The only time the past can indicate the future is when there is a similar force at work. The bitcoin “halvening” should be such a repeat event.

For the uninitiated, the halvening is a cryptocurrency event when the printing of new coins slows by half. Cryptocurrencies like bitcoin give a reward to members of the blockchain administrating network, called miners, when they crack the permission puzzle and are allowed to make the next transaction update post to the blockchain ledger. That reward is currently about $100,000 of bitcoin depending on the value of bitcoin at the time. This reward is about to halve. The process is convoluted but that’s crypto for you.

So on May 11 or thereabouts, the issuance of bitcoin will drop from 12.5 coins to 6.25 coins every ten minutes.

[Inside: This Upcoming Crypto Event Could Create the Next Round of Bitcoin Millionaires]

Most people see this as a big positive as now every day, 12.5 x 6 x 24 bitcoins are issued, $16 million worth, which have to be absorbed one way or another by new money buying bitcoin. After the halvening that issuance of new coins will halve. Lower new supply and unchanged new demand should push the price up. If the money influx remains constant, the price will rise to the point where existing bitcoin owners want to sell. These new sellers are notoriously greedy hoarders, so as such the new equilibrium point should be a lot higher.

This is what happened last time:

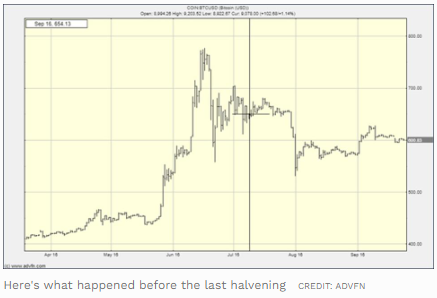

This post-halvening move, while eye-watering enough, was just the beginning, the price then rose to $20,000 before the famous bitcoin crash.

[Limited: Don’t Buy Bitcoin Before Learning About the Best Five Dollar Way to Play This Event]

Before the last halvening this happened:

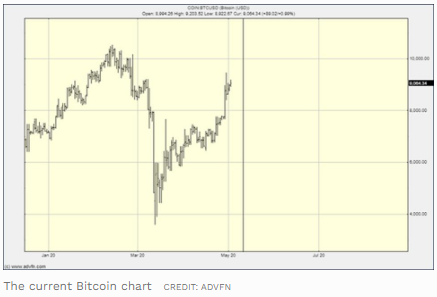

And right now this is going on:

There are clear parallels in these charts but also obvious differences and without doubt they are driven by the coronavirus crash. The halvening is bullish for sure, but the virus and its fallout trumps all other factors.

There is a major fork in the economic road ahead. Is it deflation or inflation? Market practitioners like myself say “Inflation, Inflation!” but economists say “Deflation you idiots.” Seems that one party is wrong.

So let’s look at the drivers for crypto:

1) Fiat inflation/deflation: Digital gold like bitcoin will love inflation. Deflation not so much.

2) Global financial liquidity: If money is tight all assets take a dive because cash is king. The opposite is good for crypto.

3) Global “OMG/WTF”: Bitcoin loves trade wars, sabre rattling, anything that will make people buy bitcoin to move, hide, travel with or protect their wealth.

So we currently have the halvening, a new round of Chinese devaluation/trade war/Trump tweetstorm happening, a large number of people ready for very high inflation, an unresolved global lockdown dynamic, huge uncertainty on the outcome of global bailouts, and the rolling impact of various preventative actions and then the path of the virus itself. It is no surprise then that bitcoin is rallying.

[Inside: This Upcoming Crypto Event Could Create the Next Round of Bitcoin Millionaires]

Long term it will be the outcome of the inflation/deflation paradox that affects bitcoin the most. The no-inflation future depends on maintaining the vast subterranean wells of money that are inertly trapped by their owners’ inertia, underground. There are trillions of dollars of near cash parked at zero interest. If these new trillions end up sequestered with the rest then there will be deflation, if they are forced to break surface into the economy then there will inflation.

The central banks will have to do an incredible balancing act to pull off a mid-course and they will be repurposing the QE of the global financial crisis of 2008 to do it, even though the configuration of this emergency is completely different.

For me the decision that will happen boils down to Alien versus Predator, or in this case, theorists vs. practitioners. Many of the hedge funds’ top minds see the fires of inflation soon to be licking around our feet, the economists floating in their UFOs above us see deflation and a repeat of 2009 onwards where purely technical maneuvers can solve another financial emergency.

I feel I want to throw in my hat with the hedge fund types who see that these vast stimulus packages must create inflation because as the scale of money shifts from billions to trillions I can’t see how transmission cannot ultimately hit the value of money. More money and lower prices can only happen if there is more stuff and it’s stuff that is not getting made that is the core problem.

The “sold out” signs on the internet bullion sites is the canary in the coal mine to me. If we get a pick up in inflation, bitcoin’s price will become unhinged. As such I keep buying.

[Urgent: You Have to Act Before May 12, 2020 to Take Advantage of this Lucrative Opportunity]

Read more from Clem Chambers at Forbes.com

Clem Chambers is the CEO of private investors website ADVFN.com and author of 101 Ways to Pick Stock Market Winners and Trading Cryptocurrencies: A Beginner’s Guide.

Chambers won Journalist of the Year in the Business Market Commentary category in the State Street U.K. Institutional Press Awards in 2018.