About this time of year, you see a whole lot of articles in the financial press touting or predicting what the best investments will be in the year to come. Sometimes, those picks turn out to be brilliantly on point. Very often, however, many a new-year prognostication falls short of expectations.

This should come as no surprise, as those of us who are tasked with breaking out the crystal ball and predicting what human behavior will be like months down the road face a perilous pursuit. Take this year, for example. I mean, nobody predicted that a global pandemic would cause the human, social and economic devastation that it did in 2020. Or that the S&P 500 would plunge some 25% from late February through late March, only to surge back to all-time highs in the fourth quarter of the same year.

Now, while there are many reasons to be fearful of future peril when it comes to the lasting damage caused by COVID-19, the recent developments of the first doses of a vaccine actually being injected into the arms of the first recipients is a tremendously encouraging omen for 2021.

My “prediction” here, if you want to call it that, is that, by mid-2021, we will be close to a sense of “normal” in the world. What that normal will be like, and how it will look compared to the pre-pandemic days, is very difficult to assess. Yet, I do think that humans are a remarkably resilient species, and that means we will recreate, rebuild and return (as close as possible) to the lives that we created before this pandemic knocked us on tilt.

[Breakthrough: This Could be the Closest Thing to Buying Amazon When it was $50]

Indeed, we have already seen that in the aforementioned rise to new highs in the major domestic averages. Will that rise continue? Will the leaders from this year be the leaders of last year? What specific exchange-traded funds (ETFs) should we own to take advantage of the likely prevailing tailwinds that can drive stocks in that segment higher?

All of these questions remain to be answered in what promises to be, hopefully, a more “normal” year. So, with the caveat here that nobody has a coveted crystal ball, today, I will give you one “must-own” ETF that I think will deliver for investors over the next 12 months. It is the Invesco S&P 500 Equal Weight (RSP).

In late 2020, we finally started to witness a “Growth to Value” rotation. This is a trend Wall Street has been waiting for, but over the past several years, it has remained elusive. Yet, with the vaccine now literally waiting to be injected, this could be the moment that investors have been waiting for to finally rotate capital out of large-cap tech/growth stocks and reposition that money into more traditional value sectors.

With RSP, you get exposure to the same stocks in the S&P 500 that are in the more common SPDR S&P 500 ETF Trust (SPY). However, with RSP, you get each company equally weighted in the index. Meanwhile, SPY is market-cap weighted.

My macro analyst firm of choice, Sevens Report Research, crunched the numbers here and discovered the real difference between RSP and SPY. Because SPY is market-cap weighted, you get about 35% of assets in technology, followed by about 15% in consumer discretionary. And of that consumer discretionary sector, almost half is dedicated to Amazon (AMZN) because of that stock’s heavy market-cap weighting. This means that SPY is effectively about 40% large-cap tech/growth stocks.

[Buy Alert: Buffett Recently Dumped $800 Million of Apple Stock to Invest in This!]

Now, that overweight has worked extremely well for many years. However, if we do see a rotation into value sectors, then RSP is likely to outpace SPY because of its greater exposure to value sectors such as industrials, financials, consumer staples and health care. Together, these sectors make up about 53% of RSP, as opposed to just 41% of SPY.

To be certain, owning RSP vs. SPY over the past several years was not wise from a relative performance standpoint. Over the past three years, RSP has had a total return of 33.7%, while SPY has delivered some 46.1%.

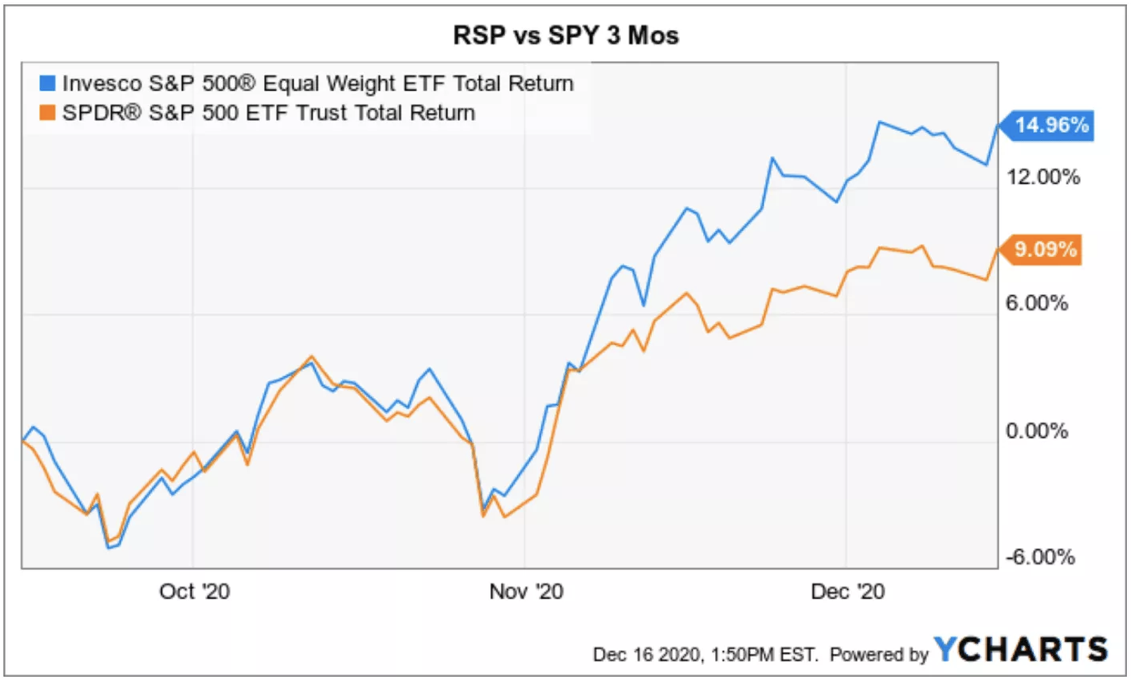

Yet, over the past three months, that performance has reversed, with RSP far outpacing its market-cap weighted brother with a gain of nearly 15% vs. a gain of just 9% for SPY. So, by adding RSP to your holdings, you can immediately gain greater exposure to the value segment without making any drastic bets on any one value sector fund (e.g. financials or industrials) or any specific value-oriented company.

Earlier this year, subscribers to my Intelligence Report newsletter advisory service received a recommendation to add RSP to their tactical portfolio, as this is one of those medium- to long-term trends that I suspect we will have in the portfolio well into 2021 (and likely beyond).

[Learn More: See Why Billionaires are Flocking to this Tiny Niche of the Tech Sector]