The U.S. stock market has witnessed sharp sell-off in the past few weeks, as investors feared the financial implications of the rapidly spreading coronavirus. The Dow Jones, the S&P 500, and the Nasdaq have plunged more than 16% each over the past month in a sharp reversal of the solid uptrend witnessed at the beginning of 2020.

Nonetheless, the coronavirus-led sell off has created buying opportunities for some investors. In current scenario, investors can look for stocks that have strong fundamentals and can drive growth once the impact of coronavirus cools off.

NVIDIA Corporation (NVDA) is one such stock. Let’s delve deeper to find out what could drive the stock higher.

Strong GPU Adoption in Datacenter and Gaming Markets

NVIDIA’s revenues doubled while its earnings grew over three times in the last four fiscal years, mainly driven by strong adoption of its GPUs in the datacenter and gaming markets.

Datacenter presents solid growth opportunity for the company. As more and more businesses are shifting to cloud, need for datacenters is increasing immensely. To cater to this huge demand, datacenter operators like Amazon (AMZN), Alphabet (GOOGL), and Microsoft (MSFT) are expanding their operations across the world, which is driving demand for GPUs.

This bodes well for NVIDIA. The company’s revenues from this segment increased to approximately $3 billion in fiscal 2020 from a mere $339 million in fiscal 2016.

Moreover, better visualization and speed is needed for a thrilling gaming experience, which NVIDIA successfully provides through its portfolio of Pascal architecture-based GPUs. Furthermore, with the emergence of Gaming-as-a-Service (GaaS) and massively multiplayer online games (MMOG) concepts, the demand for GPUs has been surging exponentially.

Notably, gaming segment revenues reached $5.5 billion in fiscal 2020 from $2.8 billion in fiscal 2015, reflecting almost two-fold growth.

[Don't Miss! The Analyst With 200 Recommendations Reaching 100%+ Reveals His 2020 Pick]

AI Proliferation Provides Solid Growth Opportunities

NVIDIA GPUs are gaining rapid traction with the proliferation of AI. The increasing usage of AI tools in datacenter, automotive, healthcare and manufacturing industries is expected to drive demand for GPUs in the long haul.

Notably, NVIDIA is already a dominant player in the datacenter market. The company also enjoys a first-mover advantage in the AI field and its expanding product portfolio is capable enough to leverage the growing adoption of AI in various industries.

Efficient Cost Management Drive Margins

NVIDIA’s operating expenses as a percentage of revenues declined in the last four fiscals. NVIDIA’s platform model has helped to reduce overall costs, while enhancing its operational efficiency. NVIDIA’s non-GAAP operating expenses as a percentage of revenues decreased to 28% in fiscal 2020 from 35% in fiscal 2016.

Furthermore, NVIDIA’s strategy of developing a single GPU architecture like Pascal and Tegra at a time has been helping it to expand gross margin. The company’s non-GAAP gross margin expanded 570 basis points to 62.5% in fiscal 2020 from 56.8% in fiscal 2016.

Moreover, NVIDIA partnered with Taiwan Semiconductor Manufacturing Company (TSM) and Samsung to develop 7nm process node-based GPUs. We believe the 7nm-based GPUs would reduce the company’s production costs while enhancing performance.

Improving gross margin and lower operating expenses are expected to continue driving NVIDIA’s bottom-line growth. The graphic chip-maker’s non-GAAP operating margin increased to 26.1% in fiscal 2020 from 14.9% in fiscal 2016.

[Don't Miss! The Analyst with SIXTEEN 1,000% recommendations unveils #1 stock]

Strong Cash Flows

The company’s accelerated revenue growth along with improving operating efficiency is bringing in higher cash flows. NVIDIA’s operating cash flow in fiscal 2020 reached $4.8 billion from $1.2 billion in fiscal 2016. Furthermore, the company ended fiscal 2020 with cash and cash equivalents, and marketable securities of worth $10.9 billion.

Strong cash flows provide NVIDIA the flexibility to invest in long-term growth opportunities as well as return cash to shareholders in the form of share repurchases and dividend payments. Notably, NVIDIA returned approximately $6 billion to shareholders through dividend payments and share buybacks in the last five fiscals.

Conclusion

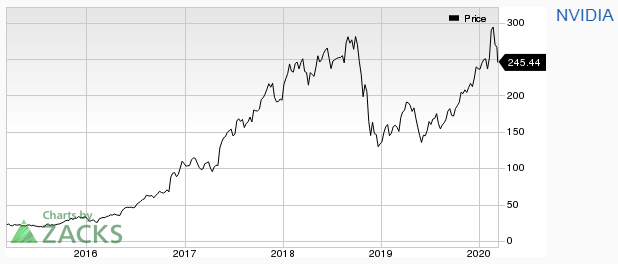

NVIDIA is down 22.4% from its all-time high level of $316.32 attained on Feb 20, making the stock more affordable for investors. The stock trades at a one-year forward P/E of 31.5X, compared to its five-year average of 36.8X.

NVIDIA Corporation Price

Nonetheless, NVIDIA trades at a massive premium to the semiconductor industry’s forward P/E multiple of 17X. Therefore, many would argue that the stock is a risky bet. However, we beg to differ due to its consistent financial performance and strong growth opportunities in various untapped markets like automotive, healthcare and manufacturing over long term.

Moreover, despite the massive recent sell off, NVIDIA is among the few stocks, which boast positive returns so far this year. The stock is up 4.3% year to date against the S&P 500 Index’s 15% decline.

Additionally, NVIDIA has favorable combinations of a Growth Score of A and a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Per the Zacks’ proprietary methodology, stocks with such a favorable combinations offer solid investment opportunities.

[Don't Miss! The Analyst With 200 Recommendations Reaching 100%+ Reveals His 2020 Pick]