Early last week, shares of Spotify Technology (SPOT) took a hit when Guggenheim analyst Michael Morris cut the stock to sell, on the belief that “the market is now pricing shares for blue-sky growth, which has made the risk-reward unattractive.”

But that “blue-sky growth” is still in play, according to RiskHedge trader Justin Spittler, who claims Spotify will soon be in the “hall-of-famer” class alongside the likes of Netflix (NFLX), Facebook (FB), and Google-parent Alphabet (GOOG).

Spotify is “rapidly becoming something of a monopoly in the audio industry,” he wrote.

“It’s doing what Facebook did with social media… what Amazon (AMZN) did with online shopping… and what Google did with online advertising.”

[Learn More: The Company About to Blow Nearly Every Other Tech Firm Out of the Water]

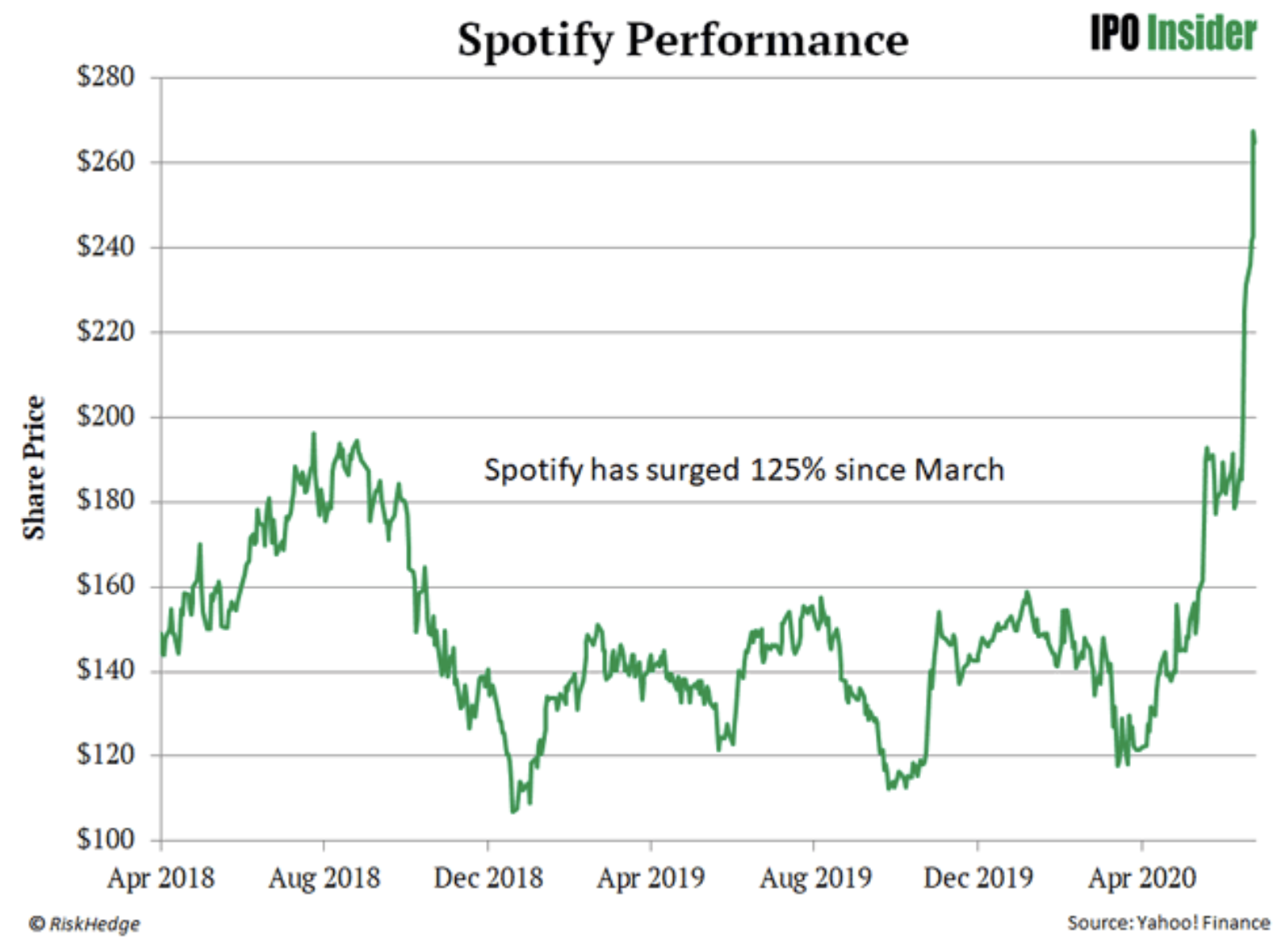

After a slow start to life in the public market, the stock has transformed from hated to loved, as you can clearly see by the parabolic move illustrated in this chart:

Spotify is currently valued at $50 billion, but Spittler sees exponential growth for the “world-class disruptor.”

[Alert! The Company With Over 200 Patents / 500 More Pending in Tech Called “the new oil.”]

He predicts the stock to hit “hundreds of billions” in market cap within a few years, thanks in part to its aggressive push into podcasts, including nabbing Bill Simmons and Joe Rogan.

“Much like Netflix did in streaming, Spotify has established itself as the world’s No. 1 destination for podcasts,” he wrote.

“Spotify cornering the podcast industry should be THE biggest story in the business world. It’s going to make Spotify an even stronger business than it is today.”

[Don't Miss: The #1 Tech Stock of 2020 is Showing Signs That It's Price is Ready to Explode]