Is the office canceled?

Sure, Steve Carell and Greg Daniels have moved on to Netflix’s Space Force.

But the future of the office is one a lot of CEOs are currently pondering.

Now, before you shake your fist at the sky or lament this possibility, understand that this is an opportunity that should make investors cheer.

If there are any bright spots to be found in the pandemic, one could be that companies finally have an excuse to deleverage themselves from one of the biggest areas of corporate waste: real estate.

Years before COVID-19, the global accounting firm Accenture found that “the average firm has 30% to 50% more real estate than it needs.”

That’s millions upon millions of dollars each year being shoveled into a furnace.

Employees have been embracing mobility and the flexibility to work remotely.

[Inside: One of the World’s Leading Angel Investors Unveils Next Tech Breakthrough]

This was pre-COVID-19.

Even then, the office was already on its way out.

The pandemic is merely accelerating its demise.

Empty Desks and Fat Wallets

Silicon Valley is leading this sea change.

Tech execs believe the era of cubicles and having to deal with co-workers microwaving smelly food in the breakroom is over.

Twitter (NYSE: TWTR) told its employees they can work from home permanently.

Alphabet (Nasdaq: GOOGL), Facebook (Nasdaq: FB), Salesforce (NYSE: CRM) and Slack Technologies (NYSE: WORK) don’t expect employees back at their old desks until 2021.

And that’s if (a big IF) they ever return.

There’s also another half-dozen tech giants considering permanently keeping a considerable swath of their employees at home.

In fact, Slack’s CEO, Stewart Butterfield, believes at least 20% to 40% of the company’s workforce will be remote.

And just like many other corporations, Slack has to make real estate decisions several years in advance. Right now, the business technology platform is weighing the possibility of 30% to 40% fewer desks.

[First Look: Amazing New Technology Will Be in 266 Million American Homes By End of 2020]

Similar conversations are likely being held at businesses small and large. Every company now has to “de-densify” its work environment.

But beyond the cloudy future of corporate real estate, there’s another issue budding from this trend…

Everyone Under Siege

There’s a troubling undercurrent to our new normal.

With more people working remotely and more devices connected to the internet, instances of everything from denial-of-service attacks to phishing scams to ransomware are on the rise.

And not just against individuals, but against corporations and government agencies too.

So far this year, 80% of companies have reported an increase in cyberattacks. There’s been a 148% increase in ransomware attacks as the number of attacks against banks has soared 238%.

Meanwhile, phishing attacks have surged 600% since February and cloud-based attacks skyrocketed 630% between January and April.

Cybercrime is rising at an alarming level. Microsoft (Nasdaq: MSFT) is observing 12 million attacks per day.

This is the pandemic inside the pandemic.

And targeting this trend has paid off handsomely in 2020.

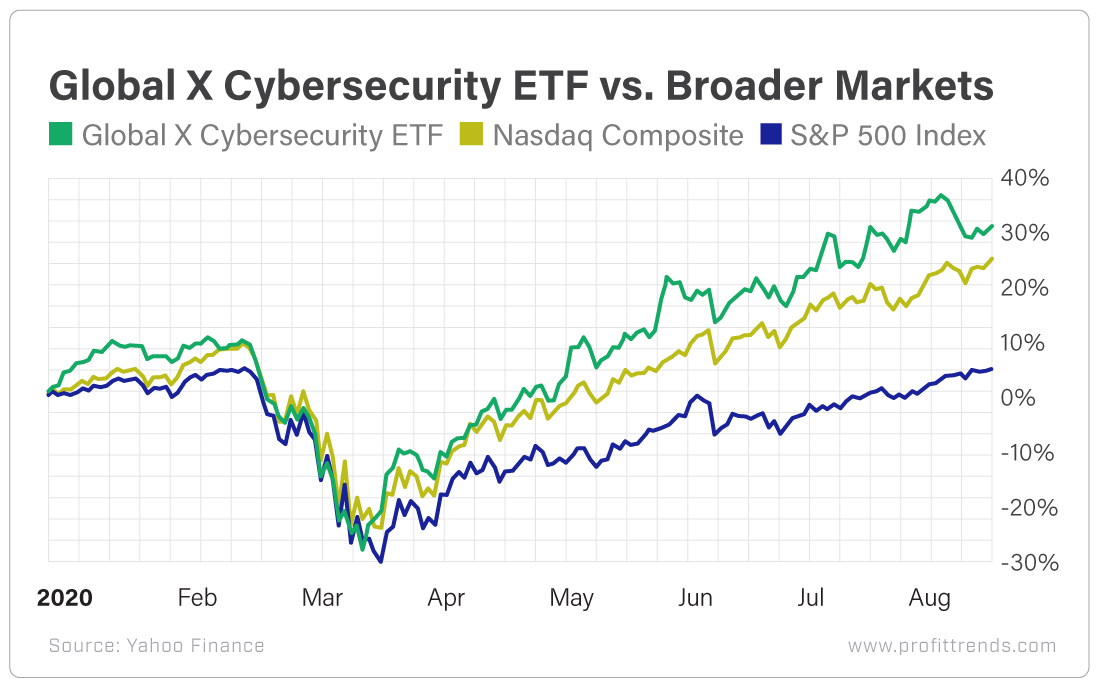

The Global X Cybersecurity ETF (Nasdaq: BUG) has outperformed the Nasdaq and the S&P 500 this year.

And hot stocks such as CrowdStrike (Nasdaq: CRWD) and Zscaler (Nasdaq: ZS) have more than doubled, as strong performers like Okta (Nasdaq: OKTA), SailPoint Technologies (NYSE: SAIL) and Tenable (Nasdaq: TENB) have returned better than 40% apiece so far in 2020.

[Learn More: Renowned Investor Reveals What He Thinks Will Be the #1 Tech Stock for 2020]

Now, before COVID-19 reared its ugly head, cloud security was already poised to be one of the fastest-growing areas in tech over the next several years.

In 2018, $10.5 billion was spent on public cloud security. By 2022, total cloud security spending is expected to surpass $17.9 billion.

But I think the totals could potentially be much larger than that. Especially considering the staggering uptick in attacks we’re facing.

The days of the office appear numbered… at the very least for some.

This is good news for investors as companies will need to trim their bloated real estate budgets. That means one of the five largest areas of corporate waste can be reined in. And we’re going to see a lot more money poured into network security, identity management software and other areas of virtual defense.

For investors, there’s a growing ecosystem to target that’s positioned to profit on the future – and protection – of the remote worker.

Here’s to high returns,

Matthew

[Inside: One of the World’s Leading Angel Investors Unveils Next Tech Breakthrough]