James Jerome Hill was born in a log cabin in Ontario, Canada in 1838.

By the time he reached his early twenties, J.J. Hill – as he was known – moved to St. Paul, Minnesota to work in steamboats and coal.

At the time, the Industrial Revolution was well underway. North America was booming and in much need of basic infrastructure.

After a couple of decades of hard work and establishing himself, J.J. Hill partnered with and purchased the railroad company St. Paul and Pacific Railroad.

His plan, which critics referred to as “Hill’s Folly,” was to take the railway westward through the Rocky Mountains, and eventually north into Canada.

It was an ambitious plan that would require the construction of new tracks through unpopulated wilderness, which is why there was no shortage of skeptics.

But J.J. Hill was methodical…

He was willing to play the long game. His approach was conservative in that he would lay new track in smaller increments of around 200 miles.

After doing so, he would pause and focus on attracting farmers, settlers, and miners to the area. He was cleverly building a population that would support the use of the railway.

His approach was so successful that by 1893 he reached Seattle. The Great Northern Railway – as it was known – operated through much of the 20th century.

A series of mergers in the 1970s and 1990s resulted in the Burlington Northern and Santa Fe Railway. Hill’s original route is still in use today, carrying freight across North America.

What’s even more impressive is that he was able to accomplish all this without receiving any government aid.

And how he financed the construction was truly unique…

A Hybrid Security

J.J. Hill created an entirely new security, a convertible bond. It was a way for the St. Paul and Pacific Railroad to differentiate itself from others who were looking to raise capital.

The convertible bond was unique. It was a hybrid security that includes components of both debt and equity.

[Jim Rickards Asset Emancipation: Profit from the 3 Companies Building “Biden Bucks”]

Investors could invest in a bond backed by assets – in this case, the railway – and have the added benefit to profit from rising equity prices due to the convertible aspect of the security.

This new form of security, the convertible bond, was so successful that it was adopted widely in the railroad industry to finance the national infrastructure build-out.

And this investment vehicle is still in use today… But convertible bonds are no longer exclusive to the railway industry.

Some best-in-class technology companies are now offering convertible bonds that will deliver us steady income, virtually no downside, and attractive upside potential with the conversion option.

A New Strategy

As I’ve been sharing with readers in recent weeks, we’re looking at new strategies to help us thrive in the current market environment. The markets have changed, and so we’re adapting with them.

Convertible bonds are one of the best options for investors right now. As I said before, these investments deliver us a guaranteed income, virtually zero downside, and leave the door open to incredible upside potential.

And in some cases, it’s possible to see triple-digit returns from these bonds. Here’s how…

[Biden Bucks: Executive Order 14067 could pave the way for a social credit system just like China]

At a high level, a convertible bond is a type of corporate debt. Holders of the bond will receive regular payments (coupons) and reclaim the par value of the bond at the time of maturity, typically $1,000.

And because these assets are bonds, they are a very conservative investment.

The issuing company is obligated to pay its bondholders. The only real risk is that the issuing company goes bankrupt before maturity. But so long as we invest in established businesses with great free cash flow, I don’t see this as a realistic possibility.

So far, this should sound familiar. Even new investors will likely understand the fundamentals of bonds.

But here’s what makes convertible bonds different…

As the name suggests, these bonds can be “converted” into shares of stock in the underlying company.

And it is this single feature that can turn a seemingly “boring” investment into an incredible one.

A Convertible Bond in Action

I recently looked at a convertible issuance for semiconductor company Advanced Micro Devices (AMD). These bonds were issued in 2016. The bonds were issued with a yield of 2.125%.

Now, that isn’t a large return…

But the return came with essentially no risk. There was/is no way AMD was going to go bankrupt. And investors got paid to wait for AMD’s shares to rise.

And they didn’t have to wait long.

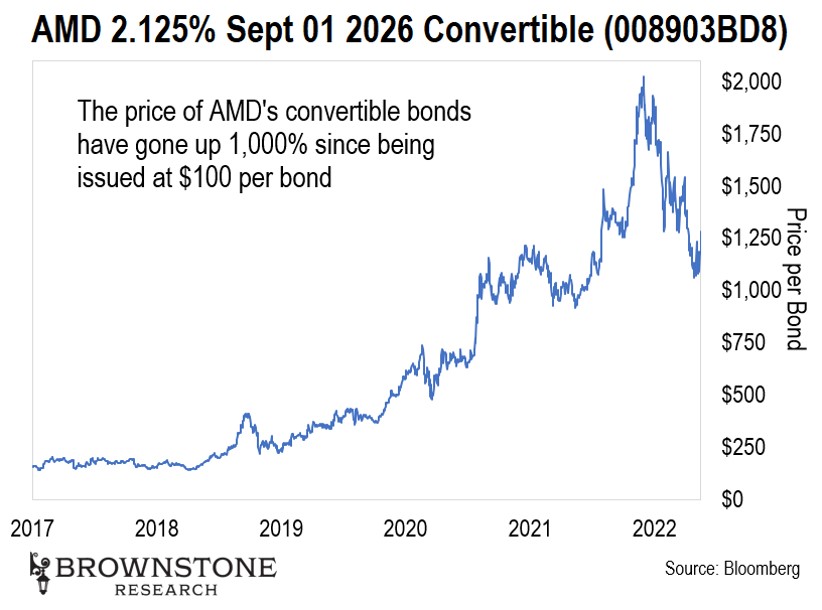

If investors purchased these bonds and held them through today, they would have made more than 10x their money. This chart tells the story:

This is possible because all convertible bonds are issued with a conversion price. The conversion price is typically above the price where the stock is trading at the time of issuance.

When these AMD bonds were issued, the price of AMD’s shares was $5.90. And the conversion price for the bonds was $8. That means that holders of those AMD bonds were able to convert their bonds at just $8 a share.

And with AMD trading close to $80 a share at the time of this writing, it’s easy to see how investors made a 10x return.

And here’s the best part…

Even if AMD traded sideways, even if the stock crashed, bond investors were protected. They could simply hold the bond to maturity – collecting a yield along the way – and make a great return when they reclaim par value.

In many ways, it’s a “heads we win, tails we win more” setup.

Why Now?

Convertible bonds are a truly unique asset class. As we can see, they are a conservative investment vehicle that delivers regular income while still leaving the door open to great upside.

But if these investments are so great, it begs the question: Why haven’t we been investing them all along?

It’s a fair question. And the answer is straightforward.

In healthy markets, it’s usually more advantageous to simply buy the underlying equity of great growth companies. But these are not healthy markets.

I’m sure there are several subscribers out there that are very anxious. When we are in the grips of this type of volatility, it can feel like the world is ending. That’s why I love convertible bonds in an environment like this.

More than the great upside potential, what these investments offer is peace of mind. So long as we pick bonds offered by solid companies, we can sleep well at night knowing we have downside protection, while still keeping a “foot in the door” for incredible growth.

Regards,

Jeff Brown

Editor, The Bleeding Edge

[The $4 Inflation Stock That Can Change Your Life – Whitney Tilson’s Latest Prediction]