U.S. equities sliding lower on Friday as renewed concerns about U.S.-China trade relations weighs on sentiment. It also didn’t help that this week’s Federal Reserve interest rate cut wasn’t well received as chairman Jerome Powell downplayed expectations that the 0.25% cut was the start of a prolonged easing cycle. Instead, he suggested it was a mere mid-cycle correction.

Not what the cheap money junkies on Wall Street wanted to hear.

Tech stocks seem to be bearing the brunt of the selling pressure so far today, with a number of well-known names taking it on the chin. Here are six tech stocks worth selling right now:

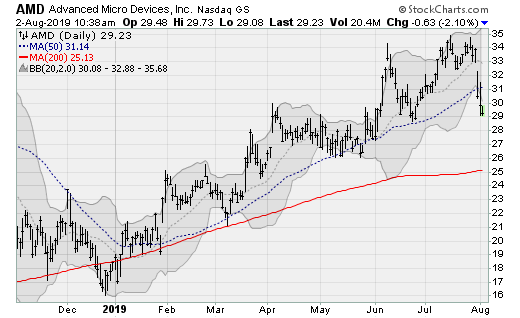

AMD (AMD)

Shares of GPU maker AMD (NASDAQ:AMD) are breaking below their year-to-date uptrend with an accelerating decline below its 50-day moving average. Watch for a move down to its 200-day moving average, which would be worth a loss of roughly 14% from here. Analysts at The Benchmark Company recently initiated coverage with a Hold rating on valuation concerns despite strong execution.

The company will next report results on October 23 after the close. Analysts are looking for earnings of 18 cents per share on revenues of $1.8 billion. When the company last reported on July 30, earnings of eight cents per share matched estimates on a 12.8% decline in revenues.

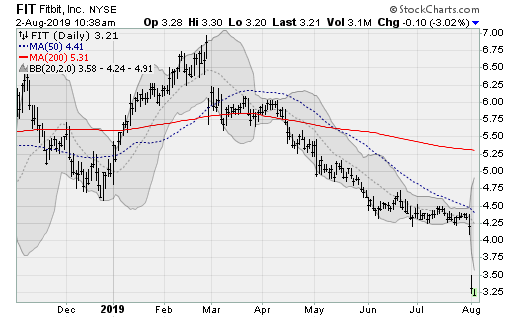

Fitbit (FIT)

Fitbit (NYSE:FIT) shares are lurching to fresh lows, down by nearly a quarter over the past week to cap a 50%+ decline from its late February highs. Not exactly the response the company wanted to the reporting of its latest quarterly numbers on Wednesday, with a loss of 14 cents per share beating estimates by four cents on a 4.8% rise in revenues. The company continues to move downmarket with its average selling price falling to $86 per device as it tries to get out of the way of Apple (NASDAQ:AAPL) on the high end.

The company will next report results on October 30 after the close. Analysts are looking for a loss of nine cents per share on revenues of $345.2 million. When the company last reported on July 31, earnings of four cents per share missed estimates by 14 cents on a 4.8% rise in revenues.

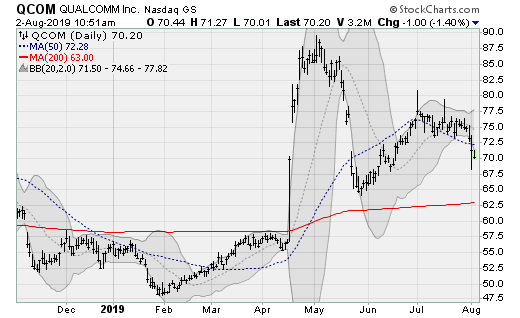

QUALCOMM (QCOM)

Shares of QUALCOMM (NASDAQ:QCOM) are falling away from a two-month consolidation range and look set for a move down to its 200-day moving average, which would be worth a loss of more than 10% from here. The stock has been under pressure since Apple announced it would be purchasing Intel’s (NASDAQ:INTC) 5G modem business — essentially undercutting QCOM’s strategy of getting a chokehold on the wireless modem industry.

The company will next report results on November 6. Analysts are looking for earnings of 70 cents per share on revenues of $4.7 billion. When the company last reported on July 31, earnings of 80 cents per share beat estimates by three cents on a 12.7% decline in revenues.

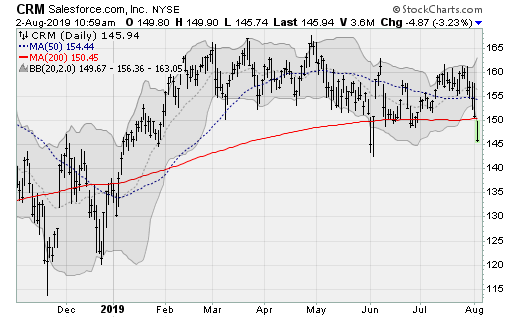

Salesforce.com (CRM)

Shares of Salesforce (NYSE:CRM) are once again testing below their 200-day moving average, threatening to break down out of a multi-month consolidation range going back to February. Next stop is likely to be the November/December trading range near $125, which would be worth a loss of roughly 14% from here.

The company will next report results on August 22 after the close. Analysts are looking for earnings of 47 cents per share on revenues of nearly $4 billion. When the company last reported on June 4, earnings of 66 cents per share beat estimates by five cents on a 24.3% rise in revenues.

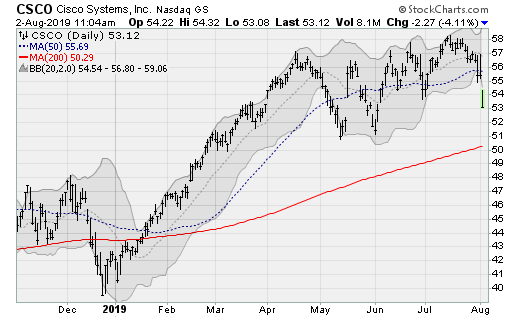

Cisco (CSCO)

Shares of Cisco (NASDAQ:CSCO) are falling out of a five-month consolidation range and look headed for a test of multiple lines of support near $51 coinciding with its 200-day moving average and its May/June lows. The company recently acquired Acacia Communications (NASDAQ:ACIA), which sells optical network equipment.

The company will next report results on August 14 after the close. Analysts are looking for earnings of 82 cents on revenues of $13.4 billion. When the company last reported on May 15, earnings of 78 cents per share beat estimates by a penny on a 4% rise in revenues.

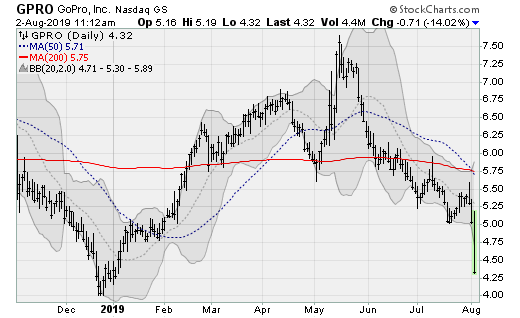

GoPro (GPRO)

Action camera maker GoPro (NASDAQ:GPRO) is suffering a nasty 14%+ decline this morning, returning to levels not seen since late December, after reporting disappointing results after the close on Thursday. Earnings of three cents per share missed estimates by a penny despite a 3.4% rise in revenues. The company’s GoPro Plus subscription service passed 252,000 active subscribers, up 15% from the first quarter, but ongoing worries about hardware sales and supply chain exposure to China is weighing on sentiment.

The company will next report results on October 31 after the close.

Leave a Comment