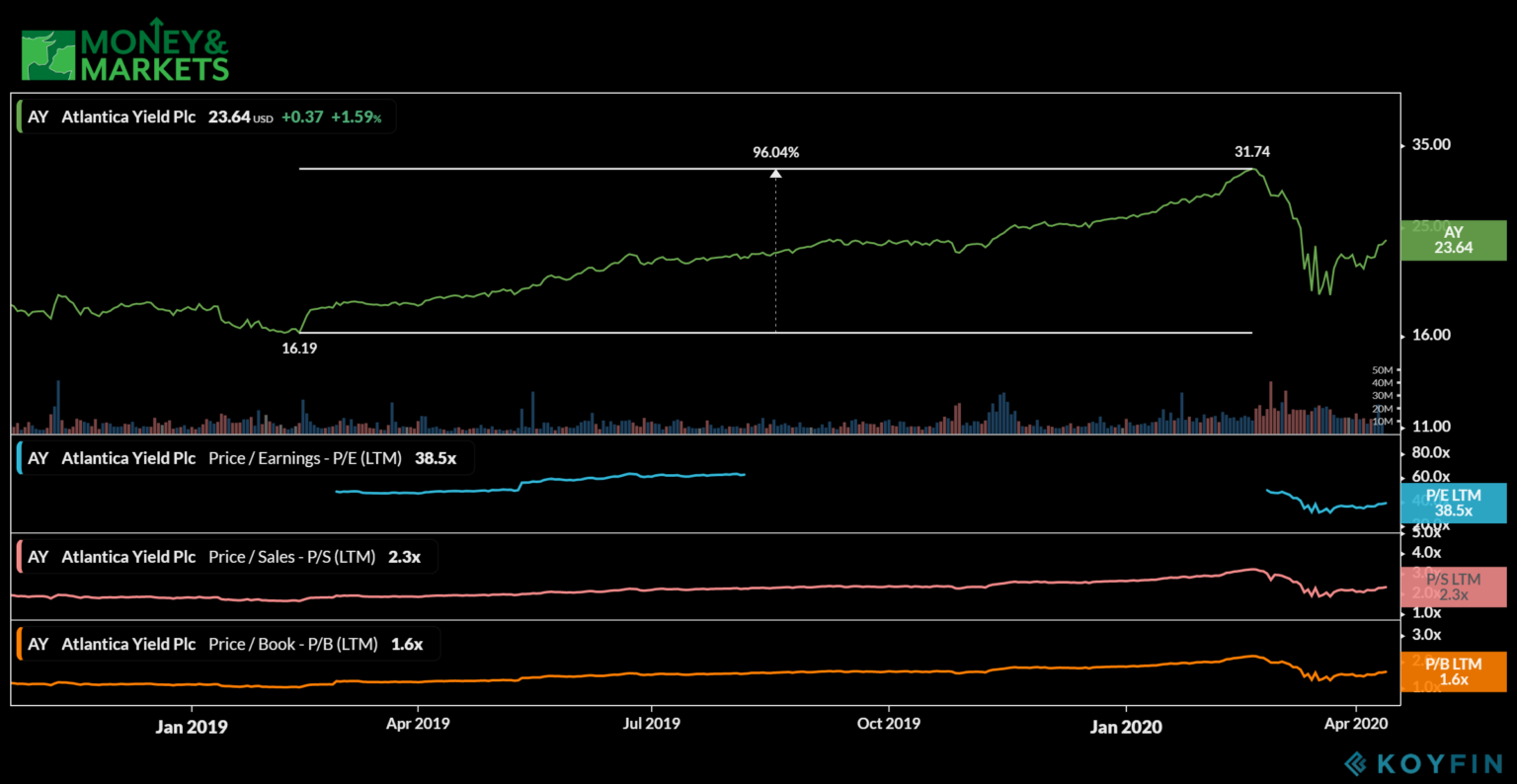

1. Atlantica Yield PLC

Market Capitalization: $2.3 billion

Annual Dividend Yield: 7%

Earnings-Per-Share Growth: 101%

60-Month Beta: 0.8

In 2019, Atlantica Yield PLC (Nasdaq: AY) did nothing but grow — and grow fast, to the tune of a 96% jump in its share price.

The British company owns, manages and acquires contracted assets in the power and environment sectors. It has holdings in North America, South America and Europe.

Since January 2019, the company has amassed sales of more than $1 billion, which is one of the reasons for its share price growth over that time.

After reaching a 52-week high of $31 per share, Atlantica retreated to around $19, which is still far from its low. And, despite the market downturn in late February, the company’s shares have already started to rebound.

[Bonus: This Little Known Secret Could Boost Your Retirement Account by an Additional $54,072]

Its volatility is relatively low with a 60-month beta of 0.8 — remember, the lower the number the better. Atlantica’s price to cash flow is also solid at 6.32 — the S&P 500 average is more than 14.

Shareholders have also been treated to a steadily increasing dividend. The company’s last dividend payment was $0.41 per share in March 2020. That’s an increase from the $0.32 dividend it paid in May 2018, when its shares took off.

It’s inexpensive and has a lot of growth potential. That’s what makes Atlantica Yield PLC one of the four stocks to buy with your stimulus check.

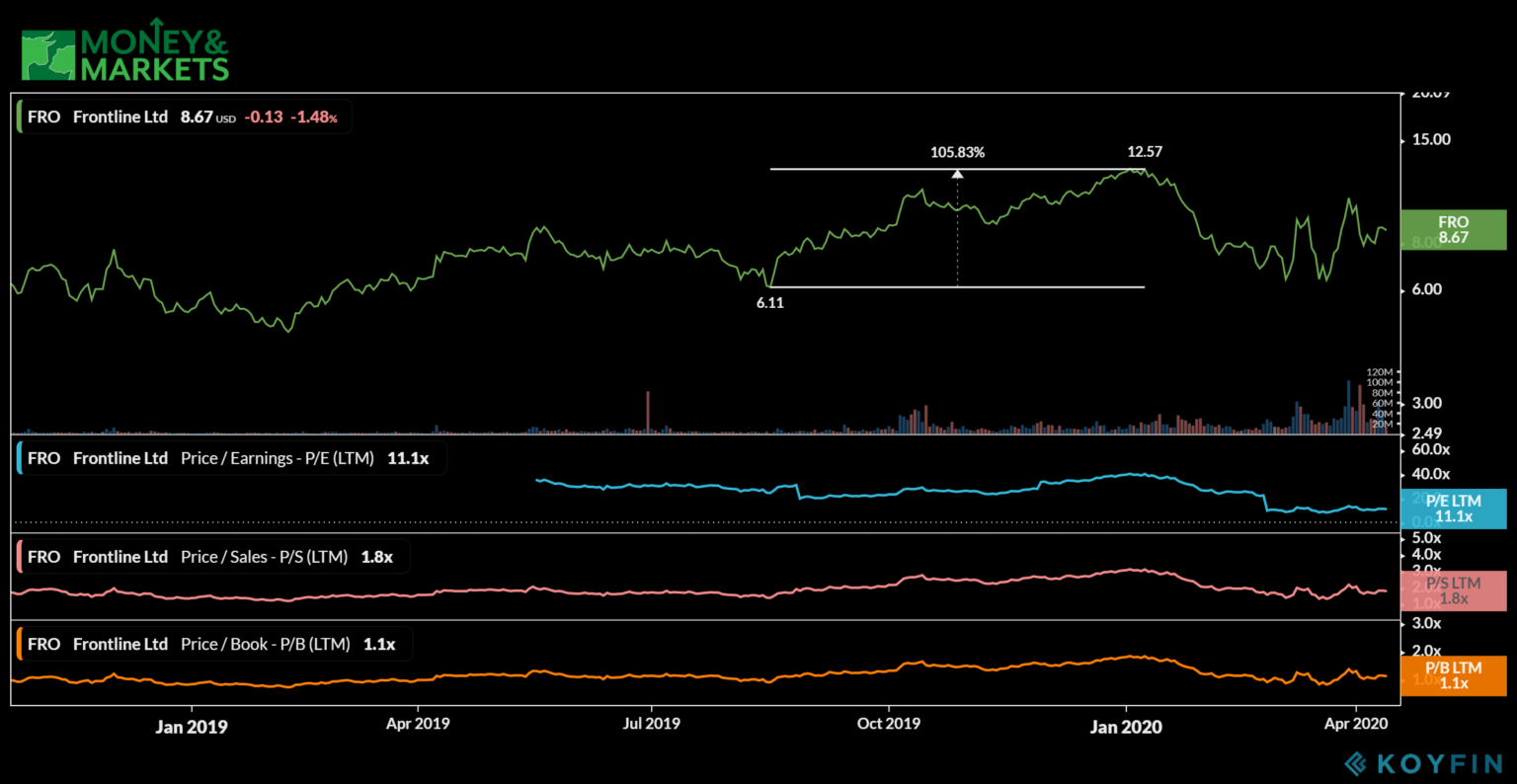

2. Frontline LTD

Market Capitalization: $1.7 billion

Annual Dividend Yield: 18.2%

Earnings-Per-Share Growth: 260%

60-Month Beta: 0.6

Whether there is a massive global recession or not, goods still need to be transported overseas. That’s where Frontline LTD (NYSE: FRO) comes in.

It’s one of the largest transporters of crude oil in the world and it’s based in Bermuda.

In 2019, the company had massive sales of more than $957 million, which helped contribute to the huge growth in its share price.

From August 2019 to January 2020, shares of Frontline LTD grew by more than 105% to around $12 per share. It fell back later in January but spiked twice during the market downturn.

Frontline is a less volatile stock than Atlantica, with a 60-month beta of 0.6. The company does have a similar price-to-cash-flow ratio as Atlantica at 6.42.

[Learn More: You Could TRIPLE Your Dividend Income with this Nearly Forgotten Group of Stocks]

It also just recently started paying dividends to shareholders. In December 2019, the dividend was $0.10 per share, but that jumped to $0.40 per share in March 2020. That makes its current annual dividend yield 18.2%.

The value of Frontline is also solid. It has a price to earnings of 11.1, a price to sales of 1.8 and a price to book of 1.1. Its earnings per share growth has been 260% year over year.

That kind of growth, coupled with a strong dividend and low volatility makes Frontline LTD one of the four stocks to buy with your stimulus check.

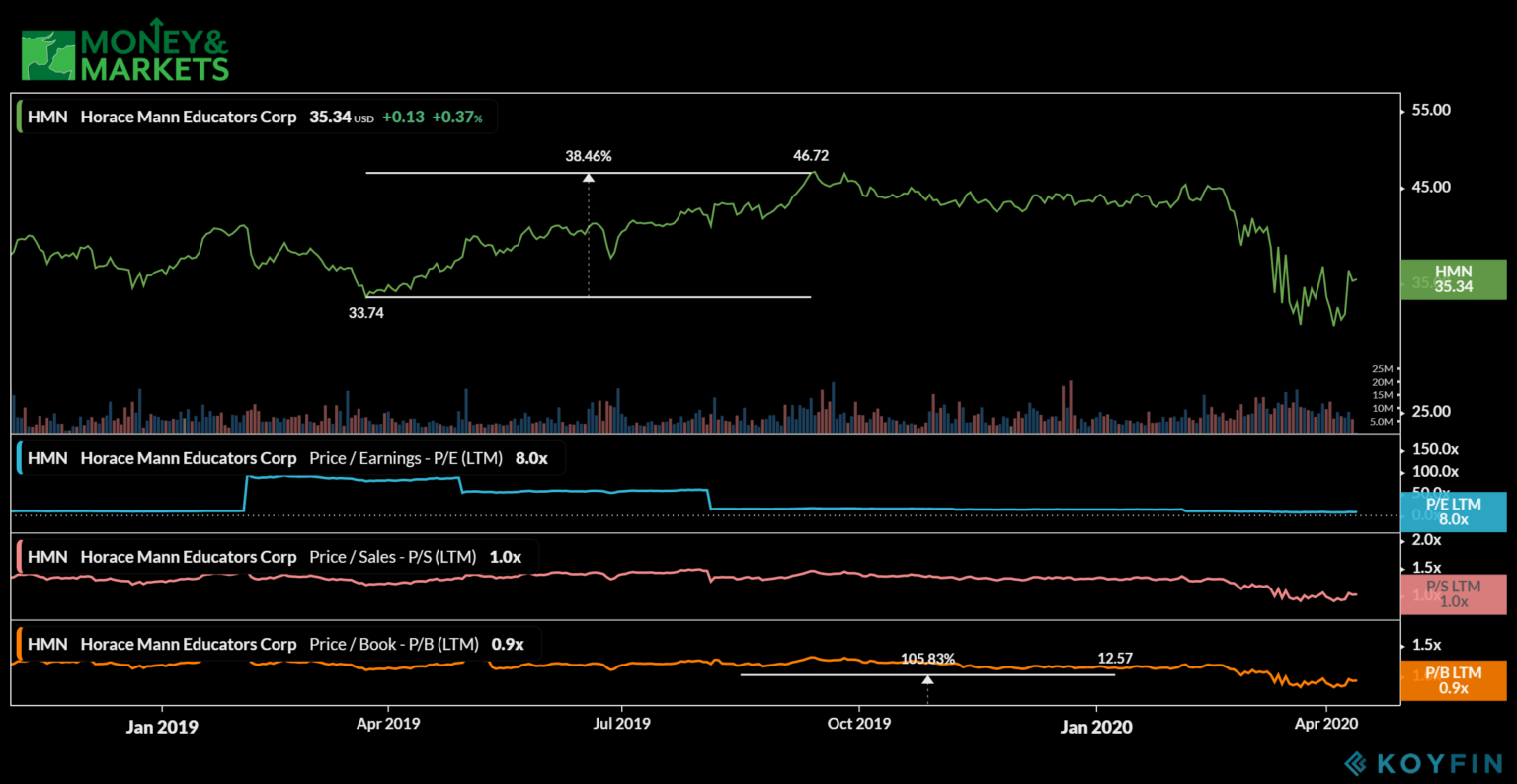

3. Horace Mann Educators Corp.

Market Capitalization: $1.4 billion

Annual Dividend Yield: 3.41%

Earnings-Per-Share-Growth: 457%

60-Month Beta: 0.6

Insurance is one of those things that all Americans need. A company that services insurance in the education field is Horace Mann Educators Corp. (NYSE: HMN).

The company provides homeowners, automobile and life insurance to elementary and secondary educators, as well as retirement annuities. It also provides group life and health insurance to school districts.

From March 2019 to September 2019, the company’s share price jumped more than 38% and held steady until markets turned south in February 2020.

The insurance market is one that is pretty flush with cash and Horace Mann isn’t any different. It had annual sales in 2019 of $1.4 billion and an annual net income of $184 million.

It has a price to cash flow of 13.3, which is just below the S&P 500 average.

The company is one of the least volatile on our list with a 60-month beta of 0.6, mainly attributed to the fact that it traded steady in the last five months of 2019.

[Read On: How to Receive a $3,250 IRS Reward Each Year Plus Other Secret Income-Boosters]

Horace Mann’s shareholder dividend also was steady at $0.28 per share, but in March 2020 it jumped to $0.30 per share.

It also offers an attractive price point of around $35 — still off its 52-week high of $46 per share.

With a nice dividend and low volatility, Horace Mann Educators Corp. is one of the four stocks to buy with your stimulus check.

4. Millicom International Cellular S.A.

Market Capitalization: $3 billion

Annual Dividend Yield: 8.74%

Earnings-Per-Share Growth: 154%

60-Month Beta: 0.9

Providing cellular phone service, high-speed broadband internet and cable services to emerging markets is big business.

One company that has capitalized on that market is Millicom International Cellular S.A. (Nasdaq: TIGO). It services countries in Africa and Latin America and is based in Luxembourg.

In 2019, the company had sales of $4.3 billion and its most recent quarterly net income was $219 million.

The company has one of the best price-to-cash-flow ratios of any company on the list at 3, and it has a very affordable stock price of around $30 per share.

Millicom did see its price get cut in half in March 2020 along with the market downturn, but has since started to build back up — still off of its 52-week high of around $50 per share.

It is a bit more volatile than the other companies on the list with a 6-month beta of 0.95, but that’s still relatively low compared to the broader market.

The company experienced earnings-per-share growth of 154% year over year.

Millicom does offer the largest dividend of any company on the list at $1.32 per share. That makes its annual dividend yield 8.74%.

That massive dividend coupled with the ability to maintain it (and possibly increase it) is why Millicom International Cellular S.A. is one of the four stocks to buy with your stimulus check.

[Bonus: This Little Known Secret Could Boost Your Retirement Account by an Additional $54,072]

So, while you may not have heard of these companies before, technical analysis suggests they are solid buys for now and the future.

They all have strong earnings growth, little volatility and room to grow with the recent market downturn. Not to mention, they are all priced low enough for any investor to jump into without breaking the bank.

That’s why they are the four stocks to buy with your stimulus check.

Honorable Mention

We’ve shown you the four stocks to buy with your stimulus check, but there are some others who just missed the cut:

- Axis Capital Holdings (NYSE: AXS) — This Bermuda-based company specializes in insurance. It’s fairly stable, with a 0.7 60-month beta and it has paid a dividend of $0.41 per share.

- Interdigital Inc. (Nasdaq: IDCC) — This Delaware company develops wireless technology used in mobile devices, networks and services. It is a bit more volatile than others on the list but turned in earnings-per-share growth of 780% from 2018 to 2019.

- Progressive Corp. (NYSE: PGR) — You’ve seen the commercials for Progressive Insurance. That’s operated by Progressive Corp. It has strong revenue growth and remains extremely stable. Its last dividend payment was pretty low, however, at just $0.10 per share.

- United Microelectronics Corp. (NYSE: UMC) — United is a semiconductor company based in Taiwan. You don’t hear much about it because it is overshadowed by Taiwan Semiconductor Manufacturing (NYSE: TSM). However, as an investment, United is solid with low price to book, price to sales and price to earnings.

Realistically, any of these eight companies would make good investments for your stimulus check. They are all inexpensive and have the potential for growth.

[Learn More: You Could TRIPLE Your Dividend Income with this Nearly Forgotten Group of Stocks]

But, as with any investment, do your homework and understand the risks before you invest in any stocks with your stimulus check.