My job is to identify the most profitable trends for investors.

Admittedly, some trends can be controversial, like 5G, cannabis, cryptocurrencies, electric vehicles, plant-based foods and renewables.

And sometimes it’s a trend investors are excited about. But the trend isn’t readily digestible, such as blockchain and digital ledgers.

However, this year, my favorite trend to target is one most of us can easily relate to…

Video games.

I love video games.

I have an arcade cabinet in my house where I routinely play my offbeat favorites, Pepper II and Robotron 2084… and get crushed by my wife in Bubble Pop.

On consoles, I regularly play Battlefield, Call of Duty, Forza, Madden and NBA 2K, among various other titles. And I’ve had a new, pandemic-fueled interest in Rocket League, as I’m online everyday with my brothers and nephew for some quarantine-style socializing and good times.

[Breakthrough: The World’s Most Successful Tech Giants are Buying into this Emerging Field]

But by no stretch of the imagination would I call myself a gamer. I don’t think I’m particularly good or deft at video games.

I’m more like the family dog: I may not know what’s going on, but I’m happy to be included.

I believe everything I just outlined illustrates how much video games are a part of our everyday lives, even at a casual level.

And COVID-19 has supercharged this.

New Highs and Bigger Gains

In 2020, investors are setting new high scores with gaming stocks!

Shares of publishers such as Activision Blizzard (Nasdaq: ATVI), Electronic Arts (Nasdaq: EA), SciPlay (Nasdaq: SCPL) and Take-Two Interactive (Nasdaq: TTWO) aren’t just hitting 52-week highs… They’re surging to record levels.

And it’s all thanks to the global pandemic.

Tens of millions of people around the world have been holed up at home during the quarantine. And for many, there are few better ways to pass the time inside than playing their favorite games.

Research from Nielsen showed 82% of global consumers played video games and watched video game content during the quarantine. And engagement with video games is at an all-time high.

In fact, during the first quarter, daily viewership on the video game streaming platform Twitch more than doubled.

And all of this has ignited a boom in gaming stocks.

[Big Money: Google and Microsoft Just Put Over $4 Billion into this New Technology]

This year, video games not only have been one of the most profitable trends to play but also have been arguably the most fun trend.

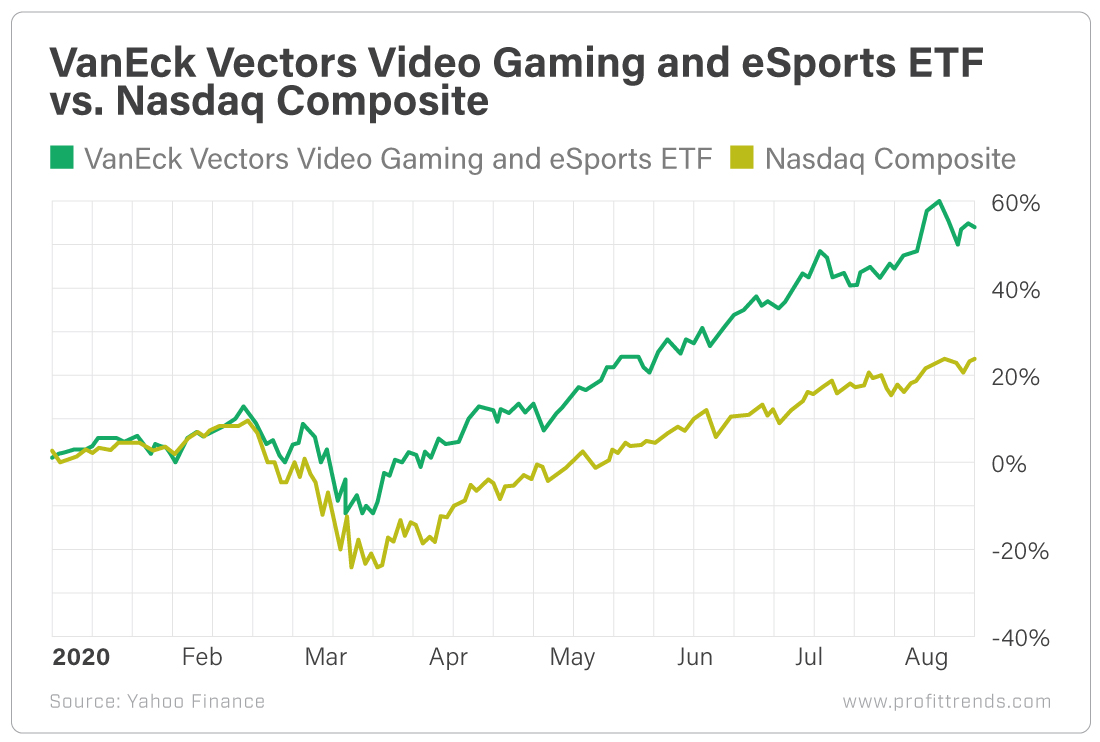

Year to date, the VanEck Vectors Video Gaming and eSports ETF (Nasdaq: ESPO) is hitting all-time highs, more than doubling the performance of the record-setting Nasdaq.

Buoyed by the pandemic, global industry sales as a whole are projected to grow nearly 10% to $159.3 billion. And by 2023, sales will top $200 billion.

[Read On: Discover What Bill Gates is Calling the “Holy Grail” of Modern Tech]

With these tailwinds, video game stocks have handed my subscribers some of their biggest wins, not only of the year but of all time. My subscribers have seen returns of 180.5% on DouYu International (Nasdaq: DOYU), 195.3% on Take-Two Interactive, 293.7% on Electronic Arts, 327.8% on Huya (NYSE: HUYA) and 2,710.5% on Sea Limited (NYSE: SE)!

This has been a global phenomenon across consoles, mobile and PCs. And this trend isn’t going to die down anytime soon.

We’re about to head into the busiest time of the year for video game companies. The holidays are on the horizon, as well as that holiday splurge in spending.

Video gaming has been one of the hottest sectors to score fantastic gains with in 2020. It’s a trend we’ve identified here before. And it’s one I’ve been happily targeting in my services Dynamic Fortunes, Trailblazer Pro and The VIPER Alert.

The industry is proving to be recession-proof and pandemic-proof. That’s the code for continued gains in the months ahead.

Here’s to new high scores,

Matthew

[Big Money: Google and Microsoft Just Put Over $4 Billion into this New Technology]