Before joining Casey Research, I traveled the world looking for new mines, oil fields, or renewable energy sites. I am a geologist, after all.

When I found a promising project, I’d arrange financing and take it public.

One of those projects was a large gold mine in Colombia.

This was a big project – more than 10 million ounces of gold, worth over $1.6 billion at today’s prices. So it needed major financing.

I ended up securing initial investments from two prominent billionaires: Lukas Lundin and Robert Friedland.

Over time, three other billionaires became shareholders of my company – Thomas Kaplan, John Paulson, and Seth Klarman – through their Wall Street investment companies.

I was directly involved in negotiating these financing deals. And it taught me something incredibly valuable… a billionaire’s secret unknown to most regular investors.

No Warrants, No Deal

When discussing financing with these major investors, warrants were one of the first things to come up. They demanded warrants in return for putting their money in.

No warrants, no deal with these billionaire financiers.

Without getting too far into the weeds, the reason is this: Warrants reward big investors for the risk they’re taking by investing in a smaller company. If and when the small company goes public… warrants are the first thing that big investors sell to reduce their total risk.

If you read our Daily Dispatch e-letter… you might be familiar with how this benefits everyday investors. (Hint – it’s because when the big investors sell their warrants, they hit the markets, and that’s how we can buy into them, too.)

But most investors aren’t familiar with warrants… and that’s by design.

For example… check out Warren Buffett. The Oracle of Omaha used warrants to grab $12 billion in profits on a boring stock: Bank of America. But Buffett barely mentions warrants in his numerous public appearances, shareholder letters, and Berkshire Hathaway investor events.

He and other billionaires, like Carl Icahn… Richard Branson… and even Jeff Bezos have repeatedly used warrants for enormous gains.

Now look… I won’t say there’s a conspiracy to keep this incredible profit tool secret. But think about it… if you were a billionaire with access to warrants, wouldn’t you be tempted to keep it all for yourself?

The potential gains are just too attractive to want to share.

And now… by adding one simple step to my readers’ repertoire, I’m here to help level the playing field…

Adding a “W” for Massive Gains

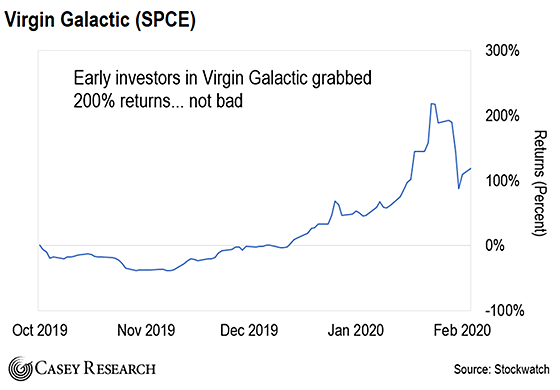

Here’s a chart of a regular stock: Virgin Galactic. This is one company nearly every investor on Earth knows. It’s billionaire Richard Branson’s space travel company. The trading symbol is SPCE.

The stock went public in October 2019… and did pretty well. Early investors grabbed 200% returns.

[Alert: Look at this RARE 5100% Chart!]

But here’s what few people know. If you added a “WS” to the end of Virgin Galactic’s stock symbol, you could have bought the company’s warrants…

Virgin Galactic’s warrants delivered over 600% gains at peak. They tripled the performance of the regular stock.

This isn’t a one-off. In fact, it’s a pattern you see a lot – if you know where to look.

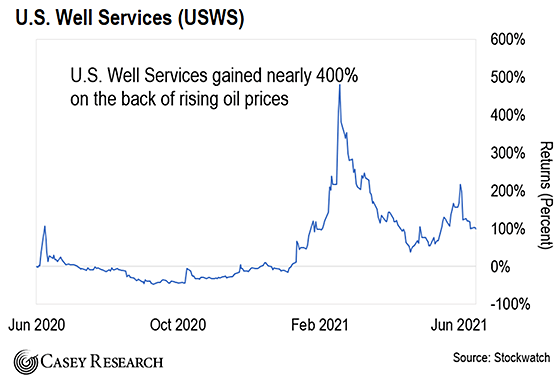

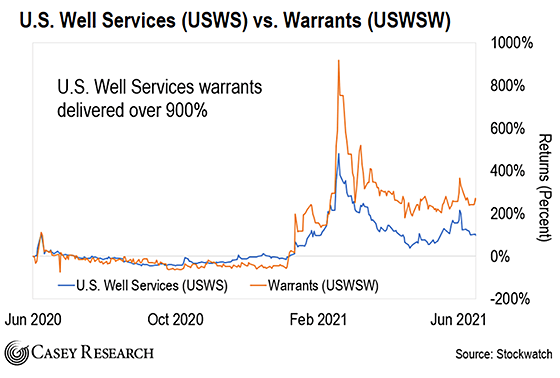

Here’s another stock: oil drilling company U.S. Well Services. You’ve undoubtedly heard about the oil sector getting hot. Crude rose over $90 per barrel recently.

U.S. Well Services’ stock rode that wave higher. Early in 2021, shares gained nearly 400%.

This company’s stock ticker is USWS. Look at what happens if we add a “W” to the end of that code.

The U.S. Well Services’ warrants delivered over 900% gains. That turns a $2,500 investment into over $25,000.

That extra profit potential is why billionaires love warrants. It’s like filling up with premium high-octane gasoline at the same price everyone else paid for the cheap stuff.

[Breakthrough: Warren Buffett made $12 billion with the idea behind this simple technique]

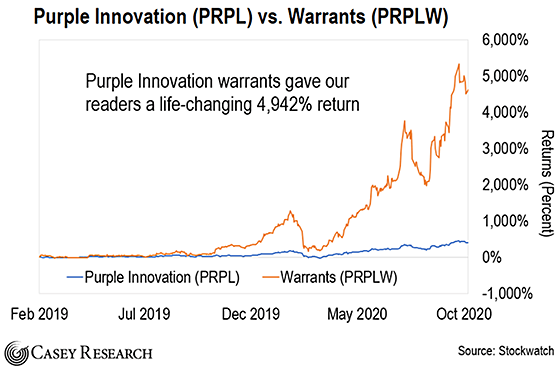

Let me show you one more example of the power of warrants.

Purple Innovation is a leader in online mattress sales. When stock markets bounced back after the April 2020 crash, its shares soared. Regular investors who tapped PRPL gained nearly 500%.

Purple Innovation’s warrants delivered astonishing gains. When we advised members to take profits, they booked a life-changing 4,942% win.

That turns $2,500 invested into $123,550 – enough to pay off a mortgage… put your kid through college… or put a chunky down payment on a vacation home.

Most investors will never see a 4,942% gain. Not in a lifetime. Even if you buy and sell stocks every week.

The profit power of warrants is obvious.

That brings us back to the question: why haven’t you heard about this before?

The Wealthy’s Interest in Keeping Warrants Quiet

The problem is this: No major service provides information on warrants for free… that’s easy to follow… or even for reasonable prices. That contrasts with the many directories and services that cover regular stocks.

The only way to get reliable information on warrants is with a Bloomberg Terminal – a tool that costs over $25,000 a year to operate – and requires lots and lots of time sifting through company press releases… numbers… and earnings reports.

Mainstream investors don’t have that kind of time or money. Essentially… big investors are pricing you out of this market.

The Profit Power of Warrants

If billionaires are actively working to hide warrants from you, don’t you owe it to yourself and your family to at least be informed?

In my experience, warrants are better, cheaper, and faster than stocks. That’s why the world’s most successful investors love them – even demand them.

Remember the examples I showed above. Warrants multiplied the profits from regular stocks by several times in some cases.

That adds thousands, or tens of thousands, of dollars in additional gains – just by unlocking that extra letter (or two) on your next trade.

What’s more… the average gain on my EV warrant picks is 867%. But that’s just the average.

Keep walking the path,

David Forest

Editor, Casey Daily Dispatch

[Learn More: These stocks can quickly multiply in price 5x, 10x, 100x, or much higher…]