There's an old saying I learned early in my career on Wall Street…

It sticks with me because I've found it to be so true. It goes like this: “The market tends to do whatever inflicts the most pain on the most people.”

There are several different versions of this saying. But you get the idea. It means that whenever everyone is piled into the same idea, it typically goes against them.

That works for a simple reason. If everyone is on the same side of an idea, who's left to keep buying?

You can think about it this way… If everyone is all-in on stocks, who's left to push stocks higher?

The answer is, probably no one. So the next wave of activity will probably be a drop in stocks.

Here's the interesting thing… We're dealing with the other side of that equation today.

Due to the coronavirus-related shelter-in-place orders, economies everywhere shut down. Nothing was happening. Investors got scared. They sold stocks and bonds, seeking the safety of cash instead.

[Breakthrough: Experts See “World’s First Trillionaire” Coming from this Emerging Industry]

Even during the recent rally, investors have kept selling in a big way. But that can't last forever. And when it changes, a flood of cash from the sidelines will propel stocks even higher.

Let me explain…

Investors are avoiding stocks in droves today. It's nothing short of incredible.

According to the Financial Times, a record $22.5 billion in assets went into U.S. bond funds last week. Investment-grade corporate bond funds saw $5.5 billion of inflows. Funds that buy investment-grade corporate bonds and government debt saw $7.5 billion of inflows. And junk bond funds saw $8.5 billion of inflows.

That's a lot of money moving around. And none of it moved into equities. That could soon change, though.

You see, that money moving into bonds is coming out of money market mutual funds. These funds saw $36 billion in outflows that same week.

If you're invested in money market funds, your return is small… But you're also safe, because it's almost the same as staying in cash.

However, when the market is rallying, that safe money isn't doing anything. Moving to bonds is climbing the next rung up the ladder in risk. And there's a lot of cash left to move out of money market funds…

[According To: Bill Gates Says One Innovation in this New Market Could be “Worth TEN Microsofts”]

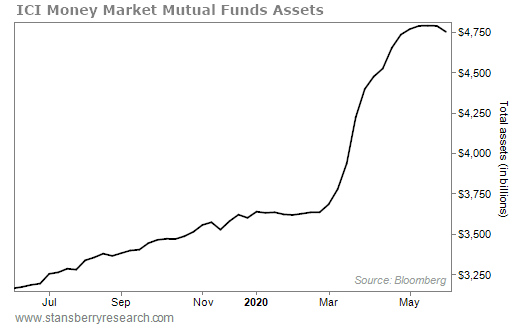

According to the Investment Company Institute (“ICI”), nearly $1.2 trillion has moved into money markets since early March. Take a look at this chart…

That's a bigger move than the one we saw during the financial crisis. Back then, a total of $509 billion went into money market mutual funds during the worst of the crisis. The recent move dwarfs it.

But now, $36 billion has come off the sidelines. And that trend should continue.

Investors are getting tired of watching their money do nothing. They want to get back in… and participate in the major stock gains we've seen since March. And it looks like that's finally starting to happen.

Remember, we've seen $1.2 trillion move into money market funds since the start of this crisis. You should expect that money to move back into bonds, and eventually stocks, in the coming weeks.

[Learn More: One Company in Particular Could Reap Major Rewards from this Imminent Boom]

This huge flood of cash is likely to push the recent rally to new highs. It's another simple reason stocks can continue rising from here.

Good investing,

C. Scott Garliss