We know it gets cold in the winter, hot in the summer.

We know that flowers bloom in spring, and leaves turn brown in fall.

Every year, we know the seasonal trends that will come up in a couple of months.

But if we are trying to predict the exact temperature a month from now, it’s near impossible.

Instead, we focus on the trends themselves.

It’s summer now, so we know to expect temperatures to cool off heading into the end of the year. Who knows exactly how low the temperature will fall? We don’t care.

I know the slopes are still going to get cold enough for snow, so we book ski trips. I love it when they call for a warm winter or talk about temps rising, that’s when I can get nice discounts.

Just knowing the trends of weather, we can benefit from the hype and worry over short-term temperature changes.

I look at investing the same way.

[Exclusive: Man Who Made EIGHTEEN 1,000% Recommendations Unveils #1 Stock]

We don’t have to know exactly where a stock will trade at two or three months from now. As long as I know what seasonal trend to expect, we can profit from it.

Seasonal trends occur in the stock market just like they do in weather, and they are still called seasonal trends. These are certain times of the year where certain sectors rise or fall like clockwork.

The trends even highlight when you can expect the biggest pullbacks in the market, like the sharp drops we are seeing today.

But after these drops, the seasonal trends point to even bigger gains for certain sectors.

And right now, we are heading into one of the most popular seasonal trends — rising consumer discretionary stocks.

Here’s why…

PEOPLE WANT TO BUY THINGS

The consumer discretionary sector includes stocks like Amazon Inc. (Nasdaq: AMZN), Home Depot Inc. (NYSE: HD) and McDonald’s Corp. (NYSE: MCD).

An online store, a hardware store and a restaurant seem like they are in totally different segments of the market.

But, they all depend on one key element to keep making progress: consumer spending.

That’s what lumps these stocks into the consumer discretionary sector. These are called consumer discretionary stocks because we, as consumers, spend our discretionary income here — the income that we have after paying all the bills.

The better off the American consumer is, the stronger these stocks will do.

[Extra: They Laughed, Yet FIVE of the Stocks He Named Went on to Soar Over 1,000%]

And every year, consumer spending surges from now till the end of the year — even in a pandemic.

It will look different, but America is ready.

In my house, we’ve already bought Halloween costumes and made plans with family and friends to meet up during Thanksgiving and Christmas. Dine-in restaurants, movie theaters and even football games are becoming normal again, and it’s great to see. And as more people are out and about shopping during the holidays, we’ll see more sales at restaurants and retail outlets — even ones that don’t have big discounts for the holidays.

Every year like clockwork, we see this play out.

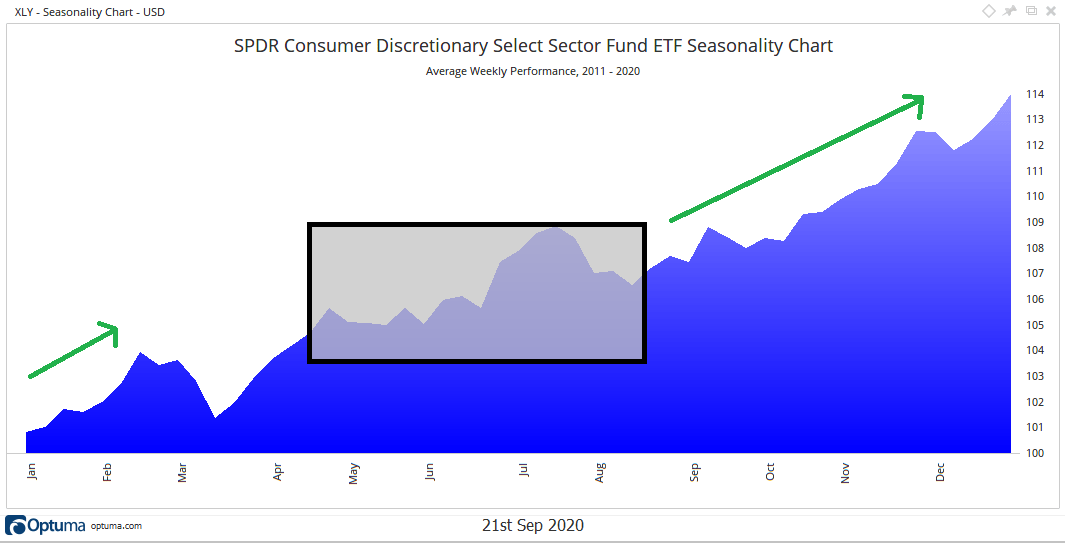

Take a look at how consumer discretionary stocks trend starting in September based on this seasonal chart:

(source: banyanhill.com)

(source: banyanhill.com)

This is a seasonality chart that takes the seasonal trend over the last 10 years for the exchange-traded fund (ETF) SPDR Consumer Discretionary Select Sector ETF (NYSE: XLY). The blue shaded area is the average trajectory for the sector from January to December.

You can see the green arrows that show the time period that I’ve been talking about. It works like clockwork — consumer discretionary stocks rise almost every year from September through February.

[Read On: Legendary Stock-Picker May Have Cracked the Code to 1,000% Gains!]

I shaded in the middle part of the year to point out that the area is choppier and not as profitable. You can see the trend picks up starting in September.

During the September to February period, we see peak spending for consumers. It’s filled with holidays all the way to February 14, Valentine’s Day.

And this year I have even more confidence we’ll see this bullish trend play out.

PANDEMIC FUELS MORE SPENDING

Our typical lifestyles have shifted tremendously in 2020. The pandemic hit and forced us all to adapt to working and going to school at home.

It also caused a rush into electronics to make the transition to a home office more convenient.

As things begin to normalize, consumers will spend heavily on this holiday season. There’s a build of demand for items that go beyond what we need and begin to fill the wants of our lives.

Buying a new computer at the beginning of the pandemic was a necessity for most people. As we see clothes, jewelry, big TVs, cars and other items get marketed heavily and reduced in price, consumers are going to jump at the chance to spend on something they really want.

That’s why I’m expecting this trend to show up strongly this year. Even if we don’t know exactly where the sector will end up, we know the trend is higher from here.

And owning XLY is a great way to profit.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert

[Exclusive: Man Who Made EIGHTEEN 1,000% Recommendations Unveils #1 Stock]