Last week, my husband and I became homeowners… again.

Well, technically we refinanced.

About six weeks ago, we started watching interest rates fluctuate. We thought, “Hey, it’s now or never. Let’s see how low we can go.”

And plenty of Americans were thinking the exact same thing.

In light of the COVID-19 pandemic, what does this refinancing wave mean for the U.S. housing market? Are we about to witness a 2008 repeat?

[Alert: New Technology Could Put Millions Out of Work while also Creating Many Millionaires]

Renewed Interest in Interest Rates

Let’s get one thing straight…

The U.S. economy isn’t exactly thriving right now. And the housing market isn’t either.

Many sellers have taken their homes off the market. Buyers are waiting out the storm as well.

The number of home listings is down 47% year over year. Pending sales are down 38.5% from the same time last year. And March home sales fell 15.4% from February’s.

In other words, not many people are buying…

But lots are refinancing.

Mortgage brokers are experiencing a wave of interest from current homeowners who are looking to capitalize on today’s interest rates.

Refinance volume is 192% higher than it was last year.

And for good reason!

[Breakthrough: New Tech Outside the Mainstream of Ai, 5G, and Robotics is Seeing Massive Gains]

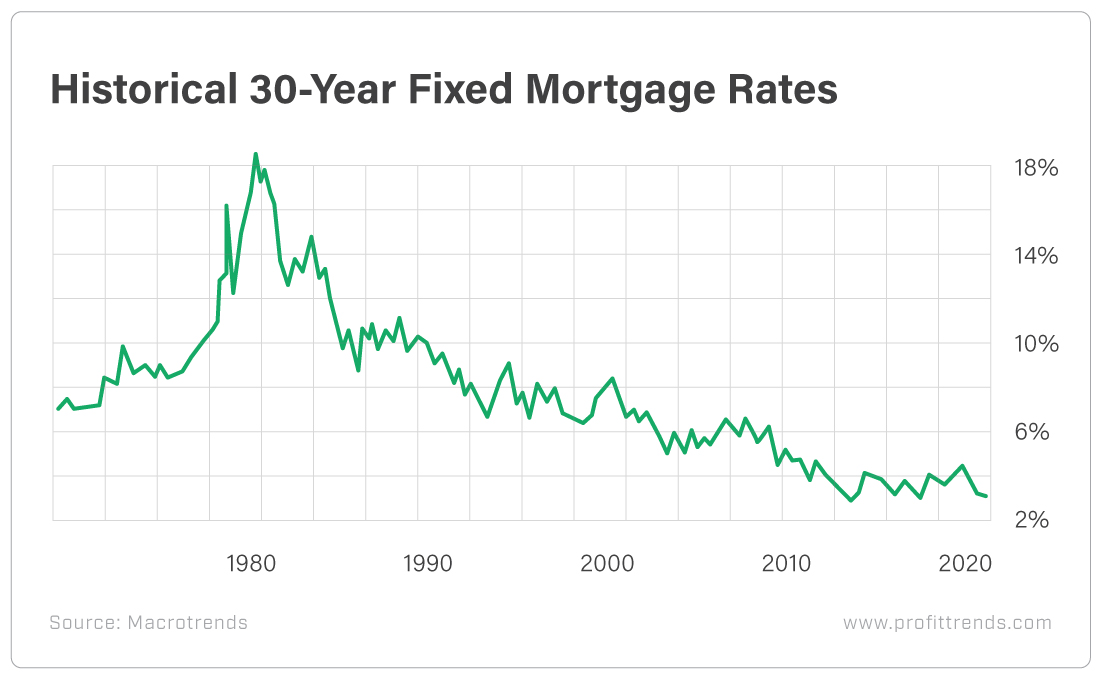

Right now, 30-year fixed mortgage rates are at historic lows. And they could be heading even lower…

Prior to 2020, the lowest average mortgage rate recorded by Freddie Mac was 3.29% in 2012.

Now the government-owned giant is predicting 2020 rates will drop to 3%… and then fall to 2.9% next year.

[Learn More: Discover the Real Reason the Rich Get Richer and Ensure You Don’t Get Left Behind]

The Lucky Ones

Americans are salivating over these rates…

But qualifying for a new mortgage is more difficult than ever.

Unemployment is rampant. More than 26 million Americans have been furloughed, fired or laid off in the last five weeks.

Needless to say, that hasn’t instilled confidence in lenders.

JPMorgan Chase recently announced new mortgage applicants will need to meet a minimum credit score of 700. Plus, they need to make a down payment of at least 20%.

During my recent refinancing experience, the underwriter checked in multiple times to make sure my husband and I were still working. The day before we closed, she even called our managers to confirm our employment status one last time.

And if you’re self-employed, lenders must verify the existence of your business within 10 days of closing. Previously, the range was within 120 days.

[Alert: New Technology Could Put Millions Out of Work while also Creating Many Millionaires]

This new process, though cumbersome, is necessary. Businesses are going under right and left.

But thankfully, the short-term outlook on the housing market is optimistic.

This Is NOT 2008

The housing market is showing signs of life.

We may be in quarantine, but the world has continued to spin.

Leases are still expiring. Jobs still require relocating. Newlyweds still need to share a roof.

Some of the panic seems to have worn off. Realtors, sellers and buyers are all adjusting to a new normal with virtual home tours and social distancing.

And this is reflected in the April numbers.

Pending sales for the second half of this month are up 6.2%. And page views on Zillow are recovering as well – up 18% year over year as of April 15.

Most importantly, many analysts do not believe we’re witnessing a 2008 repeat.

[Breakthrough: New Tech Outside the Mainstream of Ai, 5G, and Robotics is Seeing Massive Gains]

Fannie Mae predicts home prices will grow 2.5% between 2019 and 2021.

And though the usual spring housing boom won’t take place this year, summer forecasts have been buoyed by hopeful post-pandemic predictions.

Additionally, rates are expected to remain low.

As you read above, rates could drop as low as 2.9% in 2021.

This means that homeowners who can’t afford to refinance right now – due to cash flow or stricter underwriting standards – will likely get their chance in the next 12 months.

Plus, at these new historic rates, homebuyers will have significantly more purchasing power.

So despite the current downturn, it is largely believed that the housing market will rebound once Americans are finally released from quarantine.

Patience Pays

Investing with The Oxford Club has taught me a very important lesson: Don’t panic. Every crisis has a silver lining.

Lucky for me, this one turned out to be pure platinum.

[Learn More: Discover the Real Reason the Rich Get Richer and Ensure You Don’t Get Left Behind]

Thanks to unprecedented market turbulence, we ended up with a lower interest rate, a lower monthly payment and more peace of mind.

So don’t worry if your buying or selling journey was put on hold due to COVID-19. All signs suggest the worst is over.

Stay safe and sanitized,

Rebecca